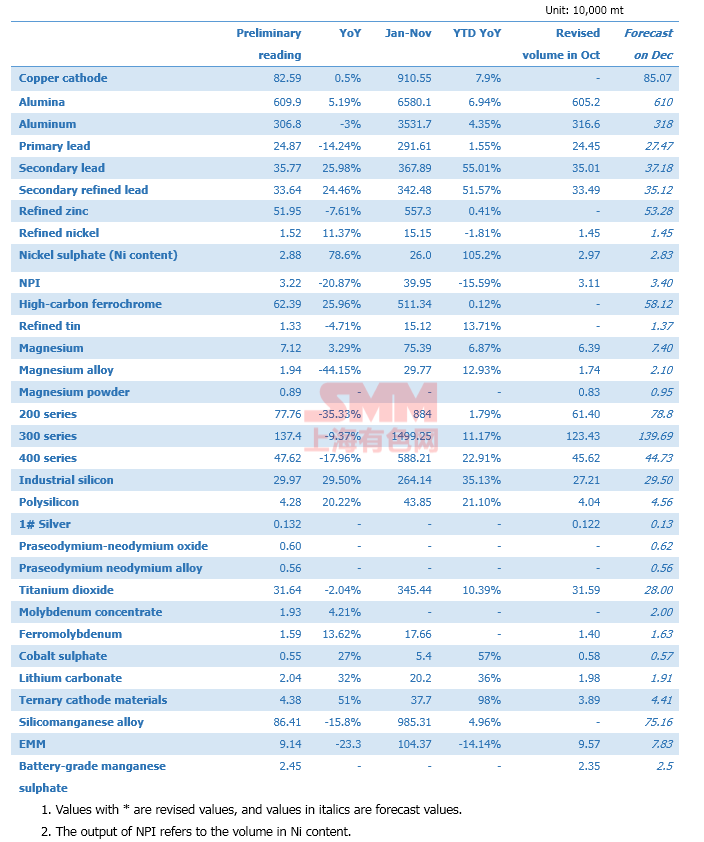

SHANGHAI, Dec 8 (SMM) — This is a roundup of China's metals output in November 2021, from an exclusive survey of key producers by SMM analysts.

Copper Cathode

China’s copper cathode output stood at 825,900 mt in November, up 4.6% month on month and 0.5% year on year

The power rationing across China was basically ended in November. The smelters in Shandong and Guangxi fully resumed the production from power rationing. The production in Jiangsu and Zhejiang were slightly restricted in early November, but recovered rapidly. The total copper cathode output in November basically recovered to the level before the power rationing.

Jiangxi Copper was under maintenance, but it had sufficient stocks of blister copper. The two smelters in Guangxi basically resumed the production from maintenance. The output reduction was basically in accordance with the market expectations.

As for the raw materials, China’s imports of blister copper continued to stand low due the riots in Africa, the shortage of containers at ports, and the global supply chain problems. Some smelters in the coastal provinces could not produce at full capacities for lack of blister copper. The major ports in north China were mostly closed under COVID-19 related control and prevention. The smelters in north-west China could not increase the use of copper cathode, which also dragged down the copper cathode output.

The sulphuric acid prices fell rapidly in the Yangtze River Basin of central China, so the smelters were less willing to produce, and the total output of copper cathode in November could not rally to the level in Q2.

The shortage of blister copper and logistic problems at major northern ports will not be alleviated significantly in December, but the production of refined copper will be less affected. Some smelters will rush to produce at the end of the year for the annual output goal, and most smelters will complete the maintenance. The output is expected to return to more than 850,000 mt in December.

