SMM, November 14:

Domestic Tungsten Market This Week:

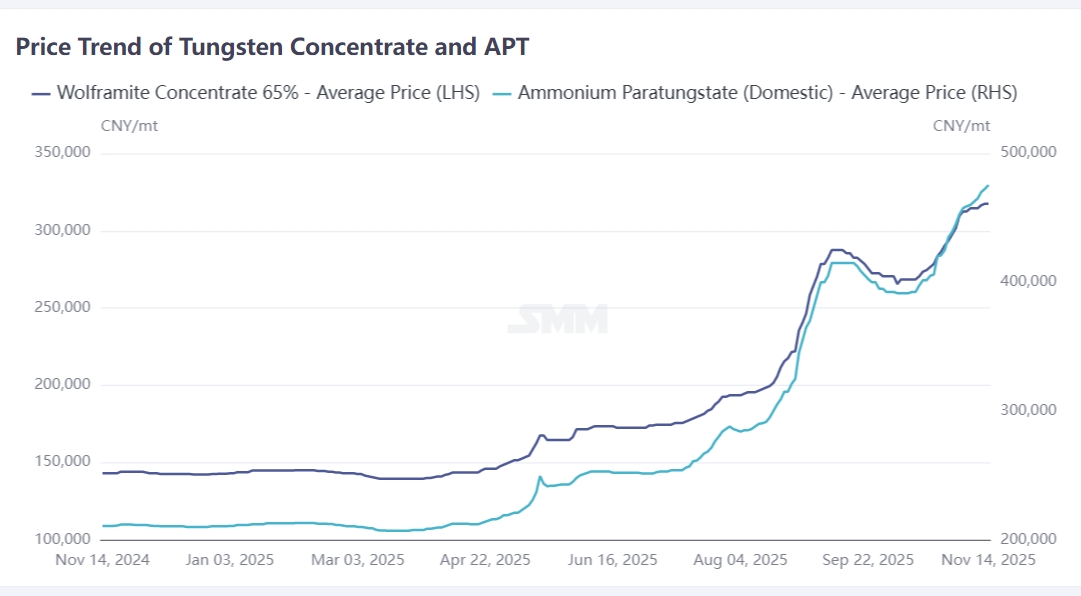

The upward momentum of China's domestic tungsten market slowed down this week. With the gradual release of the second batch of domestic mining quotas, multiple mining enterprises in Yunnan, Guangdong, and Hunan launched tender sales for shipments. Supported by low industry inventories, tungsten ore prices mainly maintained an upward trend this week. As of November 14, 65% black tungsten concentrate closed at 317,000 - 318,000 yuan per standard ton(687 US dollars per ton-unit), rising by 3,000 yuan per standard ton within the week.

Downstream APT smelting products saw a significant increase this week. As of today, APT closed at 473,000 - 478,000 yuan per ton, with a cumulative weekly rise of 13,000 yuan per ton.

Mine Shipment Updates

- On November 7, a mining enterprise in Hunan held a tender for 95 standard tons of 13-20% scheelite concentrate, with the final transaction price at 309,600 yuan per standard ton.

- On November 14, a mining enterprise in Guangdong auctioned 80 standard tons of 20% scheelite concentrate, achieving a transaction price of 320,000 yuan per standard ton(693 US dollars per ton-unit).

- On the same day, a mining enterprise in Yunnan tendered 260 tons of 36% and 50% tungsten concentrate, with positive transaction results pending announcement.

The transaction focus of mine shipments moved upward, and the tungsten concentrate market is expected to maintain a strong volatility trend. Overall, there were profit-taking trades in the mine segment this week, leading to narrow fluctuations in market transactions. However, prices of downstream products such as APT remained firm, mainly due to limited growth in smelting industry operating rates and tight market circulation. Downstream domestic buyers reported difficulties in purchasing APT, prompting APT enterprises to maintain firm quotations. Terminal cemented carbide enterprises had few new orders and mainly fulfilled previous contracts, resulting in reduced transaction volume.

