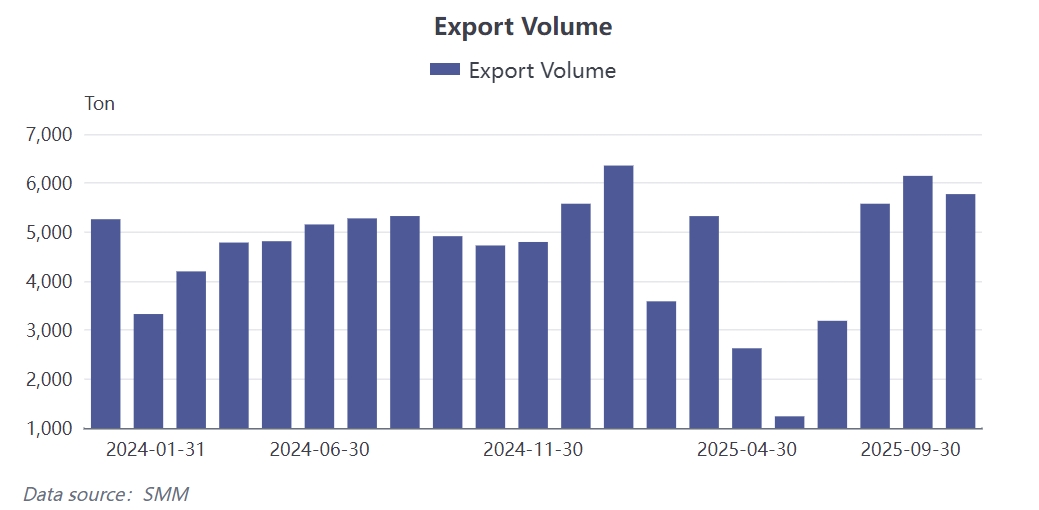

According to SMM data, China's exports of NdFeB permanent magnets totaled 5,775 mt in September, down 6.5% MoM but still up 13% YoY. From January to September 2025, cumulative exports of NdFeB permanent magnets reached 40,219 mt, a decrease of 6.5% compared to the same period last year. Based on the SMM survey, full-year exports of NdFeB magnetic materials in 2025 are expected to decline by approximately 10% YoY, with average monthly exports in Q4 projected to remain around 4,100 mt, down about 12% compared to the same period last year.

01 Export Data Perspective: MoM Decline and Annual Trend

Looking at the rare earth magnetic material export data for the first three quarters of 2025, the 6.5% YoY decline has set the tone for the full-year export contraction. The MoM pullback in September exports of 5,773 mt, compared with the high level in August, was not solely due to shrinking market demand but resulted from the interplay of multiple factors. Following the implementation of export control policies, enterprises needed time to adapt to new declaration procedures, leading to short-term disruptions in the export pace. As the export license approval process gradually normalized after June, pent-up export demand was released intensively in July and August, forming a temporary export peak.

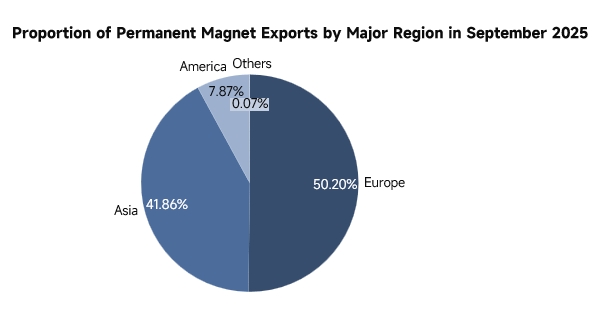

02 European Market: Dual Impact of Dependence and Pace

The European market's reliance on China's rare earth magnetic materials remains at a relatively high level, accounting for 41% of China's global exports. This structural dependence means that changes in European demand directly affect the overall export performance of Chinese magnetic materials. The cycle from order placement to purchase for European customers is approximately two months. Therefore, for the traditional peak consumption season of September-October peak season, European customers typically concentrate their ordering and stockpiling in July, August, and September. This procurement pace shows a clear synchronization with the peak period of China's magnetic material exports. Europe has relatively strong continuity in its new energy policies, lacking a strong incentive for a push for annual target at year-end stockpiling. Coupled with the Christmas holiday in December, Q4 is generally the traditional off-season for China's magnetic material exports.

03 Export Control Policy: From Disruption to Normalized Impact

In April 2025, China implemented export controls on seven categories of medium-heavy rare earth-related items, including samarium, gadolinium, terbium, dysprosium, lutetium, scandium, and yttrium, which are essential elements for high-performance NdFeB permanent magnet materials. This policy has had a profound impact on the export of NdFeB permanent magnets. Although low-performance magnetic materials are theoretically not restricted, because high-performance and low-performance NdFeB permanent magnets share the same customs classification code, they also require obtaining permits in advance for approval and inspection before shipment. On one hand, this measure strengthens the control over strategic rare earth resources, but it also entails greater investment of manpower and resources for implementation. In the short term, it has complicated the export procedures for low-performance magnetic materials, lengthened trade cycles, and extended the order payment collection period for enterprises. In practice, the approval of export permits tends to favor larger, top-tier enterprises with more robust compliance systems. Mid-tier and smaller enterprises struggle to obtain approvals due to the instability of their customer base.

04 Q4 Outlook and Future Trends

Based on the current market situation and policy environment, rare earth magnetic material exports in Q4 are expected to remain at around 4,100 mt per month, down about 12% YoY. This forecast is based on a comprehensive consideration of multiple factors. Demand in the European market is relatively mediocre at year-end, and the Christmas holiday factor will significantly reduce purchasing activity. At the same time, export control policies have entered a normalization phase, with approval pace remaining relatively stable, avoiding the concentrated declaration phenomenon seen during the initial policy period. Globally, Europe is accelerating efforts to enhance the autonomy of its rare earth supply chain, reducing external dependence through local projects and technological innovation. Although such measures in Europe will not take effect immediately in the short term, as the US continues to tighten relations with countries worldwide, Europe’s pursuit of rare earth independence has become an inevitable trend. In the short term, although rare earth raw material prices have pulled back slightly from highs, supply remains tight due to various constraints. Subsequently, as the global economy recovers and industrial and consumer demand gradually recovers, strong support for rare earth raw material prices is expected to persist.