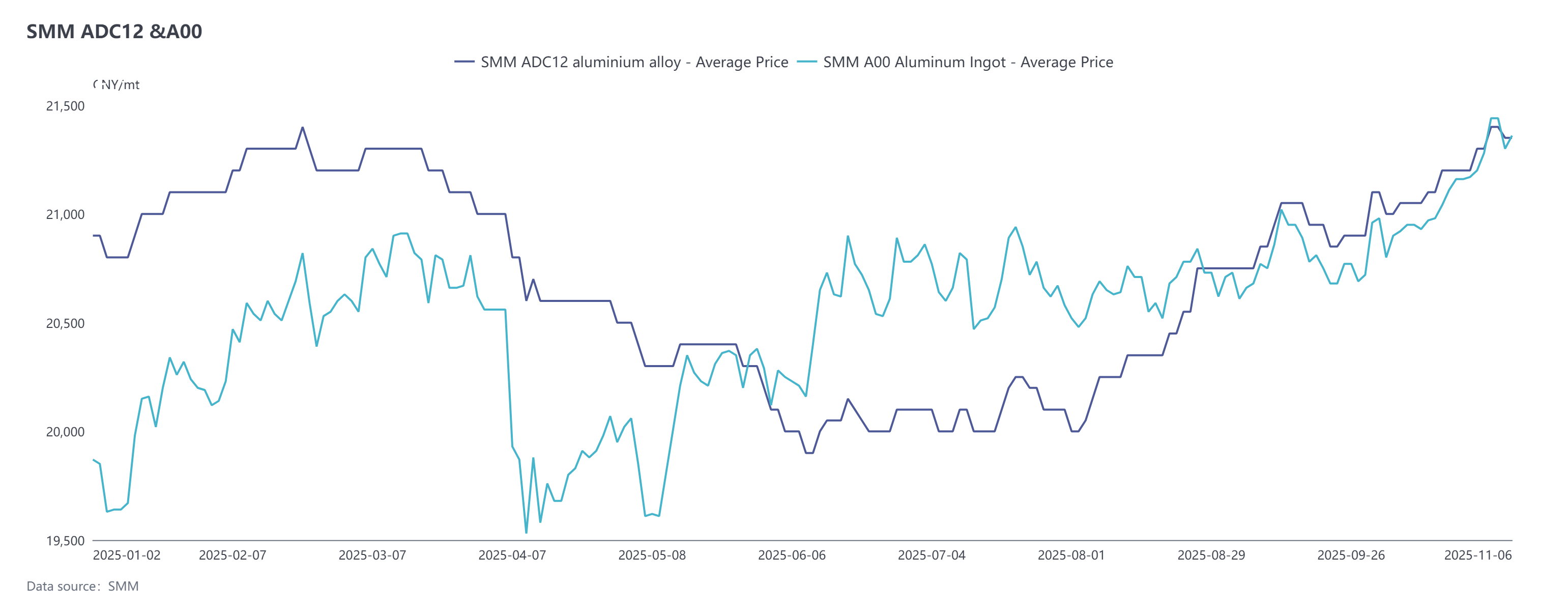

Reviewing November price trends: Futures side, after opening higher with a gap in early October, prices fluctuated rangebound within the range of 20,250–20,760 yuan/mt, bottomed out at 20,365 yuan/mt before stabilizing, then rebounded supported by moving averages. From mid-October to month-end, bulls dominated, driving prices upward in a stepwise pattern, breaking through 20,900 yuan/mt on October 31 and finally closing at 20,805 yuan/mt. Entering November, futures prices once surpassed the 21,000 yuan/mt psychological barrier but failed to hold firmly, subsequently pulling back to around 20,800 yuan/mt.

Spot side, ADC12 prices remained strong in October, but the premium over A00 continued to narrow and turned into a discount by early November. As of November 6, the SMM ADC12 price rose 250 yuan/mt from early October to 21,350 yuan/mt, with the October average price up 1.2% MoM. Market strength was mainly driven by low plant inventory and cost support.

