SHANGHAI, Jun 10 (SMM) - This is a roundup of China's metals output in May 2022, from an exclusive survey of key producers by SMM analysts.

Copper cathode

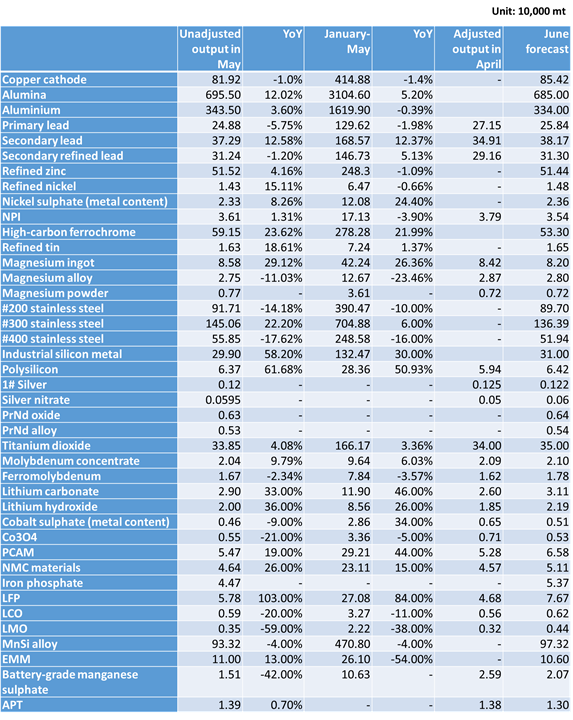

SMM China copper cathode output stood at 819,200 mt in May, down 1.0% MoM, and down 3.6% YoY.

The overall domestic copper cathode output in May was at a low level due to the intensive maintenance. Although two smelters in Shandong resumed the production in May, the production of copper did not resume. However, the output in May was slightly higher than expected as the maintenance of some smelters was delayed to June amid the pandemic and poor transportation. From the perspective of raw materials, Yanggu C&D purchased a large amount of clean ore in the market, resulting in a short-term supply shortage in the spot market. However, TCs were still at a high level of $70/mt as most smelters had sufficient raw material supply in the second and third quarters, and the overall in-plant inventories were high. At the same time, the price of sulphuric acid rebounded to over 900 yuan/mt in the mainstream areas due to the continuous rise of upstream sulphur prices, and the profits of smelters were considerable. In terms of blister copper, due to the intensive maintenance, the market demand for blister copper increased to a certain extent. Meanwhile, the blister copper imports were disturbed by the transportation inefficiency of Durban port in South Africa. Therefore, the overall supply was tight and the RCs of blister copper continued to decline.

From the perspective of the production schedule in June, Tongling Jinguan, Southeast Copper, Nanguo, etc. have gradually conducted the maintenance. Although some smelters have recovered from overhauls, most smelters are still in intensive maintenance. The overall demand increase will be mainly resulted from the production resumption of three major smelters and some other individual smelters. Although the new project of Daye Nonferrous Metals (Yangxin Hongsheng) with 400,000 mt of copper cathode capacity is delayed as some equipment failed to arrive in time, domestic output will rise steadily in the second half of the year as the expansion project of Tongling and Fuye were put into operation and three smelters in Shandong resumed the production. SMM expects that China's copper cathode output will be 854,200 mt in June, an increase of 4.3% month on month and 3% year on year.

Alumina

SMM China metallurgical-grade alumina output in May (31 calendar days) was 6.955 million mt. The average daily output of metallurgical-grade alumina was 224,400 mt, an increase of 12.16% MoM and 12.02% YoY. Alumina output totalled 31.046 million mt from January to May, up 5.2% year on year.

The production days in May added by 1 day compared with the previous month, so the output generally increased across China. The output in Chongqing and Hebei provinces increased significantly due to the additional output from new capacity. The output in Shandong, Shanxi, Henan, Guangxi, Guizhou, Yunnan, Inner Mongolia, Chongqing, Hebei increased by 11%, 3%, 5%, 9%, 6%, 3%, 2%, 224%, 119% MoM to 2.268 million mt, 1.719 million mt, 834,000 mt, 1.057 million mt, 418,000 mt, 119,000 mt, 42,000 mt, 323,000 mt and 175,000 mt respectively.

According to SMM, as of the beginning of June, in terms of new capacity, Phase II of Jingxi Tiangui with 850,000 mt has been in full production while phase III has commissioned, and is planned to be put into production in June. Chongqing Bosai Wanzhou project achieves an operating capacity of 2.7 million mt, and will continue to put another 900,000 capacity into production in June. The first production line of Hebei Wenfeng is already in full production with a capacity of 1.2 million mt, and the second production line is in production and is expected to reach full production in early June. Phase II Lubei Chemical with a capacity of 1 million mt, Phase II of Luyu Bochuang with 1 million mt, and Phase II of Guangxi Tiandong Jinxin with 1.2 million mt will all be put into production in the second half of this year. To sum up, a larger volume of new alumina production will flow into the market from Q3.

