SHANGHAI, Feb 26 (SMM) – SMM has undertaken surveys covering the impact of the current coronavirus (COVID-19) outbreak in China on the physical metals markets. Please see below for more details on the latest survey update on the steel and iron ore sectors.

We will keep you posted on the latest updates via our website www.metal.com and our social media channels- Linkedin and Twitter.

Please register for our webinars in March as we continue to connect you with the latest happening in the China ferrous and nonferrous metals market.

The next session is happening on Wednesday March 4, 5 pm CST, where we present to you a macro update of the resumption of metals industry as China recovers gradually from COVID-19 , with a deep-dive in the copper and zinc domestic markets.

Book your slots here: https://register.gotowebinar.com/register/1611773400789324555

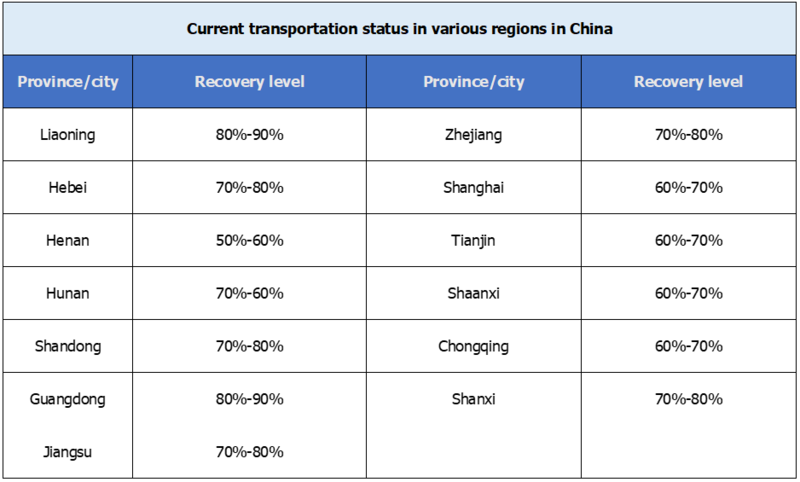

Transportation: Gradual recovery amid resumption

The latest SMM survey showed that transportation in China has recovered to 60-90% of normal levels, except for Hubei province, the epicentre of the COVID-19 outbreak. However, the actual transport efficiency was less than 50% of normal levels in Jiangsu and Henan due to the delayed return of workers.

Table 1: Updated transportation status in China

Source: SMM, data correct as of Feb 24,2020

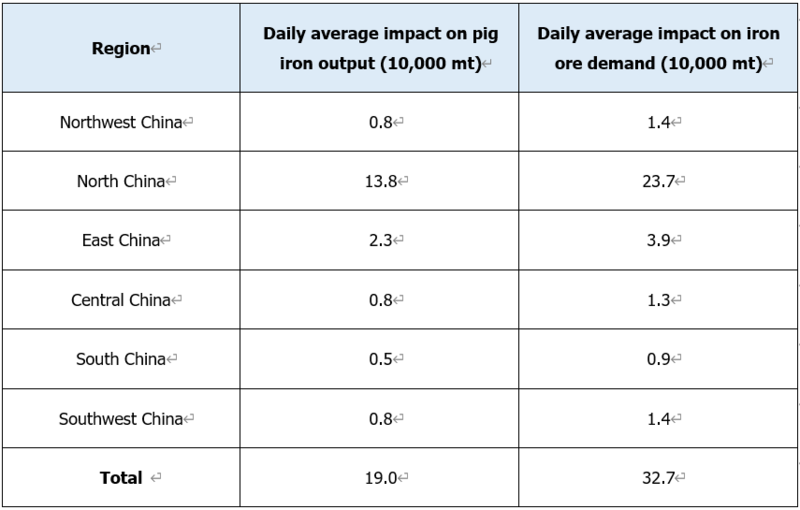

Iron Ore: Logistics issues curbed demand recovery

Maintenance at steel mills resulted in a loss of 192,000 mt of pig iron output per day on average as of February 24. This affected 330,000 mt of daily demand for iron ore. North China accounted for 72% of the demand loss, which was mainly driven by Hebei province where strict environmental restrictions prompted steel mills to undertake maintenance.

