Spurred by the '531 Grid Integration Mandate', 90-day tariff windows, and Europe's grid emergencies, industry operating rates exceeded historical benchmarks—albeit with severe fragmentation. Prices firmed amid post-competition supply tightness, yet sustainable upside momentum remains elusive.

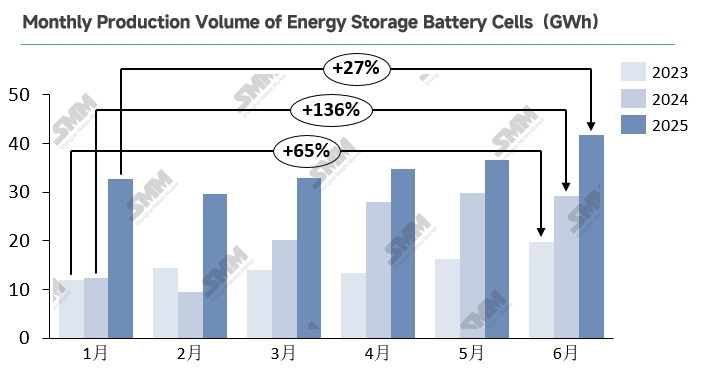

H1 Production Breakdown:

Q1 2025 Off-Season Resilience Defies Convention

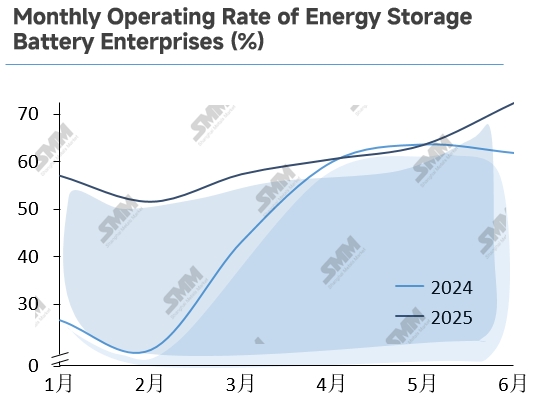

Q1 2025 saw China's energy storage market exhibit atypical off-season vigor, with January-February operating rates exceeding 50%. While February dipped due to post-grid-connection rush fatigue and Lunar New Year lull, the scrapping of mandatory storage allocations under Document No. 136 triggered developer urgency. Projects raced to lock in timelines before complex revenue calculations and merchant market uncertainties took effect, triggering accelerated cell production from March onward.

Q2 2025 Demand Dynamics: Triple-Phase Volatility Amid Sustained Growth

China's energy storage demand exhibited a peak-trough-rebound trajectory in Q2. From April to mid-May, the "531 Grid Integration Deadline" triggered concentrated project commissioning, accelerating cell production and delivery. Post-deadline (late May-June), orders plummeted—slashing tenders by 38% MoM—yet regional subsidy extensions sustained commercial & industrial (C&I) storage resilience.

Overseas, multi-engine forces emerged: U.S. tariffs spiked from 34% to 125%, freezing April-early May exports. The subsequent 10% tariff with 90-day window ignited a late-May tariff-beating surge, becoming the quarter’s core pillar. Parallel demand drivers included:

-

Australia: Pre-July rush for A$2.3bn residential subsidies

-

Europe: Post-inventory drawdowns + Spain’s blackout-driven order rebound .

Collectively, these factors maintained exceptional global demand momentum.

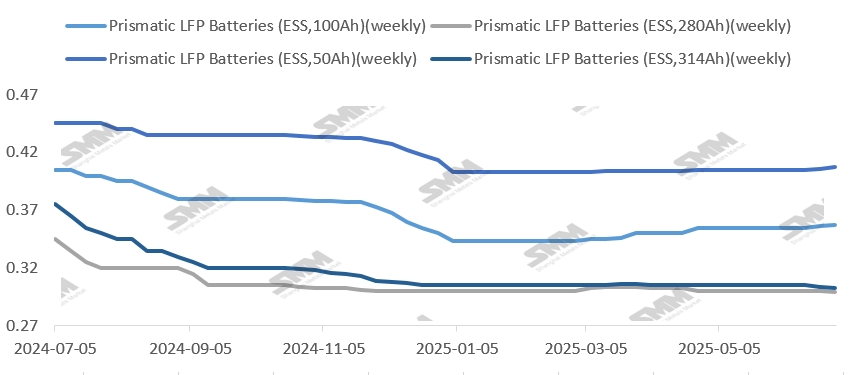

2025 H1 Energy Storage Cell Price Review and Outlook

Energy storage cell price volatility significantly moderated in 2025 compared to 2024. After hitting cyclical lows in late 2024, domestic "price wars" persisted through the first half and extended to Middle Eastern markets. Value-for-market strategies—though demanding substantial capital reserves—remained viable for select players within sustainability thresholds.

