From October 13-15, the industry association held two meetings in Beijing, with the themes being the monthly regular meeting and industry self-regulation 2.0. The meetings essentially determined the production costs of polysilicon, silicon wafers, solar cells, and modules. We refer to the Anti-Unfair Competition Law of the People's Republic of China, which came into effect on October 15. Article 14 clearly stipulates that "platform operators must not force or covertly force operators on the platform to sell goods at prices below cost, disrupting market competition order." SMM believes that this law provides legal support for the cost prices of each segment announced by the association. Enterprises that violate these provisions in the future will face corresponding legal sanctions.

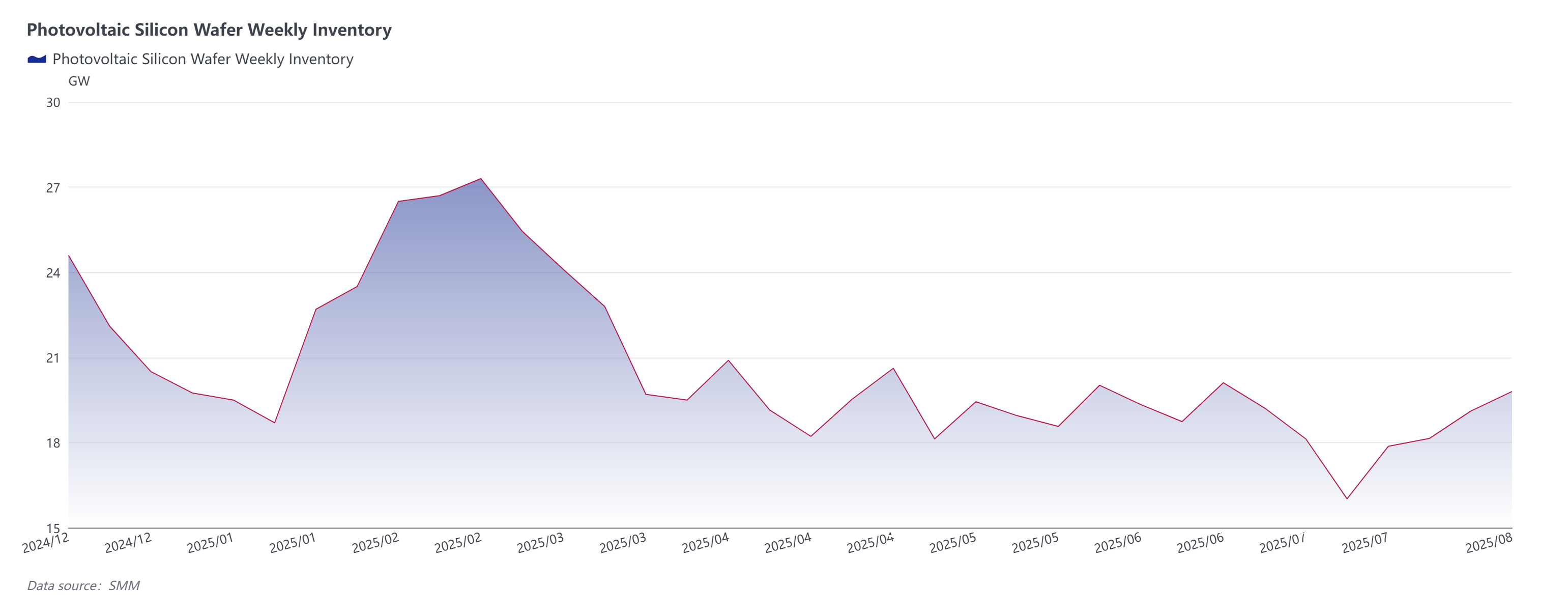

In early October, due to the decline in overseas battery orders, particularly from India, silicon wafer prices showed signs of softening. However, top-tier enterprises continued to refuse to budge on prices, which significantly contributed to the subsequent convergence of the silicon wafer price range. Starting from late October, except for 210R, the quotations for the other two sizes basically converged. Some companies' sales departments, affected by month-end KPIs, offered prices reduced by 0.02 yuan/piece to clear inventory, but the volume involved was minimal and thus not included in the mainstream quotation range. As for 210R, 1.38 yuan/piece was the high end of actual transaction prices, primarily due to supply surplus leading to excessively high inventory levels, which weakened their bargaining power in price negotiations.

