SMM: the 2020 Global New Energy vehicle supply chain Innovation Conference, co-sponsored by the Nanjing Municipal people's Government and the China Electric vehicle Association, officially opened on Sept. 16. With the theme of "how to strengthen the three Automobile chains and achieve a Real Automobile Power", the current Congress focuses on how the automobile industry will pay attention to the reform of the industrial chain and how to prepare for the new era with the theme of "how to strengthen the automobile three chains and achieve a real automotive power", as well as experts, scholars and representatives of relevant government departments inside and outside the United Nations, as well as experts and scholars in the automobile industry and representatives of relevant government departments.

During the meeting, Wu Haiping, director of chip research and development of BYD Semiconductor Co., Ltd. Power Semiconductor products Center, accepted an exclusive interview with the media.

The following is a transcript of the exclusive interview: (without changing the original intention of the guests, the first Electric has made a deletion of proofreading.)

Media: compared with traditional semiconductor manufacturers, BYD, Tesla and some other car companies are developing chips independently. Do you think there are any advantages for car companies to develop semiconductors independently?

Wu Haiping: BYD started to make semiconductors before entering the automobile industry. we began to develop power chips in the mobile phone field in 2002, and we thought from the very beginning that this industry is very core to consumer categories, including automobiles. Therefore, BYD does not make semiconductors only after making cars, but it has accumulated for a long time before that. This is where we are different from some traditional car factories that have just started to make semiconductors.

The biggest advantage of automobile manufacturers starting to do semiconductors is that they can clearly know their own needs and make products that can better meet the needs. In the past, the use of semiconductors in traditional fuel vehicles was low, but now with the electrification and intelligence of cars, semiconductor chips account for an increasing proportion in automobiles. It turns out that many semiconductor companies are secondary suppliers in the automotive industry, and they need to be associated with the mainframe factory through the Tier 1 first-level assembly, separated by a layer in the middle. Now the mainframe factory directly into the semiconductor industry, can become more closely related, more in line with their own needs to do, there are advantages in this aspect.

Media: this year, the national level proposed to give priority to the internal cycle, the international and domestic market double cycle, in this context, how much do you think this will help the localization and replacement of IGBT modules? Now in addition to automatic, what other new customers have been expanded?

Wu Haiping: with regard to the market for IGBT and power device applications, China accounts for about half of the global market share, but the local supply is only about 10%. Since the beginning of these two years, with the support of the state and the development of the industry, a lot of work has been done and some achievements have been made in localization. No matter from the perspective of supply chain or from the perspective of customers, everyone has begun to have a certain degree of acceptance of localized IGBT power devices. BYD began to make automotive power devices in 2005, reaching more than 90% of internal power devices, which has made a good start in China. However, in addition to our own use, we also need to further open up foreign markets, further improve product quality and further expand the field of application.

At present, some foreign manufacturers and mainframe manufacturers, including Tier 1, actually hold a very open attitude towards Chinese-made devices and are making some contact with us. For example, some manufacturers in Europe and Japan now have deep cooperation with us. Some car companies in Japan and Europe are also setting up joint ventures with Chinese car companies. In the past, this kind of joint venture was mainly for them to produce technology, but now the new change is that Chinese companies are gradually beginning to provide some technology in joint ventures, including power semiconductor IGBT.

Media: will BYD set up joint ventures with other manufacturers in the IGBT industry in the next 1-2 years? Apart from the power chip, do you make any other chips? Such as a power chip?

Wu Haiping: question 1, the joint venture just mentioned is mainly the final main engine factory of the car, but the semiconductor company is not very clear at present. Because the Chinese market accounts for a large share of the global market, many international companies, including big car manufacturers, also hope to give more openness and support to Chinese local enterprises if they want to make greater achievements in the Chinese market.

Question 2, when BYD was first founded, it was around the periphery of consumer mobile phones, including power, image sensing, and touch, and then gradually formed a power semiconductor as the core in the automotive industry, and on this basis further developed intelligent control chips, including MCU, power drive and other chips, hoping to do some work in vehicle control. With the two cores of power semiconductor and intelligent control chip as the basic point, we have developed several categories around automotive applications, including sensor chips, various sensors needed for automobile intelligence at present, such as optical and electrical related current sensors, image sensors, pressure sensors and LED products.

Media: BYD Semiconductor completed the rapid financing before, as part of BYD listing, what is the reason why BYD Semiconductor can get financing quickly? Is there a clear timetable for listing now?

Wu Haiping: with regard to the realization of rapid financing, I personally think it has something to do with several points:

First, we already have some core technologies in automotive semiconductors, and the core technologies have been widely used. Since our own IGBT began loading in large quantities, up to now we have loaded more than 600000 vehicles, and the longest bicycle mileage has reached 1 million kilometers, and the driving areas include China, Europe and many parts of the world, so we have indeed mastered such a core technology, and it has been applied in large quantities.

