On 13 April 2024, the United States and the United Kingdom announced new trade restrictions against Russian aluminium, copper, and nickel, prohibiting the London Metal Exchange (LME) and the Chicago Mercantile Exchange (CME) from accepting these metals produced in Russia from 13 April onwards. Moreover, both countries have banned the importation of these three metals from Russia. Following these announcements, aluminium prices soared in the early trading session on 15 April, with LME 3M aluminium opening price at a record high of $2,728 per tonne. SHFE aluminium also saw a boost, with the main contract for June reaching 21,345 CNY per tonne.

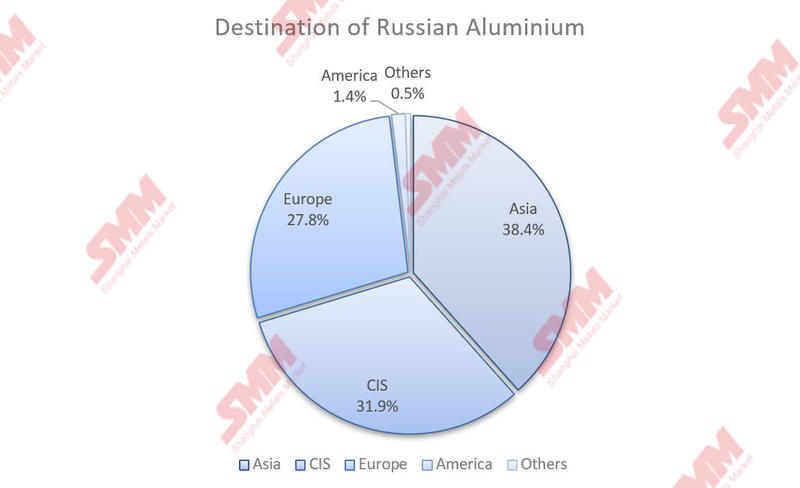

Despite these sanctions, UC RUSAL, Russia's largest aluminium company, said that production at smelters continues without interruption. Russia, a major global producer of aluminium, was responsible for approximately 5.6% of the global supply in 2023, making it the third-largest producer worldwide. According to a 2023 consolidated report from Rusal, its largest market was Asia, accounting for 38.4% of sales. The CIS countries and Europe followed, with 31.9% and 27.8% respectively, while the Americas only accounted for 1.4%.

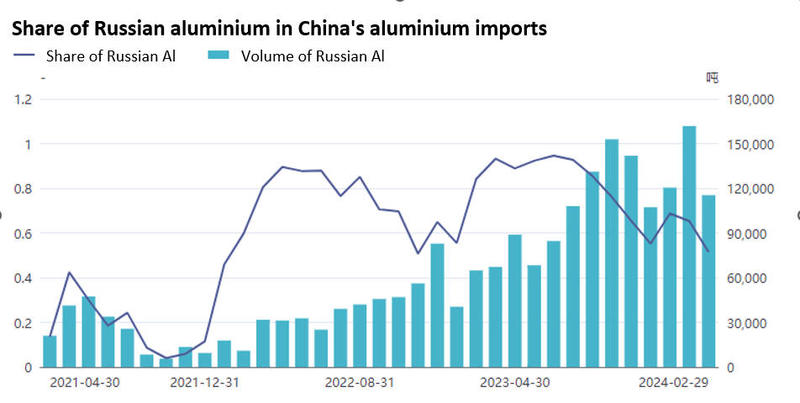

China's aluminium imports from Russia are at a record high. RUSAL generated 23% of its revenue from China last year, compared to just 8% in 2022. RUSAL also holds a 30% stake in an alumina plant of HEBEI WENFENG NEW MATERIALS to fill the alumina supply gap, which was caused by the interruption of its alumina refineries in Australia and Ukraine.

Regarding the impacts of these sanctions, SMM believes there are several main effects:

First, the realignment of overseas deliverable resources will take time as non-Russian metals are required to replace Russian metals in LME warehouses, leading to a tightening of deliverable stock. This condition will contribute to increased volatility in LME aluminium prices and heightened short-term upward risks. As of the end of March, Russian aluminium made up 91% of the warrants held.

