SMM News, December 19th:

As the year draws to a close, upstream tungsten ore enterprises in China have successively entered the equipment maintenance period. Coupled with the tightening of policy control and the limited remaining available mining quotas, the tungsten market has seen an accelerated upward trend since December. Transactions of upstream raw materials have contracted, yet such volume was sufficient to drive the overall market. The tungsten market price has been fluctuating around the news of high-price transactions, leading to a price rally amid thin trading.

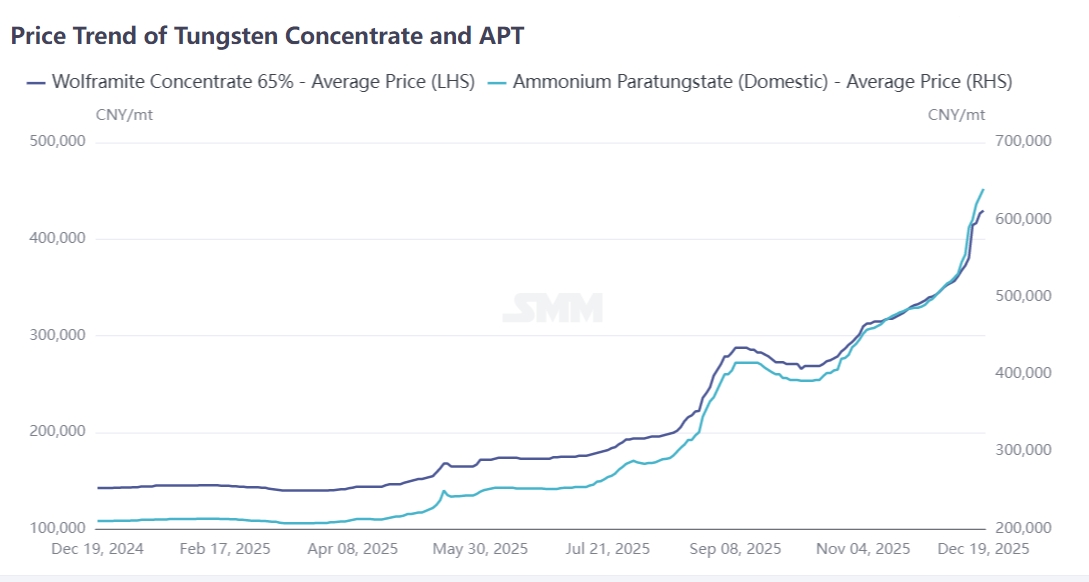

As of this Friday, the price of SMM 65% wolframite concentrate closed at 429,500 yuan per standard ton (equivalent to 935 US dollars per ton unit), surging by 90,000 yuan per standard ton month-to-date (equivalent to 195 US dollars per ton unit).

Driven by news of maintenance shutdowns at manufacturers in Hunan, Jiangxi and other regions, the APT (ammonium paratungstate) market has led the rally across the entire tungsten sector. As of this week, the SMM ammonium paratungstate price closed at 640,000 yuan per ton (equivalent to 1025 US dollars per ton unit), with a month-to-date increase of 1.4 million yuan per ton (equivalent to 223 US dollars per ton unit). Some transaction prices climbed to a high of 670,000 yuan per ton in the afternoon trading session.

Downstream tungsten powder enterprises have maintained robust operations underpinned by rigid demand, which has further exacerbated the supply-demand imbalance of APT. With strong cost-side support, downstream products such as tungsten powder and tungsten carbide have mostly followed the upward trend. Among them:

- Tungsten carbide powder was priced at 990 yuan per kilogram, up 230 yuan per kilogram month-to-date; its FOB quotation has surged to as high as 148 US dollars per kilogram.

- Tungsten powder stood at 1035 yuan per kilogram, with a month-on-month increase of 240 yuan per kilogram.

The skyrocketing tungsten prices have exerted disparate impacts on different enterprises across the tungsten industrial chain. Below is a summary of survey findings from upstream mining enterprises, midstream smelters, and downstream cemented carbide & cutting tool manufacturers:

A Mining Enterprise in Jiangxi:Against the backdrop of the recent sharp price surge of tungsten ore and acute market shortages, downstream enterprises are facing great difficulties in restocking. We mainly fulfill long-term contracts with minimal spot sales volume, thus the drastic market price fluctuations have little impact on our business. As the year-end approaches, we have basically met our annual production targets, and the shipment volume under long-term contracts will decline accordingly. Meanwhile, the mine is grappling with declining ore grades and limited mining and ore-dressing capacity. Consequently, the output converted to 65% grade concentrate has dropped year-on-year—a challenge plaguing many aging mines in the sector. Mining quota control remains stringent: competent departments of natural resources at all levels conduct regular inspections on the quota compliance of mining enterprises. By verifying statistical statements, production ledgers, resource reserve consumption, as well as sales and tax payment documents, they ensure that the actual mining output stays within the approved quota range. This makes over-mining in the industry highly unlikely.

