Nickel Ore

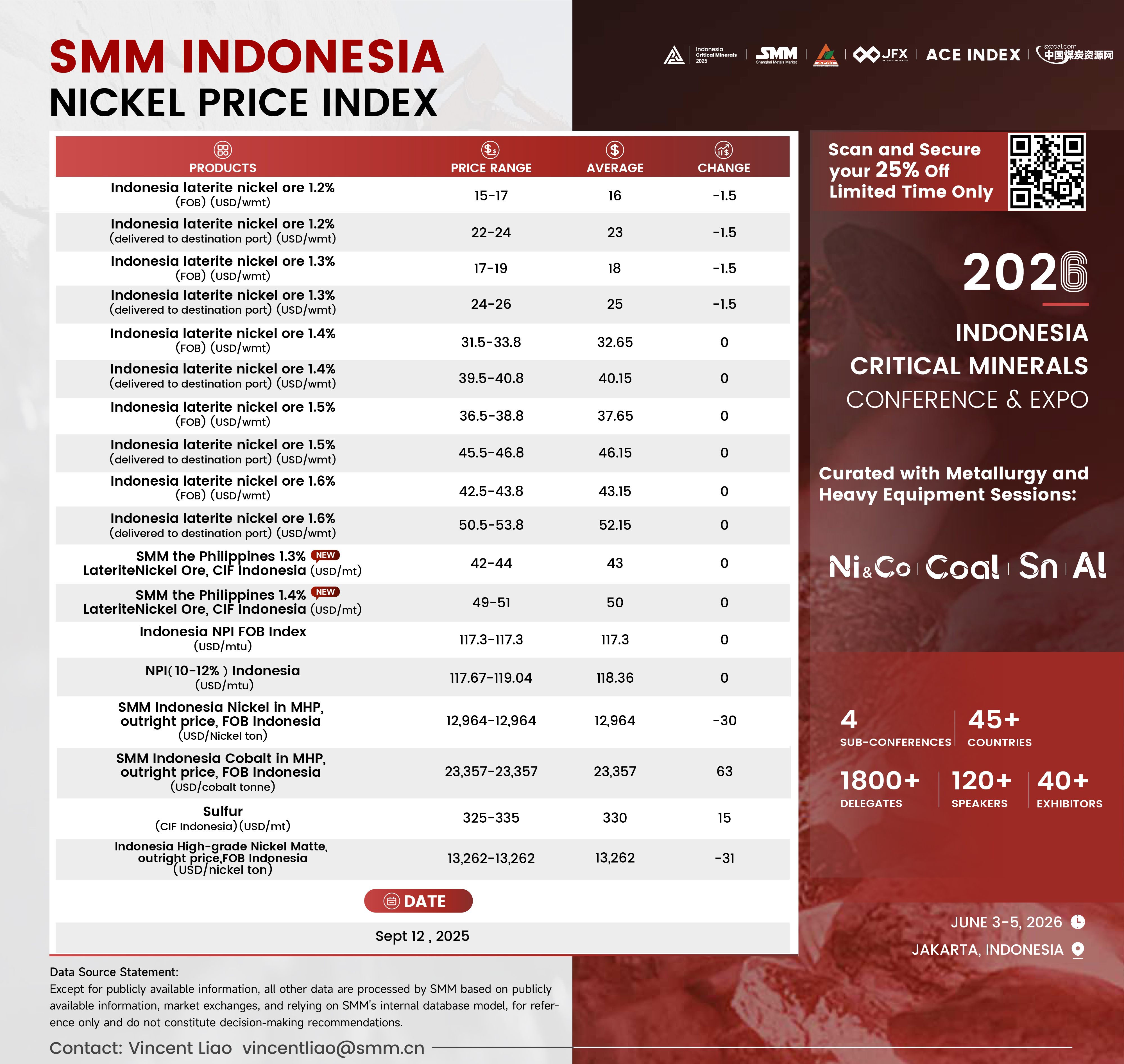

Indonesian nickel ore prices slightly declined this week. For the first period of September, domestic benchmark price of Indonesian nickel ore is USD 14,900/dry metric ton. For premiums, according to SMM data on Indonesian domestic laterite nickel ore, 1.4% grade averaged USD 22.2, 1.5% grade averaged USD25.2, and 1.6% grade averaged USD25.7. This week, SMM domestic laterite nickel ore 1.6% delivered to works price ranged from USD 50.5–53.8/wet ton, unchanged from last week. For lower-grade ores, the SMM domestic laterite nickel ore 1.3% delivered to works price remained stable at USD 24–26/wet ton, with a drop of 1.5 dollars from last week.

- Pyrometallurgical Ore:

In Sulawesi and Halmahera, weather conditions have slightly improved compared with previous weeks, with intermittent rainfall but less frequent than late August, supporting ore deliveries. On the regulatory side, the Indonesian government has initiated investigations into “illegal” mining companies that fail to comply with ESDM requirements, deploying a Forestry Task Force to review land use and permits. While the short-term impact may be limited, this signals stronger enforcement going forward. Meanwhile, approvals of revised RKABs for 2025 are nearly completed, though uncertainties remain for 2026 approvals, which could disrupt supply. Against this backdrop, nickel ore prices are expected to remain firm, especially for higher grades, as smelters continue procurement ahead of the Q4 rainy season and in anticipation of possible ore scarcity in 2026 due to delayed RKAB approvals.

- Hydrometallurgical Ore:

In September, limonite supply has remained relatively abundant, with smelters reporting signs of oversupply. This has been largely driven by the increase in RKAB allocations, resulting in a higher availability of limonite compared with saprolite in the Indonesian market. On the demand side, most smelters have already secured sufficient feedstock for their operations, leading to a moderation in procurement activity in recent weeks. Inter-island shipments have also declined, as smelters on each island generally hold adequate inventories to meet their requirements. Looking ahead, any potential decline in limonite prices is expected to be limited, given market expectations of possible delays in 2026 RKAB approvals and the likelihood of early procurement by HPAL smelters toward the end of this year.

Nickel Pig Iron

“Weak Purchasing Behavior at High Prices, Upward Pressure on NPI Prices Becomes Evident”

The average price of SMM 10–12% high-grade NPI rose by RMB 7.5/ni point to RMB 951.1/Ni unit (ex-works, including tax), while the Indonesia NPI FOB index increased by USD 1.18/Ni unit to USD 116.9/Ni unit. Tender prices from major downstream buyers also increased, pushing market prices higher. On the supply side, smelters continue to hold offers firm, supported by seasonal expectations and steady cost levels. On the demand side, despite falling stainless steel social inventory, finished product prices remain weak, and mills show limited acceptance of high NPI prices. With sufficient stock and slim profit margins, transaction activity stayed subdued this week, and some mills anticipate near-term price corrections. Overall, consumption is growing slowly during the peak season, but weak margins limit procurement appetite, suggesting upward momentum in NPI prices may start to fade next week.

Based on nickel ore prices 25 days ago, most high-NPI smelters still face negative margins, though profitability improved slightly this week. Nickel ore prices held steady, while coking coal and coke costs edged lower, easing cost pressure. Seasonal NPI price gains also supported margins. Looking ahead, auxiliary raw material costs are expected to remain stable or fall slightly, though Philippine ore prices may rise. With NPI prices already facing pressure at higher levels, smelter margins may again come under strain.