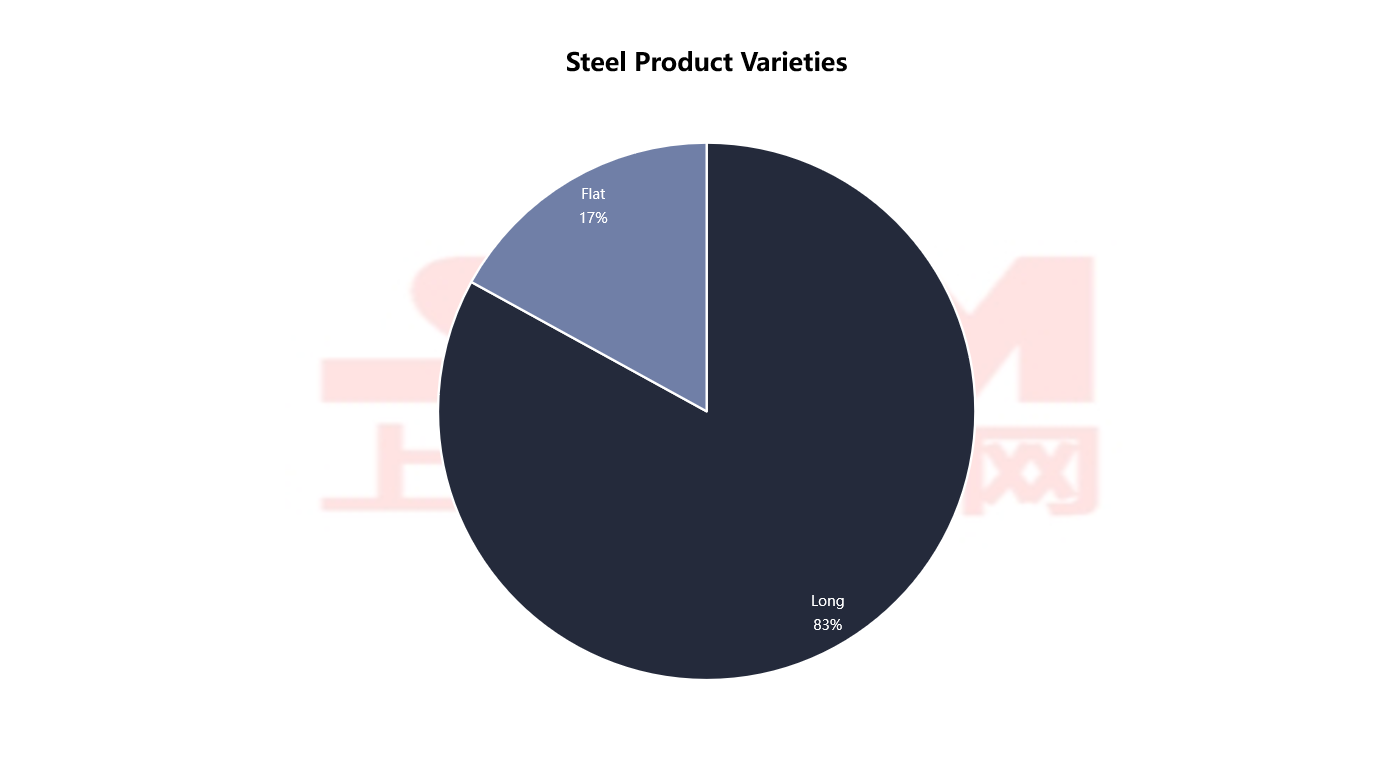

There is an overcapacity in long products, while flat products heavily rely on imports. The structural imbalance in Malaysia's steel industry continues to worsen.

The Malaysian steel industry is currently at a critical stage of transitioning from "capacity expansion" to "green transformation" and "high-value-added manufacturing." Driven by the policies outlined in the New Industrial Master Plan 2030 and the carbon neutrality vision, the optimization and transformation of the steel industry structure have become core topics.

