I. Market Overview: Production Contraction Reflects Weak Demand

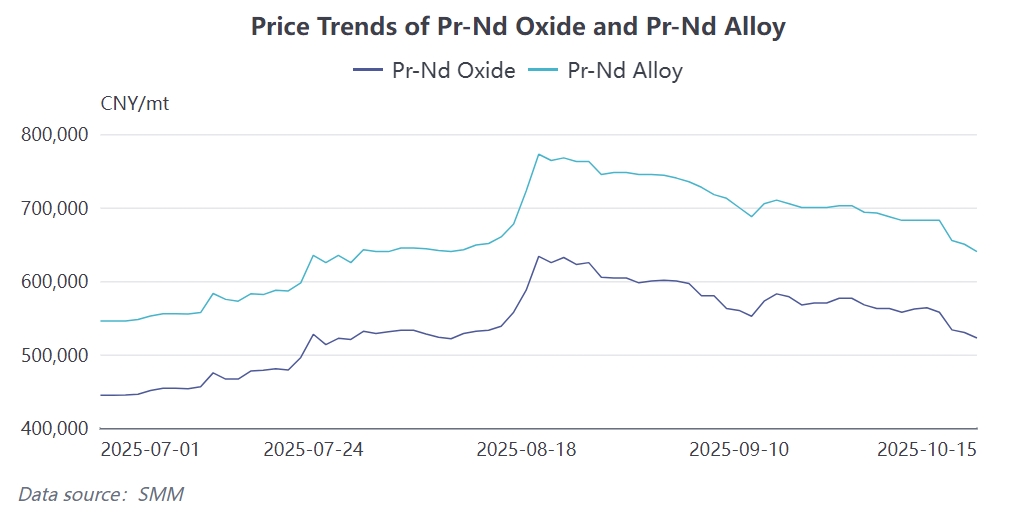

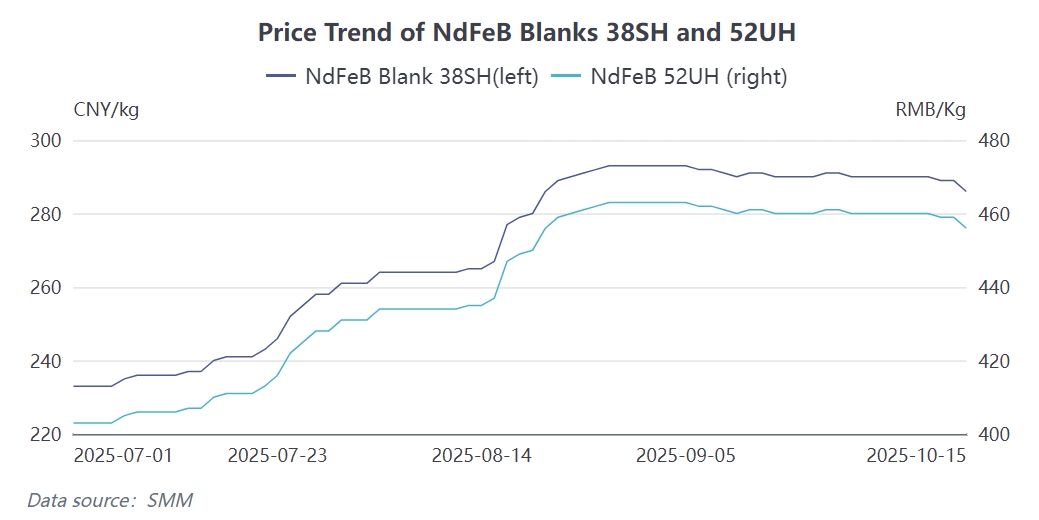

According to the latest SMM survey, China's NdFeB magnetic material production in September 2025 was 29,106 mt, down 1.66% MoM, with the overall industry operating rate at 68.1%, down 4.14 percentage points MoM. More critically, October production is expected to further decline to 27,648 mt, down approximately 5% MoM, reflecting the multiple pressures currently facing the magnetic material industry. Based on this, the NdFeB market price in October is expected to decrease by about 3.4% MoM compared to September, with the average price of the mainstream grade 52UH expected to be around 445 yuan/kg, while 48SH hovers near 300 yuan/kg. From a cost-plus perspective, the current actual transaction price corresponds to a Pr-Nd alloy price of about 650,000 yuan/mt, while the newly signed order quotes this week correspond to a level of 630,000 yuan/mt.

Notably, industry concentration is accelerating. The production share of top-tier enterprises increased by 2.76% MoM to 73.5%, while that of mid-tier enterprises decreased by 1.8% to 21.8%, and that of tail-end enterprises fell by 1.1% to 4.6%. This structural shift indicates that, against a backdrop of weak market demand, top-tier enterprises with scale advantages and technological barriers demonstrate stronger risk resilience.

II. In-Depth Analysis of Demand Side: Significant Structural Divergence

2.1 NEVs: Growth Slows but Remains Resilient

Analysis of demand performance: NEV production reached 1.617 million units in September, up 16.33% MoM, but the growth rate is expected to slow significantly in October, with overall production estimated at approximately 1.665 million units. Although NEVs may experience batch stockpiling in November and December due to the impact of the subsidy halving policy starting in 2026, the actual effect remains uncertain given the sluggish end-use consumer market.

Long-term trend assessment: The NEV industry has entered a phase of rapid, large-scale development. The annual growth rate of NEVs is projected to be 20%-25% in 2025, slightly lower than the 34.75% in 2024, but still maintaining a relatively high level. The demand for magnetic steel from NEVs ranges from 2.7-7.0 kg per vehicle. Cumulative consumption of NdFeB permanent magnets from January to August 2025 reached 40,800 mt, reinforcing NEVs' position as the largest application area for magnetic materials.

