SHANGHAI, May 31 (SMM) - At the SMM 2023 Indonesia Nickel and Cobalt Industry Chain Conference, Jim Lennon, senior commodity consultant at Macquarie Group, made a detailed analysis of Indonesia's role in meeting the soaring demand for nickel.

Jim Lennon said that global nickel supply growth has been strong in recent years, contributed by Indonesia. Nickel is currently a value-added product that contributes significantly to Indonesia's export earnings. Indonesia's planned total nickel production capacity currently exceeds 5 million mt/year, compared with global nickel production of 3.1 million mt in 2022. After losing 100,000 mt of nickel production in 2021 due to the pandemic and other factors, Indonesia began to increase production capacity to catch up. From 2022 to 2029, Indonesia's nickel production will account for more than 75% of the global supply.

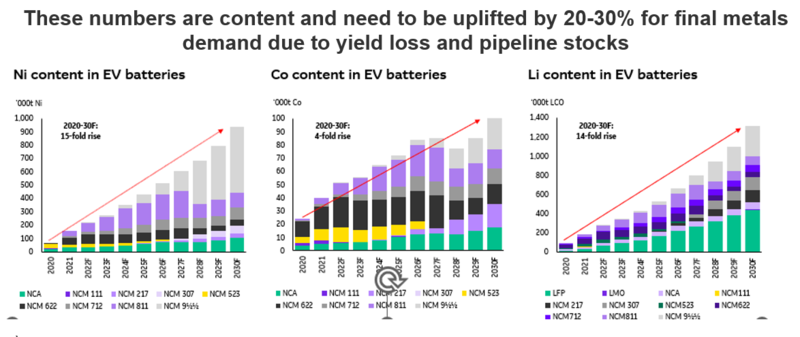

Demand for nickel in batteries is expected to grow strongly through 2030. The future race for high-nickel batteries means that demand growth for nickel is likely to outpace that for lithium, with cobalt lagging behind.

Total global EV demand for primary mines will peak in mid-2030 as secondary mines emerge - thus concerns of depleting reserves are less of a concern.

The supply of Indonesian nickel will no longer be an issue, but the type of supply and restrictions will become the main issue. Strong Indonesian supply and slowing demand caused global nickel supply to record a surplus ofr the first time in 2022. What was in surplus was not (LME deliverable) nickel metal, but rather NPI and ferronickel. Prices of LME and SHFE nickel saw an unprecedented premium over NPI and ferronickel. Considering the underutilization of nickel production capacity in Indonesia, the market may continue to be in surplus in the next five years.

Stainless steel dominates the use of nickel, and batteries are the second-largest use of nickel and nickel demand from batteries is growing rapidly. In 2022-2023, nickel use in battery and stainless steel declined due to the use of NPI and intermediate products, leading to a surplus of nickel.

Global markets are increasingly concerned about dependence on Indonesian nickel supply from a state dependence (including Chinese control) and ESG perspective. Indonesia now needs to carefully manage the next phase of nickel supply growth against a backdrop of growing concerns over the “localization” of battery supply chains in North America and Europe. Significant regional price variations for nickel battery raw materials (mainly sulphates) are increasingly likely, with potential premiums for non-Indonesian/Chinese materials also increasing.