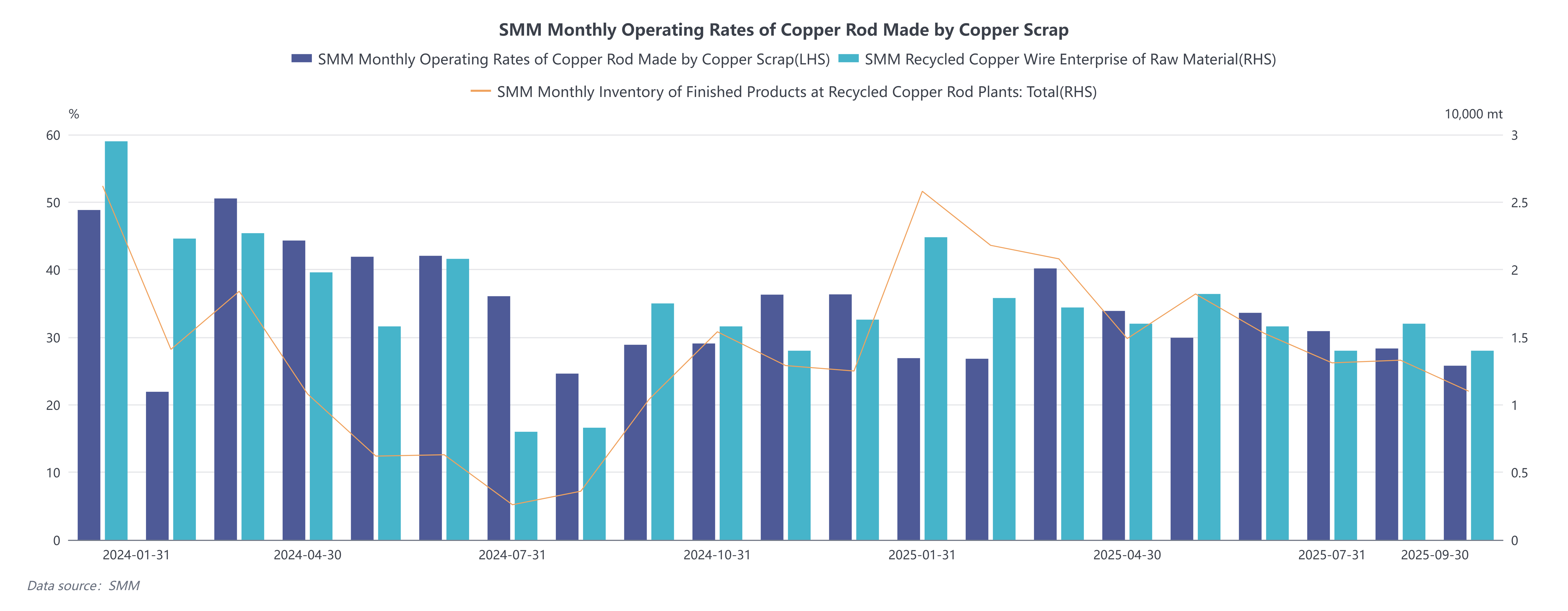

The operating rate for secondary copper rod was 28.33% in September, higher than the expected 27.43%, but decreased by 2.57% MoM and increased by 3.62% YoY. In the third quarter of 2025, the secondary copper rod industry underwent significant adjustments amid policy uncertainties stemming from Notice No. 770. This notice requires local governments to standardize investment promotion practices and eliminate irregular tax incentives and subsidy policies, directly impacting the cost structure and production plans of secondary copper rod enterprises. According to surveys, enterprises in traditional industrial clusters such as Jiangxi and Anhui suspended production on a large scale while awaiting detailed policy guidelines, leading to a sharp decline of approximately 30% in national secondary copper rod production in August, equivalent to a reduction in supply of about 48,800 mt. Although some enterprises gradually resumed production in September by purchasing imported raw materials with tax invoices, the overall operating rate remained low, with policy uncertainties continuing to suppress the industry's recovery momentum.

The core impact of Notice No. 770 lies in the restructuring of tax costs. Previously, enterprises commonly relied on local tax refunds and subsidy policies (known as "dual refunds"), maintaining an effective tax burden in the range of 5.5%–6.5%. After the policy standardization, if only the 30% VAT immediate refund after payment stipulated in Document No. 78 of the Ministry of Finance is retained, the corporate tax burden would rise to 8.3%–8.9%. To cope with cost pressures, enterprises were forced to adjust their raw material procurement strategies: on one hand, shifting toward taxed recycled copper raw materials, and on the other hand, attempting to drive down prices for non-invoiced copper scrap. However, the price of non-invoiced copper scrap would need to decrease by 2,500–3,000 yuan/mt to offset the increased tax burden, a margin difficult for suppliers to accept in the short term, leading to a supply deadlock in the market. Some enterprises attempted to adopt a "reverse invoicing" model, but the annual invoicing limit of 5 million yuan was insufficient to meet the demands of medium and large traders, and the comprehensive tax burden would still increase by approximately 0.6%–0.7%.

The policy impact showed significant regional disparities. Jiangxi, as the core region for secondary copper rod capacity (accounting for over 50% of national capacity), was the most severely affected. According to SMM surveys, numerous enterprises in Yingtan, Fuzhou, and other areas of Jiangxi chose to suspend production, retaining only anode plate production operations. This led to orders shifting to regions with more lenient policy enforcement, such as Hubei and Tianjin, driving short-term increases in operating rates among local enterprises. For example, some enterprises in Hubei had to activate additional furnaces to handle the transferred orders. This regional divergence intensified supply chain restructuring: production halts in Jiangxi expanded the supply gap for secondary copper rods, while surrounding provinces, despite higher operating rates, struggled to fully compensate for the supply shortfall due to tight availability of taxed raw materials.

Changes also emerged in the import market. Imports of recycled copper raw materials increased by 2.63% MoM to 184,100 mt in September, but heightened customs inspections extended clearance periods by 15–30 days, further constraining raw material supply efficiency. It is noteworthy that the secondary copper rod industry has demonstrated resilience: it has partially offset the impact of policies through regional coordination (order transfers) and adjustments in raw material structure (increasing the proportion of invoiced raw materials). In the future, the industry may develop a dual structure of "policy-compliant zones" and "cost-advantaged zones," where technological innovation and resource integration capabilities will become key factors for enterprises to break through.