SHANGHAI, Jun 1 (SMM) – Manufacturing activity across nickel downstream sectors in China expanded for the third consecutive month in May, albeit at a softer pace than it did in April.

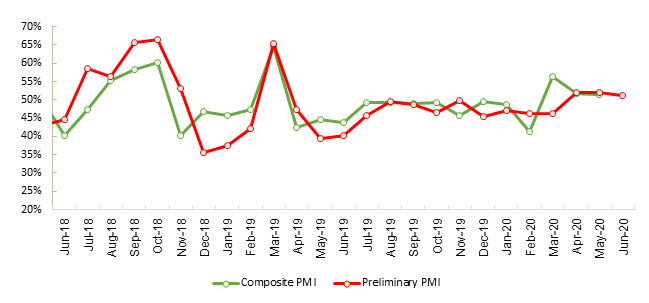

SMM data showed that the purchasing managers index (PMI) for downstream nickel industries, including stainless steel, electroplating, alloy and battery, stood at 51.44 in May, down 0.32 point from April. A reading above 50 indicates expansion.

The preliminary nickel downstream sectors PMI for June is assessed at 51.16, down 0.28 point from the final reading for May.

Production sub-index remained in expansion with stable production of stainless steel, alloy

The composite sub-index for production in April eased 4.26 points from April to 52.25, staying in expansion, on the back of stable operations in stainless steel and alloy casting sectors that have less dependence on the export market. Reduced orders, meanwhile, weighed on production in the electroplating and battery sectors. The sub-index for production in the stainless steel sector stood at 54.1, as producers ramped up production amid healthy profits. Some stainless steel mills that slowed production in April did not expand the output cut in May. Some electroplating plants reduced their weekly production hours in May as orders shrank after they in April finished fulfilling orders received before the Chinese New Year holiday. This saw the sub-index for production in the electroplating sector weaker than expected at 39.59 for May.

New orders sub-index edged up and continued to expand

According to SMM data, the overall sub-index for new orders across downstream nickel sectors grew 1.25 point from a month ago to 51.58 in May. Shipments from stainless steel mills to cold-rolled plants and distributors were steady even as consumption came weaker than supply. This kept the new orders sub-index for stainless steel sector at 53.52. The new orders sub-index for the battery sector contracted to 40.05, as end-users demand remained sluggish both at home and abroad. The coronavirus outbreak overseas slowed the resumption of work and the domestic power battery market showed no signs of picking up following the COVID-19 impact in Q1. In other nickel downstream sectors, including nickel wire, mesh and printing industry, the new orders sub-index fell to the contraction territory, standing at 46.86 for May, as the pandemic escalation ex-China has depressed export orders. While more Chinese factories have restarted operation, the number of resumed new orders in the domestic market declined.

Raw materials inventory sub-index further expanded as stainless steel plants stockpiled

The overall sub-index for raw materials inventories extended its increase to 58.57 in May, driven by active purchases of nickel raw materials by stainless steel mills. Restocking in the alloy, nickel wire and mesh sectors also increased while purchases were subdued at battery and electroplating producers who mainly consume refined nickel and nickel sulphate. The purchasing volume sub-index for the stainless steel sector came in at 61.9 with the raw materials inventory sub-index at 60.76. Shortage of raw materials improved nickel pig iron (NPI) demand and supply fundamentals. This, coupled with increased profits at stainless steel plants, facilitated their purchases of NPI. Alloy casting plants mostly produced based on sales prospects and kept their purchasing volume and procurement plan at stable levels. The sub-indexes for both purchasing volume and raw materials inventory in the alloy sector surpassed 50 in May.

Finished goods inventory sub-index stayed in expansion

The overall sub-index for finished products stocks climbed 0.86 from a month ago to 51.3, as inventory pressure continued to ease with the steady resumption of operations and production across the industry chain in Q2. The finished goods inventory sub-index for the stainless steel sector remained at 50, suggesting continued high inventories. Nonetheless, inventory pressure has transferred from the upstream to the midstream as traders and processors restocked actively. The destocking trend will likely continue across the chain.

![[SMM Analysis] Weak End-User Demand but Firm Costs, High-Grade NPI Prices Rose Steadily](https://imgqn.smm.cn/usercenter/GmHLU20251217171733.jpg)

![[SMM Analysis] Inventories Fall Below 1 Million mt, Costs and Geopolitical Risks Keep Stainless Futures Elevated](https://imgqn.smm.cn/production/admin/votes/imagesFURVz20260313180700.jpeg)