SHANGHAI, Apr 9 (SMM) – This is a roundup of China’s base metals output in March. SMM surveyed major producers in the market to get first-hand information for calculation.

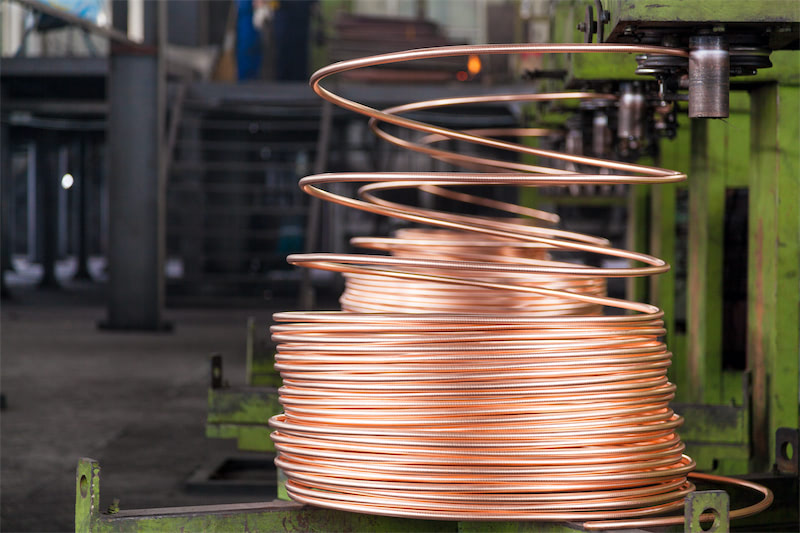

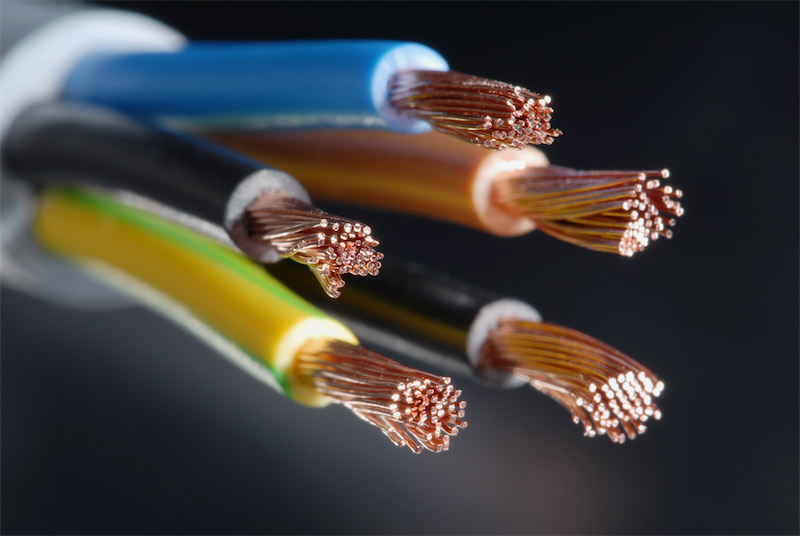

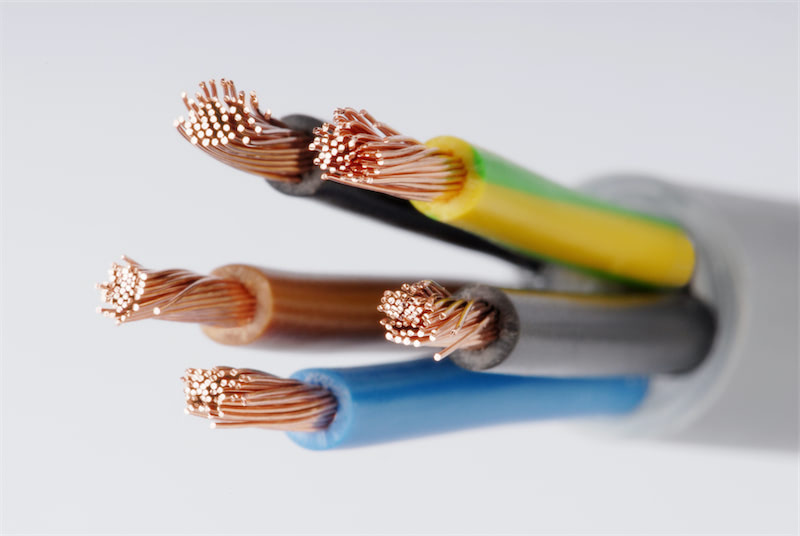

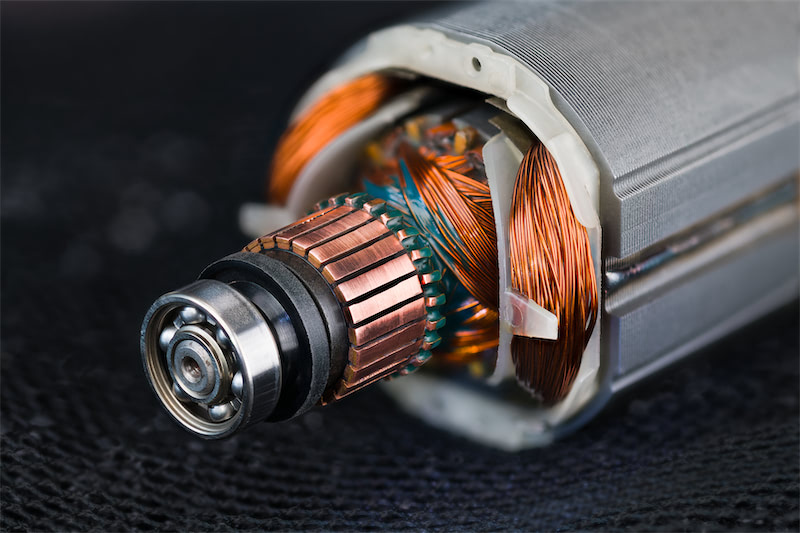

Copper: China’s refined copper output came in at 713,400 mt in March, up 1.3% month on month and up 11% year on year, SMM found. Output in the first three months of this year stood at 2.12 million mt, up 11% on the year.

March’s output fell some 10,000 mt short of the previous forecast as production was affected by the maintenance at the headquarters of Yunnan Copper and Jinchuan Group in Fangchenggang city. Operating rates at small and medium-sized secondary copper smelters including Ningbo Shimao, Baoding Jianchang, Ningbo Jintian, Shangdong Xianghui remained at lows given the higher costs of copper scrap and pressure from environmental concerns. The annual capacity at Jinchang smelter would rise to 200,000 mt of blister copper and 100,000 mt of refined copper after it is commissioned in May and June.

We estimate refined copper output in April to stand at 725,900 mt, up 1.8% month on month and up 12.4% year on year. Output in the first four months of this year is expected to come in at 2.84 million mt, up 11.4% on the year.

Alumina: China’s alumina output came in at 5.73 million mt in March, down 2.4% year on year, SMM research found. The daily output stood at 185,000 mt, up 1.9% month on month. Output in the first three months of this year stood at 16.52 million mt, down 0.7% on the year due to the winter production cuts.

As the heating season came to an end, alumina plants across the country have resumed their operations except for Henan Jinjiang, East Hope and Wanji. We saw a decline in operating capacity at Shanxi Jinzhong Chemical.

We estimate alumina output in April to stand at 5.74 million mt, with a daily output of 191,000 mt. The increase would mainly be attributed to the recovery of operations for the whole month. Besides, Henan East Hope is likely to resume its operation in April. The end of roaster renovation at Guizhong Huajin on April 15 would also bolster its alumina output.

Aluminium: China’s refined aluminium output stood at 3.03 million mt in March, down 2.7% year on year, SMM research found. Output in the first quarter of this year came in at 8.76 million mt, down 2.5% on the year.

The annualised operating capacity was down by 1 million mt to 35.64 million mt from March 2017. The slowdown in the commissioning of capacity is mainly due to the losses at plants on declining aluminium prices and winter production limitation. A total of 500,000 mt of annualised capacities at aluminium plants in Henan, Shanxi, Shandong have yet to recover.

