SHANGHAI, Mar 17 (SMM) - This is a roundup of China's metals weekly inventory as of March 17.

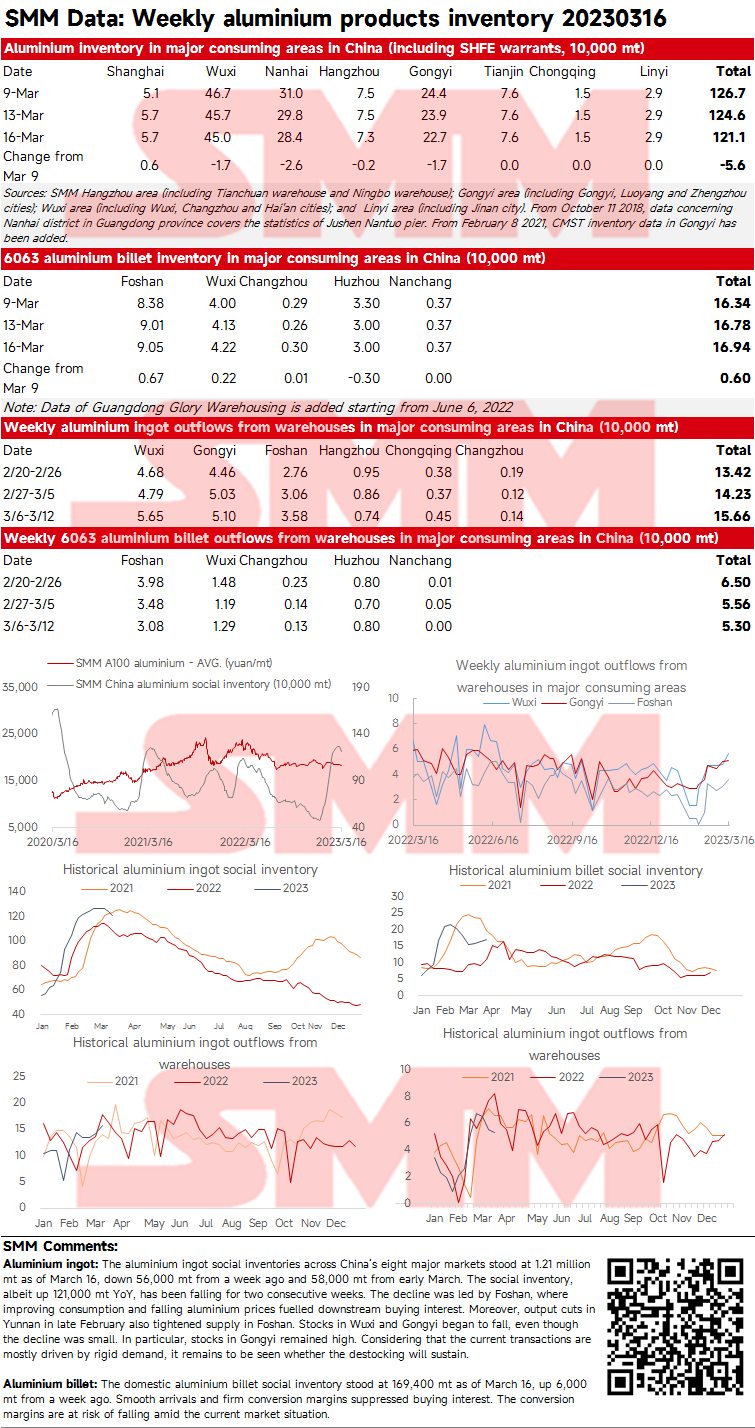

SMM Aluminium Ingot and Billet Social Inventory in China as of March 16

Aluminium ingot: The aluminium ingot social inventories across China’s eight major markets stood at 1.21 million mt as of March 16, down 56,000 mt from a week ago and 58,000 mt from early March. The social inventory, albeit up 121,000 mt YoY, has been falling for two consecutive weeks. The decline was led by Foshan, where improving consumption and falling aluminium prices fuelled downstream buying interest. Moreover, output cuts in Yunnan in late February also tightened supply in Foshan. Stocks in Wuxi and Gongyi began to fall, even though the decline was small. In particular, stocks in Gongyi remained high. Considering that the current transactions are mostly driven by rigid demand, it remains to be seen whether the destocking will sustain.

Aluminium billet: The domestic aluminium billet social inventory stood at 169,400 mt as of March 16, up 6,000 mt from a week ago. Smooth arrivals and firm conversion margins suppressed buying interest. The conversion margins are at risk of falling amid the current market situation.

