SHANGHAI, Apr 19 (SMM)—Volkswagen announced in March that it had cut production by more than 100,000 vehicles in January and February due to the lack of chips. Honda Motor announced that its Mexican plant would cease production from March 18. General Motors announced the temporary closure of its plant in Lansing, Michigan, and it was expected that it would not restart operations before April this year.

NIO announced on March 26 that it has decided to suspend production at its Hefei Jianghuai Automobile Plant for 5 days starting from March 29 amid chips shortage. On April 12, senior White House officials held a meeting with executives from nearly 20 companies to discuss the global semiconductor shortage that has caused turmoil in the automotive industry and technology companies.

The problem of chip shortages has been exacerbated by the earthquake in Japan, the fire in the Renesas electronics factory, and the cold wave in North America, which has affected the supply of other auto parts suppliers. Wheel hubs are important parts of automobiles. At present, about 90% of A356.2 primary aluminium alloy in China is used to make aluminium alloy wheel hubs.

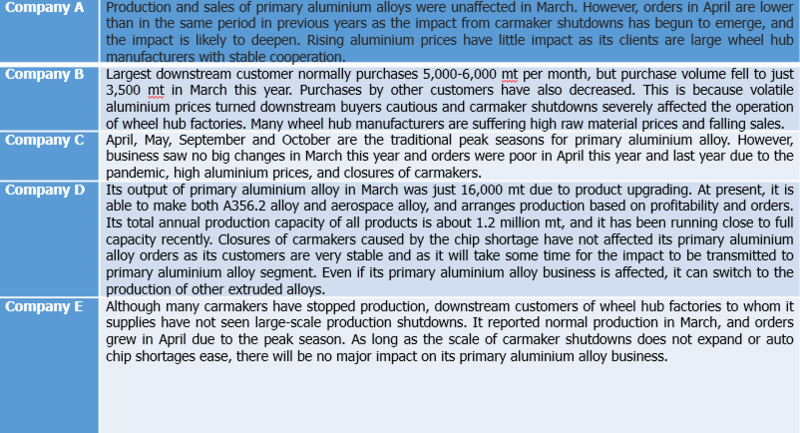

SMM has conducted surveys with a number of primary aluminium alloy companies.

In summary, wheel hub manufacturers restocked as needed amid high aluminium prices in March. The wave of production shutdowns among carmakers triggered by chip shortages has begun to have an impact on the A356.2 alloy industry. Some small and medium-sized primary aluminium alloy companies indicated that their orders in March were not as good as in the same period in previous years, and the purchases from downstream customers generally decreased.

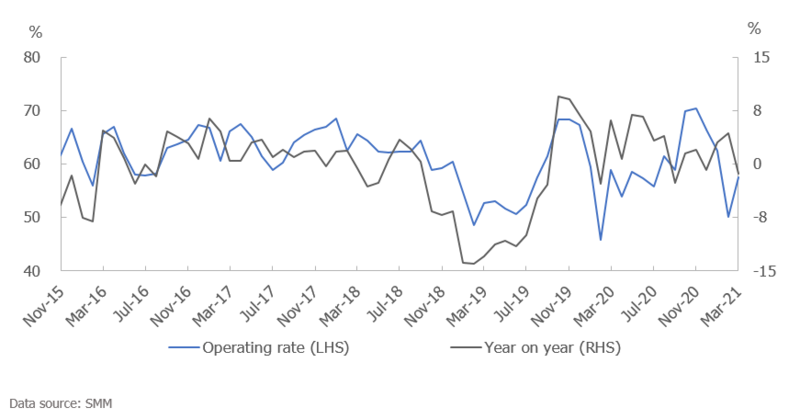

Large primary aluminium alloy companies reported normal output and sales in March. First-class product quality, stable customer resources, and ample cash flow have enable large companies to be little affected by high aluminium prices and carmaker shutdowns. However, some companies have indicated that orders did not improve in the peak season of April and are concerned that carmaker shutdowns will continue to suppress orders for primary aluminium alloys. Some companies have transformed their business and begun to produce a variety of alloy products according to market demand and profitability of each product. Operating rates at A356.2 primary aluminium alloy producers stood at 57.56% in March, up 7.48 percentage points month on month, but down 1.31 percentage points year on year, SMM survey showed.

The chip shortage is not a short-term phenomenon, and it remains to be seen how this problem will evolve in the future. If the worsening of the chip shortage leads to further shutdowns among carmakers, operating rates at primary aluminium alloy producers are likely to fall to about 50% in April, and production and sales in Q2 may drop sharply compared with the same period in previous years.

Operating rates at A356 aluminium alloy producers