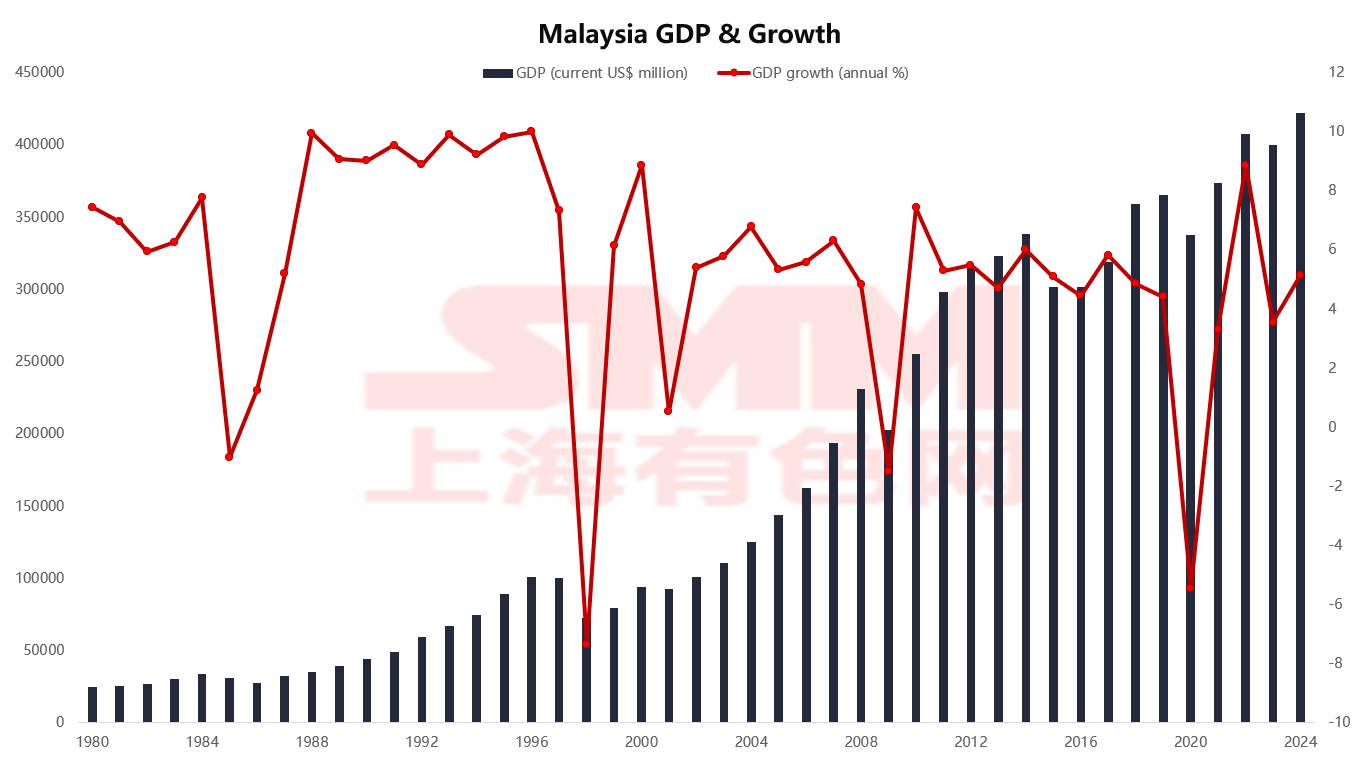

Source: World Bank Group

Source: World Bank Group

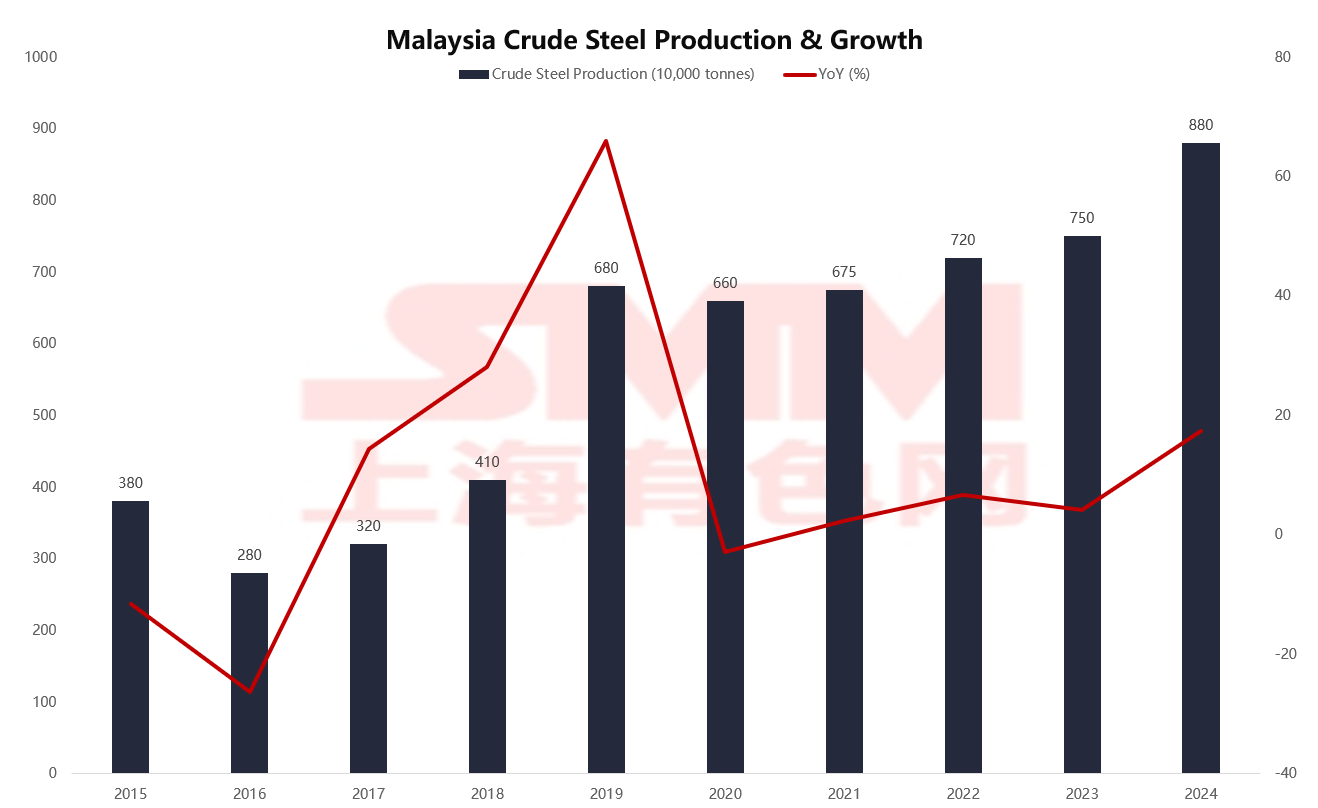

In 2024, Malaysia's GDP grew by 5% to reach $422 billion. The recovery in real estate, infrastructure, and manufacturing sectors has become the core driving force supporting steel demand. Benefiting from the release of new production capacity, crude steel production surged to 8.8 million mt in 2024, representing an increase of over 130% compared to 2015. Over the past decade, Malaysia's steel industry has gradually emerged from its trough, showing a pattern of concurrent expansion, efficiency improvement, and structural optimization.

