SHANGHAI, Nov 11 (SMM) - This is a roundup of China's metals weekly inventory as of November 11.

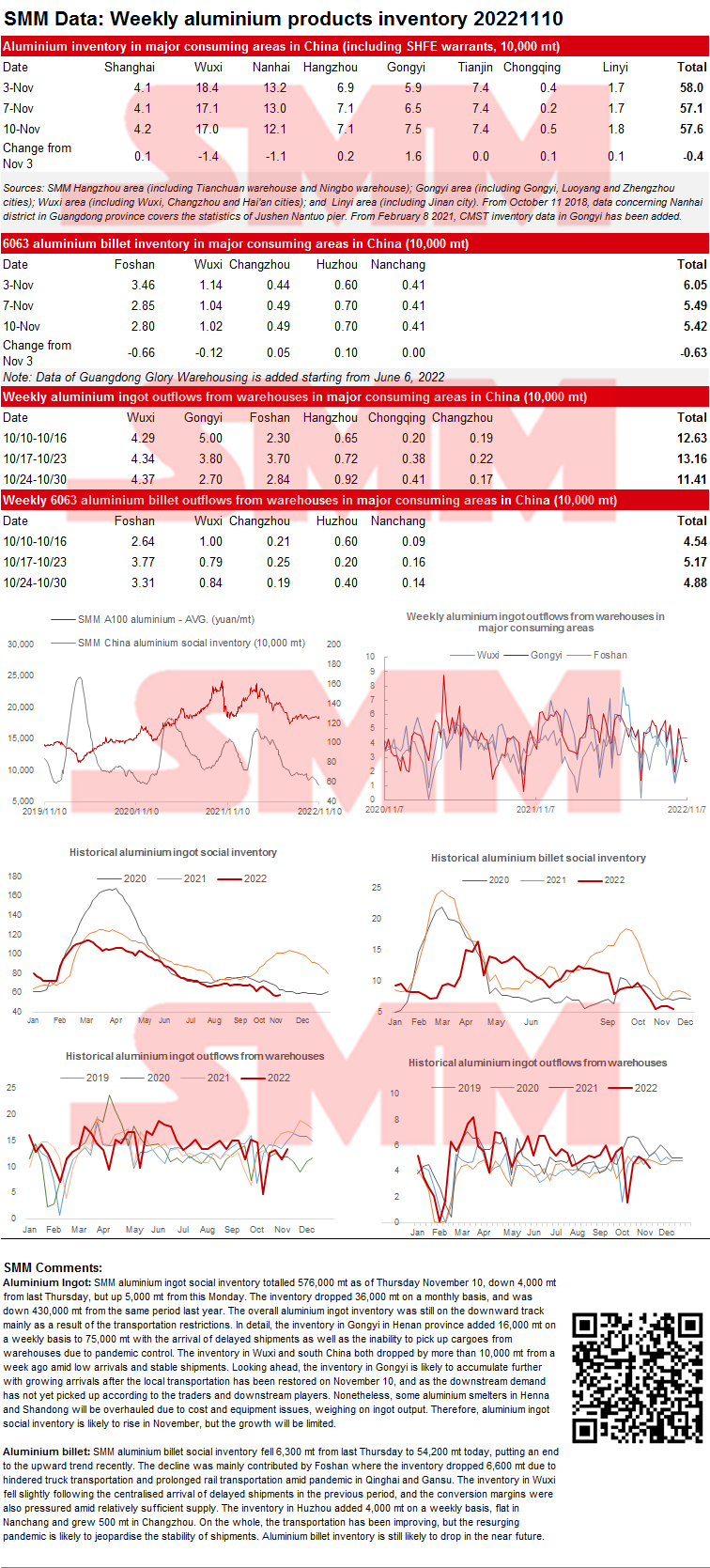

SMM Weekly Aluminium Ingot and Billet Inventory Review

Aluminium ingot: SMM aluminium ingot social inventory totalled 576,000 mt as of Thursday November 10, down 4,000 mt from last Thursday, but up 5,000 mt from this Monday. The inventory dropped 36,000 mt on a monthly basis, and was down 430,000 mt from the same period last year. The overall aluminium ingot inventory was still on the downward track mainly as a result of the transportation restrictions. In detail, the inventory in Gongyi in Henan province added 16,000 mt on a weekly basis to 75,000 mt with the arrival of delayed shipments as well as the inability to pick up cargoes from warehouses due to pandemic control. The inventory in Wuxi and south China both dropped by more than 10,000 mt from a week ago amid low arrivals and stable shipments. Looking ahead, the inventory in Gongyi is likely to accumulate further with growing arrivals after the local transportation has been restored on November 10, and as the downstream demand has not yet picked up according to the traders and downstream players. Nonetheless, some aluminium smelters in Henna and Shandong will be overhauled due to cost and equipment issues, weighing on ingot output. Therefore, aluminium ingot social inventory is likely to rise in November, but the growth will be limited.