On the whole, it is estimated that the net import of alumina in May was -150,000 mt, with a surplus of 193,000 mt. The fundamentals of alumina reversed from shortage to surplus, leading to the correction of alumina prices. Subsequent new production capacity will be put into production more quickly and significantly, and the long-term fundamentals of alumina will remain in surplus. If the prices of alumina continue to fall, the pressure on high-cost alumina plants in Shanxi and Henan will increase sharply, which may lead to production reduction. (1 mt of aluminium consumes 1.925 mt of alumina)

Aluminium

According to SMM data, China produced 3.435 million mt of aluminium in May (31 calendar days), up 3.6% on the year. The daily output averaged 110,800 mt, up 800 mt on the month, up 3,900 mt on the year. The output totalled 16.199 million mt from January to May 2022, a decrease of 0.39% on the year. In May, the domestic aluminium saw both increase and decrease in supply, and the production capacity increased slightly. Among them, output in Yunnan, Shandong and other places decreased by 252,000 mt due to capacity replacement and maintenance. The increase in supply during the month was mainly because some enterprises in Yunnan, Guangxi and Henan resumed the production and newly put 408,000 mt of capacity into production. As of early June, the domestic operating aluminium capacity reached 40.598 million mt, with the installed capacity at 44.365 million mt, hence the average operating rate stood at 91.5%. The ratio of aluminium liquid in north-west China and other places increased by 0.8 percentage point from the previous month to 65.5% in May.

In June, some production capacity in Gansu, Guangxi, Yunnan, Sichuan and other places are still expected to resume the production or be put into production. As the supply is unlikely to decrease amid the current domestic power supply and policies, the domestic operating aluminium capacity will continue to increase in June, which is expected to reach around 40.76 million mt by the end of June, and the domestic aluminium output in June is expected to reach 3.34 million mt, with a year-on-year increase of about 3.7%.

In terms of demand, although the problem of poor transportation caused by the domestic pandemic eased in May, the terminal demand was still modest. Therefore, the operating rates of mainstream consumer sectors, such as construction extrusions and aluminium plate/sheet, strip and foil, were lower than expected. As the export orders of some enterprises decreased slightly due to the pandemic in Shanghai and other regions, the domestic social inventory of aluminium fell by less than 70,000 mt, which was far lower than the monthly reduction of 140,000 mt last year. In addition, due to insufficient demand from aluminium extrusion and other sections, the inventory of aluminium billet increased slightly. As Shanghai has fully resumed work and production, and the domestic stimulus policies are about to be implemented, the application of aluminium in automobiles and new energy power sectors may increase significantly. Meanwhile, due to the impact of the scandal of repeated pledge of the same aluminium ingot stocks in a social warehouse, it is expected that the domestic aluminium inventories will continue to fall to 850,000 mt in June while the inventory of aluminium billet may be difficult to decline significantly in the short term.

Primary lead

China produced 248,800 mt of refined lead in May, down 8.36% MoM and 5.75% YoY. The combined output in January-May declined by 1.98% from a year ago. Production capacities of enterprises involved in the survey totalled 5.71 million mt in 2022.

According to the survey, the overall output of refined lead smelters fell more than expected in May, mainly because Hunan Jingui, Chihong Zn & Ge Co., Haicheng Chengxin and other enterprises reduced the production amid the maintenance. Meanwhile, a safety accident occurred in the Hunan Yongxing, and all local lead smelters suspended the production. Moreover, the major deliverable brands in Henan, such as Jinli, Wanyang and other enterprises, also reduced the production due to the shortage of raw materials and unexpected maintenance. Therefore, the output decrease expanded.

Judging from the production schedule of smelters in June, as Henan Jinli, Wanyang, Chihong Zn & Ge Co., Haicheng Chengxin and other enterprises have completed their maintenance, and the impact of the safety accident in Hunan eases, it is expected that the output of refined lead will increase in June. However, the expected increase of refined lead has been dragged on by the routine maintenance of smelters including Anhui Tongguan and Chifeng Shanjin. SMM expects China's refined lead output to increase to 258,400 mt in June.

Secondary lead

China produced 372,900 mt of secondary lead in May 2022, up 6.82% MoM, and up 12.58% YoY. The combined output in January-May increased by 12.37% from a year ago. Meanwhile, China produced 312,400 mt of secondary refined lead in May 2022, up 15.97% month-on-month, and down 1.2% from a year ago. Cumulative output from January to May advanced 5.13% on the year.

According to SMM research, the output of secondary lead continued to increase as scheduled in May as the problem of value-added tax on battery scrap were further addressed, and the supply willingness of cargo holders increased. Meanwhile, as the shipment problem caused by the pandemic was eased and the large secondary lead smelters resumed normal production in May, the output increased significantly. Although the profit situation worsened at the end of May and a few smelters reduced the production, the overall secondary lead output maintained growth.

In June, some secondary lead smelters in Henan, Anhui, Inner Mongolia and Shanxi have resumed the production from maintenance, which is expected to bring more increments. At the same time, as the smelters with expansion projects tend to increase the production and the reduction caused by the maintenance will be limited, the overall output in June is expected to increase slightly.

Refined zinc

China’s refined zinc output was 515,200 mt in May, an increase of 19,700 mt or 3.97% MoM and an increase of 4.16% YoY, SMM data showed. From January to May 2022, the combined refined zinc output is estimated to be 2.483 million mt, a decrease of 1.09% year on year.

SMM survey showed that China's refined zinc output in May basically has met expectations. The output increased mainly because a large smelter in Yunnan resumed the production after maintenance. Meanwhile, some smelters in Shaanxi and Sichuan and a smelter in Inner Mongolia raised their operating rates, and some small smelters in Guangxi returned to normal production. Nonetheless, there were reductions in the output as a smelter in Shaanxi reduced the production amid maintenance, which contributed major decrease. Meanwhile, a large smelter in Hunan was in maintenance and a small smelter suspended the production in mid-May and other smelters were under production control.

