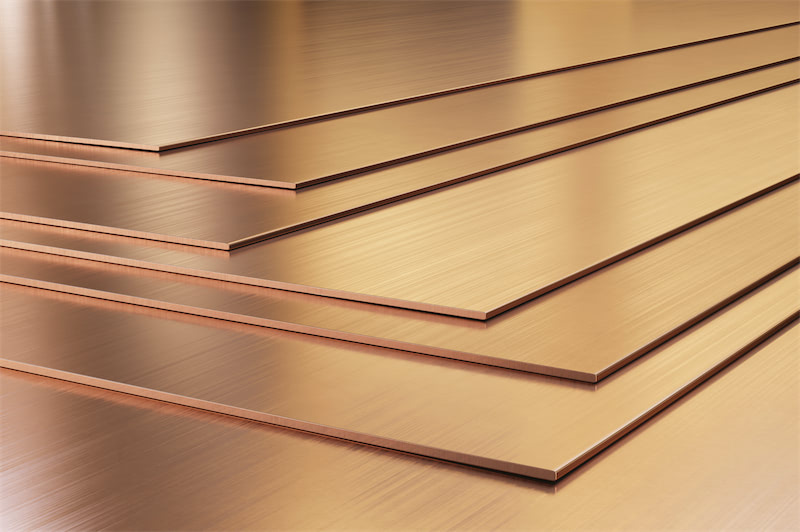

The status of copper is becoming more and more important. In anticipation of future supply crisis of copper, many copper giants have worked hard to find high-level political allies to support their efforts to include copper to the list of key minerals in the United States. But in the US, despite support from some senior politicians for the local copper industry, the United States Geological Survey (USGS) says copper has not yet reached the status needed to be included on the US Critical Minerals List.

According to news from Mining and Bloomberg, the Copper Development Association (CDA) stated that although some high-level political allies of the USGS expressed support for the local copper industry, the USGS has informed members of Congress and senators that copper has yet to reach the status of a critical mineral that needs to be included in the official list of commodities at risk of undersupply.

Copper's supply risk score is currently above the threshold for automatic inclusion on the 2022 Critical Minerals List, the CDA said. The USGS justified its decision by citing misleading arguments that were not part of its official 2022 approach. “Unlike in Europe, where copper was recently included in its proposed list of critical and strategic raw materials based on projections of future supply and demand, the USGS addresses supply risks with a forward-looking analysis. The USGS does not address current and forward-looking policy requirements that could lead to shortages in the domestic copper supply chain. “

"Continuing supply trends and solid data confirm that copper supply risk is not a short-term issue that will correct itself if decisive, immediate and strategic action is not taken," CDA President and CEO Andrew G. Kireta said in a statement. "

Kireta noted that the USGS' last official assessment of the 2022 critical minerals list was based on copper trade data from 2014 to 2018, which represented supply risk, was five to nine years out of date, and was too old and pointless.

"There are major gaps in our ability to mine and process these minerals to ensure future energy security and the government knows how important copper is to our domestic and national security," Sinema said in an interview at the time.

The letter warned of "significantly increased supply risks" for copper due to economic and geopolitical events such as the Russia-Ukraine conflict. Timing is of the essence, given the huge investment required, the time lag for new supply sources, and projected demand.

Some of the biggest copper miners including Rio Tinto, BHP Billiton and Freeport-McMoRan, as well as manufacturers such as Mueller Industries Inc., have urged the U.S. government to consider copper a critical mineral, adding to a list of 50 other minerals the government has identified as important.

It is reported that the list of critical minerals in the US is updated every three years, and includes key battery metals needed for electric vehicle production, such as nickel, lithium and zinc. Despite lobbying, the 2022 list update did not include copper, although it did add nickel and zinc. Senators had called on the White House to skip the usual three-year review and add copper to the list as soon as possible.

According to a study by Chile's Codelco, the world's largest copper miner, the global energy transition to stop climate change will increase demand for copper from the current 25 million mt per year to more than 31 million mt in 2032.

This means that in the next 8 years, the world will need to build 8 projects equivalent to BHP's Escondida copper mine in Chile, which is the world's largest copper mine.

In terms of inputs, experts estimate that the industry needs more than $100 billion to build mines to make up for a supply shortfall projected to be 4.7 million mt a year by 2030.

More popular news:

'Bond King' Jeffrey Gundlach Says Sharp Fed Rate Cuts By Year-End Will Push Up Gold Prices

Copper Shortage Is Irreparable Even after Biggest Mergers and Acquisitions, Here’s Why

Goldman Sachs Lowers Price Forecast for Aluminium, Copper in 2023, Sees Nickel Price Plunging

Zinc Prices to Plunge by 2025, Here's Why

G7 to Expand Sanctions Covering Metals on Russia, Promises Further Support for Ukraine

IMF: US Debt Defaults Will Take a Heavy Toll on Global Economy, Global GDP Growth Can Plunge

BofA Sharply Lowers Forecast for Oil Price, Global Oil Consumption in 2023

Takeaways of Warren Buffett and Berkshire Hathaway’s 2023 Annual Meeting

US Treasury Bill Rates Soar to Record High on Debt Ceiling Jitters

No Other Country can Replace China's Manufacturing Industry Including India

A Bull Gold Market Has Just Begun