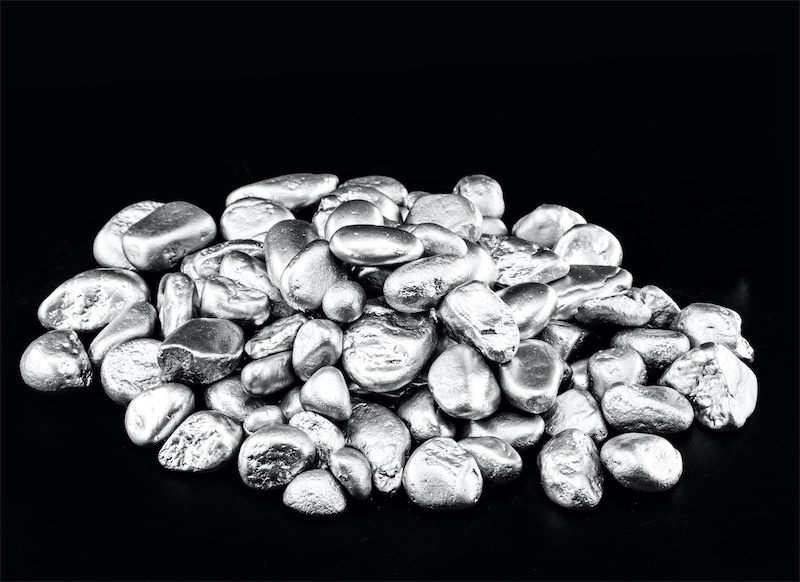

Nickel Ore

"Indonesian's Nickel Ore Premiums Dropped, Another New Trend?"

This week, Indonesia's domestic nickel ore prices have declined. The premium for laterite nickel ore has dropped to USD 24-26 per wet metric ton. According to SMM data, the delivered price of 1.6% Ni laterite ore now stands at USD 50.9-54.9/wmt, down USD 2.5 from last week. In contrast, the price of 1.3% Ni limonite ore remains stable at USD 26-28/wmt, unchanged week-on-week.

- Pyrometallurgical Ore:

From the supply side, frequent rainfall continues to disrupt mining and logistics in key production hubs like Sulawesi and Halmahera, tightening supply. However, progress is anticipated in the approval of additional RKAB (Work Plan and Budget) quotas, with approvals likely to accelerate in July.

In terms of demand, most Indonesian NPI smelters, burdened by persistent operational losses, are unable to sustain high premiums. While pyrometallurgical ore supply remains constrained, downstream producers continue pressuring for lower premiums to ensure cost-effective ore procurement. Notably, HMA prices for declined in early July, and further downward adjustments are expected for the remainder of the month.

- Hydrometallurgical Ore:

In terms of supply, limonite availability remains relatively stable to meet current demand, supported by several months of stockpiled inventory resulting from the QMB incident in March. However, due to the prolonged rainy season in Sulawesi and Halmahera, there is a possibility for the supply to be disrupted in the future. From the demand side, two major HPAL projects are expected to complete commissioning in the second half of this year, which is likely to drive increased demand for limonite.

NPI

The Buyer's Strike: What's Behind NPI's Downturn?

This week, the average price of 8-12% high-grade NPI in China declined to ¥915.2/Ni point (ex-factory, tax-incl.), down ¥10.3/Ni point WoW, while Indonesia’s NPI FOB index dropped $1.2/Ni point to $111.1/Ni point, reflecting sustained bearish momentum. In general, the supply-side pressures intensified. In China, high CIF prices for mid-high-grade Philippine nickel ore (supported by robust Indonesian demand) and elevated mining costs widened smelter losses, likely curbing output. In Indonesia, despite a marginal dip in ore premiums, severe cost-price inversion forced some smelters to reduce operating rates. In terms of demand, stainless steel mills, grappling with prolonged losses and high inventories, showed weak procurement behavior, keeping NPI prices under pressure.

The cost dynamics have also worsened. NPI smelters’ cash losses deepened due to falling product prices, despite slight relief from lower auxiliary material costs. Philippine nickel ore prices held firm amid strong Indonesian demand, but further upside is limited given smelters’ financial strain. For the future outlook, auxiliary material costs may stabilize next week on policy support, while ore prices are expected to plateau. However, with stainless steel prices stagnant and smelter margins eroding, NPI prices seem to face continued downward risks.

![[SMM Nickel Intermediate Product Daily Review] On March 3, MHP and high-grade nickel matte prices declined](https://imgqn.smm.cn/usercenter/biBGl20251217171733.jpg)