Aluminium

SMM data showed that China's aluminium output was 3.07 million mt in November (30 days), a year-on-year decrease of 3%. The daily average output was 102,000 mt, flat on the month. China produced 35.32 million mt of aluminium from January to November, a year-on-year increase of 4.35%. The operating capacity of aluminium rose slightly in November. Among them, the production in Guangxi and Chongqing reduced due to short power supply. While the output was also negatively impacted by the accident of an aluminium smelter in Wenshan, Yunnan. On the other hand, some smelters in Henan, Yunnan and Inner Mongolia resumed the production, which made up for the decreases in output to some extent. China's operating aluminium capacity stood at 37.46 million mt/year in early December, while the installed capacity stood at 43.75 million mt/year, leaving the operating rate at 85.6%. According to SMM research, the proportion of liquid aluminium was 62.4%, up 0.2 percentage point on the month.

Looking into December, the supply is unlikely to see substantial reductions or increases from resumed production. The market shall watch the recovery of the 300,000 mt/year capacity from the accident. It is expected that the output in December will stand at 3.18 million mt, with a daily output of 102,500 mt. On the demand side, the downstream processing companies will resume the production slightly from previous power rationing in Jiangsu, Zhejiang nd Henan, and downstream restocking will pick up amid retreating aluminium prices. The social aluminium ingot inventory is likely to pull back to 910,000 mt by end of December.

Alumina

SMM data showed that in November (30 days), China’s alumina output was 6.24 million mt, of which metallurgical-grade alumina was 6.1 million mt. The average daily output of metallurgical-grade was 203,300 mt, an increase of 4.14% month on month and 5.19% year on year. From January to November, China produced 65.8 million mt of metallurgical alumina, a cumulative year-on-year increase of 6.93%. The output in November increased compared with the previous month as the increase in alumina prices prompted some alumina refineries to ramp up production. Besides, the operating capacity of Alcoa stood at 200,000 mt/mt in November and rose to 400,000 mt/year in November. The net imports of alumina is estimated at around 350,000 mt as the import window was open throughout November, and China’s alumina surplus was about 543,000 mt in the month. The production of 1 mt of aluminium consumes 1.925 mt of alumina.

As of early December, China's metallurgical grade alumina operating capacity was 74.24 million mt/year, with the installed capacity at 88.6 million mt/year. The production activities of refineries in Shanxi, Shandong and Hebei were not affected by the production restrictions toward air pollution in the heating season or the Beijing Winter Olympics in November. The policies in the heating season in December and its impacts on alumina production are worth of attention. It is expected that the output of metallurgical alumina in December (31 days) will record 6.1 million mt, and the alumina market will see a slight surplus of 279,000 mt. The cumulative surplus throughout 2021 will be around 1.12 million mt.

Primary lead

China produced 248,700 mt of primary lead in November, down 1.75% from October and 14.24% from a year ago. The cumulative output from January to November rose 1.55% from the same period last year. Total production capacities of enterprises involved in the survey stand at 5.48 million mt in total in 2021.

According to SMM research, the primary lead smelters went over maintenance and production resumption at the same time in November, hence the total output in the month was generally flat from a month ago. For example, the smelters in Henan and Hunan finally shook off the influences of power rationing, and ramped up output by year-end to meet the annual production targets, which has led to more output in the region. However, smelters like Henan Wanyang, Anyang Minshan, Hunan Shuikoushan, Jiangxi Copper, Jiangxi Jinde all carried out maintenance from October to November. In other words, the increase and decrease in output have largely been offset by each other.

Looking into December, many smelters will complete their maintenance and resume their production, including Jiangxi Copper, Jiangxi Jinde, Shandong Hengbang, Henan Wanyang, etc. Even though some other smelters like Zhongjin Lingnan will start overhaul during this period, the overall output will be less affected. And the monthly output in December is likely to increase month-on-month. Domestic primary lead output in October is expected to increase by more than 20,000 mt to 275,000 mt.

Secondary lead

China produced 357,700 mt of secondary lead in November, up 2.15% from October, and up 25.98% on the year. Cumulative output in January-November surged 55.01% from the same period last year. Meanwhile, China produced 336,400 mt of secondary refined lead in November, up 0.42% month-on-month, and up 24.46% from a year ago. Cumulative output from January to November advanced 51.57% on the year.