Overseas Market

The European APT market had sluggish transactions with narrow price fluctuations. It is reported that current APT offers in Europe range from 647.5 to 700 US dollars per ton-unit, up by 26.3 US dollars per ton-unit from last Friday, equivalent to approximately 407,600 - 440,600 yuan per ton in RMB. Considering other cost factors, the domestic APT import window remains closed, and the domestic and overseas markets are relatively independent.

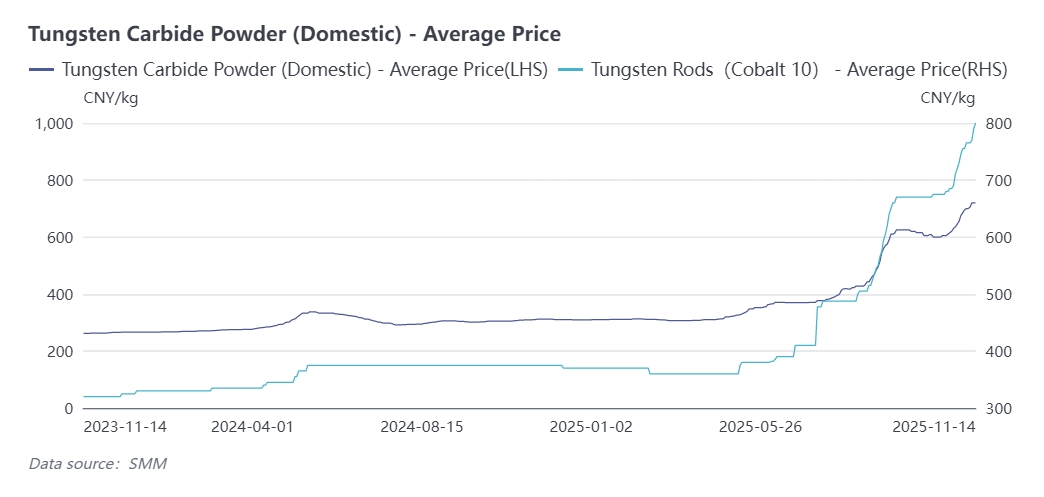

The European ferrotungsten market was active this week with rising quotations. As of this Friday, European ferrotungsten closed at 92 - 94 US dollars per kilogram of tungsten, an increase of 0.25 US dollars per ton-unit from last Friday. According to feedback from European industry insiders, intermediate products such as tungsten carbide powder and tungsten powder in Europe remain in tight supply.

Cemented Carbide Industry

The high prices in the tungsten market were smoothly transmitted this week. Driven by costs, powder manufacturers maintained firm quotations. Facing difficulties in raw material stockpiling, some powder enterprises mainly fulfilled previous orders and suspended spot sales. Cemented carbide enterprises were forced to follow the price increase.

After a wave of price hikes before September, cemented carbide enterprises and distributors have basically cleared their low-cost inventories from earlier periods and now need to replenish stocks. However, the significant cost increase has intensified the industry's capital pressure, leading most orders to adopt a "back-to-back" pricing model (negotiated on a case-by-case basis). Market activity has declined significantly, but rigid demand persists.

As of this Friday, tungsten rods (10% cobalt content) closed at 790 - 810 yuan per kilogram, rising by 180 yuan per kilogram from the start of the month. Some enterprises have adjusted quotations for new orders to 850 yuan per kilogram.

Comprehensive Outlook

With the gradual rise of the tungsten market, the entire industrial chain has shown characteristics such as tight supply-demand balance and divided merchant sentiment. It is reported that the second batch of domestic mining quotas has been gradually issued to mines through various provinces. However, factors such as low inventories and limited available shipments of major mines prevent concentrated shipments in the market.

Mining merchants firmly maintain high prices relying on resource scarcity, while downstream buyers have reduced purchasing enthusiasm due to cost pressures, mainly making on-demand purchases without strong willingness for large-scale stockpiling. The midstream APT market has chaotic quotations and widened price spreads; although tungsten powder manufacturers actively raised quotations, actual transaction volume remains limited.

Supported by low inventories and traditional stockpiling demand in the fourth quarter, tungsten prices are expected to maintain strong volatility in the short term. Next week, key attention should be paid to long-term order guidelines from leading enterprises and the shipment rhythm of mines.