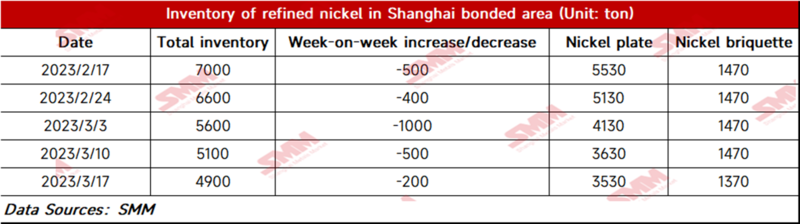

Bonded Zone Inventory of Nickel Falls 200 mt from March 10

Bonded zone inventory of nickel dropped 200 mt to 4,900 mt WoW as of March 17, with the inventory of nickel briquettes and nickel plates standing at 1,370 mt and 3,530 mt respectively, which was in line with market expectations. During the week, the nickel prices continued to decline due to the macro front, and downstream companies bought some nickel plates. In terms of nickel briquettes, although the spread between nickel briquettes and nickel sulphate shrank amid the decline in nickel prices, the production of nickel sulphate with nickel briquettes still cannot gain profits. Nickel briquette demand from the stainless steel sector was low, thus the bonded zone inventory of nickel briquettes fell only 100 mt this week.

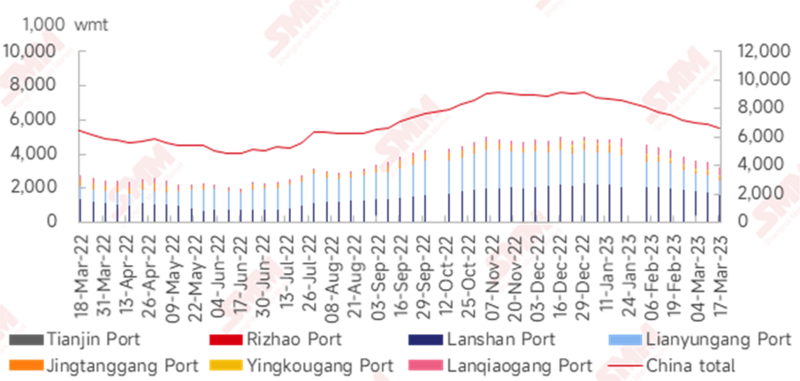

Nickel Ore Inventories at Chinese Ports Dip 295,000 wmt WoW

As of March 17, the nickel ore inventories at Chinese ports dropped 295,000 wmt from a week earlier to 6.59 million wmt. The total Ni content stood at 52,000 mt. The port inventory across seven major Chinese ports stood at 3.22 million wmt, 295,000 wmt lower than last week. Nickel ore prices crashed this week. The NPI plants had to lower their quotes on the dropping NPI prices. The upstream and downstream companies still wrestled over the prices despite some mines’ price cut. NPI plants only purchased on rigid demand. The port inventory may maintain a downward track in the near future.

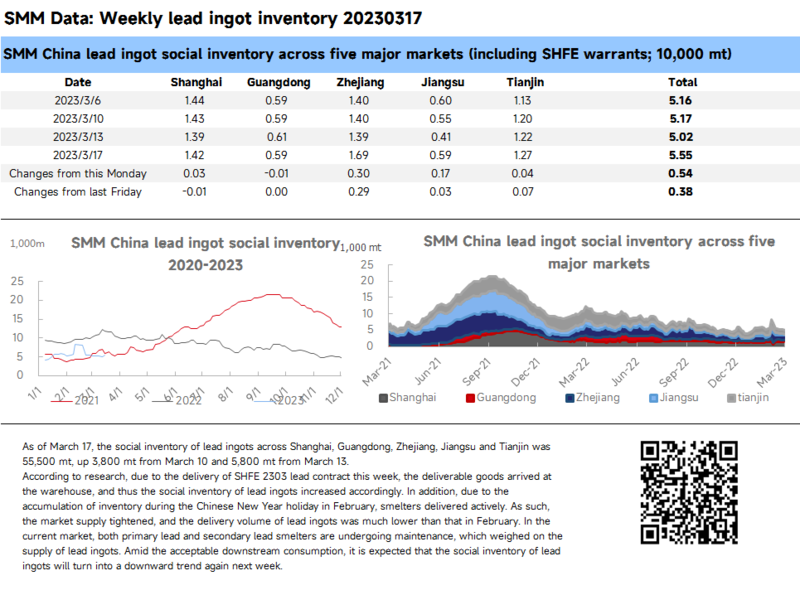

Social Inventory of Lead Ingots may Decline Futher Next Week

As of March 17, the social inventory of lead ingots across Shanghai, Guangdong, Zhejiang, Jiangsu and Tianjin was 55,500 mt, up 3,800 mt from March 10 and 5,800 mt from March 13.

According to research, due to the delivery of SHFE 2303 lead contract this week, the deliverable goods arrived at the warehouse, and thus the social inventory of lead ingots increased accordingly. In addition, due to the accumulation of inventory during the Chinese New Year holiday in February, smelters delivered actively. As such, the market supply tightened, and the delivery volume of lead ingots was much lower than that in February. In the current market, both primary lead and secondary lead smelters are undergoing maintenance, which weighed on the supply of lead ingots. Amid the acceptable downstream consumption, it is expected that the social inventory of lead ingots will turn into a downward trend again next week.