According to SMM research, the profits of secondary lead in November were fair, and most smelters were actively producing. For example, Anhui Tianchang, Shanxi Yichen, Jiangxi Zhenyu, Hunan Jinyi, etc. have resumed their production, but the real output in the month fell short of expectation. The causes are that the power rationing in Anhui and Henan continued to restrict the production, while the unplanned maintenance of some smelters out of equipment failure has negatively impacted the total output. Meanwhile, the smelters in some places of Inner Mongolia have suspended the production due to cold weather in winter. Therefore, even under lucrative profits, secondary lead smelters were slow to ramp up the output and only a small increase was achieved in November.

In December, the fifth batch of the second round of central government’s environmental protection inspection teams have arrived at four provinces, and the solid waste inspections are also under way in Anhui and Jiangxi, restricting the production of some smelters. On the other hand, however, the smelters in Anhui and Henan who have been constrained by power rationing before will return to full production in December, creating additional supply. The total monthly output of secondary lead in December is likely to keep increasing by another 10,000 mt.

Refined zinc

China's refined zinc output stood at 519,500 mt in November, up 20,200 mt or 4.05% on the month but down 7.61% on the year. The combined output from January to November stood at 5.57 million mt, up 0.41% year on year. Alloy output at domestic refined zinc smelters in SMM survey sample registered 77,000 mt in November, up 3,500 mt mt on the month.

SMM survey showed that China's refined zinc output in November was basically on par with estimate. The increase in output was partly contributed by the expected production resumption from power rationing in Hunan, Guangxi, Henan, Gansu and Liaoning. The additional output from Guangxi Yusheng Ge Co. and Southwest Energy & Mineral came on top of estimate. While the decline was mostly found n Jiangxi and Yunnan as a result of maintenance.

SMM expects that the output of refined zinc in December will rise 13,300 mt from November to 532,800 mt, which is far behind estimate as the output in Huayuan, Hunan and Shaanxi will drop due to maintenance. Nonetheless, the resuming production in Inner Mongolia and Jiangxi after the maintenance or production suspension will push up the montly output. The total output throughout 2021 is likely to stand at 6.11 million mt, up 0.03% year-on-year.

Stainless steel

According to SMM survey, the domestic stainless steel output in November totalled about 2.63 million mt, up 323,000 mt or 14% month-on-month and down 10.2% year-on-year. China’s output of stainless steel totalled 29.72 million mt from January to November, an increase of 10.23% year on year.

The output grew in November from a month ago as the production was resumed amid loosening power rationing in some regions. Among them, the output of 200-series stainless steel has increased significantly, with a month-on-month increase of 164,000 m, mainly due to the recovery of production in Fujian and Guangxi. The output of 300 series stainless steel increased by 140,000 mt or 11.3% from the previous month, mainly due to the resumption of production of a steel mill, a major manufacturer of 300 series, in Guangdong in mid-November, whose production was suspended before. The output of 400 series stainless steel remained stable in November with little changes.

In December, some steel mills will start routine maintenance. Specifically speaking, the output of 300 series will be reduced by around 50,000-60,000 mt as a steel mill and a special steel mill in Jiangsu will carry out overhaul. However, the production of steel mills in Guangdong will be resumed from government inspections. Hence the output in December will still manage to increase to some extent from November. The output of 200 series, 300 series and 400 series is estimated at 788,000 mt, 1.4 million mt and 447,000 mt respectively in December, totalling 2.63 million mt. The output in January, 2022, however, is likely to drop significantly month-on-month as most steel mills will enter routine maintenance for the year, greatly influencing the total output.

Refined nickel

The domestic refined nickel output stood at 15,200 mt in November, up 4.86% or 706 mt month-on-month. The average monthly operating rate stood at 69%. The increase in refined nickel output in November was mainly contributed by the ramped up production in Gansu, which is likely to pull back to normal level in December.