Source: WSA, MISIF

Source: WSA, MISIF

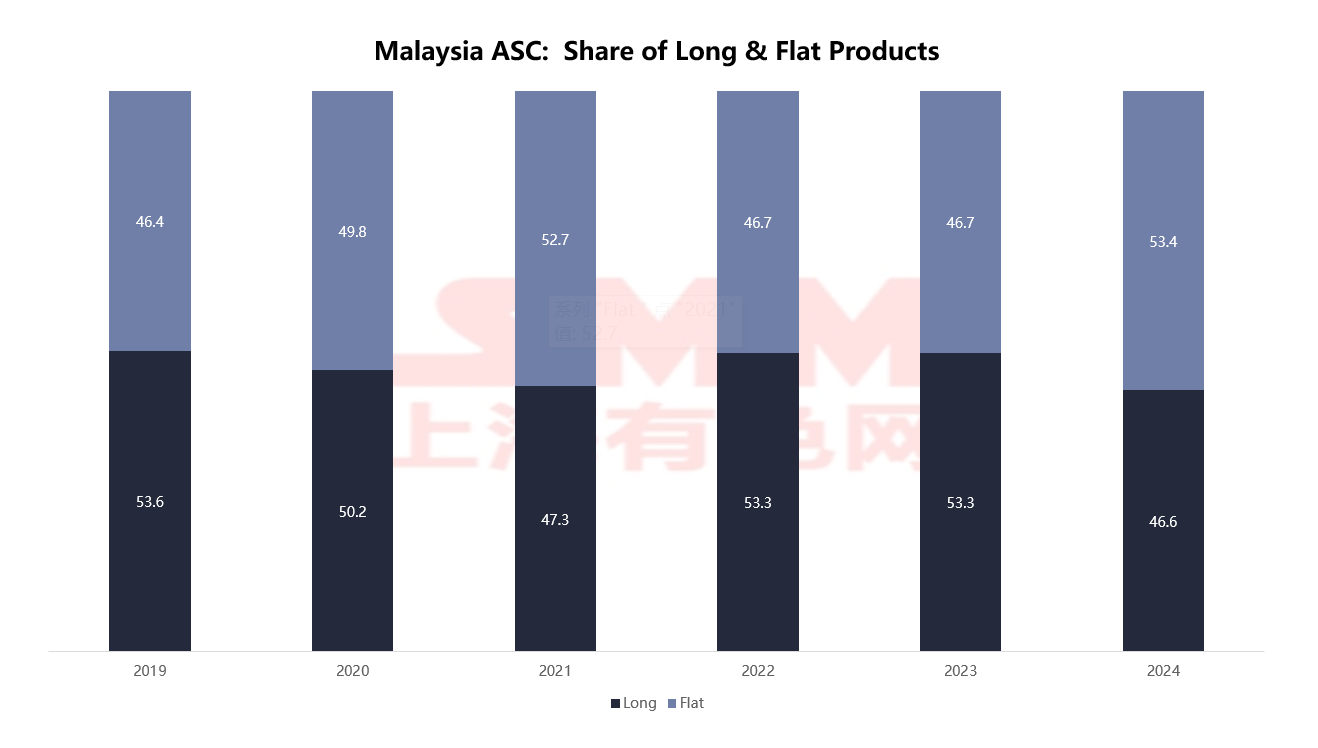

However, at the same time, the issue of structural imbalance in production capacity remains prominent. Currently, long products (such as rebar and wire rod) account for as high as 83% of production, primarily serving the construction and infrastructure sectors. Flat products (such as hot-rolled, cold-rolled, and coated sheets) only account for 17%, while the manufacturing, electrical appliances, and automotive sectors heavily rely on flat products. The low import substitution rate has become a key bottleneck restricting the upgrading of the local manufacturing chain.

Source: MISIF, DOSM

Source: MISIF, DOSM

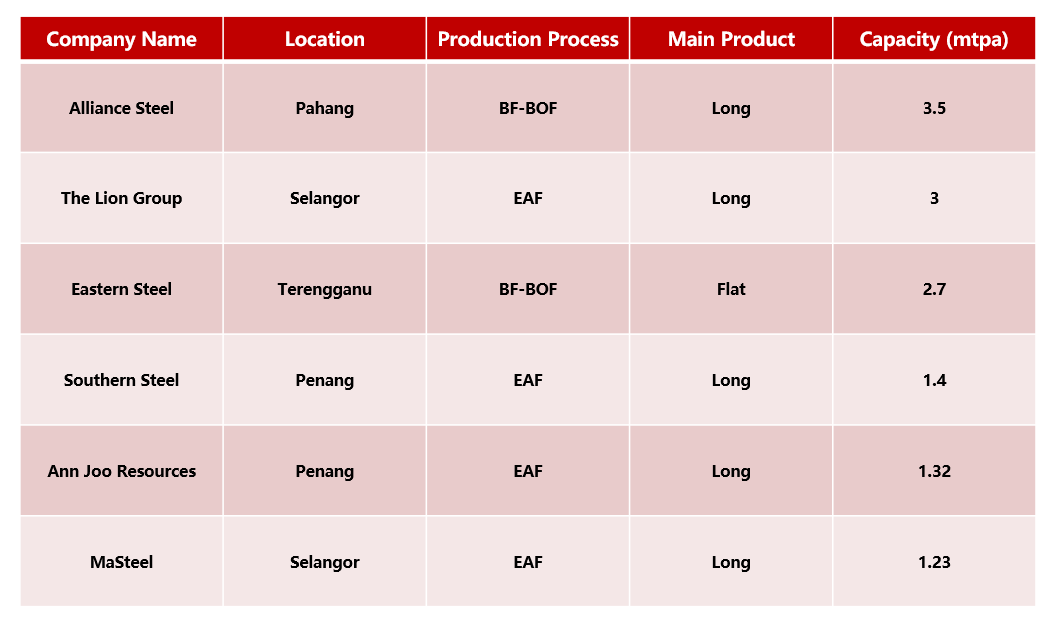

Due to the lack of iron ore resources, Malaysian steel mills generally adopt the production route of electric arc furnace (EAF) + continuous casting and rolling, with steel scrap and HBI as the main raw materials, offering significant advantages in energy conservation and emission reduction. In contrast, integrated steel mills with blast furnace - basic oxygen furnace (BF-BOF) processes are extremely scarce. Currently, only Alliance Steel and Eastern Steel possess blast furnace production lines.