China's refined zinc output is expected to fall by 800 mt to 514,400 mt in June, an increase of 6,500 mt or 1.27% YoY. From January to June 2022, the combined refined zinc output is estimated to be 2.997 million mt, a decrease of 0.69% year on year. The output increment will be mainly brought about by a smelter in Inner Mongolia that resumes the production. At the same time, a smelter in Hunan will resume normal production. The output is expected to see some decreases because some smelters in Shaanxi and Qinghai will continue to be overhauled, and at the same time, the maintenance of a smelter will be in place until the end of August. Meanwhile, a smelter in Yunnan will reduce the production due to maintenance, and the resumption date of a smelter in Hunan is not determined and the output of other secondary zinc smelters is expected to decline slightly due to the raw material problem.

Tin

According to SMM research, domestic refined tin output stood at 16,330 mt in May, a month-on-month increase of 8.12% and a year-on-year increase of 18.61%. The total output from January to May increased by 1.37% on the year. The domestic output of refined tin in May was higher than expected. The main reason for the increase in output was that the production of mainstream smelters remained stable, while some manufacturers resumed normal production, driving up the output.

Regarding the output in different regions, 1. The output of smelters in Yunnan increased slightly month-on-month. The production of mainstream smelters in Yunnan was rather stable in May, with only some smelters in Gejiu City stopping the production for a short term due to environmental protection. However, the overall output in Yunnan remained stable because the shutdown only lasted for a short time and some enterprises increased their production, which resulted in an overall increase in output. 2. The output of enterprises in Guangxi increased significantly on the month. The main reason for the surge in output was that some enterprises have returned to normal production after completing the maintenance, resulting in a substantial increase in total output. 3. The output of smelters in Jiangxi remained unchanged. The mainstream smelters have maintained normal production. The periodic output fluctuations of some enterprises were also in line with the previous research of weekly operating rates. 4. The total output of smelters in other regions increased slightly month-on-month in May, but the output of different smelters diverged. There were more companies with a month-on-month decrease in output, but the overall output did not change much because some companies resumed the production after maintenance.

In June, as domestic mainstream smelters maintain stable production, most manufacturers expect the output to be stable in June. Although some companies have lowered their production expectations due to the weak market shipments, the new production capacity has limited the expected reduction. To sum up, the operating rates of domestic smelters in May rose month-on-month, while the operating rates in June are expected to remain high. SMM estimates that domestic refined tin output in June will be 16,510 mt.

Refined nickel

China produced 14,300 mt of refined nickel in May, up 10.59% MoM and 15.11% YoY. The output increased significantly in May as expected as some refined nickel smelters resumed the production amid the low LME nickel prices. In addition, some salt factories resumed or newly commenced the production of refined nickel for lucrative profits, resulting in significant increase of the output.

The output of refined nickel is expected to stand at 14,800 mt in June 2022, up 3.49% MoM and 3.81% YoY. The expectation of output increase is mainly because some salt factories will resume normal production of refined nickel this month. In addition, the refined nickel capacity of some salt factories is expected to achieve normal production in recent months after commissioning.

NPI

Domestic NPI output declined slightly and stood at 36,100 mt in Ni content in May, down 4.68% MoM and up 1.31% YoY. The market supply was relatively insufficient. The output of high-grade NPI stood at 28,300 mt (Ni content) in May, a decrease of 7.8% on the month, and the output of low-grade NPI was 7,800 mt (Ni content), up 8.6% on the month.

In May, the NPI prices fell. As the terminal demand for stainless steel was weak amid the pandemic, some steel mills reduced the production due to the high cost and poor profits, which put pressure on the prices of high-grade NPI. The output of NPI in some MPI plants or integrated steel mills declined amid the poor market demand, and the output in June is still not optimistic. At the same time, the production suspension of a NPI plant in Liaoning for maintenance since June, and the production reduction of an integrated steel plant in south China will affect the output of NPI. Therefore, it is expected that the output of NPI will remain low in June.

It is estimated that the domestic NPI output in June 2022 will be 35,400 mt in Ni content and it is difficult to stimulate the production of NPI plants when the market is sluggish. Among them, the output of high-grade NPI may be around 27,600 mt in Ni content. The main factor limiting expectations is the stainless steel market outlook. In addition, as the Indonesian NPI production lines are put into production, Indonesia's NPI with cost advantages will grab part of the domestic NPI market, hence the domestic NPI output may fall. Meanwhile, the output will also decline due to the falling grade of nickel ore in the Philippines.

Nickel sulphate

China produced 105,000 mt of nickel sulphate, or 23,300 mt in Ni content in May 2022, up 7.6% on the month and 8.3% on the year. In May, the overall procurement demand in the market was still poor, and the increase in output was mainly because some plants recovered from the production reduction and some of them chose tolling manufacturing. Therefore, the comprehensive output increased. From the perspective of raw materials, nickel briquette (powder) accounted for about 18% of the total raw materials used in May, and the proportion of intermediate products and high-grade nickel matte increased to 59%. Imports of intermediate products and high-grade nickel matte increased significantly with the release of Indonesia's new capacity. It is expected that except for some rigid demand, the use of nickel briquette will still decline due to the poor cost effectiveness.

With the increase in the output of tolling manufacturers and integrated manufacturers, the output in June is expected to increase by 5.61% month-on-month and 3.88% year-on-year. The supply of raw materials continues to increase in June, and the production of nickel salt has improved compared with the previous period due to the fall in raw material costs. In addition, with the demand for nickel salts from the precursor sector improving in June/July, the overall market supply will increase to a certain extent, but will still be low compared to that in March.

