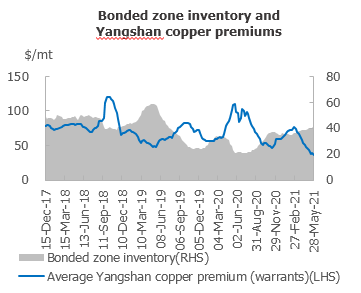

SHANGHAI, May 31 (SMM) —Yangshan copper premiums with a quotation period in June stood at $29-45/mt under warrants during May 24-28, and between $20-35/mt under bill of lading (B/L). The SHFE/LME copper price ratio stood at 7.16 as of May 28.

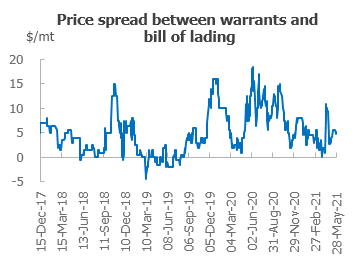

Trades remained quiet last week and Yangshan copper premiums continued to fall amid oversupply. Premiums under warrants and B/L stood at all-time lows of SMM quotes. Despite the recent appreciation of the yuan, the SHFE/LME copper price ratio failed to improve, with import losses of around 800 yuan/mt. Demand was almost absent for cargoes slated to arrive in the near term. Traders with cargoes under B/L slated to arrive in the first half of June lowered quotes. Quotes for the two high-quality brands stood at around $30/mt, and at $25/mt for mainstream pyro-copper. Trades were muted. On warrants, supply and demand were both weak. The recent stable contango structure on LME 0-3 eased cost pressure for traders, reducing offers. Demand was extremely weak and this lowered traded premiums. Import premiums under warrants are currently quoted at $29-40/mt, down $4/mt from a week earlier on average, and quotes for B/L stand at $20-30/mt, a decline of $2.5/mt. Yangshan copper premiums should dip further amid a buyer's market.

Traded import premiums for high-quality pyro-copper currently stand around $40/mt under warrants, $35/mt for mainstream pyro-copper, and $29/mt for hydro-copper. On the bill of lading front, premiums are $30/mt for high-quality copper, $25/mt for mainstream pyro-copper, and $20/mt for hydro-copper. The quotation period is in June.

Copper inventories in the Shanghai bonded zone increased 11,700 mt from May 21 to 415,500 mt as of May 28, growing for the sixth consecutive week. Exports by Chinese smelters and arriving shipments under B/L accounted for the growth. Domestic smelters have continued to export copper cathode to bonded warehouses as scheduled. Shipments arrivals of imported copper were undesirable amid severe import losses, lowering Yangshan copper premiums. In this scenario, traders moved cargoes into bonded warehouses.

![Delivery support and resistance to high prices coexisted, while Shanghai spot copper spot premiums remained generally stable [SMM Shanghai Spot Copper]](https://imgqn.smm.cn/usercenter/JnFuh20251217171711.jpg)

![Suppliers Actively Held Prices Firm, but Downstream Purchasing Was Not as Strong as Yesterday [SMM South China Spot Copper]](https://imgqn.smm.cn/usercenter/HeIuV20251217171708.jpg)

![Spot Premiums Rose While Market Activity Cooled [SMM North China Spot Copper]](https://imgqn.smm.cn/usercenter/udUol20251217171712.jpg)