Structural characteristics: The demand side exhibits significant structural divergence. Traditional application areas, such as white goods including air conditioners, have entered the production off-season following the summer. The 3C electronics sector faces saturated demand due to a lack of stimulus from new models, leading to a reduction in orders for low and mid-end magnetic materials. In contrast, demand in emerging application areas remains strong. Driven by the domestic program of large-scale equipment upgrades and consumer goods trade-ins, the demand for high-performance NdFeB in the NEV sector continues to grow steadily.

2.2 Wind Power Sector: Significant Impact from Seasonal Factors

Decline in installations: Following the power market reform in May 2025, the installation rush has largely completed most of this year's installations. In October, as major wind power installation regions gradually enter winter, outdoor operations become more challenging, leading to a noticeable decline in installation volume. Additionally, constrained by significant fluctuations in rare earth prices, the penetration rate of direct-drive turbines has decreased, providing less support for NdFeB permanent magnet production.

2.3 Traditional Application Sectors: Facing General Pressure

Air Conditioning Sector: Entering the traditional off-season in Q4, production continues to weaken. ChinaIOL data shows that in September 2025, the domestic sales production schedule for household air conditioners was 5.72 million units, a 6.3% decline YoY; in October, it was 4.815 million units, down 23.4% YoY; and in November, it was 5.55 million units, down 17.6% YoY.

Elevator Sector: Affected by the ongoing downturn in real estate, commercial property continues to decline, with limited application in Q4. Although policies allowing the extraction of housing provident funds for adding elevators to existing residential buildings have been introduced in places like Tianjin, the overall demand boost is limited.

Mobile Phone Market: The domestic market is approaching saturation, lacking growth momentum. Despite the Xiaomi 17-series setting sales records, the overall market lacks revolutionary new models to stimulate production, which is tending towards saturation.

Industrial Robots: In Q4, the sector remains basically stable, with average industrial indices and limited growth potential. However, the surge in demand for high BH magnetic materials in sectors such as industrial robots and humanoid robots partially offsets the decline in traditional areas.

2.4 Export Market: Significant Constraints from Policy Regulations

Impact of Export Controls: Due to the Ministry of Commerce's strengthened export controls, major magnetic material enterprises became more cautious about exports in October. Without further clear guidance, they maintained a wait-and-see attitude, leading to a reduction in production for those enterprises with a high proportion of exports in October.

Changes in Export Structure: The current policy requiring declarations for NdFeB magnets has concentrated export licenses in the hands of top-tier enterprises, making it difficult for mid-tier and smaller enterprises to obtain licenses, intensifying industry polarization. The export control policy highlights the advantages of large enterprises, as they directly face European top-tier enterprises, enjoying more convenient export approvals and a more complete traceability system for magnetic materials.

Q4 Export Outlook: Considering industry dynamics and policy orientation, rare earth magnet exports in Q4 2025 are expected to show "stable total volume but structural differentiation." On one hand, the European market will see a slowdown in new orders due to the Christmas holiday and the completion of stockpiling needs; on the other hand, the Asian and North American markets may take over some of the shifted demand, but the overall increase will be limited. Based on cumulative exports of 34,000 mt from January-August and an annual forecast of 49,000 mt, 15,000 mt need to be exported in Q4, averaging around 3,500 mt per month, a significant pullback from the peak in August.

III. Brief Analysis on the Supply Side: Policy Regulation Optimizes the Supply Landscape

Supply side, although the prices of rare earth raw materials have slightly pulled back from their highs, supply remains tight due to factors such as mining quotas, reduced imports of ore, and environmental protection policies. Since 2025, the state's management of the rare earth industry has entered a new phase, with the implementation of relevant regulatory measures marking a further optimization of the supply landscape for this strategic resource.

The trend of capacity concentration among top-tier enterprises has curbed drastic fluctuations in overall production, and the industry is transitioning from a fragmented competitive landscape to an oligopolistic structure. China has formed several major magnetic material industrial clusters in Zhejiang, Guangdong, Jiangxi, and Northern China. Among them, the Zhejiang region is a global hub for NdFeB, hosting numerous top-tier enterprises.

IV. Q4 Demand Outlook and Forecast

4.1 Short-Term Demand Trend Assessment

Based on current market conditions, NdFeB magnetic material demand in Q4 is expected to exhibit the following characteristics:

NEVs: Production growth in October is projected to slow to approximately 1.665 million units. A slight rebound may occur in November-December due to the push for annual targets at year-end, but actual demand growth will be limited due to weakness in the end-use consumer market.

Traditional Sectors: Demand in traditional application areas such as air conditioners and elevators is expected to remain under pressure. Q4 is the traditional off-season for these sectors, with a noticeable reduction in orders.

Export Market: Influenced by the Christmas holiday, growth potential in Q4 is limited. Overall exports are not expected to be substantial, averaging around 3,500 mt per month.

Emerging Sectors: Demand in emerging areas such as industrial robots and humanoid robots is relatively stable. However, growth potential is constrained by the overall economic environment.

4.2 Medium and Long-Term Demand Development Trends

From a global perspective, China's rare earth magnetic material industry has established a complete industry chain system. China not only maintains a leading position in rare earth reserves but also controls the majority of global rare earth mine production and NdFeB magnetic material capacity.

In the long term, the rapid development of industries such as NEVs, wind power, and robotics will continue to drive growth in rare earth demand. The global NdFeB supply-demand gap is likely to persist and potentially widen over the long run. Top-tier enterprises possessing resources, technology, and customer barriers will hold a competitive advantage, and the trend toward increased industry concentration is irreversible.