Battery-grade manganese sulphate

China's battery-grade manganese sulphate output stood at 15,100 mt in May 2022, down significantly by 42% from 25,907 mt in April. Affected by high nickel prices and the pandemic, the output of domestic precursors dropped significantly, and the output of 5-series precursors with higher unit consumption of manganese salts dropped more significantly. The manganese sulphate prices continued to fall amid the decline of demand, and the output of manganese salt factories fell sharply due to the compressed profits and the decline of downstream demand.

In June, the output of precursors is expected to increase. But since some precursor plants still have sufficient manganese salt inventory, the delivery situation at the beginning of the month improved only slightly, hence the output of salt plants does not increase significantly for the time being, and subsequent adjustments will be made according to the actual downstream demand. According to the production schedule and inventory of precursors, it is expected that the demand will increase in the mid and late-June. Therefore, some manganese salt factories initially plan to increase or resume the production in late-June. The output in June is expected to be 20,650 mt, an increase of 37% from the previous month.

High-carbon ferrochrome

SMM data showed that China's high-carbon ferrochrome output rebounded in May, with a MoM increase of 6.48% to 591,500 mt, a YoY increase of 113,000 mt or 23.62%. The output in Inner Mongolia was 290,100 mt, a MoM increase of 27,900 mt or 10.64%. The output in Sichuan was 43,500 mt, up 40.32% MoM. As the environmental inspections in Inner Mongolia completed, the production resumed. In addition, as large-scale ferrochrome manufacturers in Inner Mongolia mostly use futures raw materials, the cost remained low and the profits were maintained. In this case, the ferrochrome factories actively produced with high operating rates. The electricity prices dropped amid the wet season in Sichuan, and the electricity cost with captive power plants dropped to around 0.4 yuan/KVA, hence the output in the region increased.

The output of high-carbon ferrochromium in June is expected to be 538,000 mt, which will be lower than the output in May. The port inventory of chrome ore remains low, and the arrivals at port are expected to be low as well in June. In this case, the prices of chrome ore are high, and the profit of some ferrochrome plants will fall into the negative zone. The stainless steel output has declined for months as the finished products inventories have been high and the steel mills are in losses due to the sluggish consumption caused by the pandemic. Therefore, the demand for ferrochrome decreases. With the high output of ferrochrome in May, the supply is currently sufficient, and the prices are likely to fall. Recently, most ferrochrome factories have run out of their inventories of low-priced raw materials stored in the early stage, and some small and medium-sized ferrochrome factories have to suspend the purchase of raw materials, and choose to reduce or suspend the production for maintenance due to the high ore prices and high costs. However, the supply and demand will gradually balance again with the production reduction, eased pandemic, and the national economic stimulus policies.

Stainless steel

According to SMM survey, the domestic stainless steel output in May totalled about 2.9262 million mt, up 28,800 mt or 1% MoM and down 1.4% YoY. 200 series stainless steel stood at 917,000 mt, up 10.1% YoY; 300 series recorded 1.4506 million mt, down 2.93% YoY; and 400 series was 558,500 mt, down 3.09% YoY.

In May, the supply was more than expected. Although some steel mills reported plans to reduce the production, they decided to maintain the production due to the recovering profits and the decline of pure nickel and NPI prices. Therefore, the output in May increased significantly compared with that in April. In May, and was basically the same as that of the previous year, with an increase of 0.77% YoY. Among them, although the profit of 200 series was squeezed by the low-grade nickel ore, there was still room compared with the 300 series, hence most steel mills continued their production schedule in May, while the output of 300 and 400 series decreased compared with that in April.

In June, although the supply tightness of nickel-based raw materials has eased, the prices are still near the break-even point and the in-plant inventories are high amid the poor consumption. In addition, the supply pressure of the steel mills is still relatively heavy as the production reduction in May was less than expected. Therefore, most steel mills have suspended the production and conducted the mid-year maintenance, hence the overall output will decrease. Some steel mills are still limited by the shortage of raw materials. Since only pure nickel or Feni can be used in the final stage of production, there is still a gap between high-grade Indonesian NPI and Feni. Therefore, in the case of limited supply of Feni, the costs are high amid the unavoidable use of pure nickel. The supply of stainless steel scrap is relatively limited, which will also limit the production of some steel mills with a high proportion of steel scrap in the south. SMM expects that the output of 200, 300, and 400 series will drop slightly in June. It is expected that the 200 series output will be about 897,000 mt with a decrease of 2.19% MoM, and the 300 series output will be about 1,363,900 mt with a decrease of 5.98% MoM, and the 400 series output will be about 519,400 mt with a decrease of 7% MoM.

EMM

China produced 110,000 mt of EMM in May, up 4% MoM and down 13.2% YoY, according to SMM statistics. The combined output in January-May totalled 261,000 mt, down 54% YoY. According to SMM research, the production of EMM increased slightly in May because there were one more natural day in May compared with April. In addition, the EMM output increased only slightly by less than 10,000 mt this month as some enterprises in Guangxi gradually resumed the production while some enterprises in Guizhou and Hunan reduced or suspended the production due to environmental protection, ore and other reasons.

The production of EMM in June is expected to be slightly lower than that in May. The market sees few plans to reduce or suspend the production amid the manganese alliance meeting. The enterprises that are in production in the short term maintain normal operating rates. However, some manufacturers in Hunan and other places are expected to suspend the production in June due to the exhaustion of ore, hence the output may further decline. In addition, due to the high prices of raw materials and the high cost of EMM, the overall market willingness to reduce EMM prices is low. However, due to the current state of oversupply, the short-term EMM market game will be more obvious. But the EMM prices will remain firm in the short term due to the cost support.

