SMM News on 8/9:

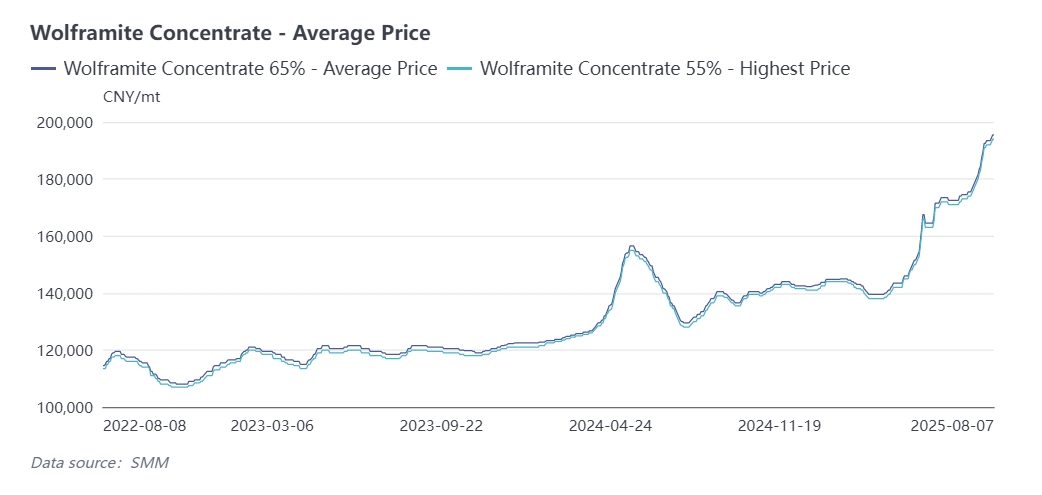

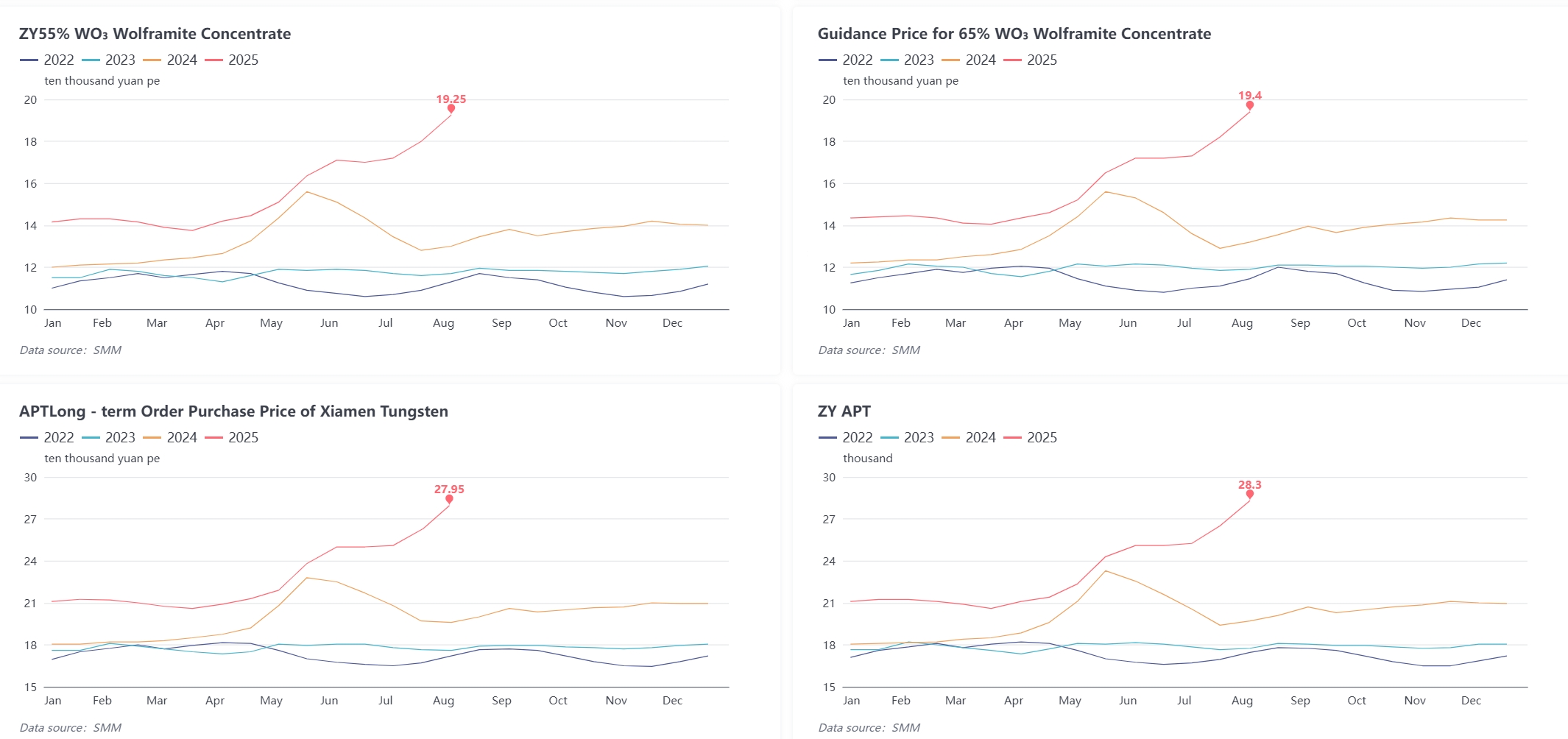

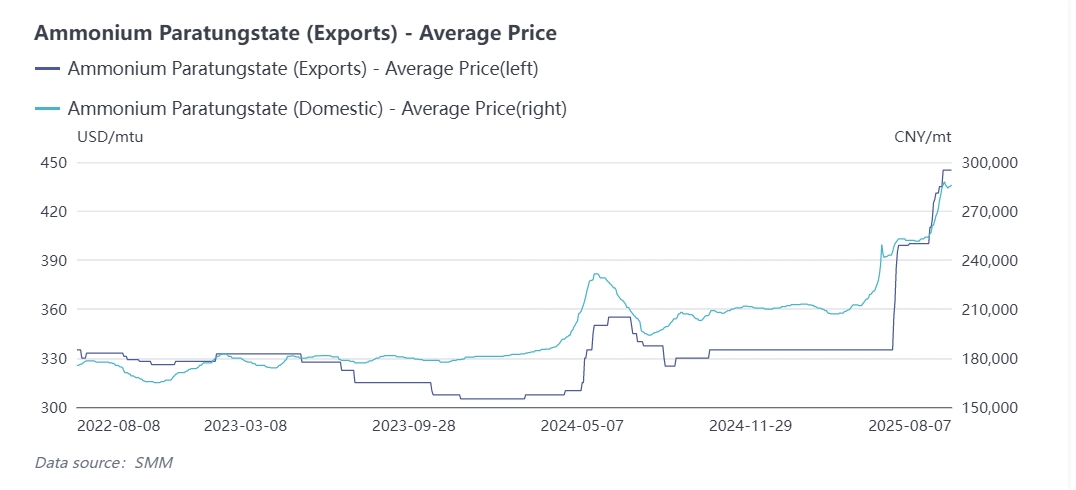

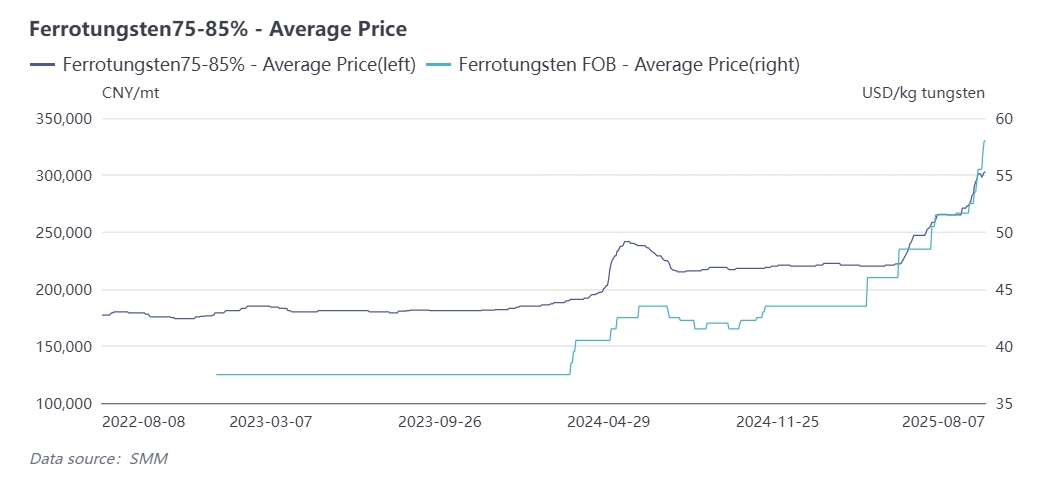

In July, the global tungsten market saw another rally, with domestic and international tungsten prices hitting new highs. Among them, tungsten concentrate prices rose by 11.2% in July, ammonium paratungstate (APT) by 13.7%, tungsten carbide powder by 13.3%, tungsten powder by 13.8%, and ferrotungsten by 13.6%. In Europe, sodium paratungstate closed at $460-490 per ton-unit at the end of July, up 2.7% month-on-month. European ferrotungsten closed at $55-59.6 per kilogram of tungsten at the end of July, a 10.7% increase from the start of the month.

In early August, major domestic tungsten enterprises successively announced long-term orders for the first ten days of August. Both tungsten concentrate and sodium paratungstate long-term order prices showed significant increases, boosting market confidence. The tungsten market is expected to maintain a high-level volatile trend in August.

