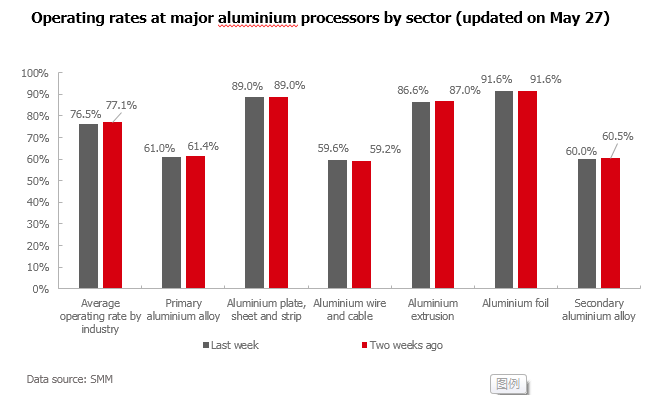

SHANGHAI, May 31 (SMM) — Operating rates of major aluminium processors dropped 0.6 percentage point last week, mainly due to decline in operating rates of primary and secondary aluminium alloy enterprises. Some construction extrusion companies were affected by electricity curtailment, but the short-term demand outlook for construction and photovoltaic industrial extrusion remains positive. Car chip shortages and high raw material prices weighed on operating rates of primary and secondary aluminium alloys, which are unlikely to rebound significantly in the short term.

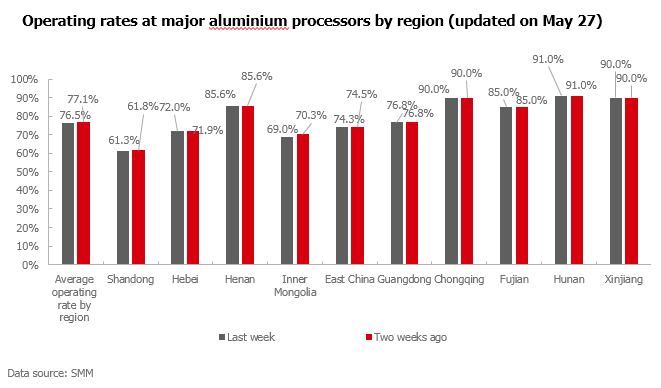

Aluminium wire and cable segment saw higher operating rates, driven by delivery to the State Grid. Domestic aluminium wire and cable consumption will increase further, based on the current tender volumes from State Grid and short-term demand from power grid construction. Productivity of leading enterprises in Guangdong and Hunan increased thanks to the transfer of orders from small and medium-sized enterprises, who were affected by power curtailment. Operating rate in Inner Mongolia declined slightly. May remains as the peak season for downstream aluminium sectors, except for the alloy sector. Aluminium prices fluctuated around 18,350 yuan/mt, easing cost pressure for processors. Orders from end-users have increased. Market focus will be the impact of industrial power curtailment and high temperature on aluminium processors.

Primary aluminium alloy: Operating rates at major primary aluminium alloy enterprises fell 0.4 percentage point from the previous week to 61%. Lower aluminium prices have not yet had a significant impact on the primary aluminium alloy market, and the wait-and-see sentiment lingers. Power curtailment in Yunnan has forced local enterprises to reduce aluminium output, but this has not affected production of primary aluminium alloy. Operating rates are unlikely to improve significantly this week. However, if aluminium prices continue to fall, downstream purchasing sentiment and operating rate may increase.

Aluminium plate and strip: Major aluminium plate and strip enterprises maintained high operating rates. Most producers hold 1-2 months of backlog orders, while some have controlled orders within a month to avoid the risk of aluminium price fluctuations. Lower aluminium prices drove downstream customers to postpone pick-up of goods or cancel orders, pushing up inventory of finished products at aluminium plate and strip enterprises. Orders for can stock will outperform orders for other aluminium plate and strip in the next few months. The peak season is approaching for aluminium plate and strip for construction use. Operating rates are expected to remain stable this week.

Aluminium wire and cable: Operating rate remained stable. Aluminium prices fell to around 18,300 yuan/mt, easing cost pressure of wire and cable enterprises. Large producers have tighter production schedules, and some plan to increase production next month. Low inventory of finished products and delivery to the State Grid supported operating rate. Some small and medium-sized producers in Guangdong were affected by power shortages. There is no power curtailment in East China.

Aluminium extrusion: Operating rates at major aluminium extrusion producers dropped slightly. Orders at large producers remained strong. Production at large producers is expected to remain high in June on the back of strong demand from real estate and infrastructure sectors. Projects involving infrastructure and improvement of people’s livelihood will also generate some new orders. In terms of industrial extrusion, demand from automobile and home appliance sectors was strong in May, and orders from photovoltaic and communication base stations were also strong. Raw material purchase declined as orders at some small and medium-sized enterprises decreased significantly and as some producers in Guangdong took a 3-day break every week due to power curtailment. Downstream customers took delivery of cargoes at a much slower pace due to unstable aluminium prices, causing inventory of finished products to grow at some enterprises.

Aluminium foil: Operating rates at major aluminium foil producers remained at 91.6%. Downstream customers were less willing to pick up goods as falling aluminium prices turned them bearish. Aluminium foil producers remained cautious in the procurement of raw materials, and had difficulty in controlling inventory of finished products due to lower willingness of downstream customers to pick up goods. As the peak season for air-conditioning foil is ending, some aluminium foil companies that focus on air-conditioning foil plan to undertake maintenance on some equipment in June. Food foil is expected to become a new bright spot. Large aluminium foil producers are expected to maintain high operating rates this week.

Secondary aluminium: Operating rates at secondary aluminium companies fell 0.5 percentage point. Secondary aluminium prices stabilised following a sharp drop in the previous week. As prices of ADC12 secondary aluminium remained high at 19,000 yuan/mt, die-casting plants suffered losses and were cautious in purchasing. Orders for secondary aluminium declined as persistent car chip shortages affected car production. Some secondary aluminium plants may slightly reduce production due to insufficient raw materials, even as aluminium scrap supply has increased. Operating rates are likely to stabilise or fall slightly this week.