Industrial silicon

The domestic industrial silicon output was 299,000 mt in May, an increase of 8.3% month-on-month and 58.2% year-on-year, according to SMM statistics. The output totalled 1.3247 million mt from January to May, an increase of 30.0% on the year.

In May, the increase in production capacity of silicon factories in Xinjiang and Sichuan contributed the main output growth of industrial silicon. Silicon factories in Yili Zhou, Xinjiang Province resumed the production after the completion of maintenance, and operating furnaces at silicon factories in Sichuan increased in the wet season. The total output in Xinjiang and Sichuan rose by about 30,000 mt month-on-month. The output in Yunnan decreased slightly month-on-month due to the delay in the resumption of production among silicon plants in Dehong Zhou and the maintenance of some RKEFs in Nujiang Zhou. The reason why the output of industrial silicon rose sharply in May on the year in Xinjiang was mainly because of the lower output in May last year due to routine maintenance of silicon enterprises, the delay of the rainy season in Sichuan and Yunnan and the power cut in Yunnan.

The supply reduction due to suspension of silicon plants in high-cost areas such as Hunan and Shaanxi will emerge in June. However, the output of the main suppliers in Sichuan and Yunnan will continue to pick up, and operating rates in Xinjiang will be maintained at a high level. It is expected that the increase in supply will be greater than the reduction. Industrial silicon output may increase to 310,000 mt in June.

Polysilicon

The domestic polysilicon output was 63,700 mt in May, an increase of 7.24% month-on-month according to SMM statistics.

The main reasons for the increase in domestic polysilicon production in May vary. On the one hand, Xinte Energy carried out routine maintenance in April, and the production lines resumed normal production in May, with an output of more than 7,000 mt, an increase of nearly 3,000 mt. On the other hand, the domestic polysilicon market remained in short supply and the prices of polysilicon continued to rise. Polysilicon manufacturers were actively producing amid lucrative profits. Except for a few enterprises that have slightly reduced the production due to maintenance, most of the enterprises produced at full capacity, and the output of some new production lines picked up. With the fast ramp-up of production, the supply of polysilicon increased to a certain extent.

Silicon-manganese alloy

The domestic output of silicon-manganese alloy stood at 933,200 mt in May (including 60,000 mt of high-grade silicon-manganese, 873,200 mt of regular silico-manganese), down 4% on the month and 11% on the year, according to SMM estimate. The domestic output of silicon-manganese alloy stood at 4.7084 million mt from January to May, a decrease of 4% year-on-year. According to SMM research, the reasons for the slight decrease on the month in silicon-manganese alloy output in May are as follows: During May, the China Ferroalloys Industry Association (CFIA) called on ferroalloy enterprises to reduce the production to alleviate the oversupply. Although the actual reduction was limited, some retail-based enterprises cut the production under cost pressure.

In June, the Qinzhou Power Supply Bureau of Guangxi Autonomous Region issued a notice on the preferential electricity tariffs in June and July. According to SMM research, electricity prices in Guangxi will basically be settled according to this notice, and the electricity cost will be reduced by about 600 yuan/mt. Therefore, under the advantage of the electricity prices, many enterprises in Guangxi have resumed the production. It is expected that the output in Guangxi in June will increase significantly from the previous month. In addition, there has not been much information concerning the production reduction and shutdown in other regions, and the market remained cautious. SMM estimates that the output in June will be about 973,200 mt.

Magnesium ingot

China's magnesium ingot output stood at 85,800 mt in May, up 1.95% MoM and 29.12% YoY, according to SMM statistics. The output totalled 422,400 mt in the first five months of 2022, a year-on-year increase of 26.36%.

According to SMM research, following the end of environmental protection inspects, the output of magnesium plants in Inner Mongolia and Xinjiang increased in May. At the same time, because of the downward movement of magnesium prices as the weather turned warmer, some factories in the main producing areas stopped the production in June for maintenance. It is expected that the domestic magnesium ingot output will decrease slightly MoM to 82,000 mt in June. SMM will continue to focus on the production changes in the main producing areas.

Magnesium alloy

According to SMM data, China's magnesium alloy output stood at 27,500 mt in May, down 4.12% month-on-month and 11.03% on the year. The output totalled 126,700 mt from January to May, a year-on-year decrease of 23.46%.

The average operating rate of magnesium alloy industry stood at 48.51% in April, down 4.12% month-on-month and 15.21% year-on-year.

According to the sales staff of domestic magnesium alloy factories, some factories have reduced the production amid the rapid decline of magnesium prices and squeezing alloy profits. As the domestic pandemic has been effectively controlled and favourable policies have been released, generous subsidies for consumers to purchase automobiles were implemented across the country, and most policies will remain in palce until the end of the year. It is expected that the domestic demand for magnesium alloys will increase and the output in June will be 28,000 mt.

Magnesium powder

The domestic magnesium powder output in May stood at 7,200 mt, down 6.87% on the month. The average operating rate of the magnesium powder industry stood at 41.97% in the month.

In May, the domestic magnesium powder output showed a downward trend. From the sales staff of some magnesium plants, wait-and-see sentiment was strong in the downstream amid the seasonal low of the magnesium powder industry and the declining magnesium prices, leading to poor market inquiries. The magnesium powder market is expected to remain weak in June, with a monthly output of 7,200 mt.

