Recently, the General Administration of Customs released the import and export data for June 2025. According to customs data:

In June 2025, imports of unwrought aluminum alloy reached 77,400 mt, down 12.3% YoY and 20.2% MoM. From January to June 2025, cumulative imports totaled 542,300 mt, down 11.6% YoY.

In June 2025, exports of unwrought aluminum alloy reached 25,800 mt, up 23.8% YoY and 6.6% MoM. From January to June 2025, cumulative exports totaled 120,300 mt, up 3.1% YoY.

From the perspective of import origins, the top five source countries of China's unwrought aluminum alloy imports in H1 2025 were Malaysia (216,000 mt, accounting for 40%), Russia (96,000 mt, accounting for 18%), Thailand (68,000 mt, accounting for 13%), Vietnam (26,000 mt, accounting for 5%), and Indonesia (25,000 mt, accounting for 5%), with the remaining countries accounting for approximately 21% in total.

From a YoY change perspective, China's unwrought aluminum alloy imports in H1 this year decreased by 72,000 mt compared to the same period last year. Among them, imports from Malaysia decreased by 52,000 mt, making it the country with the most significant reduction. Imports from Thailand, Vietnam, and South Korea also experienced varying degrees of decline. In contrast, imports from Russia increased by 66,000 mt YoY, becoming the region with the most significant growth in imports in H1.

In terms of exports, the total volume of unwrought aluminum alloy exports in H1 2025 reached 120,300 mt. Japan was the largest export destination, with exports amounting to 66,000 mt, accounting for 55% of the total, followed by India, South Korea, Mexico, and Vietnam. The trade mode was dominated by processing with supplied materials and processing with imported materials.

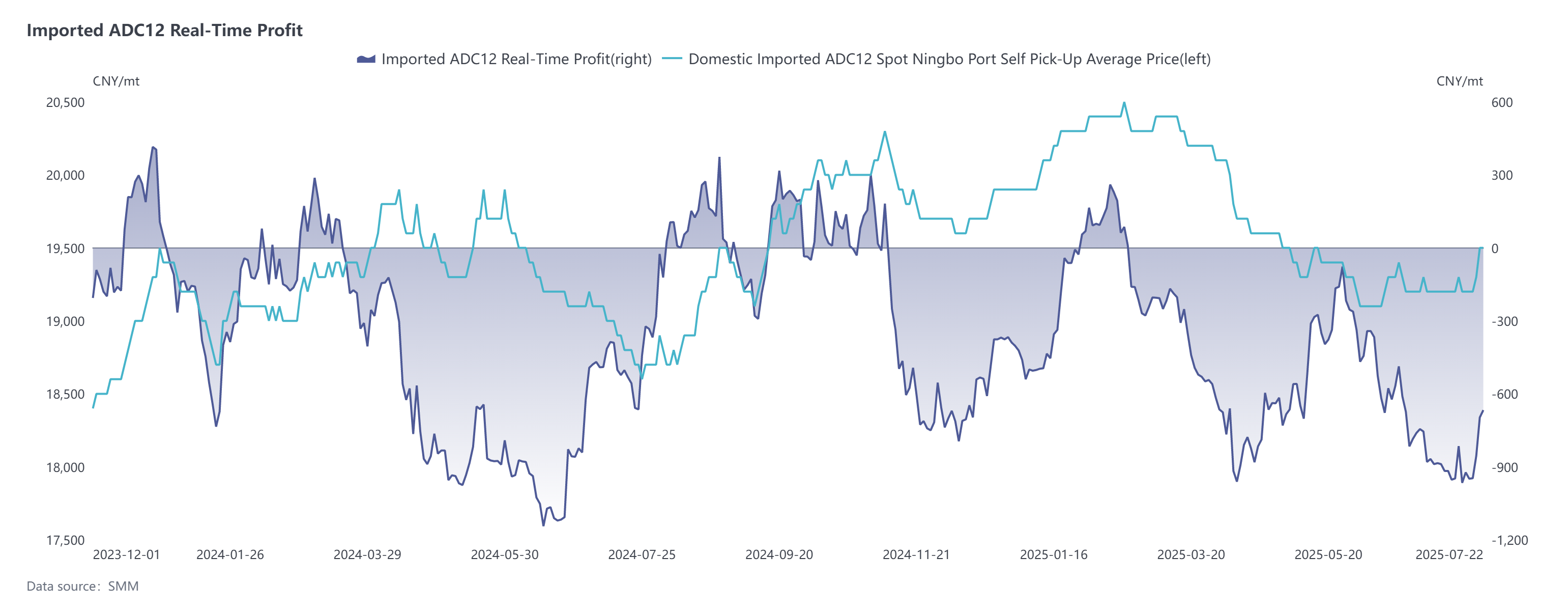

Overall, in the first half of 2025 (H1), total imports of unwrought aluminum alloy amounted to 542,300 mt, representing an 11.7% decline YoY. Monthly imports were all below 100,000 mt, while exports rebounded slightly YoY. Specifically, in mid-November of last year, the continuous decline in domestic aluminum prices dragged down the price of ADC12, while overseas prices remained stable, coupled with the depreciation of the RMB, leading to a continuous squeeze on the profit margins of imported ADC12 and resulting in losses by the end of January. In February, import profits briefly recovered to the break-even line, but from late February to April, overseas ADC12 prices continued to strengthen, reaching a peak of $2,510/mt. Meanwhile, due to the decline in aluminum prices and weaker-than-expected demand, domestic spot prices continued to fall, leading to renewed import losses that expanded, causing a contraction in aluminum alloy ingot imports. In May, although domestic prices continued to decline, the rate of decline narrowed, and overseas prices also fell below $2,400/mt, significantly narrowing immediate import losses and approaching the break-even point. In summary, due to the long-term inversion of the price spread between domestic and overseas markets in H1, the import advantage continuously diminished, leading to a significant decline in import volumes.

After mid-June, overseas prices rose again to around $2,480/mt driven by policy tightening and insufficient raw materials. Although domestic prices also rose to around 19,600 yuan/mt due to cost-push inflation, there was still an immediate import loss of 600-900 yuan/mt. Coupled with the constraints of the off-season demand, it is expected that import volumes will remain low in July-August.