Aluminium billet: SMM aluminium billet social inventory fell 6,300 mt from last Thursday to 54,200 mt today, putting an end to the upward trend recently. The decline was mainly contributed by Foshan where the inventory dropped 6,600 mt due to hindered truck transportation and prolonged rail transportation amid pandemic in Qinghai and Gansu. The inventory in Wuxi fell slightly following the centralised arrival of delayed shipments in the previous period, and the conversion margins were also pressured amid relatively sufficient supply. The inventory in Huzhou added 4,000 mt on a weekly basis, flat in Nanchang and grew 500 mt in Changzhou. On the whole, the transportation has been improving, but the resurging pandemic is likely to jeopardise the stability of shipments. Aluminium billet inventory is still likely to drop in the near future.

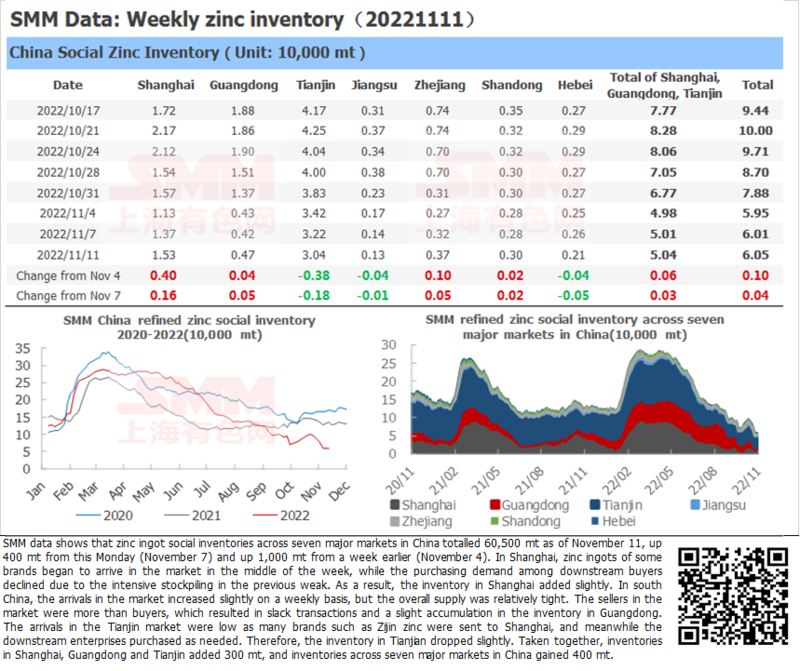

Zinc Ingot Social Inventory Up 400 mt from this Monday

SMM data shows that zinc ingot social inventories across seven major markets in China totalled 60,500 mt as of November 11, up 400 mt from this Monday (November 7) and up 1,000 mt from a week earlier (November 4). In Shanghai, zinc ingots of some brands began to arrive in the market in the middle of the week, while the purchasing demand among downstream buyers declined due to the intensive stockpiling in the previous week. As a result, the inventory in Shanghai added slightly. In south China, the arrivals in the market increased slightly on a weekly basis, but the overall supply was relatively tight. The sellers in the market were more than buyers, which resulted in slack transactions and a slight accumulation in the inventory in Guangdong. The arrivals in the Tianjin market were low as many brands such as Zijin zinc were sent to Shanghai, and meanwhile the downstream enterprises purchased as needed. Therefore, the inventory in Tianjian dropped slightly. Taken together, inventories in Shanghai, Guangdong and Tianjin added 300 mt, and inventories across seven major markets in China gained 400 mt.