Given the limited support from the newly commissioned capacities, we see operating capacity of refined aluminium remain at a low level in April. Output of refined aluminium is expected to be 2.97 million mt in April, down 2.4% year on year.

Primary lead: China’s primary lead output stood at 226,400 mt in March, up 8.3% month on month but down 5.7% year on year, SMM research found. March saw limited increase in primary lead output due to maintenance works at smelters including Yuguang, Wanyang, Nanfang, Jiangxi Copper, Hengbang, Zhicheng and Xinling that ranged from 20 to 45 days. Heavy pollution in Henan province also dampened the production at some smelters.

We see primary lead output climb up to 233,900 mt in April given that most smelters have resumed their normal operations as winter production control in the north eased. But Yuguang, Jiangxi Copper, Zhicheng, and Dongling are still undergoing maintenance.

Zinc: China produced 445,900 mt of refined zinc in March, down 2.9% month on month and up 3.8% year on year, SMM data showed. With major smelters such as Zhuzhou Smelter and Anhui Tongguan shutting down their production for maintenance, output in March went down for 13,200 mt.

In April, due to the same reason, the output is expected to be around 430,800 mt with a decline of more than 10,000 mt.

Nickel: Due to the increase of working days, March’s nickel production registered a month-on-month increase of 10.6% to 12,200 mt. Compared with the corresponding period last year, the production was up by 3.5% as a smelter in north-west China ramped up output due to better profits this year.

SMM forecast nickel production in April to be around the same level as March.

Nickel pig iron (NPI): At 38,100 mt, China’s NPI output in March was up 10.8% month on month and 17.3% year on year. The output in the first three months of 2018 reached 109,300 mt, registering a 10.2% year-on-year increase.

We expect production in April to be 39,900 mt due to higher operating rates as maintenance works come to an end.

Tin: China produced 13,129 mt of refined tin in March, 14.5% higher than in February as smelters resumed operations after the Chinese New Year. However, some of them may cut output in April due to the shortage of raw materials. We expect to see a 2.5% drop in tin output this month to 12,800 mt.

For editorial queries, please contact Daisy Tseng at daisy@smm.cn

For more information on how to access our research reports, please email service.en@smm.cn