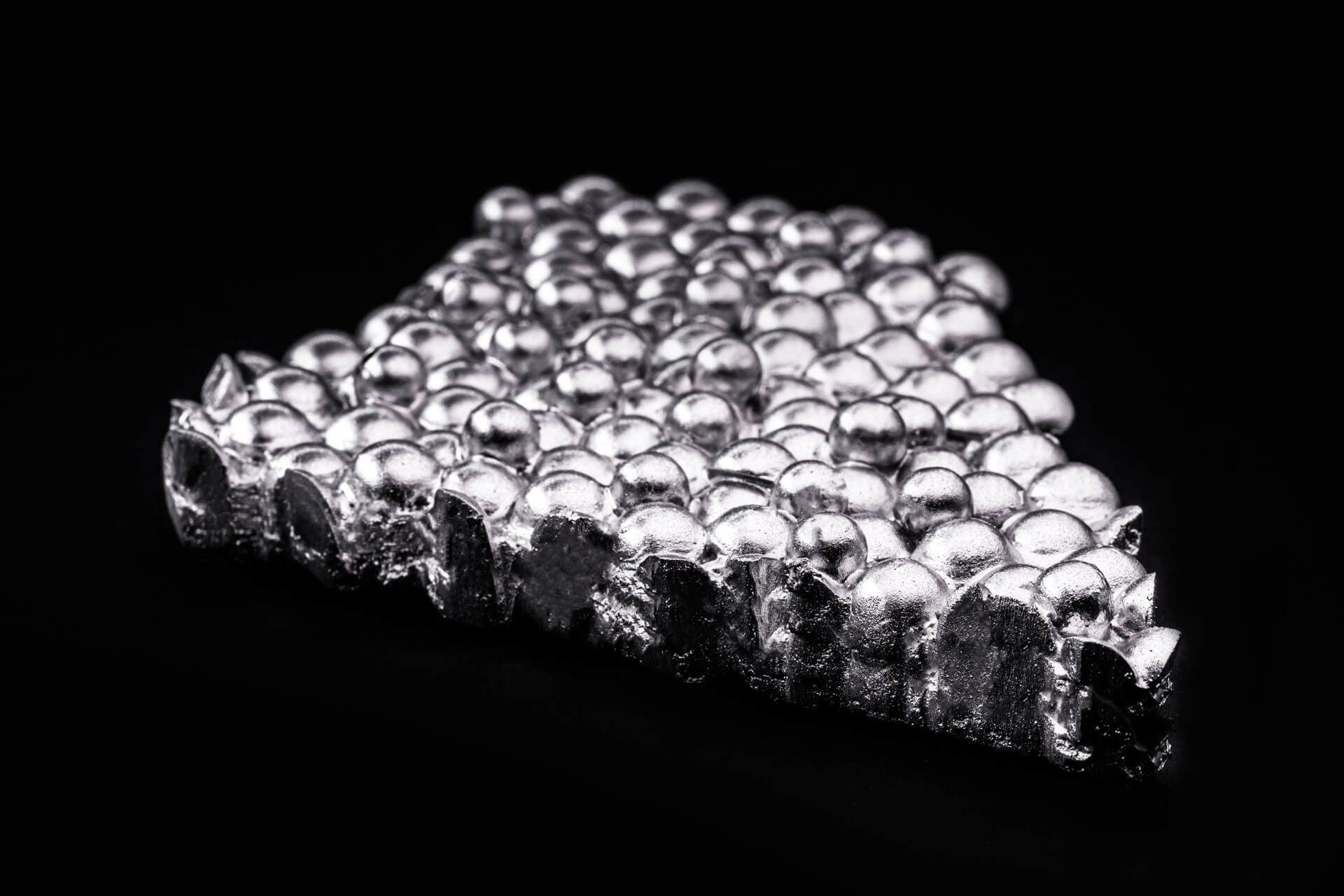

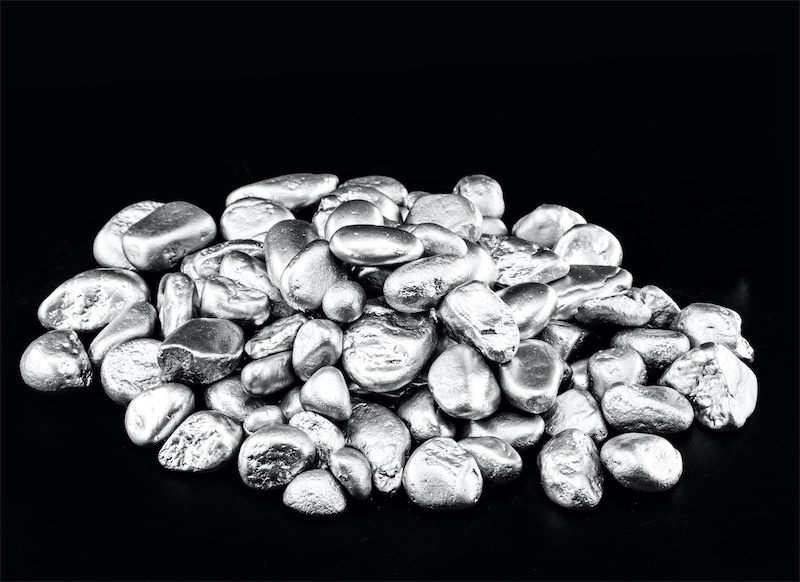

Nickel Ore

In early November, Indonesian nickel ore prices showed an upward trend. In terms of benchmark prices, Indonesia’s domestic nickel ore benchmark for the first half of October was USD 15,075 per dry metric ton, down 0.44% from the previous period. For premiums, according to SMM data on Indonesia’s domestic laterite nickel ore premiums, 1.4% grade averaged USD 22, 1.5% grade averaged USD 25.5, and 1.6% grade averaged USD 26. The delivered price for 1.6% Ni laterite ore in Indonesia was USD 51.7–53.7 per wet metric ton, unchanged from last week. For hydrometallurgical ore, the delivered price for 1.3% Ni remained stable at USD 24–26 per wet metric ton, unchanged from last week.

- Pyrometallurgical Ore:

On the supply side for pyrometallurgical ore, some areas of Sulawesi saw scattered rainfall, while Halmahera Island remained in the dry season. Overall, mining operations were not significantly affected. From the production side, mines have been increasing output to compensate for delays in previous months, and nickel ore production continues to rise. However, ongoing inspections by the forestry task force are still causing minor disruptions to current shipments. From an RKAB perspective, Indonesia’s Ministry of Energy and Mineral Resources (ESDM) plans to lower the 2026 nickel production target. This move follows the Industry Ministry’s earlier decision to restrict new smelter permits due to global and domestic oversupply. ESDM Director General of Minerals and Coal, Tri Winarno, stated that the 2026 Work Plan and Budget (RKAB) will be adjusted in line with market demand and is expected to be lower than this year’s level of around 319 million tons. On the demand side, some Indonesian smelters continue stocking up toward the end of the year to hedge against uncertainties in future RKAB approvals. Smelter inventory cycles are expected to increase slightly through the end of next year. Overall, Indonesian nickel ore supply faces potential downside risks, and combined with persistent cost inversion at NPI smelters, these factors are expected to support nickel ore prices and keep them stable going forward.

- Hydrometallurgical Ore:

From the limonite ore perspective, the supply side remains relatively stable, with overall production steady and even somewhat abundant. From the demand side, HPAL smelters have slightly increased their ore procurement, although their inventory levels remain relatively ample. With uncertainties surrounding new RKAB allocations and expectations of reduced quotas, wet-process nickel ore prices are expected to remain stable in the near term, with limited downside potential.

Nickel Pig Iron

“Weak Terminal Demand in the Traditional Off-Season; High-Grade NPI Prices Continue to Decline”