The output of refined nickel is expected to stand at around 14,500 mt in December. Domestic smelters’ production activities are relatively stable at the moment.

NPI

Domestic NPI output increased 3.74% month on month to 32,200 mt (nickel content) in November 2021. The monthly output slumped 20.87% year-on-year, indicating that this year’s production has been much worse than last year. The output of high-grade NPI stood at 26,600 mt (Ni content), an increase of 2.3% from October, and the output of low-grade NPI was 5,600 mt (Ni content), up 11.3% on the month. In November, the production of NPI plants gradually recovered from the power rationing policy, and was normal in Guangxi. The production in Guangdong was also resumed in mid-November, and stood stable in Jiangsu, Fujian, and Shandong. However, due to the cold weather in north China in winter, some NPI plants in Liaoning and Inner Mongolia were severely affected by heavy snow, and their output dropped. In addition, due to the approaching of the Winter Olympics, and in order to protect the blue sky, industrial production in the surrounding areas was affected to varying degrees, and the output could hardly reach the normal level.

Domestic NPI output in December is expected to rise 6% month on month to 34,000 mt in Ni content. The output of high-grade and low-grade NPI is likely to stand at 28,400 mt and 5,8600 mt in Ni content, respectively. The production of low-grade NPI will be stable with relatively small fluctuations in output. The production of NPI plants in north China may stabilise after they adapt to cold weather, but heavy snow will affect the transportation. The production in Guangdong has been resumed, and the output of high-grade NPI will increase.

Nickel sulphate

China’s output of nickel sulphate stood at 28,800 mt in metal content, or 131,000 mt in physical content in November 2021, down 2.93% from the previous month but up 78.6% year-on-year. The output of battery-grade nickel sulphate was 27,300 mt. The volume of Self-dissolved nickel briquette (powder) accounted for about 53% of the total raw materials in November, virgin materials (MHP/MSP/high matte nickel) accounted for about 30%, scrap took up about 14%, and the remaining was crude nickel sulphate. The overall nickel sulphate market was sluggish in November. The profits of nickel sulphate manufacturers were poor as the price moves were in a stalemate. Some manufacturers have conducted maintenance in November. In addition, manufactures with precursor capacity have reduced their output in order to contain the in-plant inventory by year-end. The total output in December is expected to stand at 28,500 mt in Ni content, down 1.76% month-on-month as the maintenance will be extended into the month.

Tin

China's refined tin output stood at 13,281 mt in November, down 8.05% from October. The decline in output was caused by multiple factors. First, the total output in Yunnan was largely stable from a month ago though the production of some smelters in Gejiu was suspended for a short time due to air pollution, which is in line with SMM estimate based on previous research. Only a small amount of output has been affected. Second, the supply of raw materials in Guangxi was less impacted than expected, hence the output only dropped fractionally month-on-month. The output of smelters in Jiangxi, however, dropped significantly as the production was ceased for quite some time due to environmental protection-related restrictions. The smelters have basically resumed normal production according to the latest SMM survey. Lastly, the output in other regions increased minimally in November on the month. And the near-term output is likely to be stable as the production in these regions has been quite smooth.

In December, around 500 mt of refined tin output is likely to be affected by the routine maintenance, which will last until the end of December, of a few smelters in Yunnan. The output in Guangxi may drop by 400 mt amid tight supply of raw materials. Jiangxi will likely see more output because the smelters, previously restricted by the environmental protection requirements, have largely resumed the production. While the output in other producing areas will stay unchanged in December. In summary, SMM expects the domestic refined tin output in December to stand at 13,740 mt.

Polysilicon

Polysilicon output hit a new high in Nov after production recovered from power rationing and maintenance

SMM data shows that domestic polysilicon output stood at 42,800 mt in November, an increase of 5.9% month on month and 20.2% year on year.