Among them, Alliance Steel has an annual production capacity of 3.5 million mt, making it the largest full-process steel mill in the region, focusing on long products for construction. It leverages the geographical advantages of Kuantan Port for raw material imports and product exports. Eastern Steel, supported by Jianlong Group, has deployed hot-rolled flat products, becoming an important HRC supplier in the region. Except for these two companies, other mainstream enterprises such as Lion Group, Nanda Steel, and Anyu Steel primarily produce long products using the EAF method.

Source: MISIF, MSI

Source: MISIF, MSI

The Malaysian steel industry enjoys significant geographical concentration advantages, with major steel mills concentrated in states such as Pahang, Terengganu, Selangor, and Penang on the West Malaysia Peninsula, forming efficient linkages with key ports. Port Klang, the largest trading port in Malaysia, supports the transportation of raw materials and products for steel mills in the Selangor region; Kuantan & Kemaman Port, adjacent to Alliance Steel and Eastern Steel, serve as important channels for blast furnace enterprises; Johor Port & Port of Tanjung Lepas connect with Singapore and export markets; while Bintulu Port supports the supply of steel in East Malaysia.

Source: MISIF

Source: MISIF

The high degree of match between steel mills and ports has established an efficient nationwide logistics system, particularly supporting the smooth flow of flat steel imports and long steel exports.

As demand for flat products continues to rise, how can Malaysia's steel industry break free from import dependence?

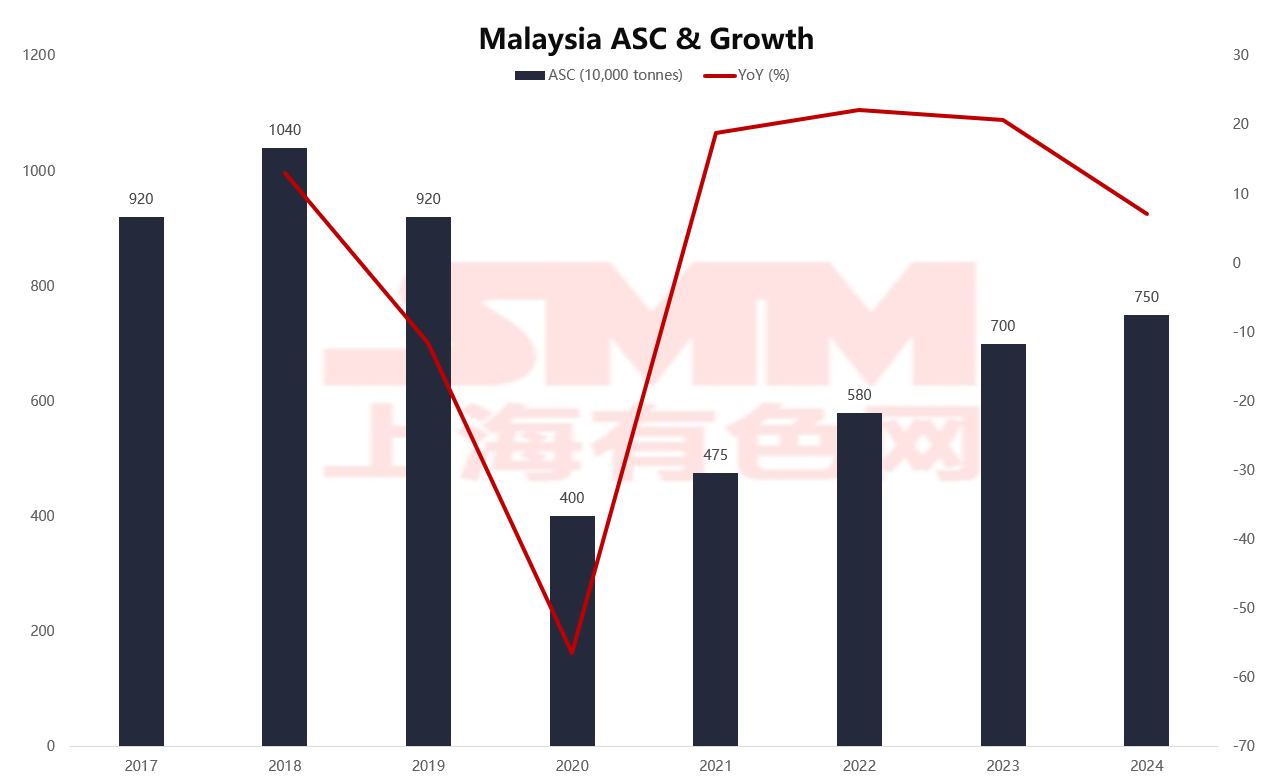

In recent years, Malaysia's apparent steel consumption has exhibited significant cyclical fluctuations. According to the chart, consumption reached a peak of 10.4 million mt in 2018, then dropped to 4 million mt in 2020 due to the pandemic impact, before gradually rebounding to 7.5 million mt in 2024, showing a steady recovery trend. Although overall consumption has not yet fully returned to the pre-pandemic peak, the growth trend is notable, reflecting a gradual recovery in domestic demand.

Source: WSA, MISIF

Source: WSA, MISIF

The consumption structure in 2024 shows that sheets & plates account for 53.4%, surpassing long products' 46.6%. However, there is a significant mismatch with the local capacity structure (long products account for 83%), indicating a heavy reliance on imports for flat products.