Praseodymium-neodymium oxide

China’s output of praseodymium-neodymium (Pr-Nd) oxide in May 2022 stood at 6,411 mt, down 1.2% on the month. The main output increase came from Sichuan, Hunan and Jiangsu provinces, while the main decrease came from Gansu, Fujian and Jiangxi provinces.

Pr-Nd oxide output in Hunan rose 12.5% month-on-month in May, and that in Sichuan increased 1.5% month-on-month. With the increase in the potential demand for chlorinated tablets in the market, the import of thorium ore has increased, and the operating rates of separation enterprises that use rare earth chloride for production in Hunan and Sichuan increased slightly.

In May, the supply of scrap and ion ore was tight. Pr-Nd oxide output in Gansu dropped 11% on the month in May, and that in Jiangxi decreased 4.8% month-on-month. The orders of magnetic material enterprises shrank in March and April affected by the pandemic, and the output of NdFeB scrap decreased. The raw materials supply was sufficient in large-scale scrap recycling enterprises in Jiangxi and some scrap recyclers affiliated to large rare earth groups, and the output of Pr-Nd oxide remained stable. Some small and medium-sized scrap recycling enterprises were forced to reduce or even stop the production, and the shortage of NdFeB scrap supply may normalise.

Ion ore mines in Jiangxi and Myanmar were difficult to see substantial production in the second quarter, affecting the restocking of ion ore separation enterprises. The operating rates of such separation enterprises in Gansu, Fujian and Jiangxi dropped.

The supply of ion ore and scrap may still remain tight, and Pr-Nd oxide output is expected to decrease month-on-month in June.

Pr-Nd alloy

China’s output of praseodymium-neodymium (Pr-Nd) alloy in May 2022 stood at 5,405 mt, down 1.2% on the month. The increase was mainly found in Jiangxi while the main decrease came from Sichuan and Inner Mongolia.

The output of Pr-Nd alloy in Jiangxi increased slightly by 5.7% month-on-month, and orders increased in some large metal enterprises in Jiangxi. While orders were modest in metal companies in Sichuan and Inner Mongolia. Moreover, the weather got hot in Inner Mongolia and the furnace temperature of metal companies increased, leading to high equipment maintenance costs. Some metal companies reduced the production due to the rising temperature. Due to the tight supply of Pr-Nd oxide, it is expected that the supply of Pr-Nd alloy will also shrink in June.

Molybdenum concentrate

The domestic molybdenum concentrate output was about 20,400 mt in May, down 450 mt or 3% on the month.

The domestic output of molybdenum concentrate in May fell slightly compared with April. On the one hand, the domestic molybdenum prices declined further in May. Some mines were less active in producing and carried out short-term maintenance amid the falling prices, resulting in a reduction in the supply of molybdenum concentrate to a certain extent. On the other hand, as domestic molybdenum prices hit new highs in early April, some domestic mines maintained a high operating rate, resulting in a serious backlog of mine inventories. In May, due to the fall in market prices, downstream companies were cautious in purchasing, leading to few reduction in mine inventories. Therefore, the mines lowered the operating rates to relieve inventory pressure.

Ferromolybdenum

The domestic ferromolybdenum output stood at 16,700 mt in May, up 500 mt or 3% on the month.

Although the domestic ferromolybdenum prices continued to fall in May, the demand from steel mills remained stable. According to SMM statistics, the total domestic ferromolybdenum bidding in May stood at 12,000 mt, an increase of nearly 25% compared with April, resulting in an increase in the output.

Silver

According to SMM survey, domestic 1# silver output stood at 1,200.53 mt (including 1,035.53 mt of mineral silver) in May 2022, down 3.93% on the month, mainly because many producers carried out maintenance in May. On the macro front, the data on the implementation of the 33 measures of the State Council shows that the direct stimulus plans have added up to more than 10 trillion yuan. Coupled with the leveraged funds such as interest rate cuts and RRR cuts, it can be described as an unprecedented economic stimulus plan. The changes in the prices of silver which priced in Chinese yuan and even gold have gradually become clearer. Recently, the minutes of the latest US Fed meeting were released, which said that it may be appropriate to raise interest rates by 50 basis points in the next two meetings. More importantly, the minutes also hinted that the accelerated withdrawal of supportive monetary policy will provide flexibility for the Fed's policy later this year. Some analysts believe that the Fed is suggesting that it will stop or postpone raising interest rates to stabilise the economy. This information brings a glimmer of light to the gold and silver prices. In addition, Ukraine said that it will reverse the conflict by the end of the year, and the Russian Defence Minister said that they will continue to act until all goals are achieved. It is expected that silver prices will continue to move rangebound in June with upward potential under the stimulation of expected tremendous macro news, especially after the implementation of Fed's interest rate hike, which may boost the silver prices. In terms of the changes in the production of manufacturers in May, the number of manufacturers with increased output was less than those with falling output. Among them, companies with significantly contracted output in May include Guangdong Gold Industry, Chifeng Yunnan Copper, Zhongyuan Gold, Guiyan Platinum, Chihong Zn & Ge, Wanyang Smelting and Guiyang Yinxing, etc. Enterprises with added output include Xing'an Silver Lead, Baiyin Nonferrous Metals, Zhongtiaoshan Nonferrous Metals, Yunnan Zhenxing Industry, Zhejiang Hongda, Yunnan Copper and other manufacturers. The output growth was limited, so the overall domestic silver output in May still declined. It is expected that domestic silver output may increase in June.

Silver nitrate

According to SMM research, the domestic silver nitrate output in May stood at 595 mt amid the seasonal high, an increase of 19% on the month, mainly due to the increase in downstream demand.