The production activities have largely resumed in November from previous power rationing, maintenance and other restrictions, hence the monthly output increased more than 2,000 mt from the previous month. Xuzhou Zhongneng's new production capacity of granular silicon will bring additional output in December. Meanwhile, the new projects and technological upgrading projects of companies like Yongxiang New Energy, Xinte Energy have been put into production, but the output will not be generated until Q1 next year. The polysilicon output is expected to rise to 45,600 mt in December, continuing to set new monthly highs.

Industrial silicon metal

Industrial silicon metal output topped in November throughout 2021 amid resuming production

Domestic industrial silicon metal output stood at 300,000 mt in November, an increase of 10% month on month and 29.5% year on year, according to SMM survey.

Xinjiang and Fujian, the two major producing regions of industrial silicon metal, contributed most of the increases in November after local production was resumed, and the silicon metal manufacturers in Yunnan also raised their operating rates slightly. The output in Sichuan dropped fractionally from a month ago amid power rationing and environmental protection inspections. While Heilongjiang barely saw any output in November due to severe COVID-19 pandemic.

The electricity prices have adopted the pricing scheme for dry season in south-west China starting from November 26, which has been closely watched by the market. The electricity prices in Yunnan and Sichuan have been adjusted to different degrees. Compared with the wet season, the average electricity price was raised by about 0.3 yuan/kWh to about 0.6 yuan/kWh. The electricity costs of silicon metal manufacturers in December will increase significantly compared with that in November, but there has been no massive production reductions for now. It is partly because the current industrial silicon metal are still quite profitable. And as the rainy season in Yunnan has been delayed this year, the power supply of small hydropower projects in the region can support the production of most silicon metal manufactures as of early December. While the manufacturers in Sichuan will maintain production with the supplement from extensive power grid, except for a few that will suspend the production.

As silicon metal prices fell close to the breakeven point, it is expected that the time for extensive production cuts in the south-west region will be postponed until the end of December. It is estimated that the output of industrial silicon metal in December will be around 295,000 mt, and our forecast for the full-year output has been adjusted to 2.94 million mt, a year-on-year increase of 33.6%.

Magnesium ingot

According to SMM, China's magnesium ingot output stood at 71,200 mt in November, up 11.43% month on month and 3.29% on the year. The output totalled 753,900 mt from January to November, a year-on-year increase of 6.87%.

According to SMM research, the exports of magnesium ingots reached 24,300 mt in November, an increase of 43.78% month-on-month. As such, the operating rates of domestic magnesium ingots increased, which stood at 65.04% in November, an increase of 10.67 percentage points month-on-month and 10.13 percentage points year-on-year.

At present, the one-month long ecological and environmental protection inspections has been kicked off. And people running magnesium plants have expressed their uncertainty as to whether the production of magnesium plants will be affected in the future. Taking into account that the fourth quarter is the traditional peak season for magnesium ingot export, it is expected that the output of magnesium ingot in December will maintain growth to about 74,000 mt, based on the outstanding overseas orders in November.

Magnesium alloy

According to SMM, China's magnesium alloy output stood at 19,400 mt in November, up 11.70% month on month and down 44.15% on the year. The output totalled 297,700 mt from January to November, a year-on-year increase of 12.93%.

The average operating rate of magnesium alloy industry stood at 35.83% in November, up 11.7 percentage points month on month and down 46.63 percentage points from a year ago, accroding to SMM survey.

According to the feedback of some salesmen from magnesium alloy factories, the demand of downstream enterprises in the Pearl River Delta region continued to weaken due to the high magnesium prices. However, under the support of rebounding overseas orders, the overall operating rates of magnesium alloy have increased. And the operating rates of leading enterprises have been maintained at a high level, while the output of small alloy plants was recovering slowly. Taking into account that overseas demand is expected to improve in the fourth quarter, the output of magnesium alloy is likely to reach 21,000 mt in December.

Magnesium powder

According to SMM data, China's magnesium powder output stood at 8,900 mt in November, a month-on-month increase of 7.63%.