The average price of SMM 10-12% NPI average price fell by RMB 9.8 per nickel unit week-on-week to RMB 909.6 per nickel unit (ex-works, tax included), while the Indonesia NPI FOB index dropped by USD 1.1 per nickel unit to USD 112.37 per nickel unit. The downtrend was driven by persistent cost-pressure losses in downstream stainless steel mills, coupled with the stable cost advantage of stainless steel scrap, which led to increased scrap usage and weaker NPI demand.

During the traditional off-season, terminal demand remained weak, and high-grade NPI prices continued to fall this week. On the supply side, as prices approached historical lows, upstream NPI plants still refrained from offering quotations, and almost no spot deals were concluded. However, under prevailing bearish sentiment, some traders continued to sell at lower prices, pushing market quotations and transaction levels further down. On the demand side, terminal consumption weakened further as the market entered the traditional low season. Downstream stainless steel mills faced increasing sales pressure and further margin contraction, while scrap stainless steel prices also continued to decline. With high stainless steel inventories and growing cost advantages of stainless scrap, downstream buyers adopted a more cautious procurement approach and shifted to a wait-and-see stance, resulting in further declines in transaction volumes. Overall, the high-grade NPI market saw weak supply and weak demand, with total inventories across the supply chain rising on a week-on-week basis. Oversupply persists, and with no clear directional guidance, high-grade NPI prices are expected to remain under pressure. Based on high-grade NPI cash costs calculated using nickel ore prices from 25 days prior, smelter margins continued to decline this week. From the raw material's perspective, nickel ore prices in the Philippines and Indonesia remained stable, while auxiliary material costs continued to rise, pushing overall NPI production costs higher. Meanwhile, market sentiment remained subdued and high-grade NPI prices continued to fall, putting further pressure on smelter profitability.

Looking ahead to next week, nickel ore prices are expected to remain firm, and auxiliary material costs may stay elevated. With NPI prices still under downward pressure, smelter cost-margin inversion is likely to worsen further.

![[SMM News] Indonesia's State Electricity Company (PLN) Increases Purchase of Tsingshan IWIP Waste Heat Power to 11 Megawatts, Aiming to Strengthen Regional Power Grid Stability](https://imgqn.smm.cn/usercenter/biBGl20251217171733.jpg)

![[SMM Analysis] Global Stainless Steel Market Review – February 2026: Policy Shocks Collide with Supply Disruptions](https://imgqn.smm.cn/production/admin/votes/imagesRoJOe20260302182134.jpeg)