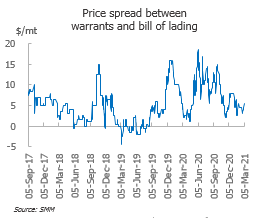

SHANGHAI, Mar 10 (SMM)—Yangshan copper premiums with a quotation period in March stood at $65-82/mt under warrants during March 1-5, and between $60-78/mt under bill of lading. The SHFE/LME copper price ratio stood at 7.39 as of March 5.

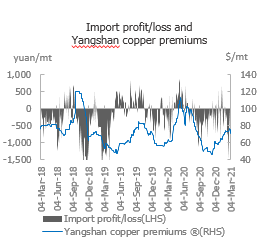

Yangshan copper premiums continued its downward trend amid subdued trades. The recovery of domestic consumption has taken longer amid high copper prices, while stocks continue to accumulate. LME copper inventories stand at low levels, arousing expectations over tight overseas supply. This has prevented the SHFE/LME copper price ratio to improve, keeping the import window closed and import losses between 200-400 yuan/mt. Demand was weak. The failure of rapid consumption recovery prompted some sellers to sell cargoes, increasing the availability of cargoes. Traders continued to lower their quotations to boost sales. Quotes for the two high-quality brands slated to arrive in mid-to-late March stood at $75/mt, and at $70/mt for mainstream pyro-copper with negotiation room.

Import premiums under warrants fell further as bonded zone inventories continued to grow. That combined with a strong backwardation structure on LME copper increased pressure on sellers, lowering traded import premiums amid quiet trades.

Import premiums under warrants are currently quoted at $65-76/mt, down $5.5/mt from a week earlier on average, and quotes for bill of lading stand at $60-70/mt, a decline of $7/mt. Oversupply is expected to lower import premiums further.

Traded import premiums for high-quality pyro-copper currently stand at around $76/mt under warrants, $71/mt for mainstream pyro-copper, and $65/mt for hydro-copper. On the bill of lading front, premiums are $70/mt for high-quality copper, $65/mt for mainstream pyro-copper, and $60/mt for hydro-copper. The quotation period is in March.

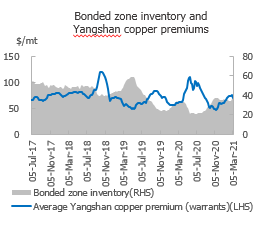

Copper inventories in the Shanghai bonded zone increased 4,900 mt from February 26 to 365,500 mt as of March 5, the third consecutive week of increase. The figure for the previous week was revised to 360,600 mt. Rapid gains in copper prices post-CNY holidays affected consumption recovery, and a high price spread between copper cathode and copper scrap also depressed copper cathode consumption, accumulating domestic copper inventory. Import losses combined with weak quotes in the domestic spot market weakened import demand, growing bonded zone inventory.

![Delivery support and resistance to high prices coexisted, while Shanghai spot copper spot premiums remained generally stable [SMM Shanghai Spot Copper]](https://imgqn.smm.cn/usercenter/JnFuh20251217171711.jpg)

![Suppliers Actively Held Prices Firm, but Downstream Purchasing Was Not as Strong as Yesterday [SMM South China Spot Copper]](https://imgqn.smm.cn/usercenter/HeIuV20251217171708.jpg)

![Spot Premiums Rose While Market Activity Cooled [SMM North China Spot Copper]](https://imgqn.smm.cn/usercenter/udUol20251217171712.jpg)