Some signs indicate that as the Red Sea crisis continues to escalate and oil tanker freight rates continue to soar, the global energy market is becoming increasingly localized and regionalized, and the once-global energy trade seems to be "dividing in two," with the Suez Canal becoming the dividing line...

Among them, one trading zone is centered on the Atlantic basin, including the U.S. East Coast and the Gulf of Mexico coastal areas, the Caribbean, and Europe (including the North Sea and the Mediterranean); while the other trading zone includes the Persian Gulf, the Indian Ocean, and East Asia.

Although some crude oil is still flowing between these two trading zones - through longer and more expensive routes around the southern tip of Africa - recent buying patterns suggest that the connection between the two seems to be on the verge of being cut off.

In Europe, according to traders, some refiners abandoned plans to purchase Basra crude oil from Iraq last month, while buyers from the European continent were rushing to buy goods from the North Sea and Guyana.

In Asia, demand for Abu Dhabi's Murban crude oil has surged, leading to a sharp increase in spot prices in mid-January, while crude oil flowing from Kazakhstani ports to Asia has greatly decreased. At the same time, ship tracking data from trade data provider Kpler shows that oil loading from the U.S. to Asia last month dropped by more than a third compared to December.

While it is foreseeable that this divergence in global energy trade will not be permanent, the current situation is indeed making it more difficult for countries heavily dependent on energy imports such as India and South Korea to diversify their sources of oil supply.

For refiners around the world, this also limits their flexibility to respond to rapidly changing market dynamics and could ultimately erode profits.

Viktor Katona, chief oil analyst at Kpler, said, "Turning to more conveniently located goods makes commercial sense now, as long as disruptions in the Red Sea keep freight rates high. It's not easy to choose between supply security and maximizing profit."

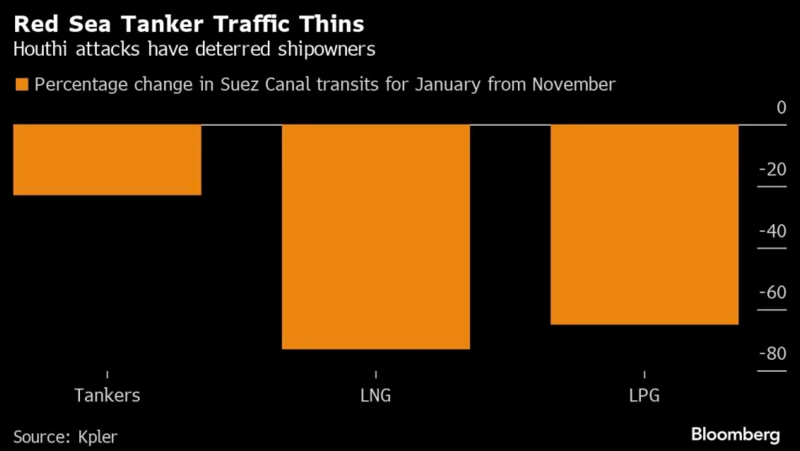

According to a report released by Kpler on January 30, the volume of oil tankers transiting the Suez Canal last month decreased by 23% compared to November. The decline in liquefied petroleum gas and liquefied natural gas was even more significant, dropping by 65% and 73% respectively.

In terms of specific product segments, the impact is greatest on diesel and aviation fuel from India and the Middle East flowing to Europe, as well as on European fuel oil and naphtha flowing to Asia. The price of naphtha in Asia reached its highest level in nearly two years last week, as the market is concerned that purchasing naphtha from Europe will become more difficult. Naphtha is a light oil used as a feedstock for chemical production, processed from crude oil or other raw materials. The impact of the Red Sea attacks is also leading to increased transportation costs, thereby prompting refiners to procure locally as much as possible. Shipping costs for Suezmax tankers from the Middle East to Northwest Europe have risen by about half since mid-December, while global benchmark Brent crude has risen by about 8% during the same period. Meanwhile, according to traders in the market, the delivery cost of oil from the increasing production in the United States to Asia has risen by over $2 per barrel in the three weeks of January. Giovanni Staunovo, commodity analyst at UBS Group, stated that while it is still possible to diversify import channels, the cost is becoming increasingly prohibitive. Refiners' profits will be impacted unless they can pass on the cost to end consumers. Adi Imsirovic, director of Surrey Clean Energy, pointed out that the geopolitical situation is not favorable for energy trade and advised caution for buyers. He also stated that it is a difficult time for refiners, especially for Asian refiners who need to be more flexible.

For more information contact Gina Wen: ginawen@smm.cn

![Lithium Ore 3.2-3.6 Market Update [SMM Weekly Review]](https://imgqn.smm.cn/usercenter/ezoBg20251217171730.jpg)

![[SMM Analysis] This Week’s Hydrometallurgy Recycling Market: Nickel, Cobalt, and Lithium Chemicals Prices Fluctuated; the Market Rebounded (2026.3.2-2026.3.5)](https://imgqn.smm.cn/usercenter/JSjkr20251217171728.jpg)