SMM, May 26, 2025:

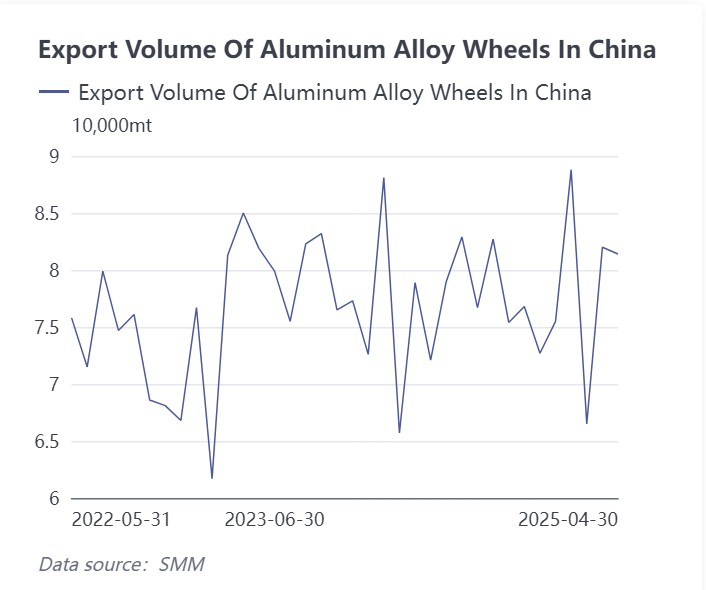

According to customs data, China exported a total of 81,400 mt of aluminum alloy wheel hubs in April 2025, which was basically flat MoM compared to 82,000 mt in March, highlighting overall resilience, and surging 13% YoY. The export performance of domestic aluminum wheels in April remained robust, with the better-than-expected results attracting market attention. Since the US sparked a tariff war in early April, the aluminum wheel industry, which has directly exported over 30% of its products to the US in recent years, was expected to be "hit first," and the market held a relatively pessimistic outlook on the industry's exports. However, the aluminum wheel export data for April appeared "calm," or even "peaceful," exceeding the expectations of most in the market. So, what secrets behind the data are worth our attention? How do major enterprises in the aluminum wheel industry chain view this data? After conducting a survey on the aluminum wheel market, SMM has compiled the following feedback:

Feedback from Producer A of aluminum wheels: The impact on exports may be delayed, and the data for May and June, two consecutive months, may better reflect the actual situation.

Feedback from Producer B of A356: 50% of our customers export to Japan, and their export orders are doing well, while domestic demand in this segment is relatively weak.

Feedback from Producer C of aluminum wheels: We have been in negotiations with foreign customers since April, but as 70% of the global production of aluminum alloy wheel hubs is made in China, it is difficult for foreign customers to find sufficient alternatives. Therefore, the impact on export data in April appears limited. Meanwhile, due to our company's limited domestic production capacity, the direct export volume to the US accounts for a relatively small portion of our China factory's business, and there has been no rush in exports. We have a factory in Mexico that can mitigate some international trade risks. Currently, we have been continuously importing materials for production, with a slight increase in production volume recently.

Feedback from Export Enterprise D downstream: There is a demand for front-loaded purchases from customers during the traditional off-season from June to August. Meanwhile, the depreciation of the US dollar in April, coupled with the pullback in LME aluminum prices, created a window of opportunity for a temporary export price advantage, coinciding with intensified domestic market competition, which compelled enterprises to intensify their efforts in exploring overseas markets.

More relevant enterprises generally reported that production has been normal recently, with consumer resilience remaining, and no significant changes in short-term production rhythms.

SMM's aluminum market research indicates the following changes in the distribution of China's aluminum wheel export target countries in April, which are worthy of market attention:

1. Affected by the tariff hike, direct aluminum wheel exports to the US in April decreased by 5,200 mt, down 18.3% MoM, but increased slightly by 1.8% YoY. Meanwhile, the proportion of exports to the US fell below the 30% threshold, which is a rare occurrence.

2. In April, exports to Mexico exceeded 10,000 mt for the first time this year, up 22.7% MoM and a significant increase of 44% YoY, demonstrating notable characteristics of re-export trade.

3. Exports to Morocco entered the top ten for the first time, closely following the top five countries of the US, Japan, Mexico, South Korea, and Thailand. The reasons behind this are worthy of attention. SMM speculates that this may be related to some domestic aluminum wheel enterprises establishing overseas factories in Morocco.

From SMM's analytical perspective, following the US tariff hike in April 2025, China's aluminum alloy wheel hub exports demonstrated strong resilience, with the negative impact being less severe than anticipated. Customs data indicated that exports remained stable overall in April, primarily due to the rigid supply chain advantages stemming from 70% of global capacity being concentrated in China, coupled with top-tier enterprises' proactive establishment of overseas production capacities in Mexico, Thailand, Morocco, and other locations. This not only met the new overseas orders but also reduced reliance on direct exports to the US (with the current proportion significantly decreasing). Consequently, there was no obvious surge in exports typically seen during traditional trade frictions in the short term. Initial success has been achieved in the industry's structural adjustments, but continuous attention is needed to the progress of overseas capacity ramp-up and the ability to pass on premium pricing in end-use markets.

However, it should be noted that the dual constraints of weakening global economic growth momentum and rising trade protectionism have led overseas buyers to generally adopt a strategy of maintaining low finished product inventories, making it difficult to see large-scale restocking demand in the short term. It is worth noting that major export markets are about to enter a tariff policy adjustment cycle. Coupled with the joint statement issued during the China-US economic and trade talks in Geneva on May 12, 2025, which significantly reduced tariff levels between the two sides, the US has canceled a total of 91% of the imposed tariffs and suspended the implementation of 24% of reciprocal tariffs for an initial 90-day period. SMM will continue to monitor the timing and implementation intensity of tariff policy adjustments in major exporting countries. SMM anticipates that China's aluminum wheel exports may show an overall decline in the next two months, with aluminum wheel exports entering an adjustment phase in the second half of the year. The industry's pain period may extend until the new tariff system becomes clearer.