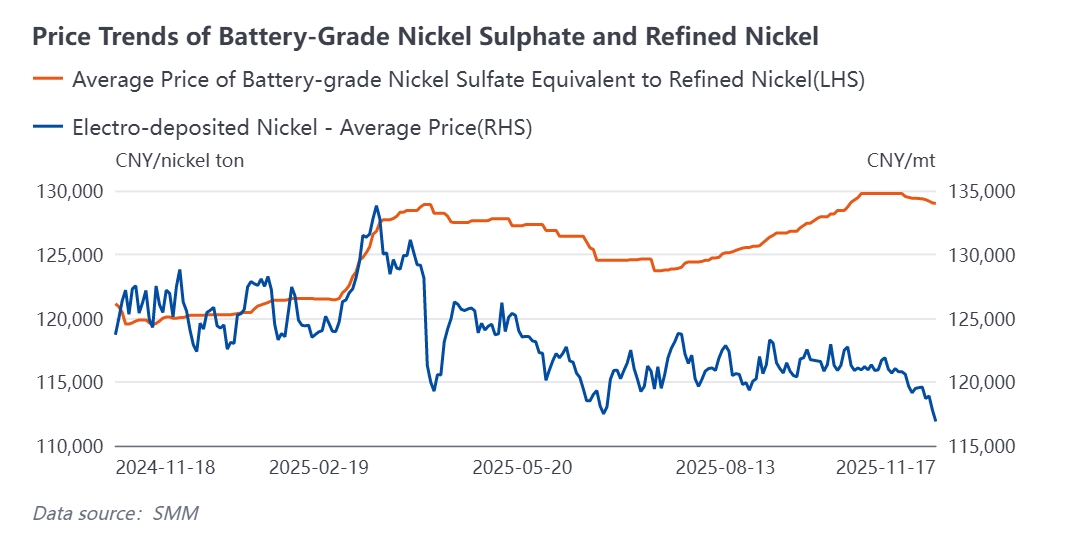

In the first half of November, the SMM battery-grade nickel sulphate price experienced some adjustments, with the average price declining from 28,450 yuan/mt at the beginning of the month to 28,280 yuan/mt on the 17th. During the same period, SMM refined nickel prices also trended lower, and related producers showed expectations for production cuts. This article analyzes the current supply-demand pattern of nickel sulphate and the price correlation between refined nickel and nickel sulphate.

Cost side: the supply and demand of nickel sulphate raw materials remained in a tight balance this month, with the raw material payables expected to stay at elevated levels overall. However, nickel prices generally weakened, leading to a MoM pullback in nickel salt production costs.

Demand side: the peak season for the ternary market lasted longer than expected this year. Stimulated by the phase-out of new energy subsidies, downstream orders this month were basically flat compared to October, supporting nickel salt procurement demand at high levels.

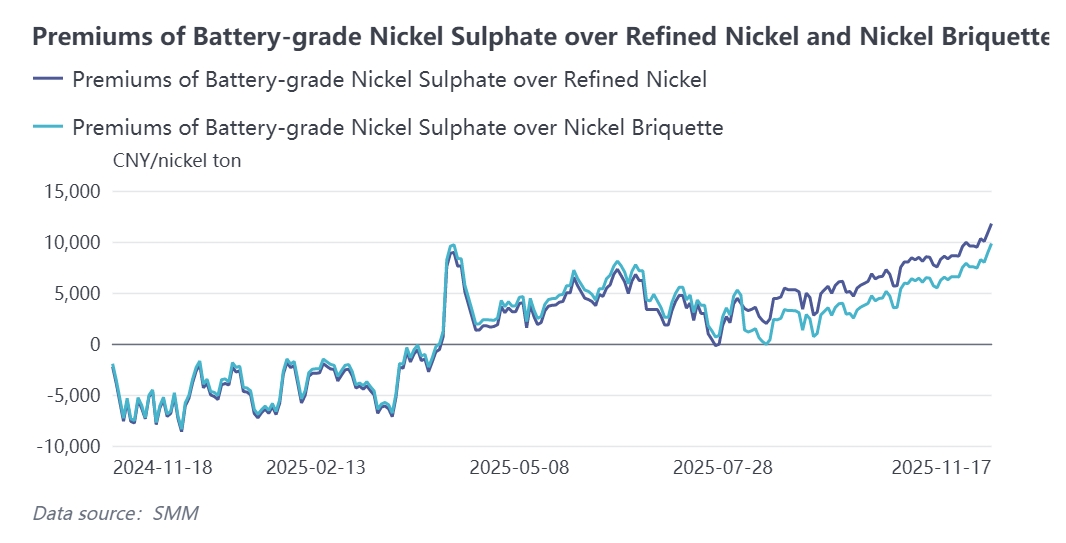

Supply side: while integrated enterprises ramped up nickel sulphate production, some nickel salt smelters also had plans to resume or ramp up production this month. It is expected that the volume of nickel sulphate available for external sales will rise, improving the supply-demand gap to some extent. Additionally, as the strength in nickel sulphate prices diverged from the weakness in nickel prices, the average premium of SMM nickel sulphate prices over SMM refined nickel prices approached 10,000 yuan in November. Based on a processing fee of 7,000 yuan, it has become theoretically economical for refined nickel producers to switch to nickel sulphate production. Some enterprises showed a tendency to cut refined nickel production this month. If a large volume of refined nickel is converted to nickel sulphate in the future, it may further drive expectations of a looser nickel sulphate market.

Overall, as demand showed no significant increase while cost and supply conditions eased relatively, nickel salt prices may face downward pressure in November.

Looking ahead to December: on the raw material side, intermediate product supply is expected to remain tight, and the payables may not ease. Demand side, demand from some leading producers is expected to remain high, but overall downstream demand is unlikely to grow further compared to November, with nickel salt procurement demand expected to decline slightly. Supply side, some producers may have expectations for production cuts by year-end, but attention should also be paid to whether the trend of refined nickel conversion to nickel sulphate can persist. Overall, nickel salt prices are expected to remain under pressure in December.