Source: MISIF

Source: MISIF

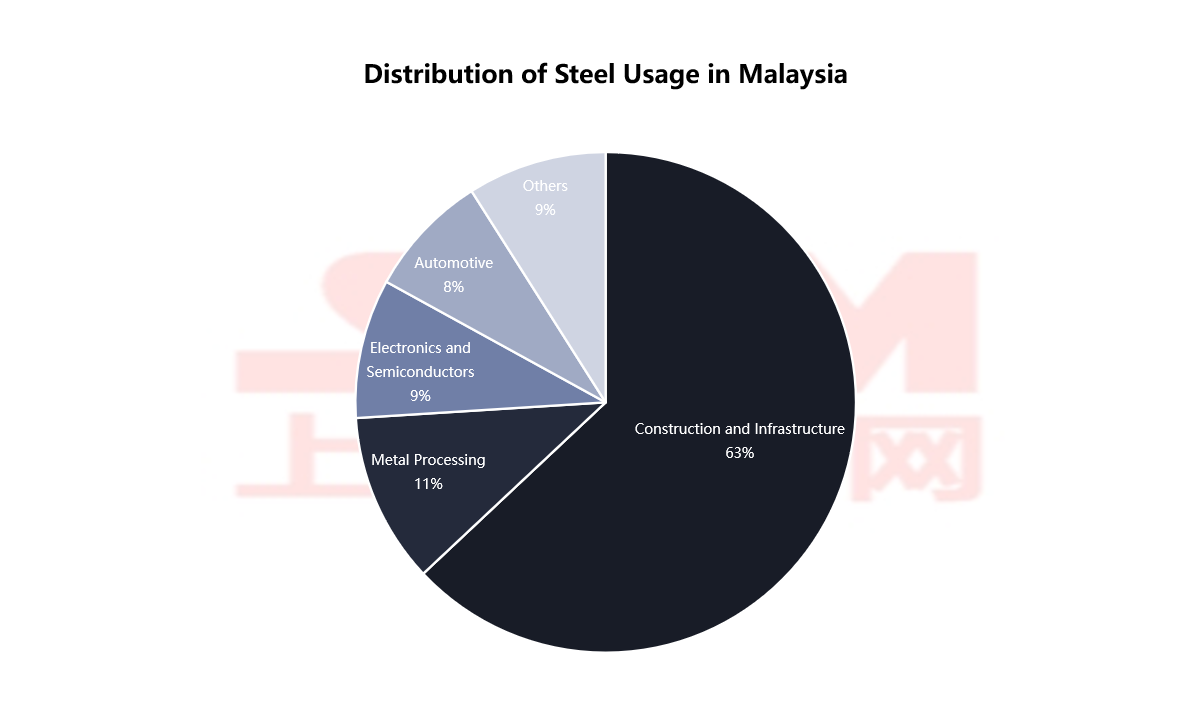

In the downstream industry distribution, construction and infrastructure account for as high as 63%, making them the absolute consumption mainstay. The high concentration of steel consumption indicates that local steel demand is still dominated by traditional industries. However, with the upgrading of the manufacturing sector, there is still room for continued growth in the demand for flat products in the future.

Source: DOSM, SMM

Source: DOSM, SMM

Malaysia Steel Trade Structure Optimized, Diversification Trend in Export Varieties Emerges