Table 2: Maintenance at steel mills and impact on iron ore demand

Source: SMM

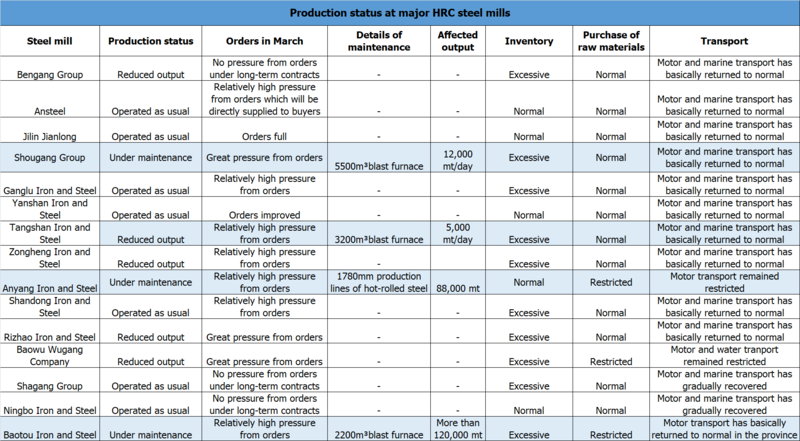

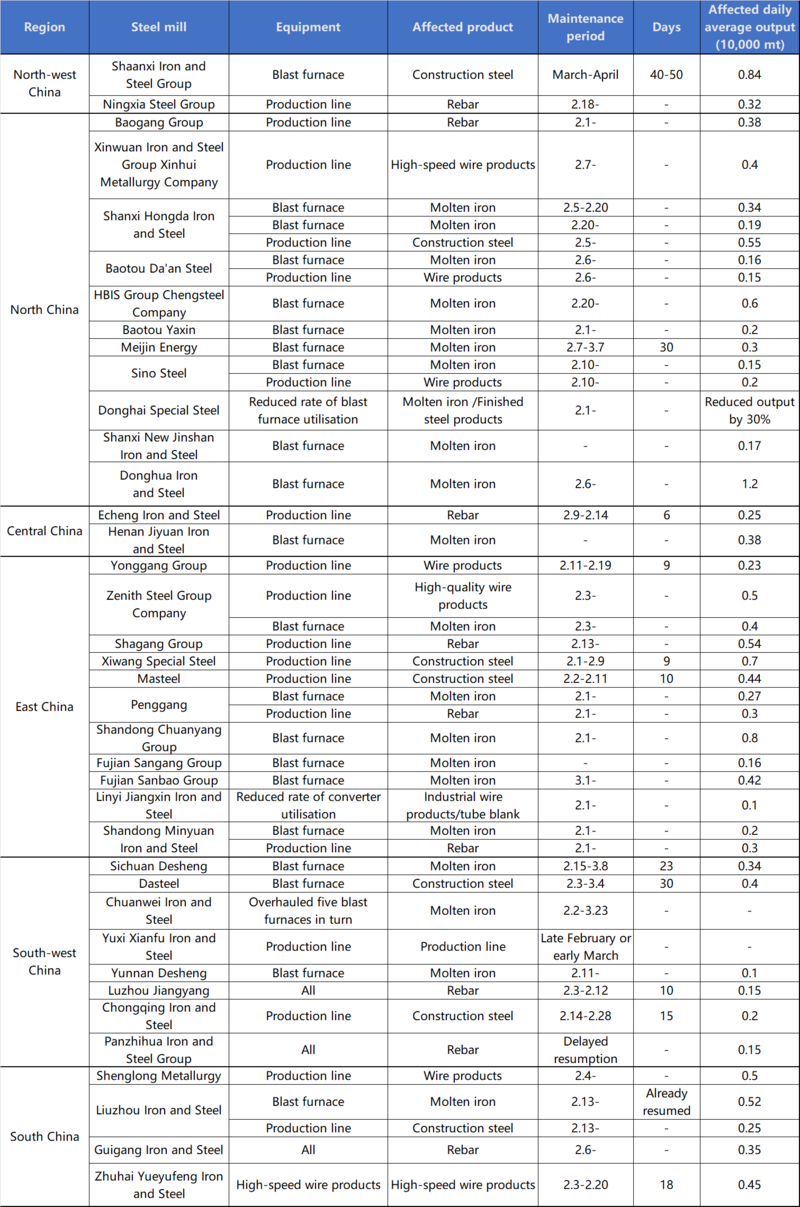

Steel: Output cuts to continue at integrated steel mills

According to the latest SMM survey that covers 102 integrated steel mills, 52.94% of them operated normally, and 47.06% conducted maintenance or reduced output (excluding mills that reduced output by adjusting rates of equipment utilisation and raw material ratios). End-user demand that has yet to recover completely, inventory pressure and environmental restrictions prompted more mills to undertake maintenance this week.

Maintenance had an impact on construction steel, while flat products were barely affected. 91.7% of steel mills under maintenance overhauled rolling lines of construction steel, and only 8.3% overhauled rolling lines of flat products. (Note: steel mills that overhauled rolling lines of both construction steel and flat products were calculated repeatedly).