Raw Material Segment: Tight Supply Drives Prices Higher

In early July, tungsten concentrates and other tungsten raw materials saw moderate price increases, with balanced market supply and demand. However, in late July, domestic tungsten concentrate inventory replenishment became difficult as mines held back stocks, triggering a rapid price surge. Leading enterprises sharply raised long-term order prices in the second half of July, stabilizing the market at a high level. By the end of the month, 65% wolframite concentrate was quoted at around 193,500 yuan/ton, with a cumulative year-to-date increase of 35.6%.

In July, major producing regions such as Jiangxi and Hunan were affected by multiple factors, including environmental inspections, extreme summer weather, and safety checks. Some mines in Jiangxi were ordered to suspend production for rectification due to substandard environmental protection facilities, leading to reduced 产能 (capacity). Meanwhile, frequent typhoons and heavy rains in summer disrupted mining operations, and multiple tailings ponds in Guangxi and Guangdong were closed. Against the backdrop of tight resource supply, tungsten ore holders showed strong reluctance to sell. Mining enterprises generally remained optimistic about future prices, hoarding stocks and avoiding sales, making low-priced supplies scarce in the market. This further exacerbated supply 紧张 (tightness) and pushed prices higher.

Ammonium Paratungstate (APT) Market: Cost-Driven Rally with Sluggish Transactions

The APT market closely followed cost-driven price increases, but enterprises faced difficulties in replenishing tungsten concentrate inventories, resulting in firm quotations. Traders and downstream enterprises adopted a wait-and-see attitude, leading to shrinking transactions in the second half of July. In terms of output, China’s APT production in July 2025 was 11,656 tons, a 6% month-on-month decrease but a 3.8% year-on-year increase. The industry operating rate was around 68%, with some small-scale factories reducing production due to concerns over high prices.