Second, we are optimistic about the new energy vehicle industry, that this is a direction of vigorous development.

Third, the investment community now attaches great importance to the semiconductor industry.

With regard to the progress of our listing, the company has a special channel to release relevant news to the outside world.

Media: you just mentioned that China accounts for half of the demand for IGBT applications, while China's local supply accounts for only 10%. What is the cause? A lot of IGBT is supplied from outside. BYD has done a better job. Who are the domestic competitors? What is BYD semiconductor material? What do you think of silicon carbide technology?

Wu Haiping: with regard to the market and supply share, it is not only power semiconductors, but also the whole integrated circuit is almost a similar situation. Basically, China accounts for nearly half of the global market, but its own supply is very small, which has something to do with the development of the industry as a whole. In terms of power devices, there are many sub-areas of this problem, but now because of the development of new energy vehicles, so the demand for power devices IGBT has been magnified, we can see very clearly.

For silicon carbide, we have been optimistic about the third generation semiconductor devices. Preliminary understanding, our company is the first company in China to use a large number of silicon carbide on cars. We first began to use silicon carbide devices on car chargers. This year, the silicon carbide module with full silicon carbide has been applied in the electric drive system on the newly listed Han EV model. The Han model has a very strong ability to accelerate for 3.9s at 100km, torque up to more than 600Nm and maximum power over 300kW. These amazing data are closely related to the use of silicon carbide devices. So we are very optimistic about silicon carbide materials.

Media: are the suppliers of silicon carbide materials domestic or foreign?

Wu Haiping: both. Around the world, including at home, many companies have begun to lay out in this industrial chain. It is believed that with the joint efforts and cooperation of upstream and downstream enterprises, this industry will soon have a relatively obvious development.

Media: first, because of the epidemic in the first half of this year, it may have blocked some foreign supplies, and second, friction in Sino-US relations will also have an impact. Have you received any intention from other mainframe manufacturers to cooperate with us in semiconductors in the first half of this year? What is the production capacity now? What is the scale of outsourced supply?

Wu Haiping: not only in the first half of this year, since we began to introduce automotive power semiconductor devices to the outside world, there has always been an intention to cooperate with us in the same industry at home and abroad, and some of them have entered a relatively deep stage. In terms of production capacity, BYD Semiconductor currently has two wafer plants in Ningbo and Changsha and two power module production lines in Shenzhen, at least so far.

Media: BYD Semiconductor has announced that it will be listed before. Are there any new plans in terms of products for this goal?

Wu Haiping: BYD Semiconductor decided to go public in the hope of better serving the entire industry in this way. Turn the original situation of only providing internal services to the enterprise into providing better services and cooperation for the upstream and downstream of the entire industrial chain. In terms of production capacity, we already have a lot of plans and arrangements, which are being gradually implemented. I believe it will not be long before you will see some reports or data. It's not a good time to talk right now.

Media: what are the advantages of BYD over Starr?

Wu Haiping: Starr is the first listed company in China to do IGBT. The start time for us to do IGBT is basically the same. The difference is that when we do it, it is aimed directly at cars, and they are more focused on industry at that time. By now, everyone's business may begin to have some crossover, but the difference is that we are the IDM, of the whole industry chain. At present, they will be more in terms of the overall shipment quantity, because the industrial modules are smaller, but the quantity is a little more. From the perspective of the whole industrial chain, we cover from chip design to wafer manufacturing, to the combination of modules and applications, and the layout of the whole industrial chain is relatively perfect and close.

Media: does 1GBT external supply discuss cooperation with first-tier suppliers or vehicle manufacturers? There are 600000 cars using the IGBT, self-provided by BYD, mainly used in our cars, or are some of them already supplied?

Wu Haiping: now the IGBT device is the core in the car, not only is it a first-class supplier, but also the mainframe factory is deeply involved in its research and development and use. The actual situation now is that basically the mainframe factory will communicate this matter directly with the semiconductor company. The 600000 cars we are talking about include both internal and external commercial vehicles and passenger vehicles.

Media: with regard to the issue of silicon carbide, there are some problems with the delivery of silicon carbide at the end of August, which is related to the supply of silicon carbide. Can the production capacity of silicon carbide keep up now? what is the capacity planning for the future supply and what is the current capacity?

Wu Haiping: now silicon carbide production capacity is in the process of climbing, there is basically no big problem this month, before because the demand is rising very fast, we did not expect the market to be so hot. In fact, at that time, the production capacity of silicon carbide also reached our initial goal, but the target was further raised later, so there was some gap with the new target, but it should be able to be met soon.

Media: full production?