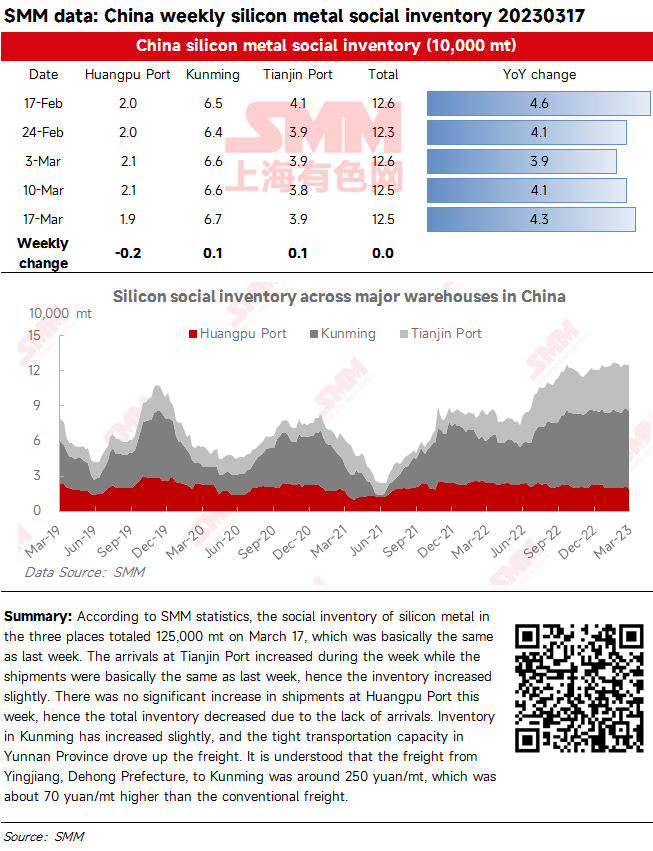

Social Inventory of Silicon Metal Remains Flat amid Sluggish Market Sentiment

According to SMM statistics, the social inventory of silicon metal in the three places totaled 125,000 mt on March 17, which was basically the same as last week. The arrivals at Tianjin Port increased during the week while the shipments were basically the same as last week, hence the inventory increased slightly. There was no significant increase in shipments at Huangpu Port this week, hence the total inventory decreased due to the lack of arrivals. Inventory in Kunming has increased slightly, and the tight transportation capacity in Yunnan Province drove up the freight. It is understood that the freight from Yingjiang, Dehong Prefecture, to Kunming was around 250 yuan/mt, which was about 70 yuan/mt higher than the conventional freight.

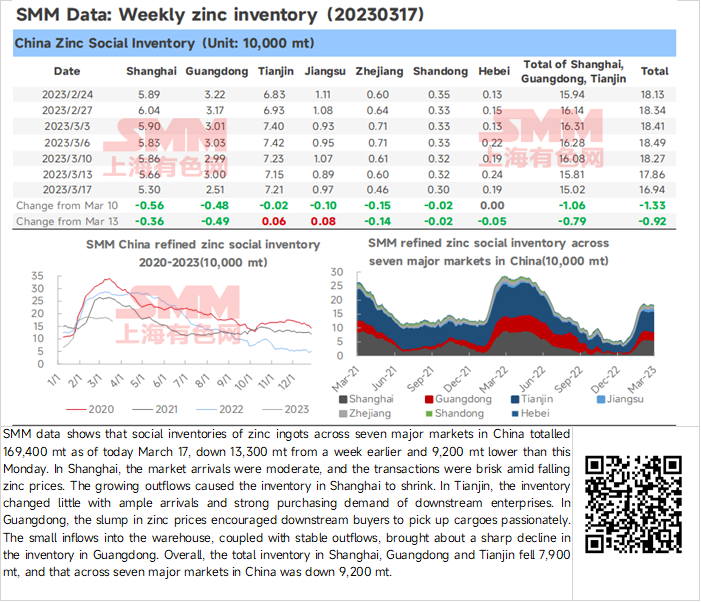

Zinc Ingot Social Inventory Down 9,200 mt from Monday

SMM data shows that social inventories of zinc ingots across seven major markets in China totalled 169,400 mt as of today March 17, down 13,300 mt from a week earlier and 9,200 mt lower than this Monday. In Shanghai, the market arrivals were moderate, and the transactions were brisk amid falling zinc prices. The growing outflows caused the inventory in Shanghai to shrink. In Tianjin, the inventory changed little with ample arrivals and strong purchasing demand of downstream enterprises. In Guangdong, the slump in zinc prices encouraged downstream buyers to pick up cargoes passionately. The small inflows into the warehouse, coupled with stable outflows, brought about a sharp decline in the inventory in Guangdong. Overall, the total inventory in Shanghai, Guangdong and Tianjin fell 7,900 mt, and that across seven major markets in China was down 9,200 mt.