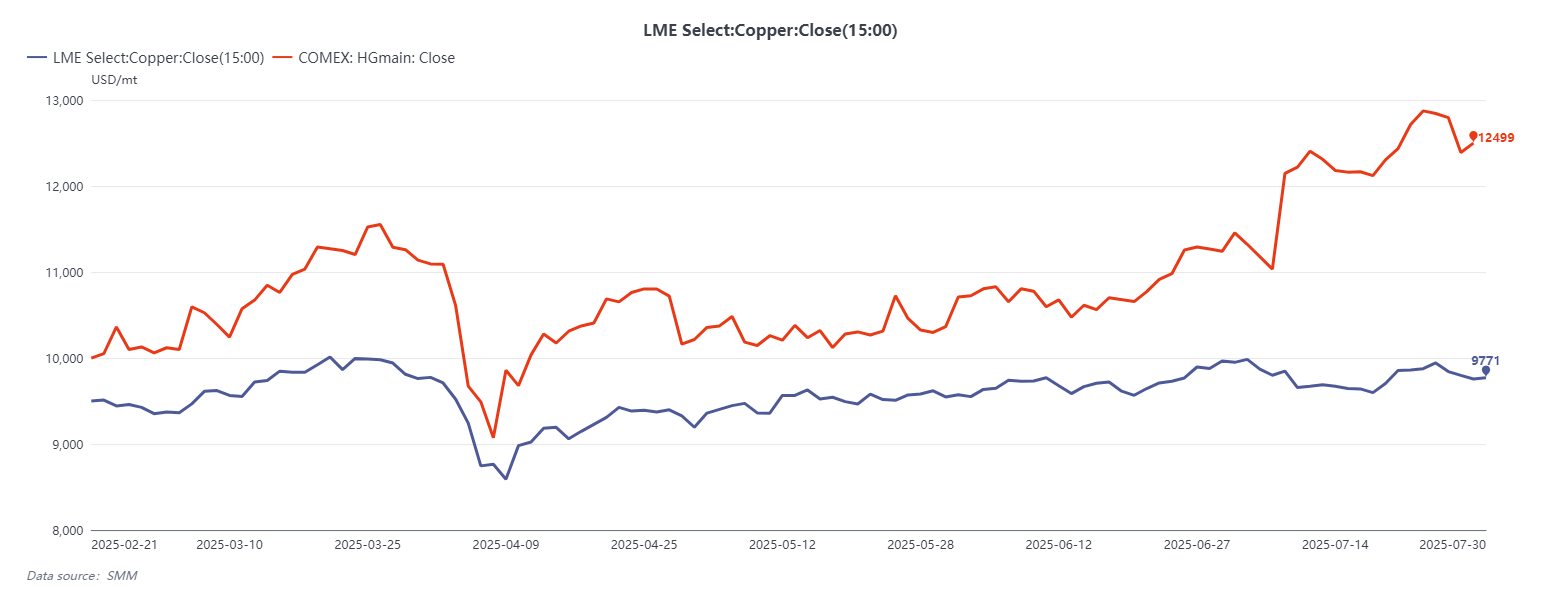

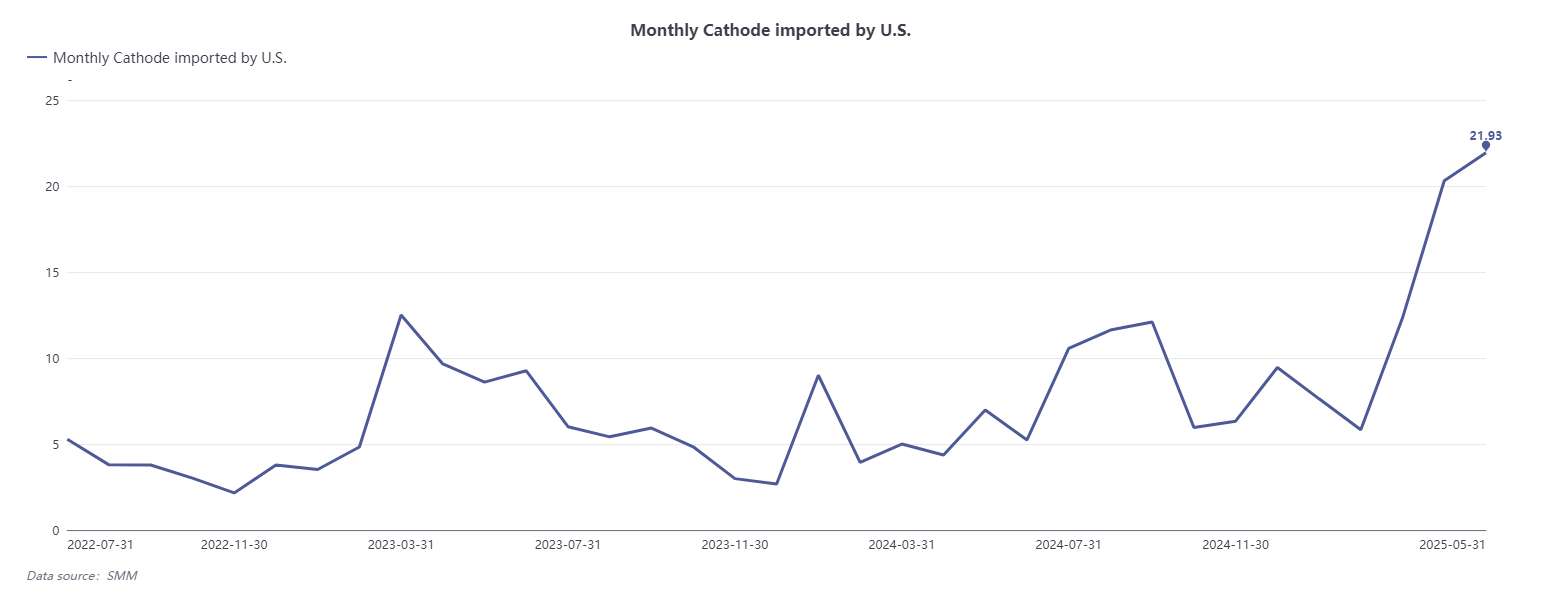

On July 30, 2025, U.S. President Donald Trump announced that effective August 1, a 50% import tariff would be imposed on semi-finished copper products (semis), while upstream raw materials—including copper concentrate, blister copper, and refined copper cathodes—would be exempt. This decision came as a shock to the market, abruptly dismantling the trading logic built around expectations of a blanket tariff. On the same day, copper futures on COMEX experienced their largest single-day decline in history, plunging over 18%. Previously, under the assumption that all refined copper imports would be subject to tariffs, the price spread between COMEX front-month contracts and LME 3M copper had widened to over 28%, triggering significant arbitrage activity. From February to July 2025, global metals traders rushed to ship copper cathodes to the U.S. in anticipation of the tariff window. This policy reversal not only caused severe market volatility, but also set in motion a chain reaction that could reshape global copper trade flows, regional price spreads, production layouts, and overall supply chain stability.