The average operating rate of magnesium powder industry recorded 50.19% in November. Affected by the rebounding export orders in November, the overall operating rates have increased on the month. Taking into account that the fourth quarter is the traditional peak season for exports as stockpiling demand is relatively high ahead of the Christmas holiday, it is expected that the domestic magnesium powder output in December will record a positive growth to 9,500 mt.

Molybdenum concentrate

SMM data shows that in November 2021, the domestic molybdenum concentrate output was 19,300 mt, an increase of 4.21% from the previous month.

The output in November increased slightly from a month earlier. As far as SMM understood, the production activities of domestic mines were generally stable, and the output of some mines increased palpably after resuming part of the production, driving up the total output slightly. As the sustaining short supply of molybdenum concentrates and the continuous increase in prices in December, the mines are generally more enthusiastic about producing. It is expected that the monthly output will continue to increase in December.

Ferromolybdenum

The domestic ferromolybdenum output stood at about 15,850 mt in November, up 1,900 mt or 13.62% on the month. Domestic ferromolybdenum has saw great increase in supply.

The steel mills’ demand picked up significantly in November on the whole. According to SMM research, the purchasing volume of ferromolybdenum through tender in November totalled about 9,900 mt, surging 130% from the previous month. Meanwhile, the production of ferromolybdenum was boosted as the orders received by manufacturers grew significantly, and the overall prices improved in late November. Some traders and downstream companies were also considering stockpiling amid an active market. Hence the output of ferromolybdenum increased significantly. Some ferromolybdenum manufacturers’ production has been scheduled until the end of December amid exciting market transactions. It is expected that the ferromolybdenum output will keep rising in December.

High-carbon ferrochrome

China’s output of high-carbon ferrochrome in November surged by 189,200 mt or 43.53% on the month to 623,900 mt, an increase of 25.96% year on year. The output in Inner Mongolia increased by 106,800 mt or 55.39% month on month to 299,600 mt. The power rationing was significantly alleviated in November. The ferrochrome plants actively produced amid brisk profits, and they raised their operating rates for the delayed shipments of goods under long-term contracts with steel mills. The domestic high-carbon ferrochrome output peaked in November.

China is expected to produce 581,200 mt of high-carbon ferrochrome in December, up 15.13% on the month but down 6.84% on the year. Sichuan and Shanxi will continue to restrict the production under environmental protection policies in winter. Some plants in Guizhou have reduced or suspended production for maintenance after the central environmental inspection team arrived. In addition, the prices have been falling recently, the chrome ore prices have been on the rise amid low inventory, and the coke prices have also stabilised after falling. As such, some plants in south China may suspend production due to high costs. Despite the production restrictions for Beijing Winter Olympics, the output in Inner Mongolia is expected to stand high amid lower electricity prices and brisk profits.

Silicomanganese alloy

SMM data shows that China’s silicomanganese production stood at 864,100 mt in November, a month-on-month increase of 32.23% but a year-on-year decrease of 15.8%. The output totalled 9.85 million mt from January to November, an increase of 4.96% on the year. The average operating rate of silicomanganese alloy industry stood at 56% in November, up 19.1% month on month, but down 15.53% year on year.

The output across major silicomanganese alloy production areas rebounded rapidly as there was basically no power rationing in November. However, the downstream demand by steel mills was weak amid frequent production restrictions. The prices of silicomanganese alloy kept falling as the supply grew. The raw material costs declined in November, but the production costs of plants dropped slowly as they were still producing with the raw materials previously purchased at high prices. The profits shrank rapidly, and the plants may reduce the production later. The high electricity prices in Guangxi are weighing on the local plants, and more plants have suspended the production as the electricity prices will be further raised in December. The production in Guizhou and Ningxia may be cut as well due to the central environmental protection inspection. Therefore, the total output of silicomanganese alloy is expected to decline to about 751,600 mt in December.