In May, the domestic silver nitrate manufacturers almost produced at full capacity. The main reason for the sharp increase in demand for silver nitrate was that the pandemic affected the transportation efficiency of imported silver powder, while the prices of imported silver powder remained high, subsequently leading to less imports of silver powder. Domestic silver paste manufacturers gradually increased the purchases of domestic silver powder, which boosted the domestic demand, and silver powder manufacturers sourced from the upstream manufacturers, driving up the demand for silver nitrate. In addition, for other producers who have demand for silver nitrate other than silver powder, the prices of silver nitrate were low. The prices of silver nitrate other than silver powder were more acceptable for other downstream enterprises, and downstream enterprises restocked actively to welcome the seasonal high.

Although the silver prices were low in May, the silver spot was not able to supplement the market due to the pandemic in Shanghai, leading to tight silver spot in the market and driving up the spot premiums. Some silver nitrate manufacturers reduced their inventory considering the costs and delivery pressure amid rising demand and the spot premiums of silver. Some manufacturers also extended the delivery date amid the rising orders.

In June, some silver nitrate manufacturers will still be producing for orders placed in May. And since June 1, Shanghai has fully resumed normal production and work. The downstream manufacturers are optimistic about the demand with bullish sentiment in the market. Therefore, SMM expects that output of silver nitrate will rise slightly in June.

Titanium dioxide

China's titanium dioxide output stood at 338,500 mt in May, down 0.4% MoM. The output totalled 1.6617 million mt in 2022, a year-on-year increase of 3.36%.

According to SMM research, the downstream demand for titanium dioxide was still low affected by the pandemic in May, but it improved significantly compared to April this year. The export of titanium dioxide was fair, which made up fpr the poor demand in the domestic market to a certain extent. In June, as Shanghai lifted the COVID lockdown, the resumption of work and production across the country is progressing smoothly, but transportation is still restricted. SMM expects that domestic titanium dioxide output will rebound slightly to 350,000 mt in June.

APT

According to SMM survey, China's APT output in May was 13,900 mt, up 0.7% month-on-month, flat from the output in April.

In the first quarter and the beginning of the second quarter, APT long-term orders were full under robust downstream demand and the positive outlook. Smelters mainly delivered long-term orders, so the operating rates of domestic APT smelting enterprises remained stable MoM.

However, the pandemic recurred in Q2, so the terminal demand and cargo transportation were affected to a certain extent due to the scattered distribution of downstream enterprises in the tungsten market, resulting in a continuous decline in the operating rates of producers. By the end of May, the operating rates of downstream enterprises were less than 50%. There were less new small orders of APT affected by the shrinking downstream demand, and some private smelting enterprises appropriately reduced the production to lower the costs.

SMM believes that under the support of the full long-term orders, the APT output in May is able to maintain the level in April. However, when the terminal demand has not been fully reflected in the upstream and has not returned to normal, the demand side will need to consume raw material inventory first to stabilise the operation. A small drop in APT output is expected in June.

Lithium carbonate

China’s lithium carbonate output was 29,244 mt in May, a month-on-month increase of 10% and a year-on-year increase of 33%. Although a small number of manufacturers reduced te production due to maintenance and inadequate raw materials, new production capacity ramped up the production, while the production of the salt lake returned to peak. The overall supply increased amid the resumption of production from the previous maintenance and pandemic prevention and control measures. In June, the new production capacity will keep ramping up the production, and the production of salt lakes will peak this month with total output of the industry increasing MoM. Output of lithium carbonate is expected to be 31,128 mt in June, a month-on-month increase of 6% and year-on-year increase of 37%.

Lithium hydroxide

China’s lithium hydroxide output was 20,663 mt in May, a month-on-month increase of 12% and a year-on-year increase of 36%. In terms of smelting production, some of the new production capacity has entered the trial production stage, but supply only increased slightly due to the shortage of raw materials and short-term maintenance in May. The output of the causticising process increased significantly in May amid the stable lithium hydroxide prices and low prices of industry-grade lithium carbonate. In June, some leading manufacturers will complete maintenance and the new production lines continue to ramp up the production, while the supply though causticisation is expected to rise slightly, the overall supply of lithium hydroxide will still rise slightly. Domestic lithium hydroxide output is expected to be 21,922 mt in June, a month-on-month increase of 6% and a year-on-year increase of 40%.

Cobalt sulphate

China’s cobalt sulphate output stood at 4,642 mt in metal content in May, a month-on-month decrease of 29% and a year-on-year decrease of 9%. On the raw material side, the arrivals of intermediate products in May were still low. Considering the high finished product inventories and the sluggish market prices, some intermediate product manufacturers suspended or reduced the production. The frequent decline in refined cobalt prices in May caused fluctuations in the cost of recycled materials, and recycled material smelters tended to be cautious in purchasing raw materials, while the output fell slightly from the previous month. Therefore, the overall output of cobalt salts declined in May, mainly contributed by intermediate product smelters. On the demand side, the output of downstream precursor manufacturers recovered from April as the pandemic gradually improved in May. The demand for cobalt salt was modest while enterprises mainly consumed the inventory and purchased on rigid demand. It is expected that the impact of the floods in South Africa on cobalt-based raw materials will be transmitted to China in June, and the arrivals of intermediate products may decline. Downstream production will resume further in June, and the demand from the precursor sector will increase accordingly. The cobalt salt plants will mainly consume the finished product inventory. The smelters that stopped the production in May will resume the production in June, and the output of cobalt sulphate is expected to increase slightly in June. Output of cobalt sulphate is likely to stand at 5,113 mt in metal content in June, up 10% on the month.