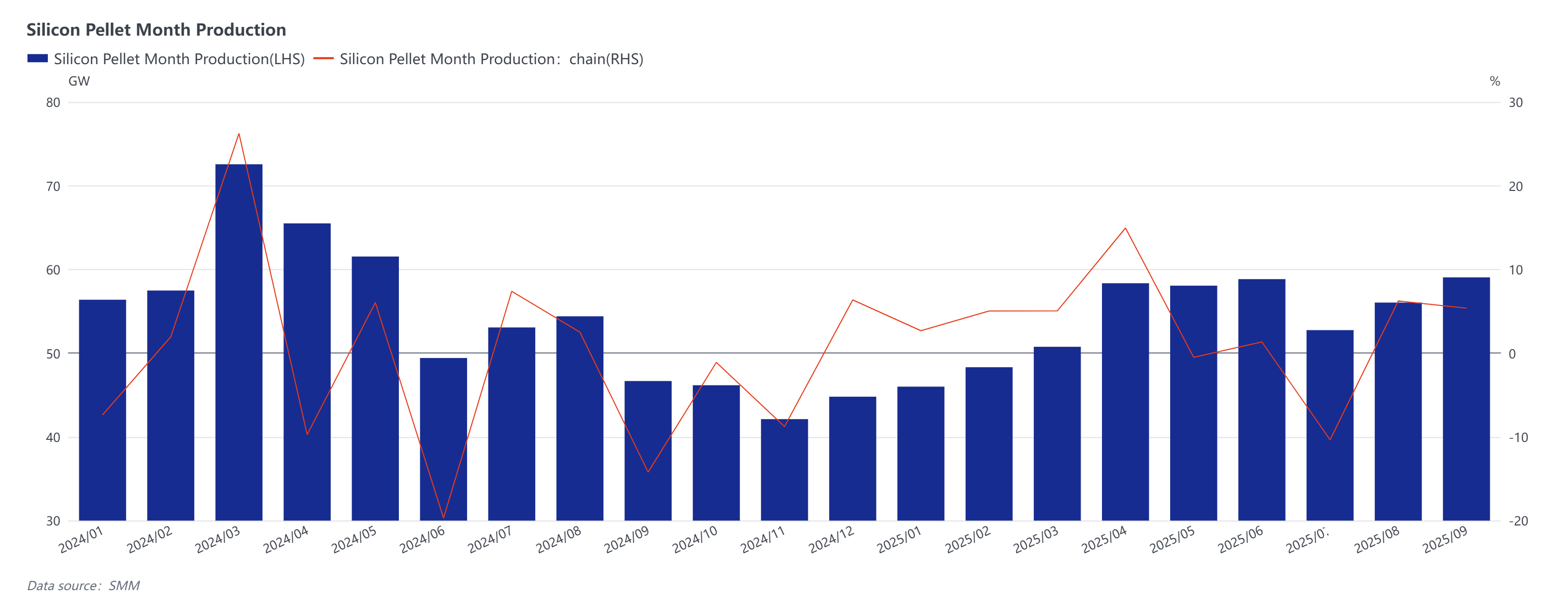

According to SMM statistics, wafer production in October is expected to exceed 61 GW, up about 3% MoM. This production schedule forecast increased compared to the version released at the end of September, mainly due to multiple enterprises adjusting their operating plans after the National Day holiday, resulting in a rise rather than a decline in wafer production, which also reflects their optimistic expectations for future price trends. Based on supply-demand balance calculations, wafers shifted to a tight balance this month, with adjustments in the internal structure of inventory. Inventory at upstream wafer enterprises increased significantly, while inventory at downstream cell enterprises decreased notably, but the total volume remained largely unchanged. Overall, the total wafer inventory remains below half a month, which is within a reasonable range and provides support for price trends.

According to the SMM wafer cost model, in October, only the 183mm wafers had a positive average industry gross margin, at about 0.51%, while the other two sizes were negative, with 210R at -10.16% and 210N at -6.04%. If we look ahead to November based on current expectations, both costs and profits are expected to improve significantly. The shift from an expectation of price decreases to one of price increases for wafers is primarily due to the determination to implement anti-involution policies at higher levels. The progress of platform companies has also become a core part of our judgment logic. If the progress plans go smoothly, it would be like injecting a "shot in the arm" into the market, with raw material quotes driving wafer prices to rise. Pessimists may be right, but optimists move forward. What we now consider reasonable rules have indeed been seen as exaggerated expectations in the long course of history. The melancholy and hesitation brought by the marketization of electricity under Document No. 136 is only temporary. The pain of transformation is inevitable, but what remains unshaken is our confidence in the increasing responsibility weight for green electricity consumption year by year.

![[SMM PV News] Armenia Hits 1.1 GW Solar Capacity,](https://imgqn.smm.cn/usercenter/qQwIB20251217171741.jpg)

![Spot Market and Domestic Inventory Brief Review (February 5, 2026) [SMM Silver Market Weekly Review]](https://imgqn.smm.cn/usercenter/tSwaX20251217171735.jpg)