Source: WSA

Source: WSA

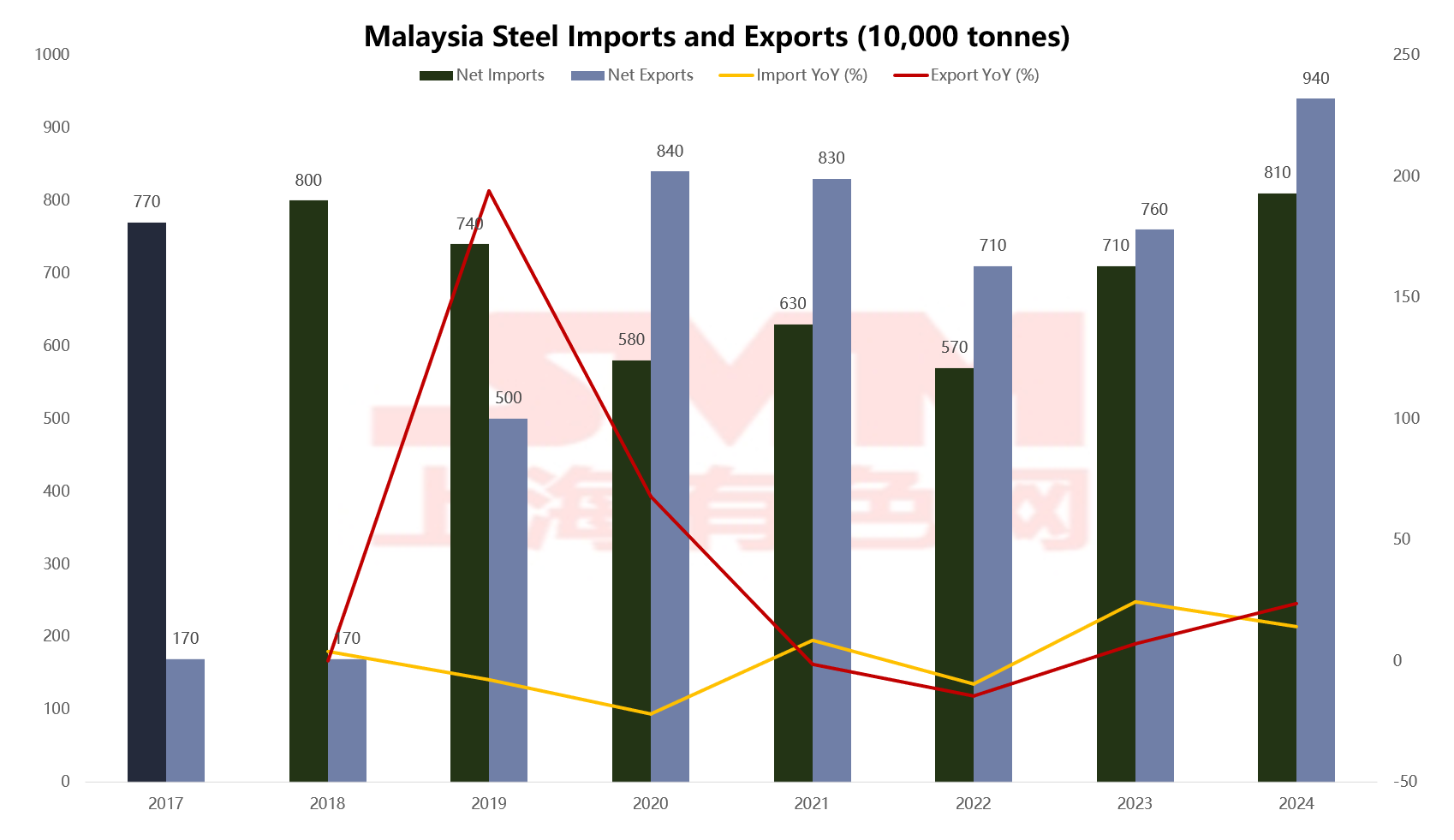

In recent years, Malaysia's steel exports have shown an overall upward trend, reaching 9.4 million mt in 2024, significantly higher than 1.7 million mt in 2018 and surpassing the peak that emerged after the pandemic in 2020. Although the YoY growth rate of exports has slowed down, the overall scale has steadily expanded. In terms of imports, the volume remained relatively stable at 8.1 million mt in 2024. Since 2020, Malaysia has achieved a net export of steel for five consecutive years, with a preliminary formation of a net export structure. However, it is worth noting that the steel industry still has a high degree of external dependence, especially with prominent contradictions in the variety structure.

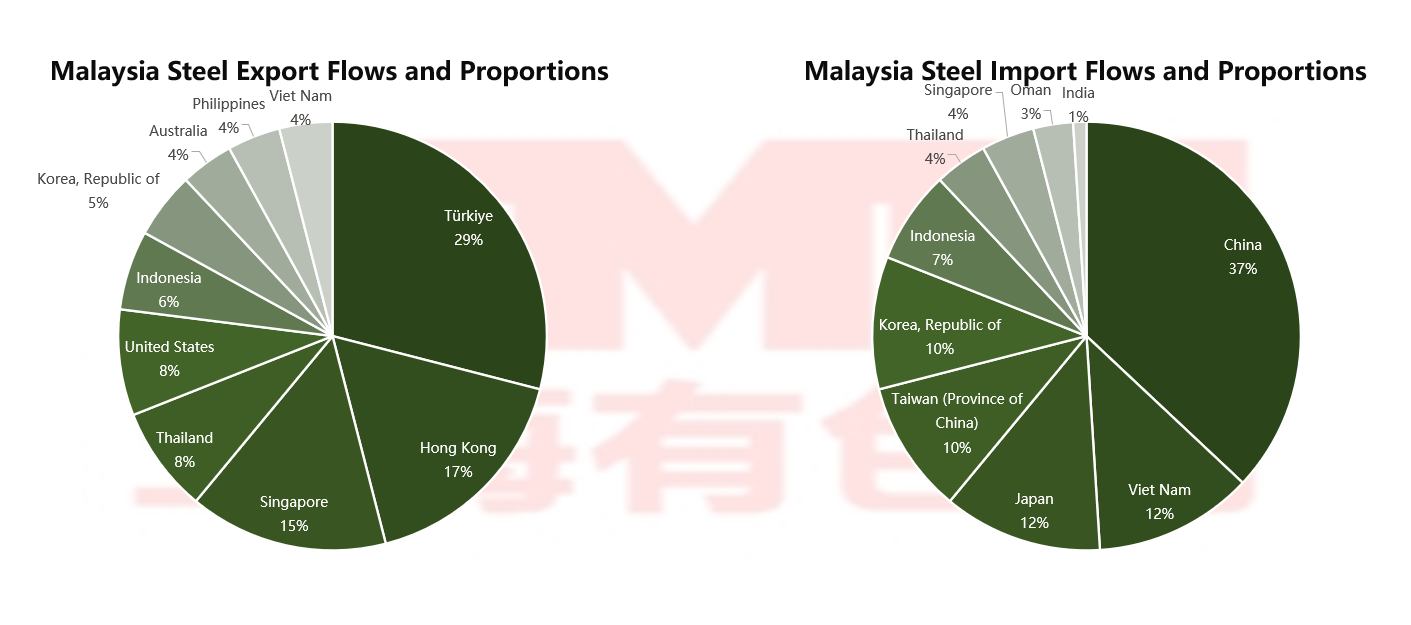

Export destination-wise, Turkey is the largest export destination for Malaysia, accounting for 29%. Hong Kong (17%) and Singapore (15%), as re-export hubs, also hold significant shares, facilitating further distribution of Malaysian steel to a broader range of Asia-Pacific or European and US markets. The other major export countries indicate that the export market has already developed a certain level of diversification.

Source: MSI, DOSM

Source: MSI, DOSM

In terms of imports, China is Malaysia's largest source of steel, accounting for 37% of the total, almost occupying 40% of the overall import market. It is followed by Vietnam (12%), Japan (12%), Taiwan, China (10%), and South Korea (10%), indicating a high degree of dependence on the East Asian region for Malaysia's steel supply chain. Other ASEAN countries also hold a certain share. This Asia-dominated import pattern is beneficial for transportation cost control, but it also exposes the risk of dependence on supplies from specific regions.