Wu Haiping: the production capacity of our design is greater than the demand, so it can only be said to meet the demand, not full production, because the design capacity is very large. On the demand side, it is estimated that there will be a very rapid growth next year, of course, our production capacity has always matched the demand to increase rapidly. This is also one of our advantages, we can quickly increase production capacity according to demand. Data on the specific situation for next year are not yet available.

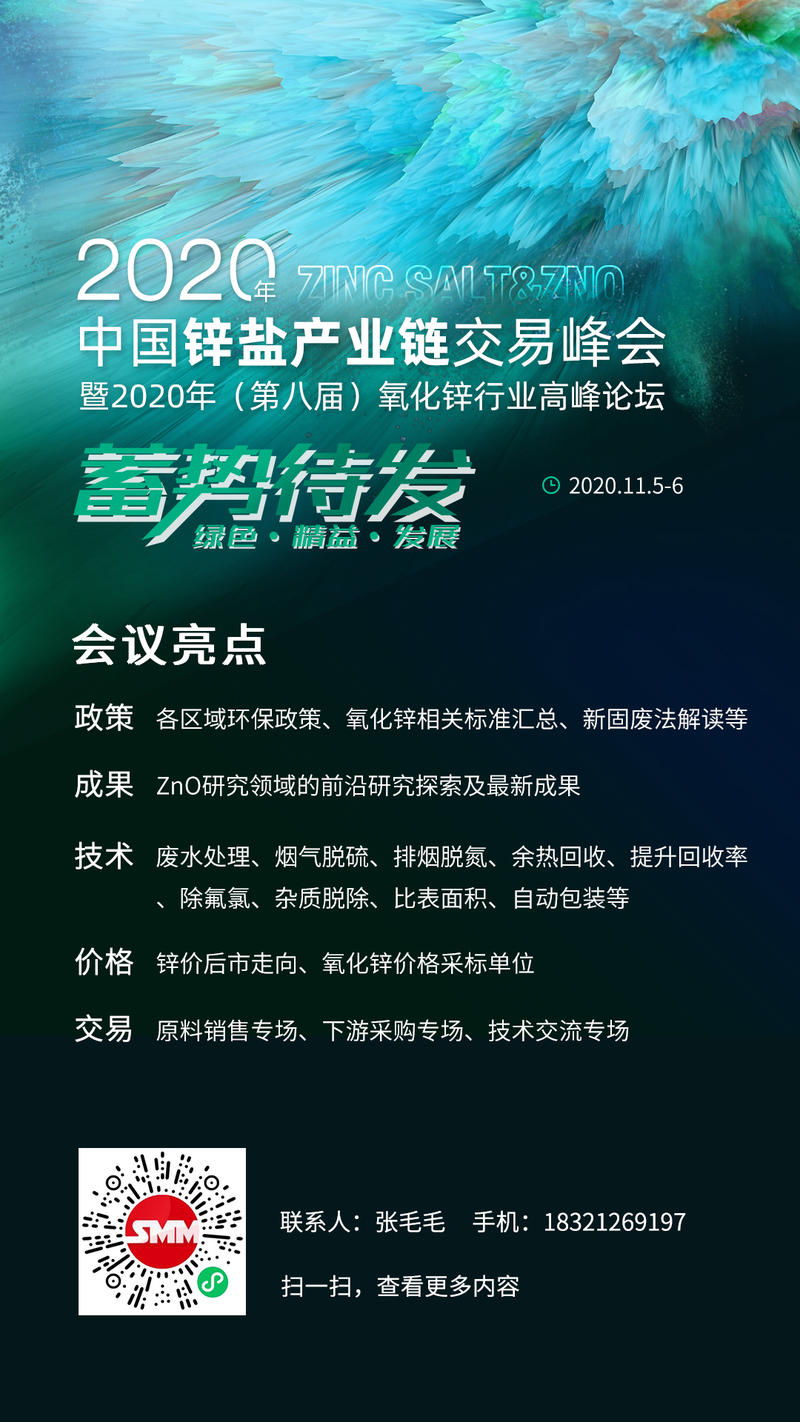

2020 China Zinc Salt Industry chain Trading Summit

The eighth Zinc oxide Industry Summit Forum

Scan the code to participate in the meeting or apply to join the SMM zinc oxide industry exchange group

![[SMM New Energy] Gotion High-Tech Secures Upstream Supply with Three Lithium Mines in Yichun](https://imgqn.smm.cn/usercenter/BQoXd20251217171731.jpg)

![[SMM New Energy] Shanshan Shares Restructuring Plan Submitted: Control May Shift to Anhui SASAC](https://imgqn.smm.cn/usercenter/KnMyT20251217171727.jpg)

![[SMM New Energy] Shunbo Alloy Anhui Phase II Focuses on Battery Foil to Meet ESS and EV Demand](https://imgqn.smm.cn/usercenter/GVVKq20251217171728.jpg)