A Mining Enterprise in Hunan:All the tungsten ore produced by our mine is for internal consumption within the group. As we approach the year-end, the mine has entered the annual maintenance phase with no spot shipments available. We have already completed the annual production targets for this year.

Mining Enterprises in Other Regions:Some mines still have a portion of unused quotas by the end of the year, but their production capacity fails to keep pace, resulting in low marketable inventories. A small number of mines in regions like Guangxi and Yunnan launched bidding sales this week, with a total volume of over 200 physical tons. No bidding plans have been heard from mines in Hunan, Henan and other provinces so far.

Tungsten Ore Trading Enterprises:The trading volume and transaction activities of tungsten ore and other tungsten products have declined recently. On one hand, enterprises are under pressure to recoup capital at year-end, and the sky-high tungsten ore prices have added to their financial strains. On the other hand, tight market supply has made it difficult for enterprises to restock. In addition, some traders are exhibiting risk aversion toward the elevated prices. With downstream enterprises showing weak enthusiasm for restocking at year-end, market confidence remains subdued.For enterprises engaged in imported tungsten ore trading, global tungsten ore resources are clearly in short supply. European and American sellers are aggressively sourcing tungsten ore overseas. Coupled with exchange rate fluctuations and import tax factors, overseas sellers are offering more favorable prices to European and American buyers than to their Chinese counterparts. This has led to a reduction in the volume of tungsten concentrate purchased by Chinese buyers from overseas markets compared to previous periods.

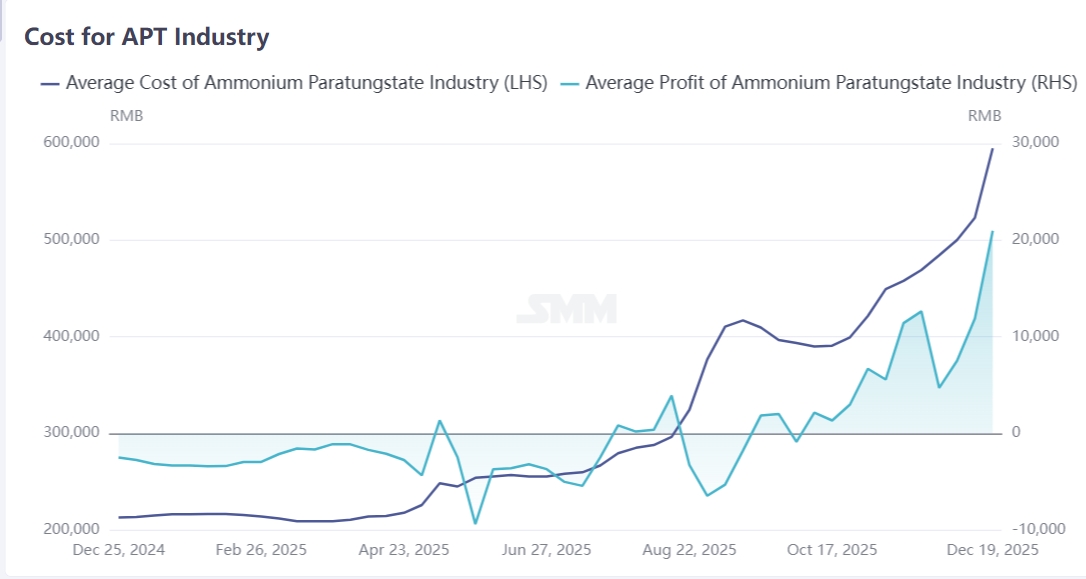

Downstream APT Enterprises:This week, a major APT producer in Chenzhou, Hunan, entered a phase of production cuts for maintenance. Moreover, additional maintenance plans are scheduled for producers in Jiangxi and other regions in the coming period. As a result, APT supply has tightened significantly, fuelling a sharp price rally. Downstream tungsten powder enterprises are operating with low inventories and facing great difficulties in restocking, forcing some of them to secure supplies at elevated prices. In the first half of December, the price of domestic APT under long-term contracts was concentrated in the range of 520,000–530,000 yuan/ton. Current spot transaction prices have far exceeded the long-term contract rates, prompting some enterprises to resell their long-term contracted cargoes to capitalize on the price spread.

