SMM News on 9/12:

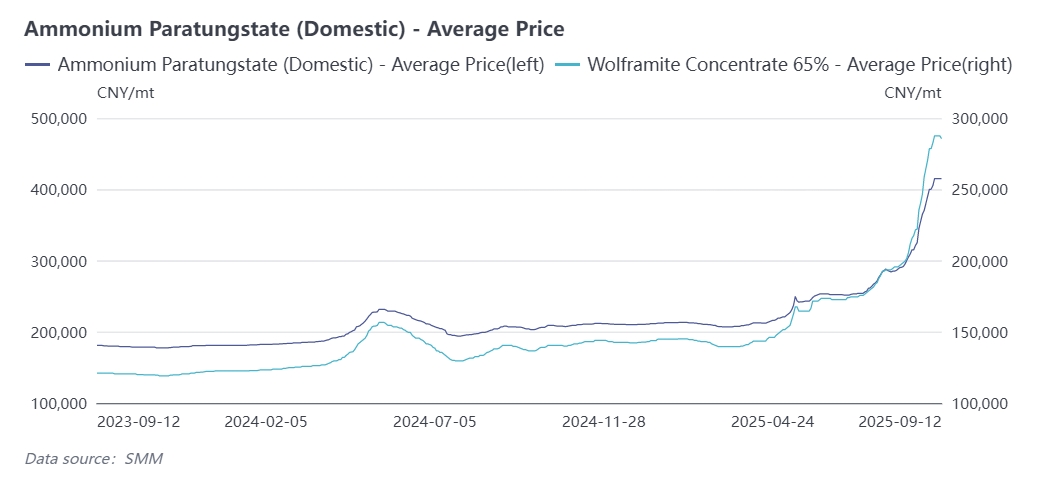

Recently, constrained by the continuous record-high tungsten prices, transaction volumes in the tungsten market have shrunk significantly. The transmission of high prices to the downstream sector has been relatively slow, and the operating rate of the downstream cemented carbide industry has declined due to the pressure of high costs, leaving the market in a stalemate.This week, risk aversion among some traders has increased, and they have chosen to destock to secure profits. As a result, the transaction price of tungsten concentrate market has loosened slightly: the price of 65% black tungsten concentrate fell by 2,000 yuan per standard ton compared with last week, closing at 285,500 yuan per standard ton. At the same time, high-priced waste tungsten products have occupied the cash flow of waste tungsten recyclers. Some waste tungsten enterprises have opted to take profits to ease cash flow pressure, leading to sufficient supply in the waste tungsten market. The price of waste tungsten dropped first this week: the price of waste tungsten rods fell by 5 yuan per kilogram compared with last Friday, closing at approximately 440 yuan per kilogram.

Has the tungsten market peaked? SMM (Shanghai Metals Market) holds the view that the contradiction between supply and demand mismatch in the tungsten market has not yet been resolved. It is hard to say that there will be a sharp correction in the market outlook, and the market will still be dominated by strong fluctuations. The main supporting factors are as follows:

1. Domestic tungsten enterprises significantly raised long-term order prices in the first half of September, with spot market prices fluctuating at high levels anchored by long-term order prices

A number of major tungsten enterprises have substantially increased their long-term order quotations for the first half of September, with details as follows:

- Chongyi Zhangyuan Tungsten Industry Co., Ltd.: The long-term purchase quotations for the first half of September are as follows - 55% black tungsten concentrate: 280,000 yuan per standard ton, up 69,000 yuan per standard ton from the previous quotation; 55% white tungsten concentrate: 279,000 yuan per standard ton, up 69,000 yuan per standard ton from the previous quotation; Ammonium Paratungstate (APT, national standard grade zero): 410,000 yuan per ton, up 100,000 yuan per ton from the previous quotation.

- Jiangxi Tungsten Industry Holding Group Co., Ltd.: The guiding price of national standard grade one black tungsten concentrate for the first half of September 2025 is 275,000 yuan per standard ton, up 62,000 yuan per standard ton from the second half of August.

- Xiamen Tungsten Co., Ltd.: The long-term purchase price for the first half of September 2025 is 405,000 yuan per ton, up 100,000 yuan per ton from the previous quotation.

- Guangdong Xianglu Tungsten Industry Co., Ltd.: The tax-inclusive unit prices of long-term tungsten raw material orders for the first half of September 2025 are as follows - black tungsten concentrate with a grade of over 55%: 280,000 yuan per standard ton, up 48,000 yuan per standard ton from the previous quotation; white tungsten concentrate with a grade of over 55%: 279,000 yuan per standard ton, up 48,000 yuan per standard ton from the previous quotation; APT: 410,000 yuan per ton, up 70,000 yuan per ton from the previous quotation. The above prices include 13% value-added tax (VAT).

- Ganzhou Tungsten Industry Association of China: The forecast prices of the tungsten market for September 2025 are as follows - 55% black tungsten ore: 280,000 yuan per standard ton, up 97,500 yuan per standard ton month-on-month; APT: 410,000 yuan per ton, up 127,000 yuan per ton month-on-month; medium-grain tungsten powder: 650 yuan per kilogram, up 210 yuan per kilogram month-on-month.

2. Limited growth in the operating rate of domestic tungsten concentrate enterprises in September, with tight market supply remaining

The available quota of some mines has hit a low, so it is difficult for the operating rate of domestic tungsten concentrate enterprises to increase in September. Although some holders have recently chosen to take profits (leading to a slight increase in the supply of spot goods in the market), the available inventory in the market is still low. As the circulating inventory is cleared, the market can only wait for major mines to release goods, and the mines still have a strong willingness to maintain high prices.