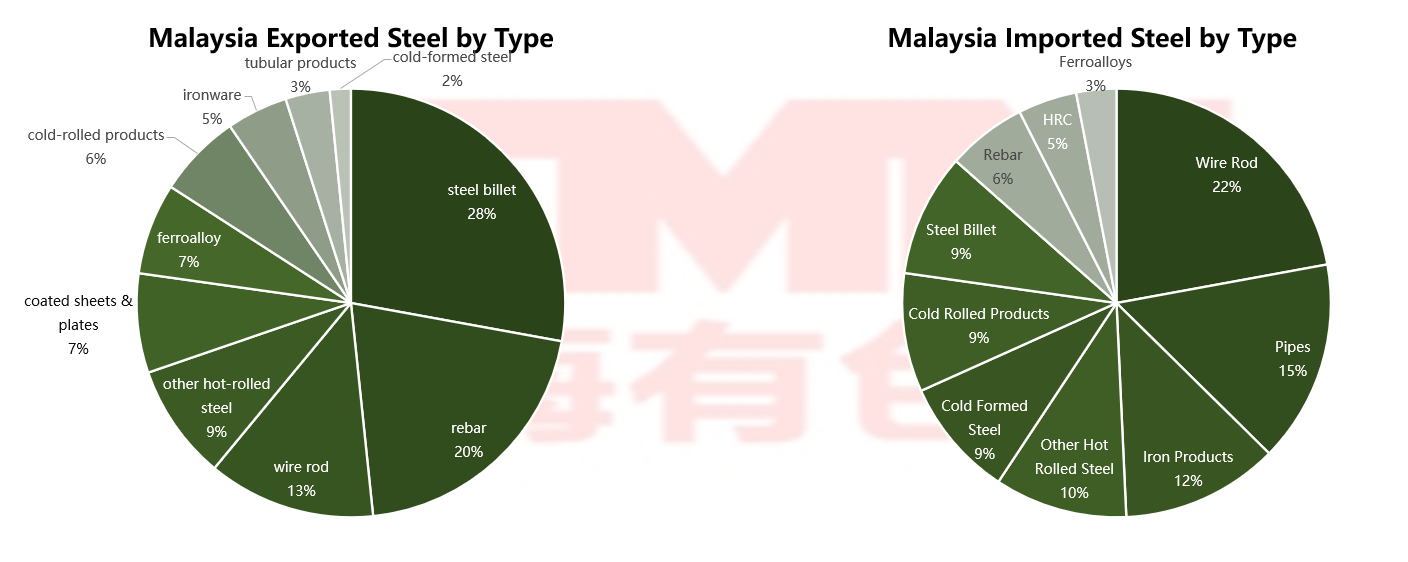

The structure of imported steel varieties mainly focuses on intermediate products such as wire rods (22%), tubes and pipes (15%), iron products (12%), and steel billets (9%). Additionally, there are flat products categories including cold-rolled products (9%), cold-formed steel (9%), and HRC (5%), which are widely used in manufacturing, automotive, electrical appliances, and other finishing industries, indicating that Malaysia's domestic high-end capacity remains insufficient.

Source: MSI, DOSM

Source: MSI, DOSM

While exports are skewed towards primary products, mainly consisting of steel billet (28%), rebar (20%), and wire rod (13%), all of which fall under the category of long products and primary raw materials; high value-added products such as coated sheets & plates and alloy steel account for a lower proportion. This structure, characterized by "primary" exports and "high-end" imports, reflects that Malaysia's steel industry is still in the mid-to-lower end of the industry chain and needs to extend towards high-end processing.

Malaysia Steel Trade Frictions Escalate: Initiating and Responding to Anti-dumping Pressures Coexist

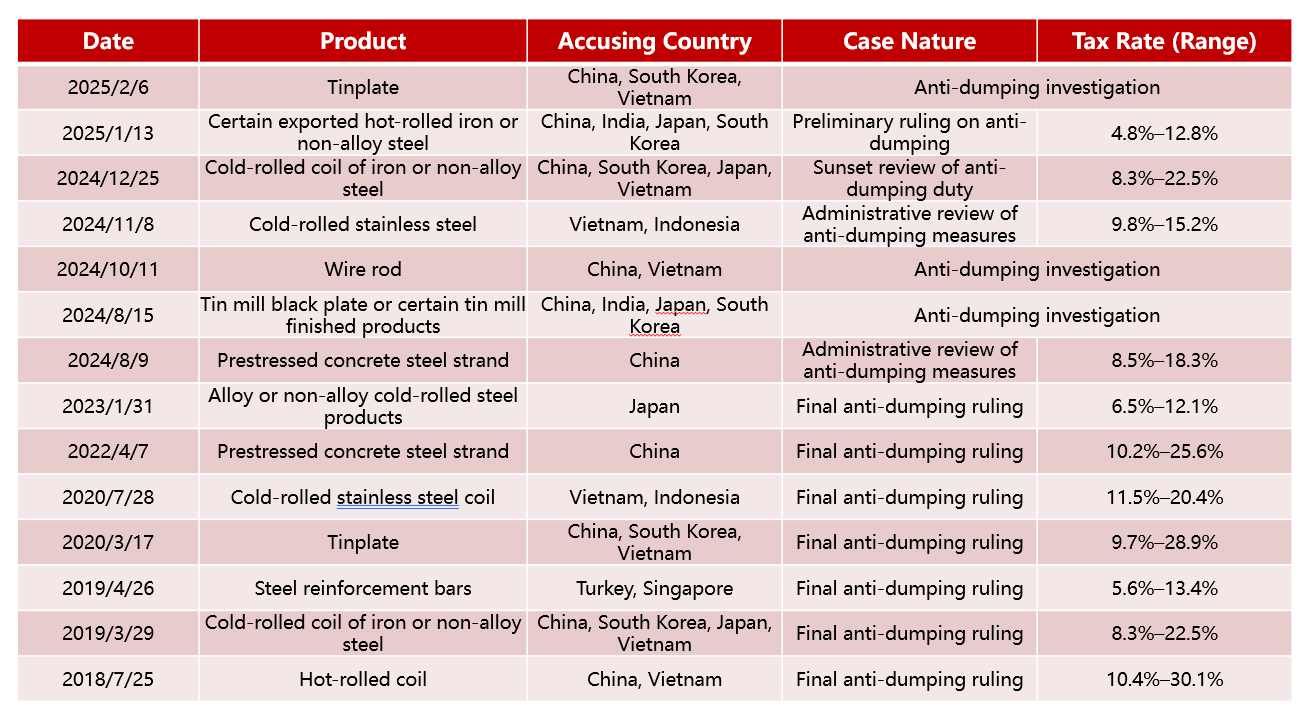

As the scale of steel imports and exports expands, Malaysia is increasingly embroiled in global steel trade frictions. Since 2018, Malaysia has initiated over ten anti-dumping cases against multiple countries, covering products such as cold-rolled, rebar, and wire rod, with the highest tariff reaching 30%, highlighting its determination to strengthen protection for the local steel industry.