Powder Segment: Cost Pressures and Downstream Resistance Create Market Contradictions

In July, downstream tungsten powder and tungsten carbide powder enterprises faced significant cost pressures, with some experiencing obvious losses from inverted prices and slow price-following. In late July, volatility in raw material markets led enterprises to adopt a wait-and-see approach toward new orders. Downstream cemented carbide enterprises only replenished inventories based on rigid demand, while end products such as cutting tools struggled to pass on costs quickly. Multiple cemented carbide enterprises issued a joint statement opposing high raw material prices.

As intermediate product manufacturers, powder enterprises faced conflicting market trends: high upstream costs combined with weak downstream demand. Enterprises mostly quoted prices based on orders, considering raw material price fluctuations during the delivery period. By the end of July, tungsten carbide powder hit a high of 418 yuan/kg, and tungsten powder reached 427 yuan/kg. Industry caution and wait-and-see sentiment intensified, resulting in sluggish market transactions.

Ferrotungsten: Supply Constraints and External Market Spillovers

In July, the ferrotungsten market mainly followed raw material price increases. Upstream recycling of waste tungsten products such as recycled tungsten became difficult, with prices remaining high and enterprises showing little willingness to sell at low prices, leading to firm quotations. Enterprises producing ferrotungsten using tungsten concentrates saw reduced operating rates due to difficulties in sourcing high-grade ore and high-temperature power restrictions. By the end of July, domestic ferrotungsten (≥75%) was quoted at 301,000 yuan/ton, with a cumulative year-to-date increase of 36.8%.

Additionally, the ferromolybdenum market surged in late July, prompting multiple steel mills to issue a joint statement suspending ferromolybdenum purchases. This spillover effect led some steel mills to pause purchases of both tungsten and molybdenum to wait for market clarity.

End Demand: Stable Growth in Key Sectors

In July 2025, the Purchasing Managers’ Index (PMI) for the equipment manufacturing industry and high-tech manufacturing industry stood at 50.3% and 50.6%, respectively, indicating expansion. According to National Bureau of Statistics data, domestic output of metal-cutting machine tools increased by 13.5% year-on-year in the first half of 2025. As key tools for mechanical processing, cemented carbide cutting tools saw rising demand for tungsten in line with growing machine tool production. Customs data showed that China’s exports of cemented carbide mechanical knives and blades reached approximately 1,775 tons in the first half of 2025, a 2.8% year-on-year increase.

Brief Comment: High-Level Volatility to Persist in August

The tungsten market is expected to remain in high-level volatility in August, supported by tight ore supply. Tungsten concentrate mining is constrained by quota limits, with little room for output growth. The first batch of 2025 tungsten mining quotas decreased by 6.45% year-on-year, with Jiangxi’s quota reduced by 2,370 tons. Some mines in Jiangxi face quota shortages and low inventories. Although Guangxi and Guangdong’s combined first-batch quotas reached 4,510 tons, few mines are in operation in these provinces this year, resulting in low operating rates. Moreover, domestic tungsten concentrate mining quotas are non-transferable, leading to low quota utilization and exacerbating supply 紧张. Attention should be paid to the release of the full-year tungsten concentrate quota allocation in late August or early September.

In August, downstream cemented carbide operating rates are expected to decline due to seasonal weak demand and high raw material costs. In the medium to long term, the scarcity of global tungsten resources and growing demand in emerging sectors will provide strong support to the tungsten market.

![Transaction Pushed Magnesium Prices Up, Today's Magnesium Prices Hold Up Well [SMM Analysis]](https://imgqn.smm.cn/usercenter/CkvAg20251217171724.jpg)

![[SMM Magnesium Analysis] China Magnesium Trade Faces Challenges Amid Geopolitical Tensions and Export Controls](https://imgqn.smm.cn/usercenter/teIej20251217171724.jpeg)