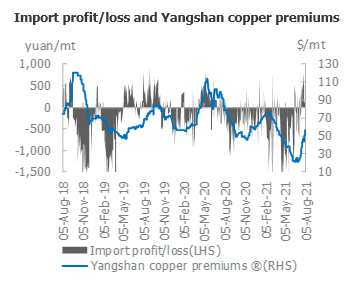

SHANGHAI, Aug 11 (SMM) - Yangshan copper premiums with a quotation period in September stood at $42-67/mt under warrants during August 2-6, and between $35-64/mt under bill of lading (B/L). The SHFE/LME copper price ratio stood at 7.34 as of August 6.

Brisk trades pushed import premiums higher significantly. The influx of imported copper, driven by a higher SHFE/LME copper price ratio, lowered premiums in the domestic spot market. Lower spot premiums eroded into profits of imported cargoes, with import losses below 100 yuan/mt. Market demand was strong. However, offers were limited. Most of the sellers were optimistic over the market in the short term, holding onto their cargoes.

Quotes for mainstream pyro-copper under B/L stood at around $65/mt, and quotes for the two high-quality brands stood at around $70/mt, which was close to long-term contract levels. Traded import premiums under warrants rose amid tight supply. Quotes for hydro-copper rose to around $55/mt.

Import premiums for warrants are currently quoted at $49-67/mt, up $9/mt from a week earlier on average, and quotes for B/L stand at $46-64/mt, a rise of $17.5/mt. Domestic inventories currently stand at a low level. Spot premiums rebounded last Friday. This combined with higher import premiums kept import losses at a low level. Import premiums are expected to climb further amid brisk trades and sellers holding back cargoes.

Traded import premiums for high-quality pyro-copper currently stand at around $67/mt under warrants, $61/mt for mainstream pyro-copper and $49/mt for hydro-copper. On the B/L front, premiums are $64/mt for high-quality copper, $58/mt for mainstream pyro-copper, and $48/mt for hydro-copper. The quotation period is in September.

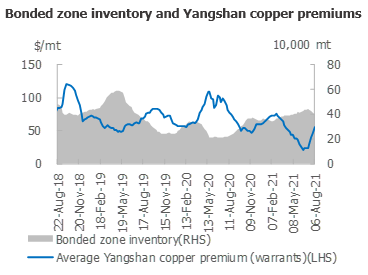

Copper inventories in the Shanghai bonded zone decreased 17,500 mt from July 30 to 392,100 mt as of August 6, a fourth straight week of decline.

Buyers have sought cargoes under warrants and bill of lading amid a favourable SHFE/LME copper price ratio, and this pushed up Yangshan copper premiums significantly. Increased customs declaration has driven continuous decline in bonded zone inventory.

![Delivery support and resistance to high prices coexisted, while Shanghai spot copper spot premiums remained generally stable [SMM Shanghai Spot Copper]](https://imgqn.smm.cn/usercenter/JnFuh20251217171711.jpg)

![Suppliers Actively Held Prices Firm, but Downstream Purchasing Was Not as Strong as Yesterday [SMM South China Spot Copper]](https://imgqn.smm.cn/usercenter/HeIuV20251217171708.jpg)

![Spot Premiums Rose While Market Activity Cooled [SMM North China Spot Copper]](https://imgqn.smm.cn/usercenter/udUol20251217171712.jpg)