SHANGHAI, Feb 23 (SMM) – The SHFE and LME nickel prices diverged markedly in the afternoon trading on Tuesday. The SHFE/LME nickel price ratio shrank from 7.28 to 7.07. The import loss widened to $1,000/mt.

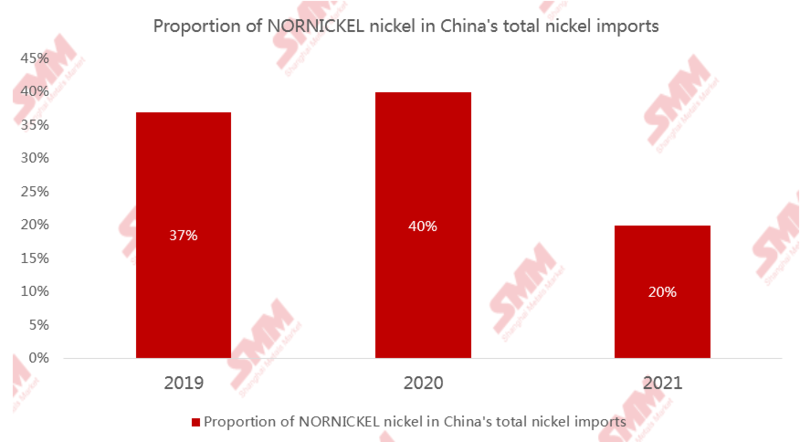

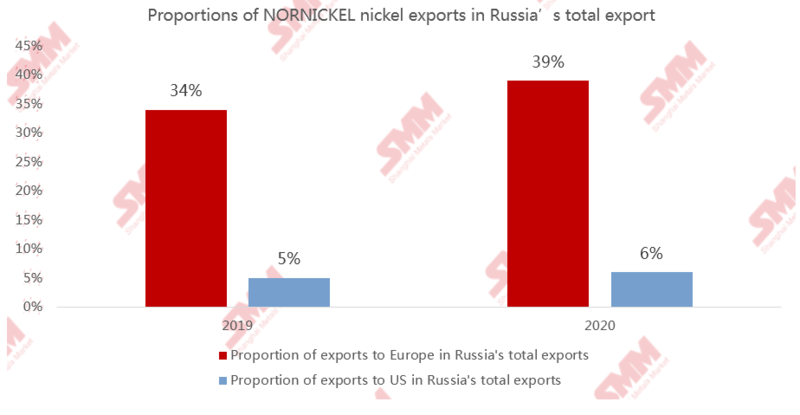

If US imposes sanctions on Russia, the NORNICKAL nickel plate that were previously shipped to US may flow into other countries, especially China. According to SMM data, the annual NORNICKEL nickel output stood stable at around 210,000 mt in recent years, and the output was reduced only in 2021 because of accidents. It plans to produce about 210,000 mt of refined nickel in 2022. China imported about 40,000 mt of refined nickel from Russia in 2021, accounting for about 20% of the total import volumes, and the proportion stood at 40% and 37% in 2020 and 2019 respectively. The exports of NORNICKEL nickel from Russia to Europe in 2019 accounted for about 34% of the country’s total exports, and the proportion increased to 39% in 2020. While the exports to US accounted for 5-6% in 2019-2020.

If the market continues to worry about the sanctions, more NORNICKEL nickel is likely to be exported to China or delivered to LME warehouses. Therefore, the refined nickel supply in US and Europe is expected to be tighter than in China. The LME and SHFE prices will diverge more significantly. In addition to the NORNICKEL nickel, the global trade of refined nickel from other countries will also be affected by the sanctions.

If the NORNICKEL nickel is delivered to LME warehouses, the LME nickel stocks will increase significantly in the short term. While the nickel importers in China will suffer severe import losses, and the tight spot supply will push up the spot premiums and open the import window, then the NORNICKEL nickel will be shipped from LME warehouses to Chinese market. In the other case, the supply shortage in China may directly drive up the spot prices and open the import window. As such, China’s imports of NORNICKEL nickel are bound to increase.

After more refined nickel flows into China, Europe and US will need to look for the substitutes in the global market. According to SMM survey, the European market sees higher demand from the stainless steel and alloy industries, and the nickel plate can replace nickel briquette as raw materials.

Therefore, the supply gap of refined nickel in European and US market may be supplemented by the goods from Japan, Canada, Australia, and Norway. The premiums of the refined nickel from these countries will rise in the European and US markets. While in Chinese market, the price spread between nickel brands may expand.

![[SMM Nickel Midday Review] On March 3, nickel prices continued to retreat, and Iran claimed the Strait of Hormuz had been closed](https://imgqn.smm.cn/usercenter/yaAtG20251217171733.jpg)