June marked a turning point as robust demand drove broad price stabilization. As of July 18th:

-

314Ah prismatic LFP cells down merely 0.33% year-to-date

-

280Ah prismatic LFP cells recovered to January levels after interim adjustments

-

100Ah and 50Ah cells rose 4.08% and 0.74% respectively

Product Segmentation Perspective

From a product segmentation standpoint, the 314Ah energy storage cell completed full production capacity transition in 2025, capturing over 70% domestic market share. Economies of scale significantly reduced costs, while surging overseas orders and concentrated "531 Grid Integration Deadline"-driven preemptive installations collectively created a modest oversupply situation. This pushed 314Ah cell prices down marginally. Meanwhile, 280Ah cells primarily target safety-sensitive European and Australian markets (over 50% regional share), where stable supply-demand equilibrium limits their overall price impact. Despite lithium carbonate prices continuing to decline—theoretically reducing costs—these savings failed to transmit effectively to end-product pricing, with raw materials' marginal influence on price fluctuations progressively weakening. Throughout H1, supply-demand dynamics remained the core driver of large-scale storage price movements. Price increases for small-capacity cells stemmed from two key factors: firstly, explosive overseas residential demand—Australia's A$2.3 billion residential storage subsidy effective July 1, coupled with sustained growth in European and emerging markets; secondly, rigid capacity constraints—small-scale production lines account for a low share of total capacity, while high specification-switching costs deter manufacturers from short-term production shifts, sustaining tight supply-demand conditions that support upward price momentum.

Price Outlook

Looking ahead, amid current supply tightness, spot quotations from some enterprises began rising in late June (generally within ¥0.005/Wh). Market research indicates Tier 1-2 manufacturers' utility-scale storage orders are scheduled through September, with sustained demand potentially extending spot price increases. However, downstream integrators show weak purchasing appetite—beyond fulfilling prior long-term contracts, they maintain only essential procurement for high-priced spot orders. On the cost front, lithium carbonate prices have risen steadily since July, reaching ¥70,550/tonne for battery-grade material by July 24. Industry feedback confirms every ¥10,000/tonne lithium carbonate increase drives cell price fluctuations of approximately ¥0.002-0.003/Wh, providing short-term price support. Long-term, however, this lithium price rally remains largely sentiment-driven with weak fundamental backing; cell prices are expected to undergo a minor correction post-August before stabilizing.

Regional Market Analysis

China: Initial concerns about grid-side demand following Document No. 136's cancellation of mandatory storage allocations were mitigated by accelerated power market reforms and timely provincial subsidy interventions. H2 2025 storage cell demand is projected to remain stable. Notably, market-oriented mechanisms impose higher requirements for system integration capabilities and cost control—technologically advanced players will capture most incremental demand. Long-term, the operational model for independent energy storage stations remains exploratory. Revenue diversification extends beyond peak/off-peak arbitrage to include capacity leasing, capacity subsidies, market trading, and peak-shaving/frequency regulation. However: capacity leasing prices/tenures fall below guidance, disadvantaging investors; capacity subsidies vary provincially; market arbitrage faces liquidity and counterparty constraints; and grid-controlled dispatch creates uncertainty for ancillary services. Downstream project owners maintain cautious attitudes.

United States: Short-term, domestic cell manufacturers remain optimistic about tariff renegotiations, but core demand variables hinge on the Big and Beautiful Act. While terminating solar ITC/PTC tax credits, the Act simultaneously relaxes storage ITC restrictions—subsidies require meeting "foreign entity of concern" cost thresholds (phase-down aligned with the IRA). Thus, the August 18 implementation rules release becomes the critical node for future US demand. Long-term, H2 2025 US demand should continue providing incremental support. Consequently, after 2025's policy-driven demand surge, 2026 growth slowdown pressures will intensify, necessitating capacity reallocation toward non-subsidy-dependent scenarios.