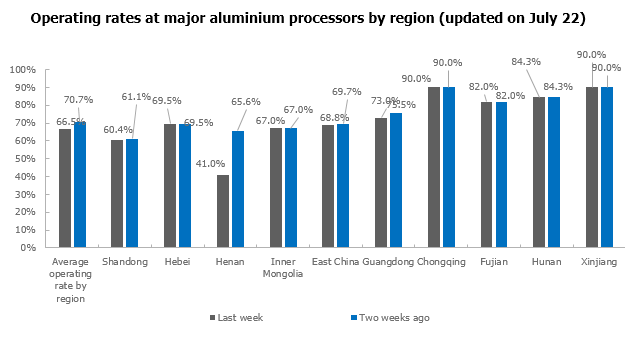

SHANGHAI, Jul 26 (SMM) - Operating rate of major aluminium processing enterprises fell 4.3 percentage points to 66.5% last week.

The operating rate in Henan slumped 24.6 percentage points to 41%, the sharpest decline among all regions, as the worst ever flooding has forced local enterprises to reduce or suspend production. Operating rates dropped slightly in Guangdong and Shandong, and were largely stable in other regions.

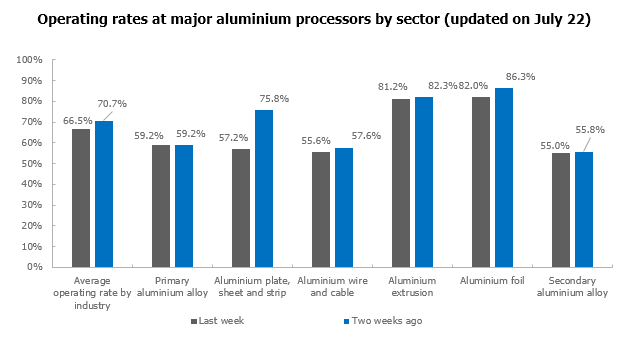

The aluminium plate/sheet, strip and foil sectors registered bigger decline in operating rate than any other aluminium processing sector. The operating rate of large aluminium plate/sheet companies fell 18.6 percentage points to 57.2%, and that of large aluminium foil companies fell 4.3 percentage points to 82%, due mainly to the floods in Henan. The operating rate of large aluminium extrusion companies continued to decline in the off-season. Spot aluminium prices fluctuated at a high level of above 19,000 yuan/mt, leaving downstream producers restocking as needed. The flooding in Henan severely hindered transportation at local companies. It is expected that the operating rate of large aluminium processing enterprises will pick up slightly this week, with market focus on how soon will processing enterprises in Henan recover from the disaster.

Primary aluminium alloy: Operating rate of large primary aluminium alloy enterprises remained stable, underpinned by rigid demand. The shortage of automotive chips, poor automobile consumption and summer break at car makers have continued to constrain orders at primary aluminium alloy producers.

Aluminium plate/sheet and strip: Operating rate of large aluminium plate/sheet and strip companies dropped to 57.2% as many of the companies in our survey sample are located in Henan, where the flooding halted production and disrupted transportation. Although power restrictions in Henan were slightly alleviated, local companies are still troubled by power shortages as the government has given priority to power supply for disaster relief and daily use by residents. The flood situation in Henan has gradually come under control. If controlled rapidly, operating rate of aluminium plate/sheet and strip companies in Henan is expected to rebound significantly this week.

Aluminium wire and cable: Operating rate of large aluminium wire and cable companies fell 2 percentage points as the flooding in Henan caused failures in meting furnace equipment and forced local companies to reduce production. The recovery time is yet to be determined. Large enterprises in Jiangsu and Zhejiang maintained stable production. Spot aluminium prices traded at above 19,000 yuan/mt, but this has little impact on production at large wire and cable companies. Operating rate may stay at current level in the short term since it takes time for companies in Henan to return to normal production.

Aluminium extrusion: Operating rate at large aluminium extrusion enterprises dropped slightly. Some companies cut output as summer heat affected sales. Large companies reported stable orders by relying on their own capital and product advantages, while orders at small and medium-sized enterprises fell sharply. Volatile aluminium prices and aluminium billet processing fees muted trades in the aluminium billet market. Only a few companies who are bullish on aluminium prices stocked up on aluminium billets. Operating rate at large aluminium extrusion enterprises may continue to drop slightly.

Aluminium foil: Operating rate at large aluminium foil companies fell 4.3 percentage points to 82%. The decline was bigger than in the previous week mainly because a large aluminium foil enterprise in Henan slowed down production due to the floods. Although orders at large companies are still relatively abundant even in the off-season, operating rate is lower than in the peak season. The performance of brazing foil sector remains the worst. As transportation in Henan has gradually recovered after the flood situation has eased, it is expected that operating rate in Henan will return to normal this week.

Secondary aluminium alloy: Operating rate of large secondary aluminium alloy enterprises dropped 0.8 percentage point to 55%. Wait-and-see sentiment triggered by falling aluminium prices and poor orders in the off-season dampened the buying interest of die-casting plants. Tight supply and high price of raw material also contributed to lower operating rate at secondary aluminium enterprises. Operating rate is expected to stabilise or continue to fall slightly this week.

![Middle East Situation Remained at a Stalemate, Aluminum Prices Held Up Well in Volatile Trading [SMM Aluminum Morning Meeting Summary]](https://imgqn.smm.cn/usercenter/HVmVi20251217171654.jpg)