This is a roundup of China's base metals output in September 2020, from an exclusive survey of key producers by SMM analysts.

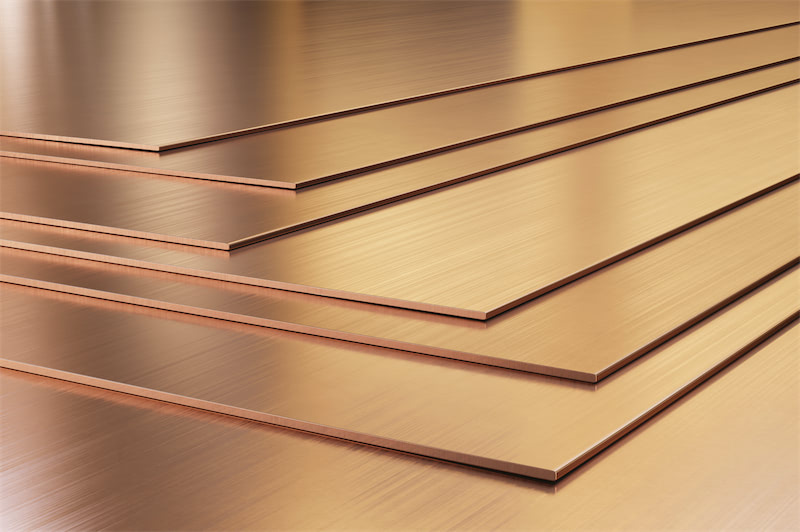

Copper

China’s copper cathode output was largely unchanged month on month in September, staying at high levels, as some large-scale smelters stepped up production in order to fulfill annual output targets and imports of copper concentrate rebounded significantly. However, output at smelters that use copper scrap as raw materials slid on the month as the price spread between copper cathode and copper scrap narrowed as domestic copper scrap supply tightened.

SMM survey showed that China produced 809,800 mt of copper cathode in September, edging down 0.09% from August, but rising 6.65% from a year ago. For the first nine months of 2020, China’s copper cathode output totalled 6.8 million mt, up 3.76% from the same period last year.

SMM expects China’s copper cathode output to rise 1.28% on the month and 4.75% on the year to 820,200 mt in October, and output for January-to-October is likely to increase 3.87% on the year to 7.62 million mt, as some smelters recover from maintenance and new capacities come online.

Alumina

China’s alumina output stood at 5.91 million mt in September. This included 5.7 million mt of metallurgical-grade alumina, with the daily output up 2.29% on the month and 5.56% on the year to 189,900 mt. Output of metallurgical-grade alumina over the first nine months of the year totalled 49.79 million mt, 4.22% lower on a year-on-year basis. The release of new capacities in southwest China and stable operating rates at northern plants accounted for the slight increase in China’s daily average alumina output.

As of early October, the operating capacity of metallurgical-grade alumina stood at 68.65 million mt/year. SMM sees output of metallurgical-grade alumina at 5.94 million mt in October (31 days), with the daily output rising to 191,500 mt.

Aluminium

China’s primary aluminium output rose 7.68% year on year to 3.11 million mt in September (30 production days), showed an SMM survey. As of the end of September, there was 38.16 million mt among 43.28 million mt per year of existing primary aluminium capacity in operation, while operating rates across Chinese primary aluminium producers stood at 88.2%. With new capacities in Yunnan and Inner Mongolia coming online, the daily average primary aluminium output rose 900 mt from August to 103,800 mt in September.

During the first nine months of 2020, China’s primary aluminium increased 3.68% year on year to 27.43 million mt, while consumption rose 4.81% to 28.15 million mt. Social inventories of primary aluminium shrank 165,000 mt amid strengthened demand.

SMM expects China’s primary aluminium output to stand at 3.24 million mt in October, up 8.18% year on year, as output at Yunnan and Inner Mongolia smelters is likely to continue to rise.

Nickel

China’s refined nickel output declined 13.81% or about 2,000 mt from August and 7.26% from a year earlier, to 12,300 mt in September. Output at Gansu and Liaoning smelters shrank 12% and 40% on the month respectively, as they overhauled production lines, while output at Xinjiang smelters fell 23.79% as they adjusted production schedule in the middle of the month. Smelters in Shandong kept low operating rates, with output flat on the month, while smelters in Tianjin and Guangxi remained suspended and no resumption plan has been heard by far.

SMM expects China’s refined nickel output to fall to the lowest level in this year at 10,200 mt in October, as output at a Gansu smelter is likely to shrink by about 18% due to equipment breakdown. Smelters in Xinjiang plan to resume production to normal levels in October, Shandong smelters keep stable production, while smelters in Guangxi, Tianjin and Jilin continue to halt production.