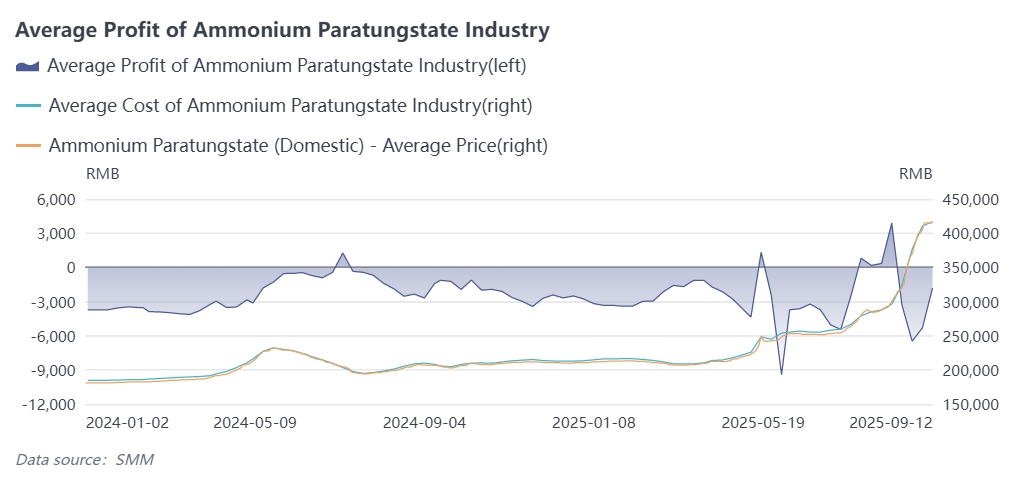

3. High prices continue to transmit downstream, while the profitability of the intermediate smelting product industry still needs to be improved

Since July, the price of tungsten raw materials has risen rapidly, while the price of downstream smelting products has followed up slowly, resulting in continuous losses in the industry. The operating rate of APT manufacturers has dropped significantly. At present, the industry is still digesting the inventory of high-priced raw materials, and the market is in the stage of high-price transmission. It is unlikely that enterprises will lower prices for sales. According to SMM's calculation, the average cost of domestic APT this week increased by 6,438 yuan per ton month-on-month to 416,800 yuan per ton, and the industry still suffered a loss of 1,811 yuan per ton.

4. The arrival of the peak season has driven a positive trend in industry demand.

Downstream enterprises mostly stock up according to orders, and the raw material inventory of enterprises such as cemented carbide is at a low level. Driven by the increase in orders during the peak demand season, the industry has a demand for stockpiling, which further exacerbates the imbalance between supply and demand.

5. The US announces tariff exemption on tungsten metal trade, driving growth in global tungsten trade

The US tungsten ore reserves account for only 1.2% of the world's total, with a large gap in domestic supply and high dependence on imported tungsten. Tungsten is a core raw material in key fields such as aerospace and national defense industry. For example, in the military field, tungsten alloy is the preferred material for armor-piercing projectile cores and ultra-high kinetic energy penetrators; in the aerospace field, tungsten is also relied on for high-temperature stability in missile hot-end components and rocket nozzles. Imposing tariffs would increase the cost of domestic manufacturing in the US and affect the security of the military industrial supply chain. The exemption policy aims to ensure the stable operation of these key industries.

The US announcement of tariff exemption for tungsten and other metals in its global national tariff list will undoubtedly smooth global tungsten trade. As an important tungsten consumer market, the US may see an increase in imports due to lower import costs, thereby driving up the volume of global tungsten trade. At the same time, the increased demand for tungsten imports in the US may affect the supply-demand relationship in the global tungsten market to a certain extent, and then impact tungsten prices. From the perspective of China's tungsten market, the growth in overseas tungsten demand is beneficial to the domestic tungsten market. However, China is still under export control for tungsten, so the export volume of some raw materials may not see a significant increase in the short term. Nevertheless, this policy is beneficial to the export expectation of domestic tungsten end products such as cemented carbide.

Comprehensive Outlook

Recently, profit-taking-based goods delivery in the market has eased the short-term tight supply of raw materials, putting some pressure on tungsten prices. However, from the perspective of medium and long-term supply and demand, the supply of tungsten concentrate is tightening. As the core contradiction between market supply and demand has not undergone a fundamental change, the fundamentals of the tungsten market provide solid support, and there is little room for a sharp correction.

At the same time, the following points need to be paid attention to in the future:

- Information on the annual quota of domestic tungsten concentrate: Significant fluctuations in the quota will lead to adjustments in the subsequent market supply-demand balance.

- The situation of "strong domestic prices and weak international prices" may stimulate the inflow of overseas tungsten resources into the Chinese market, thereby easing the domestic supply tension. The import volume of tungsten resources needs to be continuously monitored.

- The adjustment direction of domestic and foreign policies related to tungsten import and export.

![Baiyin Nonferrous Group Co., Ltd. Copper Tendered 1 mt of Tellurium Ingots [SMM Report]](https://imgqn.smm.cn/usercenter/cgspx20251217171725.jpg)

![[SMM Analysis] Titanium Dioxide Prices Rise Post-Holiday, Geopolitical Risks Cloud Export Outlook](https://imgqn.smm.cn/usercenter/NPpAM20251217171723.jpeg)