SHANGHAI, Aug 3 (SMM) - Yangshan copper premiums with a quotation period in August stood at $34-58/mt under warrants during July 26-30, and between $26-45/mt under bill of lading (B/L) with a quotation period in September. The SHFE/LME copper price ratio stood at 7.32 as of July 30.

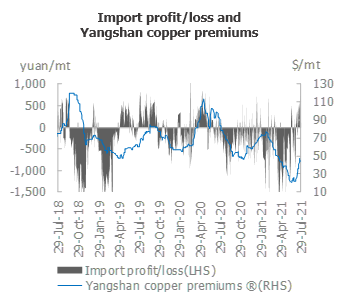

Trades were subdued initially before improvement last week. Yangshan copper premiums continued its upward trend. The import price ratio weakened in the first half of the week, muting trades. Premiums dipped slightly even as sellers raised their quotes. The SHFE/LME copper price ratio improved in the second half of the week, narrowing import losses over the August contract to less than 300 yuan/mt. This, together with high premiums in the domestic spot market, boosted market demand. Traders continued to raise quotes.

As of the end of the week, quotations for domestic pyro-copper under warrants stood at $55-60/mt at the end of the week, and traded import premiums stood at around $52/mt. Traded import premiums under B/L currently stand at around $45/mt for the two high-quality brands slated to arrive in late August. Import premiums for warrants are currently quoted at $40-58/mt, up $6/mt from a week earlier on average, and quotes for B/L stand at $30-45/mt, a rise of $5.5/mt. Import premiums will have upward room. Low domestic inventory has kept spot quotes firm, and import profits incentivised customs clearances. Trading has been brisk while sellers have held onto their cargoes.

Traded import premiums for high-quality pyro-copper currently stand at around $58/mt under warrants, $52/mt for mainstream pyro-copper, and $40/mt for hydro-copper, with a quotation period in August. On the bill of lading front, premiums are $45/mt for high-quality copper, $40/mt for mainstream pyro-copper, and $30/mt for hydro-copper. The quotation period is in September.

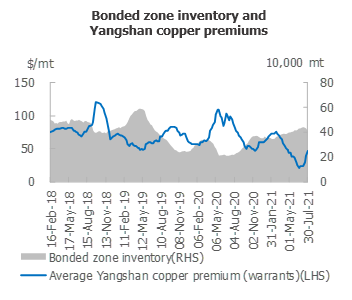

Copper inventories in the Shanghai bonded zone decreased 19,000 mt from July 23 to 409,600 mt as of July 30, the third consecutive week of decline. The inventory decline exceeded the prior week. Domestic consumption was brisk, and social inventories continued to decline. High premiums in the domestic spot market encouraged import. Orders that were signed two weeks ago amid import profits under warrants implemented customs clearance last week, driving further declines in bonded zone inventories.

![Copper Prices Fell Stimulating Downstream Restocking Spot Premiums Rose [SMM South China Spot Copper]](https://imgqn.smm.cn/usercenter/ieria20251217171709.jpg)

![Downstream Fully Resumes Production Market Activity Warms Up [SMM North China Spot Copper]](https://imgqn.smm.cn/usercenter/JYzFE20251217171714.jpeg)