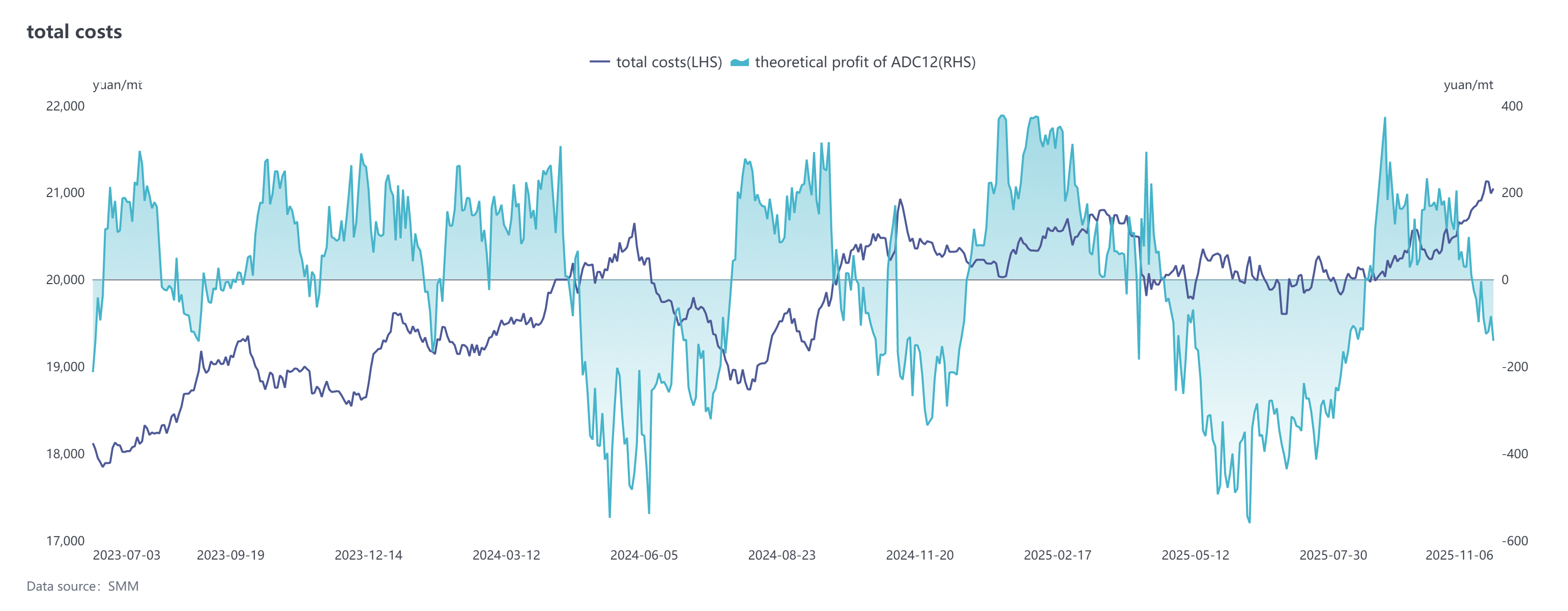

According to the latest SMM data, the theoretical total cost of the ADC12 industry reached 20,680 yuan/mt in October, continuing its upward trend MoM. Specifically:

Aluminum scrap led the gains significantly: Due to persistent tight supply of aluminum scrap, traders held strong bullish sentiment, driving the cost per metric ton of aluminum scrap up sharply by 304 yuan MoM, making it the primary driver of this round of cost increases.

Auxiliary material prices rose in tandem: Copper prices continued to hit record highs, coupled with an increase in the average price of silicon, putting comprehensive pressure on raw material costs for secondary aluminum plants. Notably, aluminum alloy products with higher copper content, such as A380, began to raise processing fees, with the current premium over ADC12 expanding to 1,100-1,400 yuan/mt.

Cost pass-through effects emerged: The comprehensive rise in raw material prices led to a significant increase in enterprises' overall production costs, providing strong cost support for alloy ingot quotations. However, due to the rapid pace of cost growth, the industry's theoretical profit margins were somewhat compressed.

National ADC12 Theoretical Profit and Loss Trend:

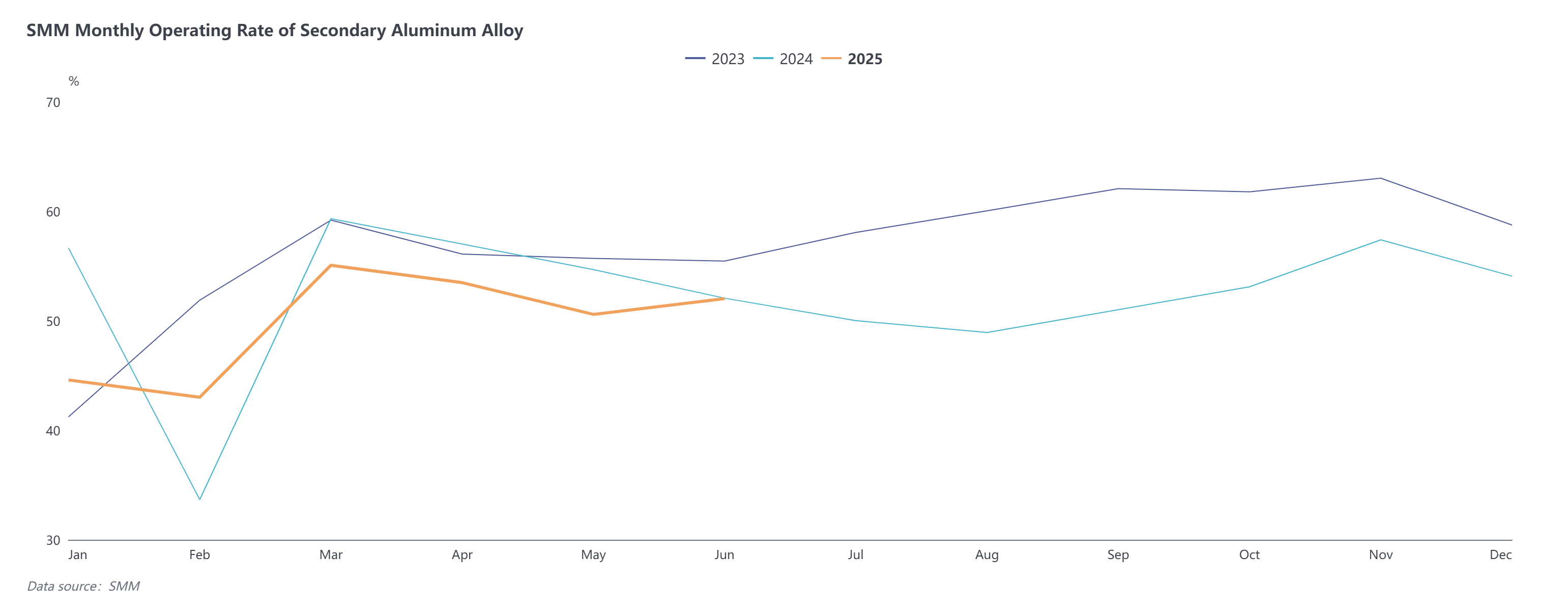

Supply side, the operating rate of the secondary aluminum alloy industry fell 1.7 percentage points MoM to 55.84% in October, but rose 2.73 percentage points YoY. The operating rate performance diverged in October, with some enterprises, mainly large plants, maintaining high operating levels, basically stable or slightly increasing production; overall operations were under pressure due to constraints, mainly including: ① shutdowns during the National Day holiday; ② tight raw material supply combined with difficulties in restocking, leading to production constraints for enterprises; ③ high raw material prices squeezing profits, forcing production cuts due to cost pressures; ④ continued production cuts or suspensions in Henan, Jiangxi, and other regions due to policy uncertainty; ⑤ environmental protection-related controls implemented at month-end in Hebei and other areas, causing localized production constraints. Entering November, as the holiday impact fades and year-end demand for pushing annual targets is released in the end-use market, secondary aluminum plants are expected to see phased support for orders and operating rates. However, the industry still faces multiple challenges: on one hand, raw material supply deficits, regional environmental protection-driven production restrictions, and policy uncertainty continue to hinder capacity release; on the other hand, rapid aluminum price increases in November led to a significant decline in downstream purchase willingness, with insufficient momentum to chase rising prices, resulting in a contraction in secondary aluminum orders and further limiting upside room for the operating rate. Overall, the industry's operating rate in November is expected to show a slight improvement MoM but remain weak YoY.

In November, the tight supply of aluminum scrap persisted, coupled with prices of auxiliary materials such as copper fluctuating at highs. With cost support, ADC12 prices still possess short-term upward momentum. On the demand side, although supported by the resilience of end-use consumption in sectors like automotive, the rapid surge in aluminum prices at the beginning of the month triggered fear of high prices among downstream enterprises, leading to a decline in market trading activity. Currently, high social inventory is putting pressure on prices, and there is a need to be cautious of periodic correction risks. Overall, ADC12 prices are expected to hold up well in November, with the projected range shifting upward to 21,200-21,600 yuan/mt. Key factors to monitor include the extent of improvement in aluminum scrap supply, the implementation effects of policies, and changes in the procurement pace of downstream enterprises.

In November, the tight supply of aluminum scrap persisted, coupled with prices of auxiliary materials such as copper fluctuating at highs. With cost support, ADC12 prices still possess short-term upward momentum. On the demand side, although supported by the resilience of end-use consumption in sectors like automotive, the rapid surge in aluminum prices at the beginning of the month triggered fear of high prices among downstream enterprises, leading to a decline in market trading activity. Currently, high social inventory is putting pressure on prices, and there is a need to be cautious of periodic correction risks. Overall, ADC12 prices are expected to hold up well in November, with the projected range shifting upward to 21,200-21,600 yuan/mt. Key factors to monitor include the extent of improvement in aluminum scrap supply, the implementation effects of policies, and changes in the procurement pace of downstream enterprises.