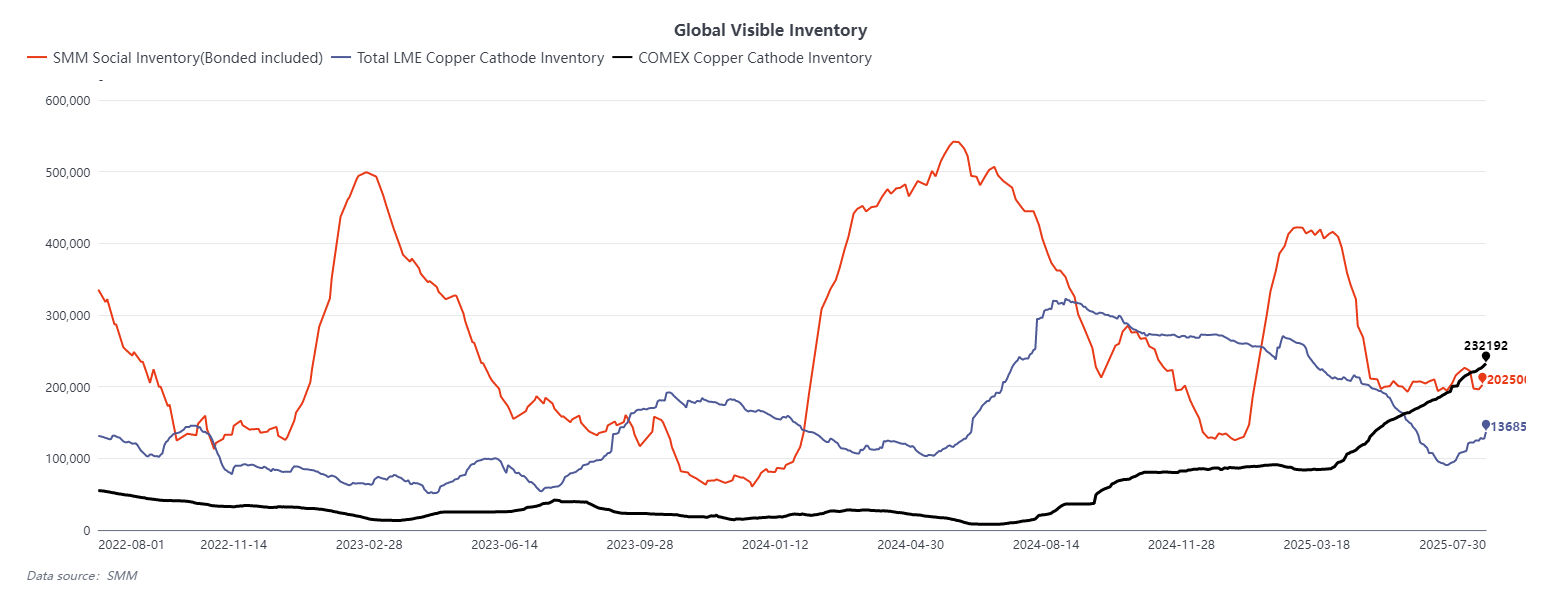

In the short term, the new policy directly impacted the spread between LME and COMEX copper. As the market had widely anticipated tariffs on all refined copper, COMEX prices had surged. However, the announcement of an exemption collapsed the arbitrage logic and rapidly compressed the spread. Considering current visible copper cathode inventories in the U.S. are estimated at 250,000 metric tons, and according to SMM, another 350,000 tons exist in off-warrant or off-market inventories, total accessible stocks likely exceed 600,000 tons—sufficient to meet short-term domestic consumption. While there remains a possibility that the COMEX-LME spread could turn negative, whether this reversal creates a sustainable arbitrage opportunity remains doubtful, with a low probability of materializing.

With the end of tariff-driven arbitrage, the flow of copper from Asia to the U.S. will come to an abrupt halt. Copper cathodes currently en route to the U.S., now deprived of their arbitrage value, may reassess their final destination. Taking into account costs such as re-export logistics and spot discounts, most of these cargoes are still likely to be delivered into the U.S. market—either to COMEX-approved warehouses or LME warehouses located in the U.S. This also marks the end of short-term arbitrage-driven inflows, as copper flows return to being governed by price signals and underlying supply-demand fundamentals rather than policy incentives.

For the Chinese market, bonded-zone copper premiums will be among the first to reflect the shift. As the U.S. loses its arbitrage-driven appetite for Asian copper, premiums in the Chinese offshore market are expected to normalize, moving away from the previously inflated levels and realigning with LME/SHFE spread, import arbitrage conditions, and domestic market fundamentals. China’s domestic cathode inventories remain low, and SHFE front-month contracts had previously shifted into a backwardation structure. If the LME continues to deepen its contango, short-term import arbitrage windows may reopen, pushing bonded-zone premiums higher. However, this outcome is conditional on domestic smelter output. Should production remain robust despite low treatment charges (TCs), the arbitrage window may stay closed.

From a mid- to long-term perspective, the U.S. decision to impose high tariffs on copper semis clearly aims to support the expansion of domestic manufacturing and downstream processing industries. As key suppliers of copper semis to the U.S., Mexico and Canada will be among the most affected, facing squeezed profit margins or even the risk of industrial relocation. Meanwhile, to enable "manufacturing reshoring," the U.S. is expected to accelerate the development of a complete domestic copper supply chain—from refined copper inputs to downstream applications. This would substantially increase demand for imported copper cathodes. Currently, U.S. annual consumption of refined copper is around 1.5–1.6 million tons, with approximately 900,000 tons sourced from imports,besides there are about 600000-700000 tons semis import per year. Market estimates suggest that if manufacturing expansion continues, U.S. demand could rise to 2.3–2.5 million tons in the coming years—an increase of 600,000 tons.