Malaysia Initiated Anti-Dumping Case

Source: China Trade Remedy Information Network

Source: China Trade Remedy Information Network

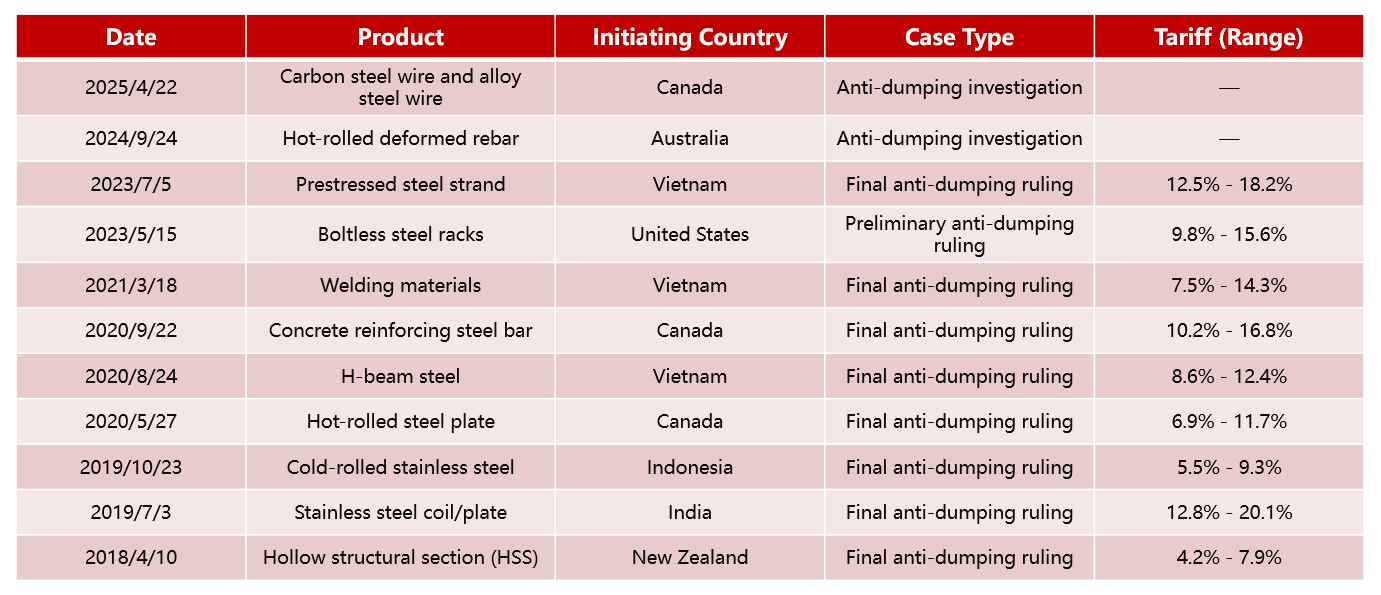

Meanwhile, countries such as Canada, the US, Australia, and Vietnam have also launched multiple anti-dumping investigations against Malaysian products, involving goods like welded pipes, concrete rebar, HRC, with most tariffs ranging between 10-20. Malaysia faces dual pressures of "export restrictions" and "import defense," making its trade environment increasingly complex.

Malaysia Anti-Dumping Case Source: China Trade Remedy Information Network

Source: China Trade Remedy Information Network

Future Outlook: From Long Product Surplus to Structural Upgrading, Malaysia's Steel Industry Aims for Green and High-End Development

As the Southeast Asian economy gradually recovers and the trend of manufacturing returning strengthens, steel demand in Malaysia is steadily recovering. It is expected that the apparent consumption of steel in Malaysia will continue to rise, with construction and infrastructure remaining traditional pillars. However, the share of sheets & plates consumption will increase year by year, driven by the development of manufacturing, electrical appliances, and the automotive industry. Currently, there is a temporary surplus in long product capacity in Malaysia, leading to increasingly fierce market competition; while flat product capacity is relatively scarce, highly dependent on imports. In the medium and long-term, Malaysia needs to accelerate the expansion of flat rolling production lines to enhance local self-sufficiency in flat products, thereby reducing reliance on imports. At the industrial structure level, companies with fully integrated production lines will become the core dominant force in the future Malaysian steel market. In comparison, other steel enterprises mainly using electric arc furnaces (EAF) need to accelerate their extension into the flat product sector to gradually achieve a value chain leap from traditional building material suppliers to mid-to-high-end manufacturing.

Overall, Malaysia's steel industry stands at a critical crossroads of green transformation and structural adjustment. The industry faces three major challenges in the future: "green and low-carbon, capacity transformation, and regional competition." Only by clearly positioning themselves and promoting differentiated development can companies seize opportunities in regional integration and the reshaping of the global supply chain, achieving a strategic transformation from "capacity expansion" to "quality and efficiency."

![Before the holiday, the black chain is unlikely to see a trend-driven market [SMM Steel Industry Chain Weekly Report].](https://imgqn.smm.cn/usercenter/zUFfM20251217171748.jpg)

![[SMM Chromium Daily Review] Inquiries and Transactions Weakened, Chromium Market Showed Mediocre Performance Before the Holiday](https://imgqn.smm.cn/usercenter/ENDOs20251217171718.jpg)