Mid-October has arrived, yet lead prices continue to fluctuate rangebound. Downstream lead-acid battery consumption remains lukewarm, providing insufficient momentum for lead price increases. Additionally, from late August to early-mid September, multiple secondary lead smelters halted production.

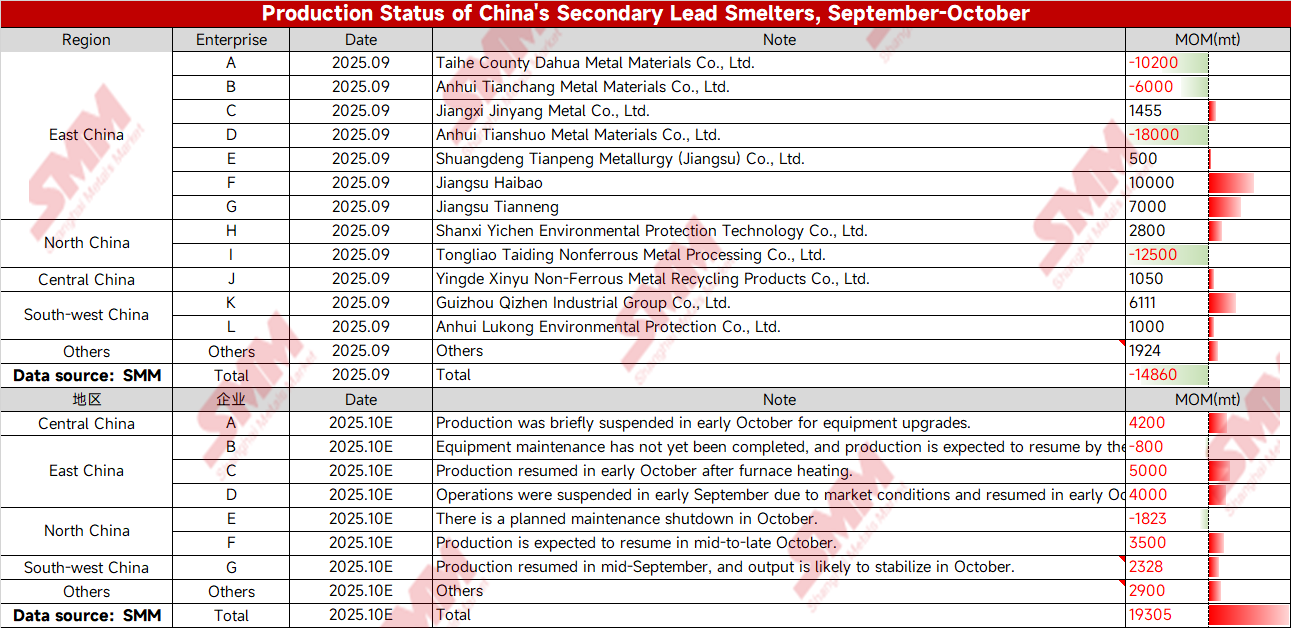

As production resumption plans progress in October, the supply of secondary lead in circulation is gradually increasing, which may exert some pressure on lead prices. According to SMM data derived from market communication and processing at the end of September, secondary refined lead production in October is expected to increase by approximately 20,000 mt.

Following the National Day and Mid-Autumn Festival holidays, some smelters in East China have officially resumed production with stable output, and a few enterprises even exceeded production expectations.

Although the resumption of production at secondary lead smelters is relatively concentrated, factors such as raw material supply, prices, and smelting profits continue to affect their production enthusiasm. In September, sales of replacement batteries for two-wheeled e-bikes increased, but the volume of retired waste lead-acid batteries did not show significant growth.

Since secondary lead smelters that halted production in September did not stop purchasing raw materials, raw material inventories have accumulated at various plants, and the supply-demand imbalance for scrap batteries is not yet prominent. With the resumption of production at secondary lead smelters, demand for waste lead-acid batteries has increased, leading to a slight rise in scrap battery prices recently. However, the cost pressure from raw materials remains within an acceptable range for smelters. Currently, smelters that have not resumed production due to a wait-and-see sentiment are more focused on lead price trends and smelting profit margins.

According to feedback from some idled secondary lead smelters in North and East China, furnace heating is expected to begin in late October, with spot orders of refined lead available for sale likely in November. Overall, while the resumption of production at secondary lead smelters in October contributes significantly to the production increase, the initial output is primarily allocated to fulfilling long-term contracts, leaving limited spot orders available for sale. Consequently, the downward pressure on lead prices remains relatively small.

Data Source Statement: The data is processed by SMM based on publicly available information, market exchanges, and internal database models, and is for reference only.