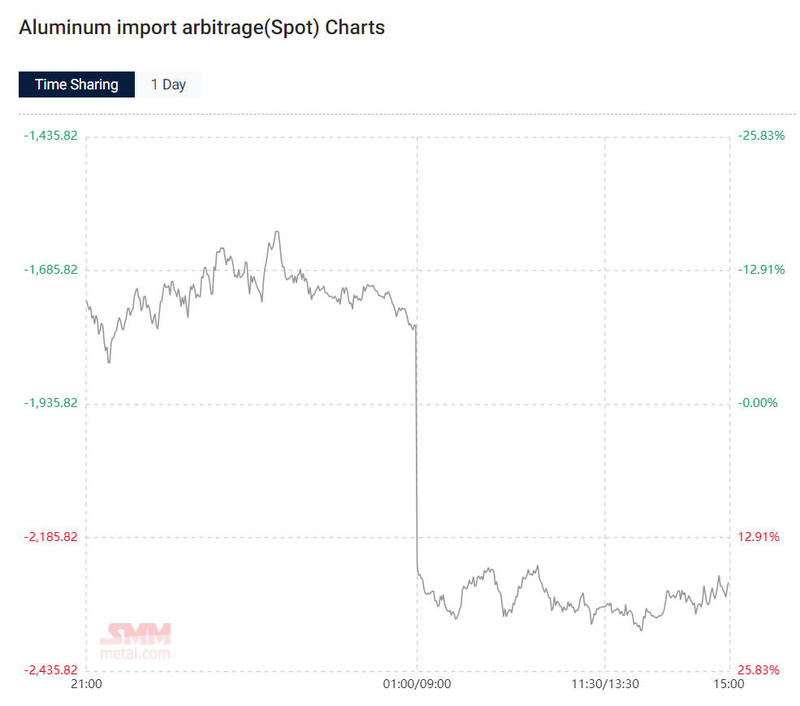

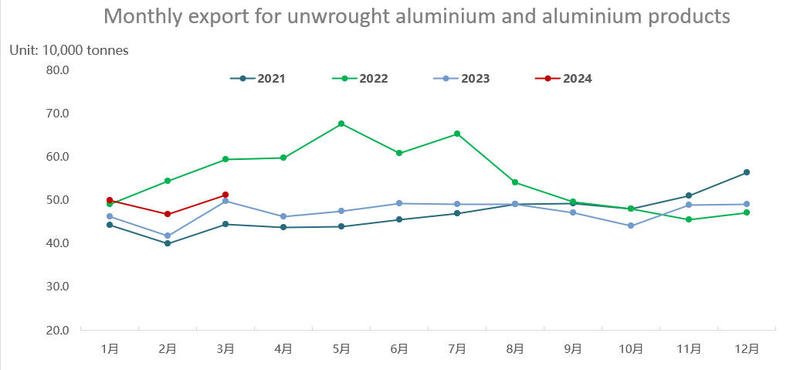

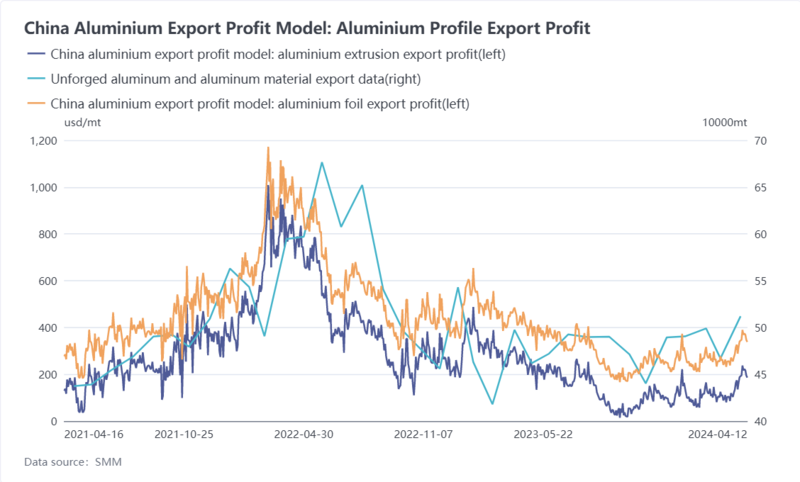

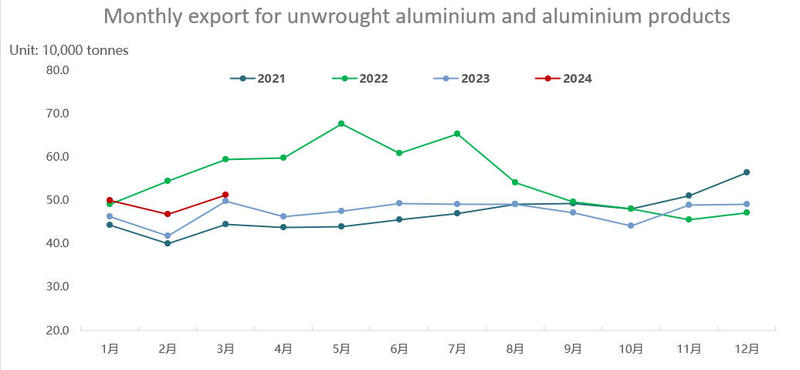

Secondly, the discrepancy between stronger LME aluminium prices and weaker domestic Chinese aluminium prices, where domestic prices are passively following, could boost Chinese aluminium exports. The domestic spot market lacks sufficient momentum to follow suit, resulting in a widening of the discount. This scenario creates an incentive for exports, particularly as regions restricted from trading with Russian aluminium will shift towards importing Chinese aluminium products. Both the increase in export profits and the reorganization of global aluminium supply and demand are conducive to exports.

Thirdly, there is speculation about whether this situation will lead to an increased influx of Russian aluminium into China. While there might be an increment, it is not expected to be complete, as other unrestricted regions also possess the capacity to absorb Russian aluminium. These decisions will be made based on a comparison of actual domestic and international prices. Even though these regions might be more attractive than the Chinese market for Russian aluminium, unless these regions are unable to absorb the surplus of Russian aluminium, there will not be a significant increase in aluminium ingot imports. Given the current prices and overseas consumption capabilities, China is not the primary choice for Russian aluminium but remains one of the alternatives.