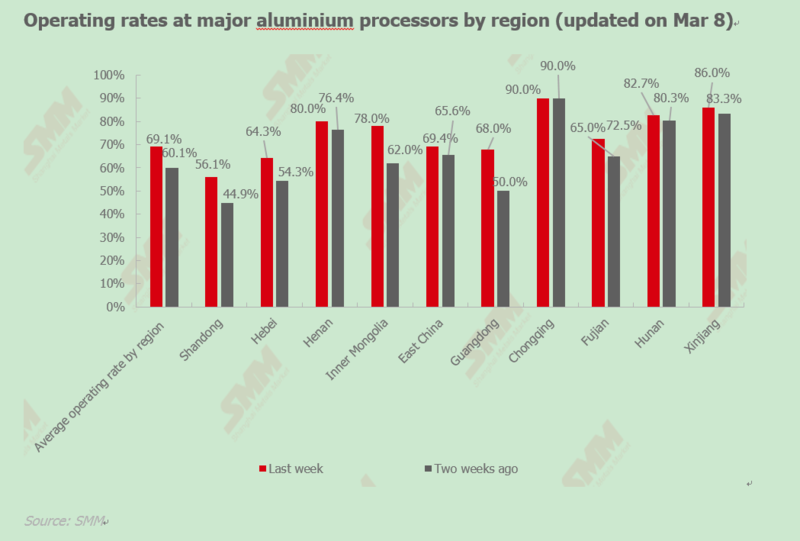

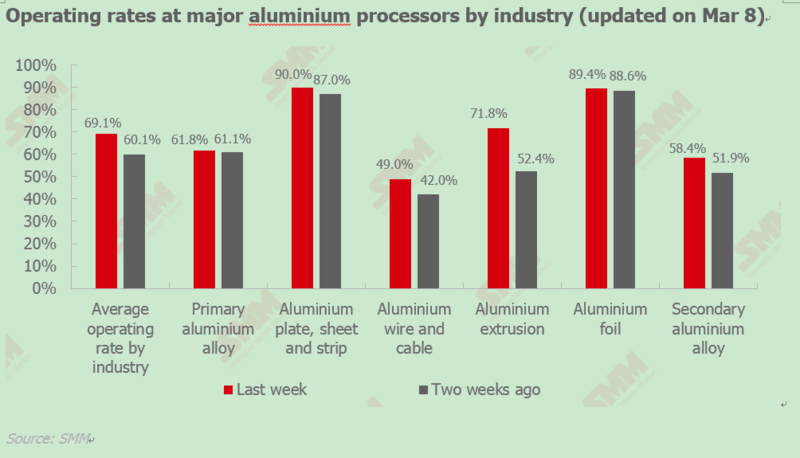

SHANGHAI, Mar 9 (SMM)—SMM has surveyed 41 aluminium processing enterprises across 12 provinces. Operating rates across major aluminium processors increased 9 percentage points from a week ago to 69.1% last week. Most aluminium aluminium processing enterprises began to reduce inventory and restocked as needed amid rising aluminium prices. Aluminium plate, strip, foil and industrial extrusion producers reported heavy backlog orders and maintained high operating rates.

Construction extrusion producers resumed production slowly as high aluminium prices affected downstream purchases. Wire and cable producers may reduce operating rates as rising aluminium prices weighed on new orders from the State Grid. Alloy ingot producers reported stable production, but their finished product inventory increased as high aluminium prices curbed downstream purchases. Large producers have backlog orders and thus resumed production faster, while small and medium-scale producers resumed slower. At present, it is difficult for aluminium processing enterprises to pass higher aluminium prices to end-users. There is still room for operating rates at aluminium processing enterprises to increase if end-user accept higher aluminium prices.

Primary aluminium alloy: Operating rates at major primary aluminium alloy enterprises increased to 61.8% last week, an increase of 0.7 percentage point from a week ago. Production resumption at aluminium wheel plants allowed operating rates at primary aluminium alloy enterprises to increase accordingly. However, rising aluminium prices drove most aluminium wheel plants to reduce purchases as they had signed long-term orders with car makers earlier and locked in prices. Operating rates at primary aluminium alloy enterprises are expected to return to pre-CNY level in March, but are unlikely to see sharp rise.

Aluminium plate and strip: Major aluminium plate and strip enterprises maintained high operating rates last week. Large producers have1-2 months of orders, while small and medium-scale producers have kept orders within 10-20 days due to volatile aluminium prices and increased difficulty in purchasing raw materials. Producers are expected to run close to full capacity in March. Producers reduced raw material inventories, restocked as needed and stepped up shipments of finished products in response to rising aluminium prices. Some producers restarted melting and casting, cold rolling, and hot rolling capacity.

Aluminium wire and cable: Operating rate of major aluminium wire and cable companies climbed 7 percentage points to 49%. Producers are focusing on delivery of orders received before CNY. Surging raw material prices curbed new orders from State Grid. As aluminium prices are expected to remain firm in the short term, operating rate of aluminium wire and cable companies may decline.

Aluminium extrusion: Operating rates at major aluminium extrusion enterprises recovered significantly, but production at most producers is still far from normal level. Orders for industrial extrusion remained strong, mostly from the automotive and electronics sectors. Orders at some large-scale companies are scheduled through the end of March. High silicon prices affected orders in the photovoltaic industry, which in turn depressed orders for related aluminium extrusion. Orders at construction extrusion companies were subdued high aluminium price kept clients cautious about placing orders. With the gradual recovery of market, operating rates at aluminium extrusion enterprises will gradually return to normal level.

Aluminium foil: Operating rates at major aluminium foil enterprises remained stable. Domestic demand for automotive foils, battery foils, and air-conditioning foils remained strong, driving a slight increase in operating rates at major producers. Large enterprises will maintain relatively full production this week. Many aluminium foil companies refused to lock in prices with clients at the current high aluminium prices. Export orders fell as the fact that LME aluminium rose slower than SHFE aluminium weakened the price advantage of Chinese aluminium foil, but the impact was not significant. Most small and medium-sized enterprises continued to be affected by rising aluminium prices, and their willingness to take orders and produce remained relatively weak.

Secondary aluminium alloy: Operating rates at secondary aluminium companies rose 6.5 percentage points to 58.4%. Production at most of the producers have recovered to pre-CNY level. Aluminium scrap supply was tight, especially in north China. Downstream die-casting companies have basically run out of inventories that they stockpiled before CNY, and restocked as needed amid rising aluminium prices, causing orders at secondary aluminium producers to decline slightly. Operating rate of secondary aluminium enterprises is expected to stabilise this week.