SHANGHAI, Dec 6 (SMM) - China's exports of rare earth products are mainly rare earth permanent magnets. In October, the export volume of rare earth oxide and mesh metal recorded only 1,358 mt and 762 mt respectively. Among them, lanthanum, yttrium took up the majority of total exports, while the proportion of key raw materials of rare earth permanent magnets such as praseodymium, neodymium, dysprosium, and terbium was relatively small. In other words, the overseas market is underdeveloped in terms of upstream manufacturing process of rare earth permanent magnets.

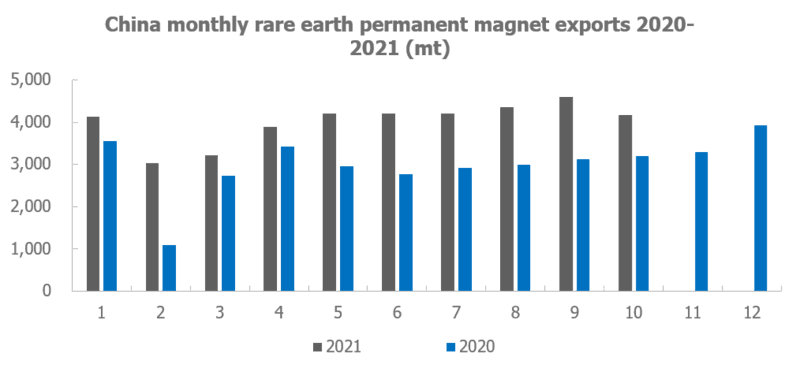

China exported 4178 mt of rare earth permanent magnets in October, a year-on-year increase of 30.5%. The cumulative exports from January to October increased by 43.7% from 2020. Supplies from China could fulfil 80%-90% of the global demand for rare earth permanent magnets, which have grown rapidly in 2021, supporting the sharp increase in the prices of rare earth products and boosting China's rare earth permanent magnet exports.

However, the exports in October decreased 9.2% from the previous month, falling for the first time since this February. Rare earth permanent magnets are mainly exported to Europe and the United States, accounting for 54% of the total.

The decline was mainly contributed by European countries and the US. Among them, the exports to Europe and the US totalled 1754 mt and 484.7 mt respectively, a decrease of 10% and 25.6% from the previous month. And 679 mt of products were exported to South-east Asia, an increase of 3.7% month-on-month. Due to the low popularity of of January of production and labour, some processing plants in Europe and the US have been re-located in South-east Asia, hence the exports of rare earth permanent magnets to South-east Asia are increasing.

From the aspect of industry demand, the global sales of new energy vehicles in October decreased slightly by 50,000 units from the previous month. And due to the shortage of chips, the output of traditional fuel vehicles also decreased, and the impact has lasted until November. The number of orders for wind turbines in the United States decreased as well owing to the uncertainty of tax relief in Congressional bills and cost pressures. In October, downstream demand from overseas new energy vehicles, traditional fuel vehicles, wind turbines, etc. weakened, and the costs of shipping containers increased. In other words, the profits of overseas downstream enterprises of rare earth permanent magnet were damaged, hence the orders decreased, resulting in a decrease in China's rare earth permanent magnet exports.

On the other hand, the prices of domestic raw materials for permanent magnets were high, the payment period has been shortened or changed to cash transactions. Therefore, some magnetic materials companies suffered losses. Under financial pressures, domestic magnetic materials companies had to reduce their export orders.

China's imports of rare earth products are mainly rare earth ore from Myanmar and the United States. Among them, the structure of imports from Myanmar has changed from mixed rare earth carbonate to unlisted rare earth oxides. The ore imports from Myanmar have been falling year by year in 2018-2021, and recorded 14,000 mt from January to October 2021. The import volume of rare earth mesh metal ore from the United States has increased year by year from 2018 to 2020, and the imports from January to October 2021 were 56,000 mt, surpassing the import volume in the same period last year. The production of MP mine is close to full capacity, and the import growth of rare earth mesh metal ore from the United States will be limited. Myanmar has been affected by the COVID pandemic and closed its customs since July. The global pandemic prevention and control still faces great difficulties, and subsequent imports of Myanmar ore will be low.