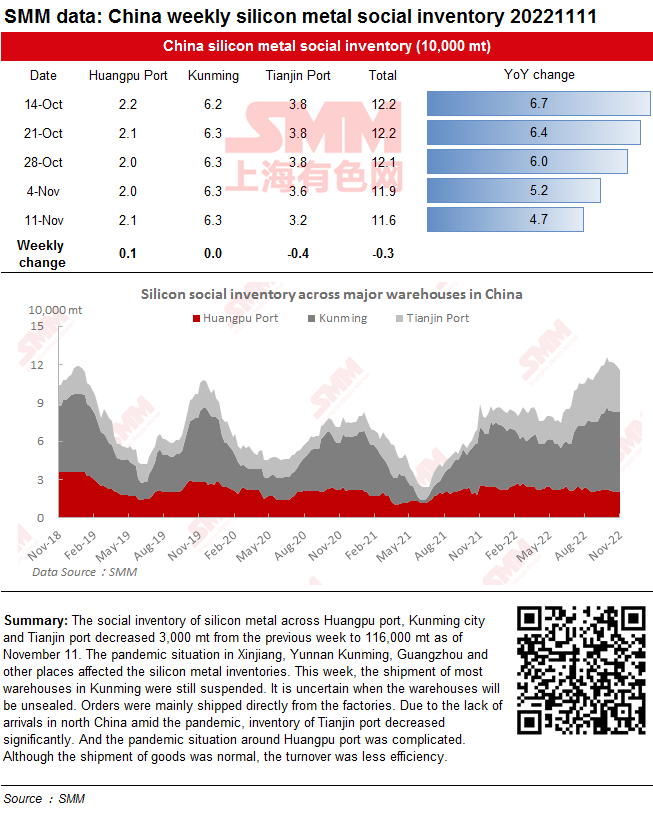

The arrivals are Limited by the Pandemic, and the Social Inventory of Silicon Metal Declines

The social inventory of silicon metal across Huangpu port, Kunming city and Tianjin port decreased 3,000 mt from the previous week to 116,000 mt as of November 11. The pandemic situation in Xinjiang, Yunnan Kunming, Guangzhou and other places affected the silicon metal inventories. This week, the shipment of most warehouses in Kunming were still suspended. It is uncertain when the warehouses will be unsealed. Orders were mainly shipped directly from the factories. Due to the lack of arrivals in north China amid the pandemic, inventory of Tianjin port decreased significantly. And the pandemic situation around Huangpu port was complicated. Although the shipment of goods was normal, the turnover was less efficiency.

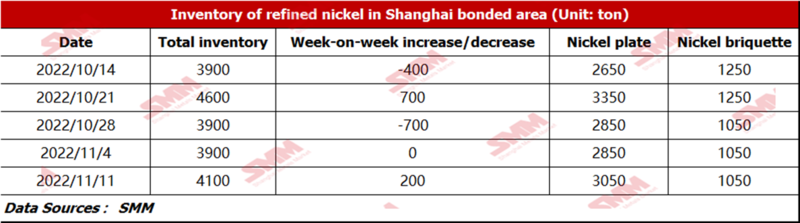

Bonded Zone Inventory of Nickel Falls Slightly from November 4

According to SMM research, the bonded zone inventory stood at 4,100 mt this week. The inventory of nickel briquette was 1,050 mt, and that of nickel plate stood at 3,050 mt. Spot import losses stood at around 9,000 yuan/mt in the weekaffected by price difference between the domestic and overseas futures prices. Downstream demand weakened amid the surging futures prices. Besides, the huge import losses reduced the clearance volume.

Copper Inventories in Domestic Bonded Zones Dip 2,600 mt from November 4

SMM survey showed that copper inventories in domestic bonded zones dipped 2,600 mt from November 4 to 28,300 mt as of November 11. Inventory in the Shanghai bonded zone dipped 1,700 mt to 23,400 mt, and that in the Guangdong bonded zone fell 900 mt to 4,900 mt. Importers who locked the price ratio when the import window was open in the past few weeks moved the goods from the bonded warehouse to the domestic market, driving the inventory down.

