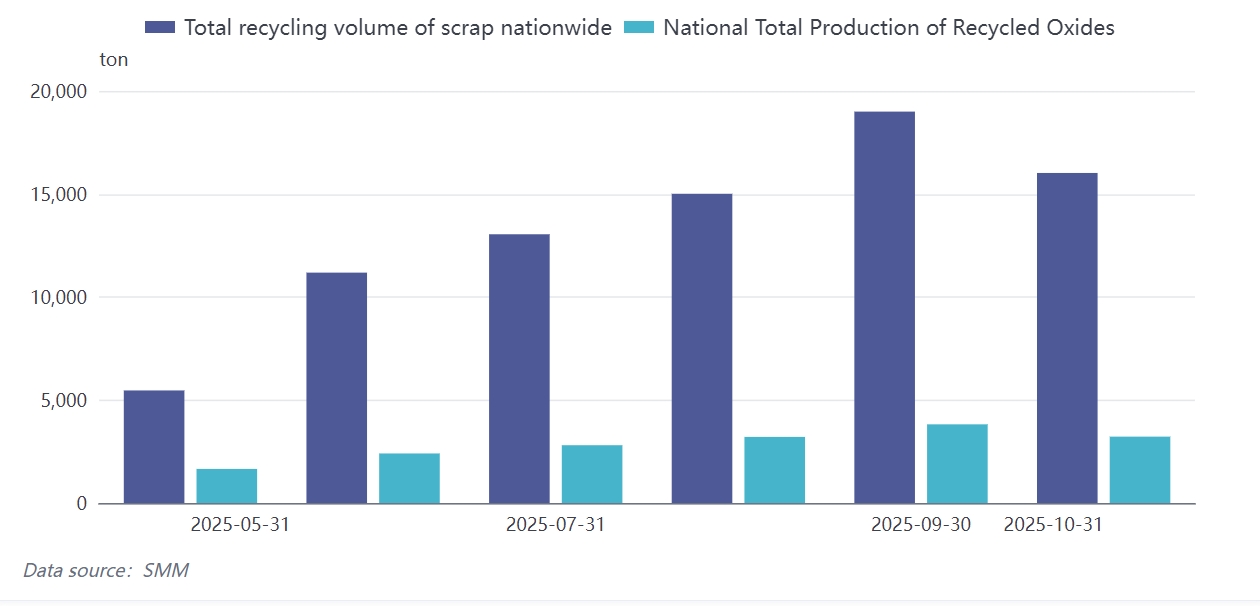

SMM October 31: In October, China's recycled oxide market saw a decline in production and weakening prices. Specifically, national recycled oxide production decreased by approximately 16% MoM. This significant change was mainly due to leading scrap recycling enterprises conducting concentrated equipment maintenance in October. As a result, the operating rate of scrap recycling enterprises dropped significantly, leading to a substantial reduction in recycled oxide production.

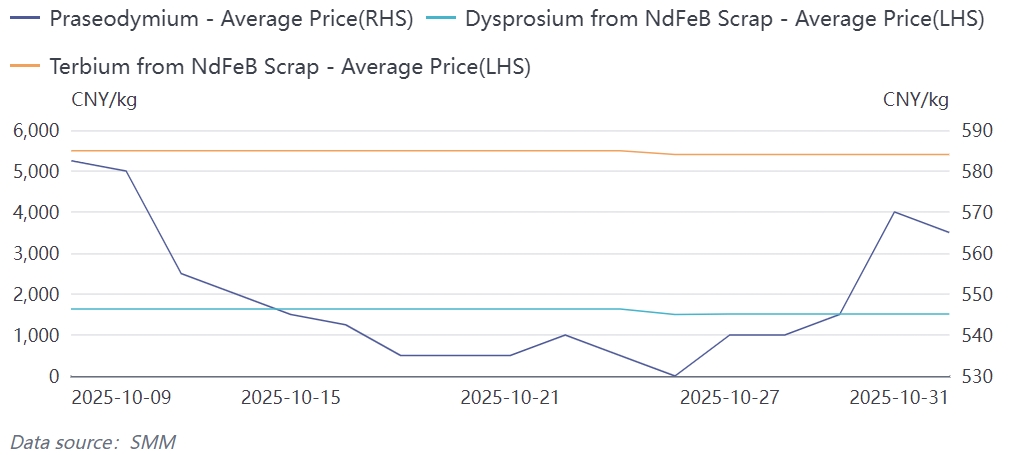

In terms of prices, oxide prices continued to decline in October. To control costs, recycling enterprises repeatedly lowered scrap quotations, leading to a significant drop in scrap prices. At the beginning of the price decline, driven by panic, suppliers concentrated on selling off scrap, which temporarily improved procurement conditions for recycling enterprises. However, as prices continued to fall, suppliers' willingness to sell decreased sharply, making procurement significantly more difficult for recycling enterprises. Most enterprises had to rely on depleting their inventory to maintain production. Although raw material inventories of recycling enterprises were relatively sufficient, ensuring normal production, procurement difficulties remained prominent. Starting in October, intensified scrutiny of reverse invoicing and the full implementation of the rare earth product traceability system led recycling enterprises, for compliance reasons, to prefer purchasing invoiced scrap, further exacerbating procurement challenges.

Looking ahead to November, the market landscape is expected to see positive changes. In the initial phase of the one-year extension of export controls, downstream magnetic material enterprises are anticipated to experience a significant increase in orders. As orders rise, national NdFeB production is projected to grow, with a corresponding increase in scrap output. At the same time, the growth in downstream orders will drive up demand in the oxide market, pushing oxide prices higher and improving the profitability of scrap enterprises. With both supply and demand showing strong momentum, the output of recycled oxides is expected to increase.

However, uncertainties remain in the market. If downstream magnetic material enterprises fail to see a notable improvement in orders, recycling companies will continue to face procurement challenges, and the output of recycled oxides may remain at low levels. Therefore, the direction of the scrap market in November will still require close attention to changes in orders from downstream magnetic material enterprises.