EMM

The domestic EMM output in November stood at 91,400 mt, a drop of 4.4% from October and down 23.3% on the year. The average monthly ex-works price of EMM in November was 42,243 yuan/mt, an increase of 2.58% from the previous month. The average monthly FOB price of EMM was $6,850/mt, an increase of 5.64% from the previous month. The EMM prices are expected to move downward in the short term as the end demand from steel mills stood flat.

Battery-grade manganese sulphate

According to SMM survey, China's battery-grade manganese sulphate output stood at 24,500 mt in 2021, an increase of 4.3% from the previous month. A few producers ramped up the production at the end of the year, while the demand declined, so the prices fell amid slight supply surplus. However, most battery-grade manganese sulphate producers expect the demand to grow next year.

Praseodymium-neodymium oxide

China's output of praseodymium-neodymium (Pr-Nd) oxide in November 2021 stood at 6,044 mt, down 2% from a month earlier. The production was cut mainly in Jiangxi, Hunan, Guangxi, Sichuan, and Shandong.

Baotou Iron & Steel planned to suspend the production for maintenance in November after achieving the annual mining target, which further tightened the domestic supply of rare earth ores, especially ion ores. The ROM holders reduced shipments amid low inventories. The separation companies in Jiangxi, Hunan, and Guangxi reduced the production in November. The operating rates of separation companies stood at 70-80% in Jiangxi. The operating rates of a few companies in Hunan fell below 50% due to ROM shortage and power rationing in some areas. The output of some companies in Shandong declined slightly due to the stricter environmental protection inspections amid poor air quality.

The separation companies mainly delivered for long-term orders, and the spot inventories of Pr-Nd oxide were low. The separation companies producing mainly with scrap materials maintained stable output of Pr-Nd oxide, and some companies ramped up the production.

Some border ports in Yunnan opened in December, and the domestic ore holders increased shipments as the ore from Myanmar gradually completed the customs clearance. Some plants increased the purchase of ROM. The operating rates across some southern areas are expected to rise in December, and the national output of Pr-Nd oxide is expected to increase slightly to 6,150 mt.

Pr-Nd alloy

SMM data shows that output of praseodymium-neodymium (Pr-Nd) alloy in November 2021 stood at 5,574 mt, down 7.5% from a month earlier. The production was cut mainly in Jiangsu, Guangxi, Sichuan, and Gansu, while the output increased mainly in Zhejiang.

The shortage of rare earth ROM led to the tight supply of Pr-Nd oxide, which caused the Pr-Nd alloy companies to lower their operating rates in Jiangsu, Guangxi, Gansu, and other places. The output of Pr-Nd alloy fell slightly. The spot prices of Pr-Nd oxide stood stable at 780,000-790,000 yuan/mt in early November, and was pushed up by the bullish news in the market to 850,000-860,000 yuan/mt at the end of the month. Some separation companies reduced the purchase of raw materials and lowered their operating rates due to high raw material costs. The Pr-Nd alloy companies in Zhejiang raised operating rates after the power rationing was lifted.

The supply of rare earth ROM will remain tight in the long term, but the current shortage has been alleviated as the ores from Myanmar are under customs clearance. China’s output of Pr-Nd alloy is expected to increase slightly to 5,600 mt.