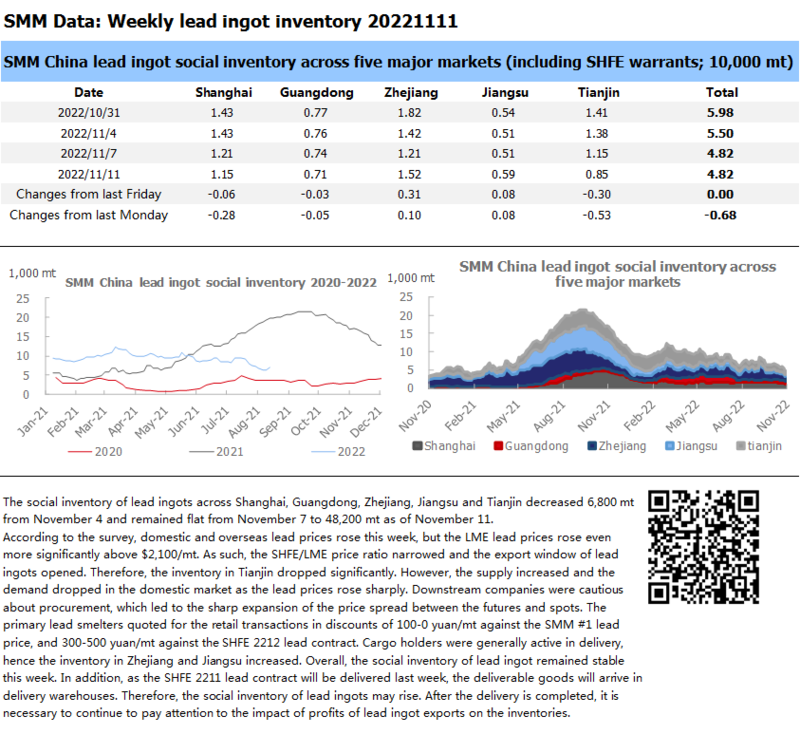

Social Inventory of Lead Ingots Remains Stable amid the Delivery and Exports

The social inventory of lead ingots across Shanghai, Guangdong, Zhejiang, Jiangsu and Tianjin decreased 6,800 mt from November 4 and remained flat from November 7 to 48,200 mt as of November 11.

According to the survey, domestic and overseas lead prices rose this week, but the LME lead prices rose even more significantly above $2,100/mt. As such, the SHFE/LME price ratio narrowed and the export window of lead ingots opened. Therefore, the inventory in Tianjin dropped significantly. However, the supply increased and the demand dropped in the domestic market as the lead prices rose sharply. Downstream companies were cautious about procurement, which led to the sharp expansion of the price spread between the futures and spots. The primary lead smelters quoted for the retail transactions in discounts of 100-0 yuan/mt against the SMM #1 lead price, and 300-500 yuan/mt against the SHFE 2212 lead contract. Cargo holders were generally active in delivery, hence the inventory in Zhejiang and Jiangsu increased. Overall, the social inventory of lead ingot remained stable this week. In addition, as the SHFE 2211 lead contract will be delivered last week, the deliverable goods will arrive in delivery warehouses. Therefore, the social inventory of lead ingots may rise. After the delivery is completed, it is necessary to continue to pay attention to the impact of profits of lead ingot exports on the inventories.

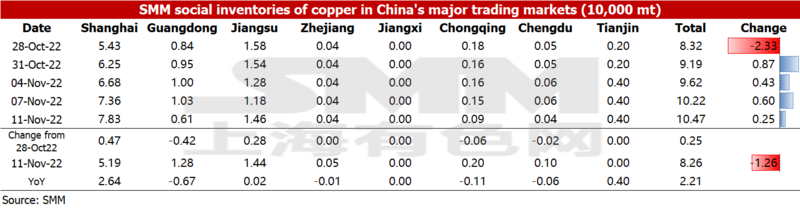

Copper Inventory across Major Chinese Markets Add 2,500 mt from Monday

As of Friday November 11, SMM copper inventory across major Chinese markets stood at 104,700 mt, up 2,500 mt from Monday and 8,500 mt from last Friday. The total inventory was 22,100 mt higher than the same period last year when the figure was 82,600 mt. Inventory in Shanghai added 26,400 mt compared with the same period last year, that in Guangdong dropped 6,700 mt. Inventories in Jiangsu, Zhejiang and Jiangxi stood flat YoY, and those in Chongqing and Chengdu dipped 1,100 mt and 600 mt respectively. The inventory grew this week as the arrival of imported copper increased and the consumption weakened by the sharp rise in copper prices.

The inventory in Shanghai grew due to the large inflow of imported copper and the average consumption. It should be noted that 10,000 mt of deliverable copper flowed into the SHFE warehouses. Lower inventory in Guangdong was caused by the tight supply and rare arrivals.

The SHFE 2211 copper will be delivered next Tuesday. It is expected that this weekend and at the beginning of next week, the SHFE inventory will increase significantly. After the delivery is completed, some copper warrants will flow into the market, slightly pushing up the social inventory.

![[SMM Analysis] Chrome Ore Market Got Off to a Good Start after Chinese New Year amid Tight Supply](https://imgqn.smm.cn/usercenter/ChqBy20251217171724.jpeg)