Nickel pig iron (NPI)

China’s NPI output rose 2.91% from August to 46,000 mt Ni in September, but was 12.74% lower than a year earlier. This included 38,600 mt Ni of high-grade NPI, up 3.67% on the month, and 7,400 mt Ni of low-grade NPI, up 0.83% month on month. High prices of high-grade NPI prompted some plants to ramp up production. This, coupled with new capacities coming online, accounted for the increase in high-grade NPI output in September, in spite of a tight nickel ore supply. Output of low-grade NPI was largely unchanged from a month ago as some #200 stainless steel makers slightly raised output.

SMM expects China’s NPI output to fall 2% on the month, and 13.9% on the year, to 45,100 mt Ni in October. Output of high-grade NPI is likely to shrink 3.04% to 37,400 mt Ni as its high prices drive steelmakers to increase use of other raw materials, and as some NPI plants will halt production as they are running out of nickel ore. Output of low-grade NPI is expected to rise 3.39% to 7,700 mt Ni in October due to longer operating days.

Nickel sulphate

China’s nickel sulphate output rose 4.26% on the month and 28.46% on the year, to 63,100 mt or 13,900 mt in nickel content in September. This included 54,900 mt of battery-grade materials and 8,200 mt of electroplating materials. Improved demand for nickel sulphate prompted nickel salts plants to operate at full capacity, but implementation of the new solid waste law affected imports of nickel suphate raw materials.

SMM expects China’s nickel sulphate output to rise 6.96% on the month to 14,800 mt (Ni content) in October as demand is likely to remain strong in October and nickel salts plants have restocked ample raw materials.

Zinc

China's refined zinc output stood at 549,500 mt in September, rising 40,500 or up 7.95% on month and up 6.57% on year. Zinc smelters produced 81,000 mt of zinc alloy in September, up 4% from the previous month.

SMM survey showed that China's refined zinc output in September basically met expectations as some smelters in Henan, Inner Mongolia, Guangdong and other regions resumed production after the maintenance. In addition, some refineries in Shaanxi and Sichuan continued to increase production. The reduction of refined zinc was mainly concentrated in smelters in Gansu which were undergoing maintenance.

Although TCs for zinc concentrate in some areas fell on a month-on-month basis, there are no refineries planned to carry out maintenance in China according to the scheduled production of various smelters in October. From inventories of zinc concentrate raw materials in smelters, the overall inventory days of zinc concentrate raw materials in smelters still maintained at 26 days, down one day from the previous month.

SMM expects refined zinc output to increase 14,900 mt to 564,400 mt in October. In addition, Xinjiang Zijin Smelter plans to start production in mid-November.

Lead

SMM data showed that China produced 268,000 mt of primary lead in September, down 5.87% from August, and up 7.33% from a year ago. For January-September, output increased 4.77% from the same period last year.

SMM survey showed that most primary lead smelters maintained stable production, while smelters including Western Mining, Haicheng Chengxin and Zhongjin Lingnan undertook maintenance in September. The maintenance time ranges from 20 days to 2 months, leading to the decline of output on the month.

In addition, the prices of precious metals (gold and silver) continued to weaken in September, which reduced the production enthusiasm of smelting enterprises that partially relied on by-products (silver) for profit. Therefore, the actual decline of primary lead output in September was larger than expectations in the previous report.

Compared with the same period of last year, the release of smelting enterprises' production capacity has been limited in September 2019, as Beijing, Tianjin, Hebei and its surrounding areas were restricted in production due to the military parade on the seventieth anniversary of the National Day, and heavy polluted weather occurred in Henan. There was no environmental impact in September this year.

Except Haicheng Chengxin continued maintenance in October, some small and medium-scale smelters in Henan and Yunnan have carried out equipment maintenance. At the same time, Western Mining and Zhongjin Lingnan finished maintenance, and the primary lead output generally remained unchanged.

SMM expects China's primary lead output to reach 266,000 mt in October.

Tin

China's refined tin output rose on a month-on-month basis in September as a large-scale smelter in Yunnan increased production after maintenance in September.

SMM data showed that China produced 14,342 mt of refined tin in September, up 0.93% from August. Some tin plants in Yunnan and Jiangxi have carried out equipment maintenance, reducing some production. Mining operations and transportation were affected in Myanmar as the country experienced continued rainfall and pandemic over the recent months. Domestic tin supply was still tight and lower treatment charges (TCs) for tin ore have narrowed profits of smelters.

The tight supply of tin ore is unlikely to recover in October, while some enterprises will resume production from maintenance.

China's refined tin output is expected to come in at 14,500 mt in October.