To bridge this growing raw material gap, the U.S. is likely to strengthen its cooperation with copper-rich regions such as South America, Africa, and Southeast Asia. Chile and Peru, as two of the world’s largest exporters of refined copper, are expected to further expand shipments to the U.S., while new smelting projects in Indonesia and select African nations may also pivot toward the American market. During this restructuring of global trade flows, U.S. copper cathode premiums are expected to climb as existing inventories are drawn down. At the same time, processing fees for semis are likely to rise, with cost pressures eventually passed along to end users. Given the U.S. is currently undergoing a critical phase of energy transition and electrification, this cost transmission may dampen some copper demand in the near term. Nevertheless, once new domestic smelting capacity comes online, pricing structures and supply stress are expected to gradually stabilize. This would lead to a more rational relationship between copper premiums, fabrication margins, and end-market prices, forming a new and balanced price discovery system.

Beneath the surface of this tariff episode lies a deeper structural realignment of global copper trade. An American-centered “Pan-Americas copper supply zone” and a China-centered “Asia-Pacific consumption and re-export hub” are both likely to solidify in the coming years. The global copper market may gradually shift away from a single, integrated trading system toward a more regionalized and internally circulating structure. In this context, competition over copper resources in Africa and Indonesia will intensify, becoming a new focal point of geopolitical resource strategies. Moreover, once the U.S. completes its domestic cathode production build-out, the possibility of reintroducing tariffs on refined copper—this time to protect domestic producers or limit imports—cannot be ruled out, adding persistent policy uncertainty to the global copper landscape.

All in all, the policy pivot on July 30 is not an isolated event, but rather a strategic move under the broader umbrella of the Trump administration’s “manufacturing reshoring” agenda. The resulting spread volatility, collapse of arbitrage flows, and rerouting of global shipments represent a structural correction to both market expectations and resource allocation mechanisms. More importantly, this event lays the groundwork for long-term shifts in copper industry dynamics, regional competition, and global policy risks.