Tungsten Powder Enterprises:These enterprises have been forced to raise their ex-factory prices. New order intake remains sluggish, with pricing conducted on a one-order-one-negotiation basis. Furthermore, partial prepayment is required to lock in a quotation.

Cemented Carbide Enterprises:Raw material inventories have fallen to critically low levels, leaving these enterprises with no choice but to restock passively. However, end-users typically impose a payment term of around three months, placing significant financial pressure on cutting tool and carbide manufacturers. Consequently, some enterprises have adopted a cautious stance toward accepting new orders.Price inversion has emerged in overseas markets, leading to a marked decline in export orders for domestic enterprises. Some manufacturers report that end-users are considering ceramic alternatives to tungsten-based cutting tools.A number of small and medium-sized enterprises are caught in a dilemma: they must either raise their product prices, accept narrower profit margins, or postpone raw material procurement. Those lacking sufficient capital, technological edge, and market competitiveness have been forced to reduce production or even halt operations entirely to stem losses.

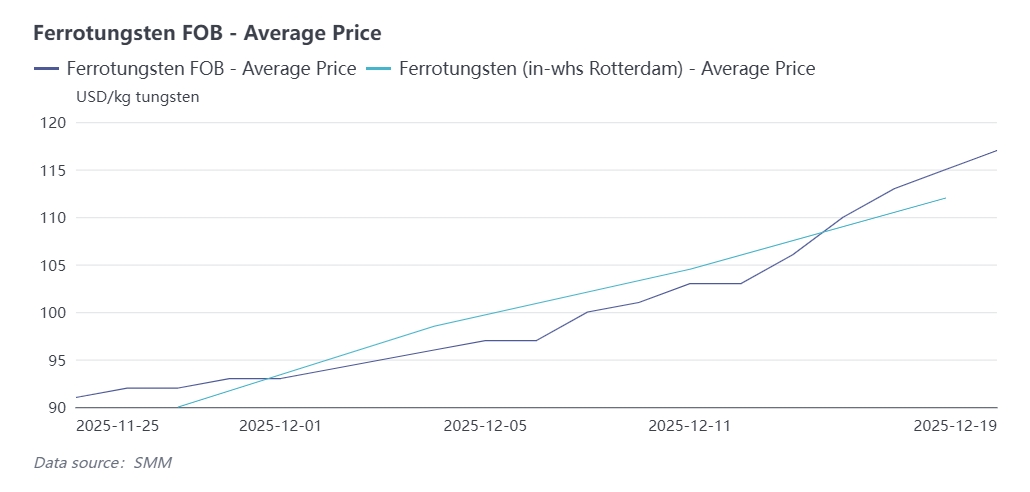

Export Order Status:Recent price inversion between domestic and overseas tungsten markets, combined with the upcoming Christmas holiday in overseas regions, has led to reduced stocking activity and fewer inquiry orders. Domestic exporters of intermediate tungsten smelting products have seen a notable drop in new overseas orders.To date, the price of domestic ferrotungsten (80% grade) has surged to 600,000 yuan/ton, with its FOB quotation reaching as high as 117 US dollars per kilogram of tungsten. In contrast, the ferrotungsten price in Europe stands at approximately 112 US dollars per kilogram of tungsten:Amid this export price inversion, some domestic ferrotungsten exporters have suspended overseas quotations. It is anticipated that the overseas tungsten market will experience a rapid price surge following the Christmas holiday.

Policy Update:On December 12, China’s Ministry of Commerce issued Announcement No. 68 of 2025, Stipulations on the Application Criteria and Procedures for State Trading Enterprises of Tungsten, Antimony, and Silver Exports for 2026–2027 (hereinafter referred to as the Announcement). The Ministry has completed the review of applications submitted by enterprises vying for state trading qualifications for tungsten exports for the 2026–2027 period.During the application window, a total of 16 enterprises filed applications. Following the review:

- 14 were existing qualified enterprises that met the requirements specified in the Announcement;

- 1 was a newly applying enterprise that satisfied the criteria;

- 1 newly applying enterprise failed to meet the required standards.

Overall Assessment:As the year draws to a close, reduced ore shipments from mines combined with increased maintenance at APT plants have led to a pronounced tightening of upstream raw material supply in the tungsten market. The supply-demand imbalance is unlikely to ease in the near term, suggesting that the current pattern of price rally amid thin trading will persist. It is expected that tungsten prices will remain at elevated levels. Market participants should closely monitor the price guidance of long-term contracts in the tungsten industry and the shipment pace of domestic tungsten concentrate in Q1.