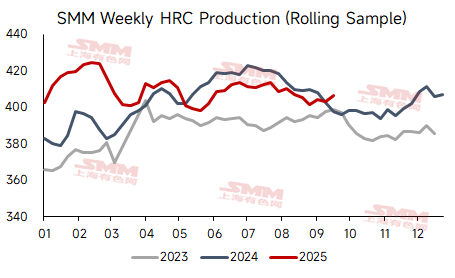

- Hot-Rolled Coil Production Fell 0.9% MoM in September, Slightly Higher Than the Same Period Last Year

According to SMM data, the average weekly production of domestic hot-rolled coils in September was 4.0384 million mt, slightly higher than the same period last year, but down 0.9% MoM from August.

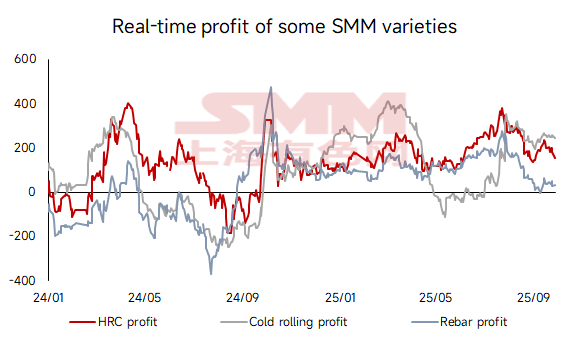

- Steel mill profits narrowed in September, with average monthly steel profits down nearly 32%.

Profitability-wise, steel mill profits narrowed MoM in September. Specifically, hot-rolled profits fell to 185 yuan/mt from an August average of 244 yuan/mt, rebar profits dropped to 32 yuan/mt from 126 yuan/mt, and cold-rolled profits decreased to 240 yuan/mt from 276 yuan/mt. In September, raw material prices fluctuated rangebound while steel prices fell to varying degrees, leading to a MoM contraction in steel mill profits.

- Steel Mill Maintenance Impact Slightly Decreased in October, but Recent Steel Price Decline May Trigger Production Cuts

According to SMM's statistics on steel mill maintenance, the impact from maintenance on hot-rolled production in October is temporarily 410,200 mt, down 448,800 mt MoM from September. However, with prices weakening continuously recently, if prices remain in the doldrums after the holiday, some steel mills may add new maintenance and production cut plans. The actual impact is expected to exceed the current estimate.

Overall, focus in October is on post-holiday inventory accumulation during the resumption of operations. If the accumulation exceeds market expectations, steel prices may face a new round of decline. However, considering expectations for macro meetings still to be held in October, the extent of price decline is likely to be limited.

![Before the holiday, the black chain is unlikely to see a trend-driven market [SMM Steel Industry Chain Weekly Report].](https://imgqn.smm.cn/usercenter/zUFfM20251217171748.jpg)

![[SMM Chromium Daily Review] Inquiries and Transactions Weakened, Chromium Market Showed Mediocre Performance Before the Holiday](https://imgqn.smm.cn/usercenter/ENDOs20251217171718.jpg)