SMM: the sharp rise in gold prices since last year has made global gold producers enter a good state that has not been seen for many years, but many gold mines are closed due to the epidemic, which worries many gold producers.

With the surge in gold prices this year, the cash flow of major gold producers has improved a lot. Fengye Bank (Scotiabank) estimates that large and medium-sized gold producers held about $5 billion in cash as of June 30 this year.

However, the impact of the epidemic on gold minerals makes the situation not optimistic.

Seven of the world's top 10 gold producers have cut their forecasts for gold production this year, a drop of about 7 per cent.

Tom Palmer, chief executive of Newmont, said the difficulty in the gold market in the past was to chase production.

Newmont's full-year budget for this year is $1.3 billion, about half of what it was in the previous cycle.

Gold Fields said that even if the price of gold rises, it will not mine low-grade gold mines in pursuit of production.

Mark Bristow, chief executive of Barrick, said his long-term gold price is expected to remain at $1200 an ounce, which means the miner's dividend is expected to increase and bonds can be reduced. "No one really made any money in the last cycle."

Gold prices have risen by almost 500% over the past 20 years, while gold production has increased by 22%.

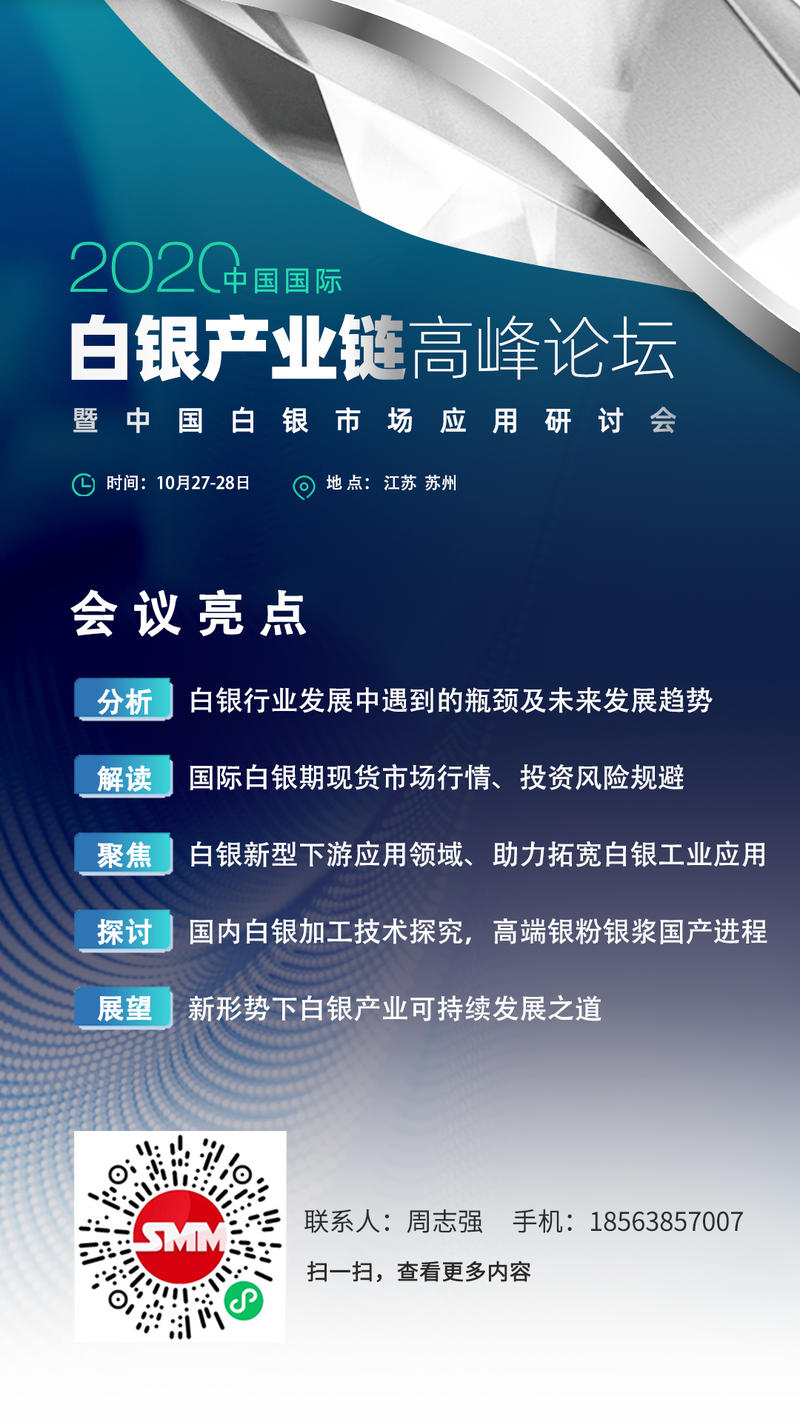

Silver Industry chain Summit Forum

Seminar on the Application of Silver Market in China

Scan the code to participate in the meeting or apply to join the SMM Precious Metals Industry Exchange Group.

![This Week, Platinum and Palladium Experienced Significant Pullbacks, End-Use Demand Recovered, and Spot Market Trading Was Normal [SMM Platinum and Palladium Weekly Review]](https://imgqn.smm.cn/usercenter/obeMy20251217171735.jpg)

![Silver Prices Continue to Pull Back, Suppliers Remain Reluctant to Sell, Spot Market Premiums Hard to Decline [SMM Daily Review]](https://imgqn.smm.cn/usercenter/LVqfJ20251217171736.jpg)