Tricobalt tetraoxide (Co3O4)

China’s Co3O4 output stood at 5,495 mt in May, a month-on-month decrease of 23% and a year-on-year decrease of 21%. The weak demand for Co3O4 in May has not improved. In 2022, domestic mobile phone shipments significantly reduced on the year. The seasonal low in the electronics market in Q2 remained. Cobalt manufacturers have reduced the production in May and sold finished products at lower prices to reduce the inventory. The Co3O4 market has not improved in terms of orders in June. The market is less active in consumption with bearish sentiment in June and the demand is also sluggish. Co3O4 enterprises will maintain the low production schedule in May. Co3O4 output is expected to be 5,321 mt in June, a month-on-month decrease of 3% and a year-on-year decrease of 28%.

PCAM

China produced 54,750 mt of PCAM (precursor of cathode active material) in May, an increase of 4% month-on-month and 19% year-on-year. On the supply side, the precursor enterprises were still affected by poor demand, and the output recovery was slow. Some small factories suspended the production for one week or more at the beginning of May. The new production capacity of leading enterprises saw rising operating rates, and the overall output increased slightly. On the demand side, the supply chain of terminal car companies recovered slowly as the pandemic was still serious in Shanghai in May, while the leading battery factories continued to reduce ternary cathode materials inventory. The demand of precursors recovered slowly in May. In addition, in terms of electronics, the market was muted in May with few small orders. The demand in the power market was fair in the overseas market, and the export volume of precursors increased steadily. Therefore, the demand for precursors in May was relatively stable. It is expected that downstream power sector will recover smoothly in June and electronics demand may recover slowly while overseas orders will increase steadily. The output of precursors is expected to be 65,839 mt, up 20% on the month.

NMC

China’s output of NMC material stood at 46,433 mt in May, an increase of 1% month-on-month and 26% year-on-year. Affected by the domestic pandemic, market demand remained low under the weak terminal demand while demand in overseas market rose steadily, and the supply of NMC material remained stable in May. By product, orders for the 5 and 8-series increased slightly, while the 6-series declined, and the proportion of each series was basically stable. In June, some manufacturers have put new production capacity into production, and terminal demand has also picked up after the pandemic improves and as some domestic battery factories have lower inventory. Orders in overseas market are expected to rise steadily. The output of NMCmaterials in June is expected to be 51,062 mt, up 10% from the previous month.

Iron phosphate

China’s output of iron phosphate stood at 44,694 mt in May, an increase of 29% on the month. In May, the overall supply of iron phosphate increased due to the gradual ramp-up of the production lines of some new sample companies. On the demand side, as the impact of the pandemic gradually subsided, the downstream terminal demand has picked up, driving LFP enterprises to restock iron phosphate. Operating rates of production lines at iron phosphate enterprises rose, which were producing at full capacity and sold all their products with a sharp increase in output. Domestic output of iron phosphate is expected to be 53,776 mt in June, an increase of 20% on the month.

LFP

China’s output of LFP stood at 57,806 mt in May, an increase of 23% month-on-month and 103% year-on-year. In the post-pandemic time, terminal demand has gradually recovered. China’s production and sales of LFP finally bottomed out after three consecutive months of decline. In addition, new production capacity of some large first and second-tier factories has been put into production and the market supply has increased. The new production lines in Guizhou Yuneng, Yiwei Defang, Jintang Times and Longbai will be gradually released in the third quarter, and the expansion of LFP supply is still expanding quickly. On the demand side, as the impact of the pandemic gradually subsides, most car and battery companies in the Yangtze River Delta have resumed normal production, and demand from power battery and energy storage has recovered. The industry will welcome the boom in supply and demand in June. The output of LFP is expected to reach 76,755 mt, an increase of 33% month-on-month and a year-on-year increase of 161%.

LCO

China’s output of LCO cathode material stood at 5,888 mt in May, a year-on-year decrease of 20% and a month-on-month increase of 4%. It was still the seasonal low for the consumption of LCO materials and downstream electronic products in May. The weak demand has not changed and the downstream inquiries decreased. The output dropped sharply on the year, and domestic electronic product consumption was weak. Even the mid-year promotions did not boost the market demand for LCO. Domestic LCO output is expected to be 6,173 mt in June, a month-on-month decrease of 5% and a year-on-year decrease of 14%.

LMO

China’s output of LMO stood at 3,510 mt in May, a month-on-month increase of 7% and a year-on-year decrease of 59%. In May, the LMO market remained sluggish. Most LMO enterprises in the industry suspended half or even full of the production due to the long-lasting losses. Since the mid-to-late May, the rising lithium salt prices pulled up the prices of LMO, driving the downstream to restock at low prices, and the supply of LMO rebounded slightly. On the demand side, the downstream demand for LMO was still weak, and there was no obvious sign of recovery in the terminal battery market such as electronics and E-bike battery. Domestic output of LMO is expected to be 4,371 mt in June, a month-on-month increase of 25% and a year-on-year decrease of 49%.

![This Week, Platinum and Palladium Experienced Significant Pullbacks, End-Use Demand Recovered, and Spot Market Trading Was Normal [SMM Platinum and Palladium Weekly Review]](https://imgqn.smm.cn/usercenter/obeMy20251217171735.jpg)

![Silver Prices Continue to Pull Back, Suppliers Remain Reluctant to Sell, Spot Market Premiums Hard to Decline [SMM Daily Review]](https://imgqn.smm.cn/usercenter/LVqfJ20251217171736.jpg)