Table 3: Production status at major HRC steel mills in China

Source: SMM

Table 4: Update of equipment and output at Chinese steel mills

Source: SMM

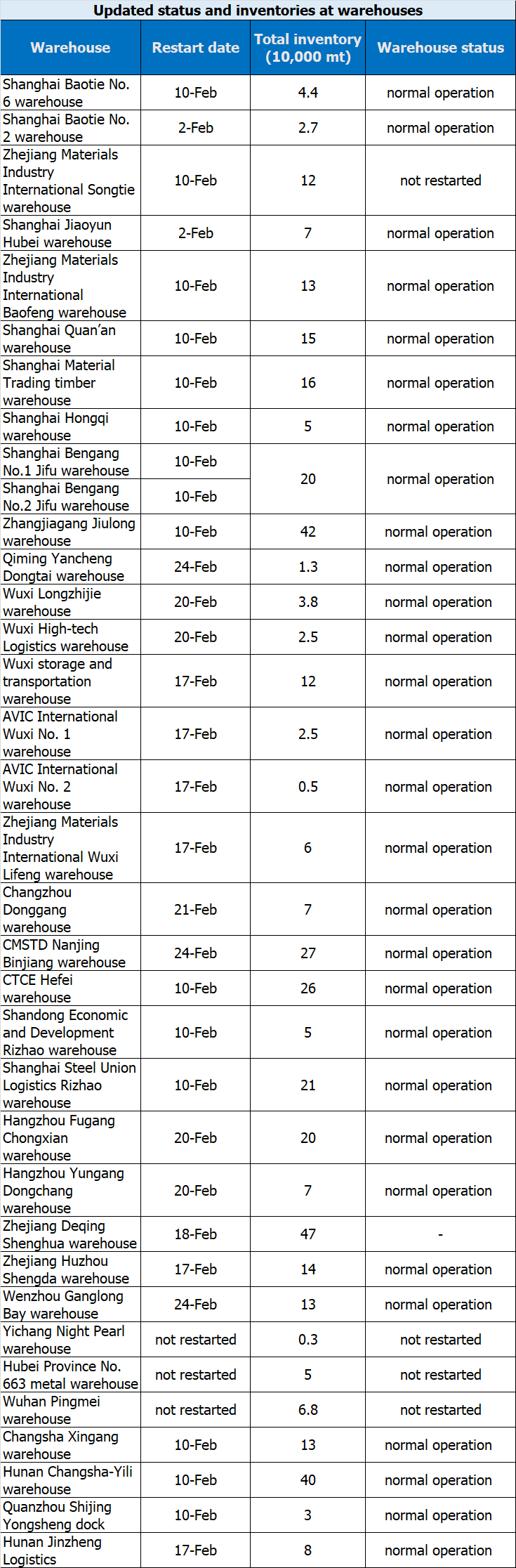

Warehouses: Recovery in progress except for central China

Unloading of cargoes at warehouses in south, east, north and north-east China has generally returned to normal. However, there was a slower recovery at warehouses in central China (epicentre of COVID-19) as it was badly hit by the epidemic. Inventories declined slightly thanks to recoveries in end-user demand. Cargoes at ports are expected to go to warehouses when the shipments arrive.

Table 5: Updated status and inventories at warehouses

End-users: Recovery in construction sector expected in mid-March

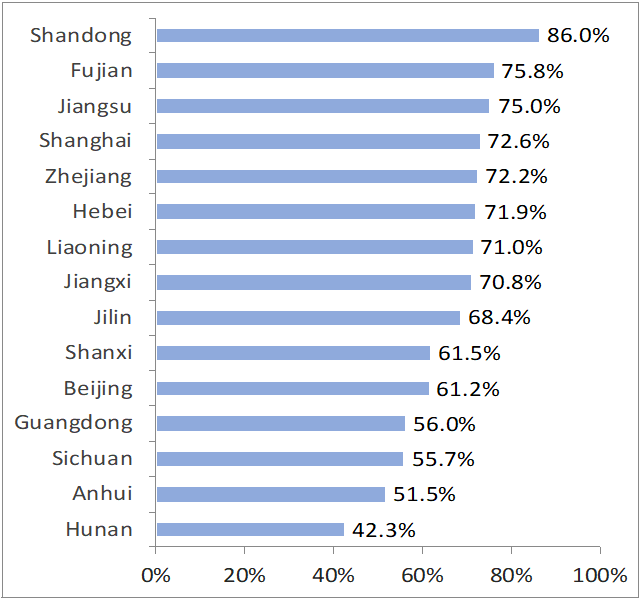

End-users in China are proceeding with production resumptions, except for Hubei which will delay resumptions to March 10. As of February 20, industrial enterprises with annual revenues from main business above 20 million yuan have resumed to 42.3%- 86% of their normal production levels, led by Shandong.

Manufacturing sector saw the highest recovery. The recovery rate in the automobile industry reached 75% as of February 18, according to the China Association of Automobile Manufacturers. In the construction sector which heavily rely on migrant workers, only several projects have restarted, while resumptions may only happen until mid-March.

Chart 1: Resumptions at industrial enterprises (with annual revenues from main business above 20 million yuan in different regions)

Source: SMM

Steel prices are expected to move sideways in the short term as improved fundamentals will provide support while heavy inventory pressure may cap gains. Steel prices rallied recently, lifted by surging futures prices and downstream restocking. On the one hand, market fundamentals improved amid output cuts at steel mills and recovery in end-user sectors, and market sentiment also improved following a series of positive news. On the other hand, steel inventories are high and demand recovery is slow.

Further Reading

1. China rebar inventories rose at slower pace on falling production (Feb 25, 2020)

2. Iron ore shipments from Australia recovered on improved weather (Feb 25, 2020)

3. Over 37% of major roads and waterways construction projects have resumed work (Feb 25, 2020)

4. SMM Hot News China Metal Special Report 6-Impact of the coronavirus (COVID-19) outbreak on China metals market (Feb 21, 2020)