Silver

The domestic 1# silver output stood at 1316.84 mt (including 1121.34 mt of mineral silver) in November, up 8.08% from the previous month, which is basically in line with SMM estimate in October. The output is expected to keep rising slightly in December. At the end of November, the national foreign exchange reserves was $3.22 trillion, a month-on-month increase of $4.8 billion. The gold reserves reported 62.64 million ounces, unchanged from the previous month. According to the US National Association for Business Economics, the inflations in US will remain high until at least 2023 due to strong demand and other factors. Economists believe that the supply chain bottlenecks, strong demand for goods and services, higher salaries, and stronger housing demand were the key factors that drove up the prices in US. 43% of the economists expect that the supply chain bottleneck will begin to ease in Q2 2022. Therefore, the silver prices moved downward with limited rally in November amid thin transactions. The silver prices are expected to fluctuate within a wider range under the impact of US economy and global COVID-19 pandemic and remain in a downward trend in December, but the prices may rebound limitedly. The silver production was basically normal. The production suspension and recovery mainly resulted from the maintenance plans, and some plants ramped up the production significantly to achieve the annual production target at the end of the year. Fewer companies reduced the production in November, including Jiangxi Copper Lead and Zinc, Shandong Humon Smelting, Jiangxi Longtianyong, etc. The output in Shandong Zhaojin, Guandong Gold Industry, Mengzi Mining and Metallurgy, Yunnan Zhenxing, Baiyin Nonferrous, Sino-Platinum Metals, and other companies increased significantly after the production resumption or production expansion at the end of the year, which contributed to the increment in the total silver output in October. The current supply of silver-containing materials including anode mud remains tight, and the pricing coefficient is little changed. The national silver output is expected to increase slightly in December.

Titanium dioxide

China's titanium dioxide output stood at 316,400 mt in November, up 0.15% month on month but down 2.04% on the year. The output totalled 3.45 million mt from January to November, a year-on-year increase of 10.39%.

The downstream purchase of titanium dioxide declined in November as the market left the peak season, and some producers lowered the quotations. Some titanium dioxide plants plan to suspend the production for maintenance amid expectations of weaker demand in December. The suspension will last for half a month to a full month. The titanium dioxide output in December is expected to drop to 280,000 mt.

Cobalt sulphate

China’s cobalt sulphate output is estimated at 5,489 mt in metal content in November, a month-on-month decrease of 2.4% but a year-on-year increase of 27.2%. On the supply side, the rising costs of cobalt raw materials weighed on the cobalt salt production, and the output dropped slightly. The orders for cobalt sulphate decreased as the end demand recorded little increase and the ternary cathode material precursor producers reduced the purchases to lower the in-plant inventories. The high costs are expected to ease slightly, and the supply may increase. China’s cobalt sulphate output is expected to be 5,537 mt in metal content in December, a month-on-month increase of 0.9% and year-on-year increase of 19.5%.

Lithium carbonate

China’s lithium carbonate output was about 20,448 mt in November, a month-on-month increase of 3% and year-on-year increase of 32%. The lithium carbonate prices hit a new high in November. The output under OEM orders in Sichuan and Jiangxi increased. The lithium output extracted from spodumene increased significantly by 13%. The output in Jiangxi rose by 9% amid richer resources, while the output in Qinghai fell by 22% on the month due to adverse weathers and the suspension of some production lines. The major large producers of lithium carbonate will start the maintenance for Chinese New Year in December. The lithium carbonate output is expected to stand at 19,115 mt in December, a month-on-month decrease of 7% but a year-on-year increase of 25%.

Ternary cathode material

China produced about 42,791 mt of ternary materials in November, an increase of 10% month on month and 51% year on year. The companies maintained normal production as the power rationing was lifted, and the total output increased because some large plants put more capacities into production. The leading battery companies placed more orders for the 5 and 6 series products, mainly due to the higher demand by the automobile companies. The orders for the high-nickel ternary cathode materials increased slightly, mostly from the overseas power battery industry and high-end digital industry. While the demand from E-bike battery market and digital market was weak. The overall demand of ternary cathode materials increased. The demand from the power battery markets at home and abroad remains relatively high in December, and the orders from the E-bike battery market and digital market increased steadily. China’s ternary cathode material output is expected to stand at 44,110 mt in December, an increase of 3% month on month and 50.5% year on year.

Metals output November 2021

![Platinum Prices Plunge Intraday Spot Market Transactions Recover [SMM Daily Review]](https://imgqn.smm.cn/usercenter/VphiQ20251217171736.jpg)