SHANGHAI, Oct 28 (SMM) - This is a roundup of China's metals weekly inventory as of October 28.

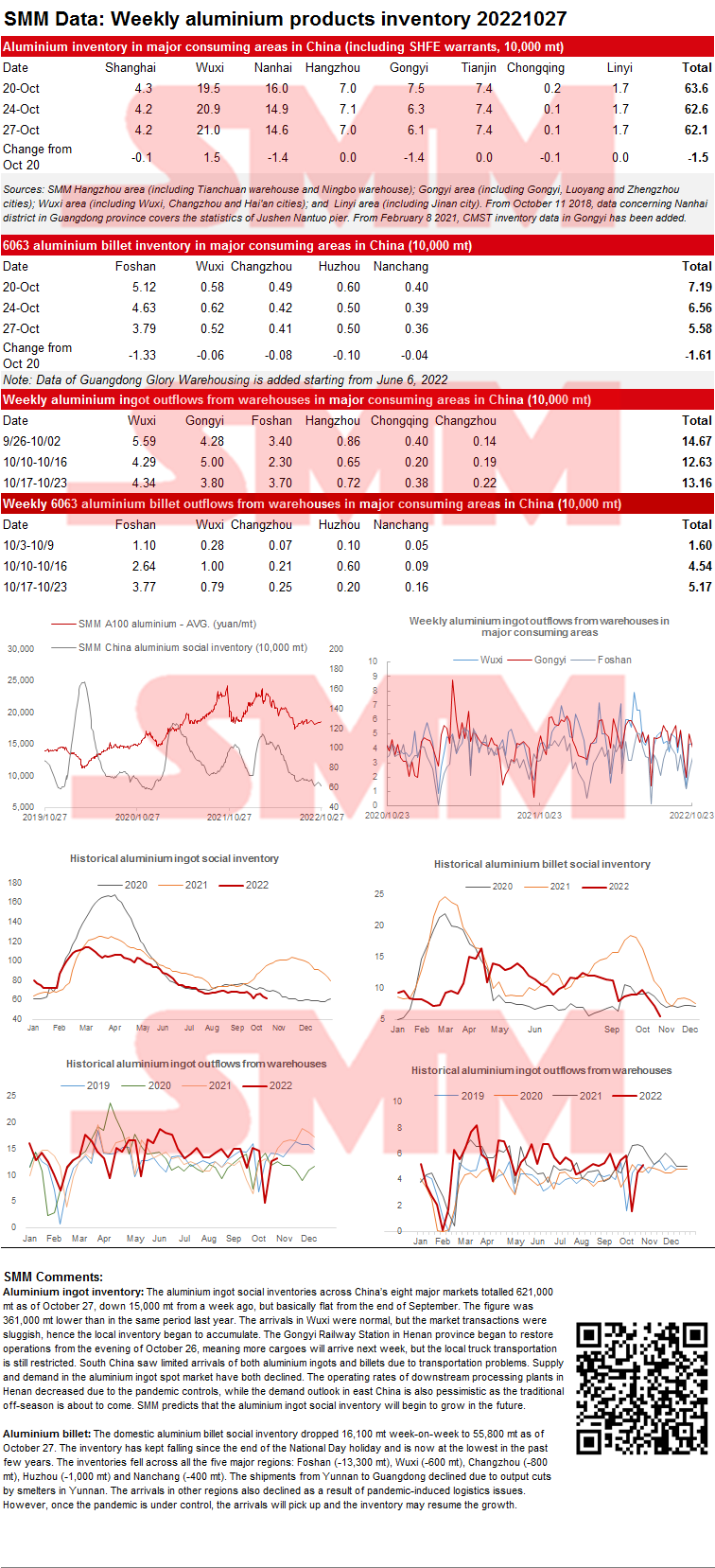

SMM Updates on China Aluminium Ingot and Billet Social Inventories as of October 27

Aluminium ingot inventory: The aluminium ingot social inventories across China’s eight major markets totalled 621,000 mt as of October 27, down 15,000 mt from a week ago, but basically flat from the end of September. The figure was 361,000 mt lower than in the same period last year. The arrivals in Wuxi were normal, but the market transactions were sluggish, hence the local inventory began to accumulate. The Gongyi Railway Station in Henan province began to restore operations from the evening of October 26, meaning more cargoes will arrive next week, but the local truck transportation is still restricted. South China saw limited arrivals of both aluminium ingots and billets due to transportation problems. Supply and demand in the aluminium ingot spot market have both declined. The operating rates of downstream processing plants in Henan decreased due to the pandemic controls, while the demand outlook in east China is also pessimistic as the traditional off-season is about to come. SMM predicts that the aluminium ingot social inventory will begin to grow in the future.

Aluminium billet: The domestic aluminium billet social inventory dropped 16,100 mt week-on-week to 55,800 mt as of October 27. The inventory has kept falling since the end of the National Day holiday and is now at the lowest in the past few years. The inventories fell across all the five major regions: Foshan (-13,300 mt), Wuxi (-600 mt), Changzhou (-800 mt), Huzhou (-1,000 mt) and Nanchang (-400 mt). The shipments from Yunnan to Guangdong declined due to output cuts by smelters in Yunnan. The arrivals in other regions also declined as a result of pandemic-induced logistics issues. However, once the pandemic is under control, the arrivals will pick up and the inventory may resume the growth.

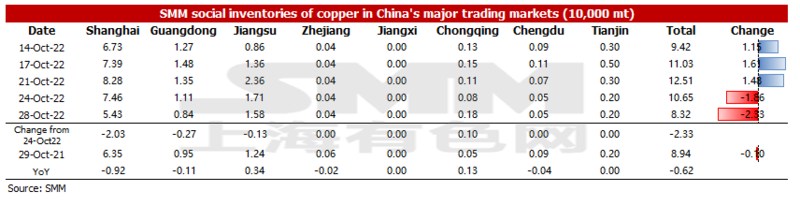

Copper Inventory across Major Chinese Markets Dip 23,300 mt from Monday

As of Friday October 28, SMM copper inventory across major Chinese markets stood at 83,200 mt, down 23,300 mt from Monday and 41,900 mt from last Friday. Compared with Monday’s data, the inventory in all regions of China decreased except that in Chongqing. The total inventory was 6,200 mt lower than in the same period last year when the inventory stood at 89,400 mt. Among them, the inventory in Shanghai fell 9,200 mt, that in Guangdong dipped 1,100 mt, while that in Jiangsu added 3,400 mt. The supply and demand were both weak this week, but the arrivals were fewer, resulting in a decline in inventory.

In detail, the inventory in Shanghai dipped 20,300 mt to 54,300 mt because the arrival of imported copper was delayed. Inventory in Guangdong dropped 2,700 mt to 8,400 mt due to the maintenance of smelters in surrounding areas and the low arrival of imported copper. The inventory in Chongqing added 1,000 mt due to poor consumption.

Looking forward, the total supply is expected to increase slightly owing to the arrival of imported copper next week and the low arrival of domestic copper. At the beginning of November, downstream consumption may be better. The market shall keep an eye on the price trend. If consumption improved further, the total inventory would decline slightly next week.

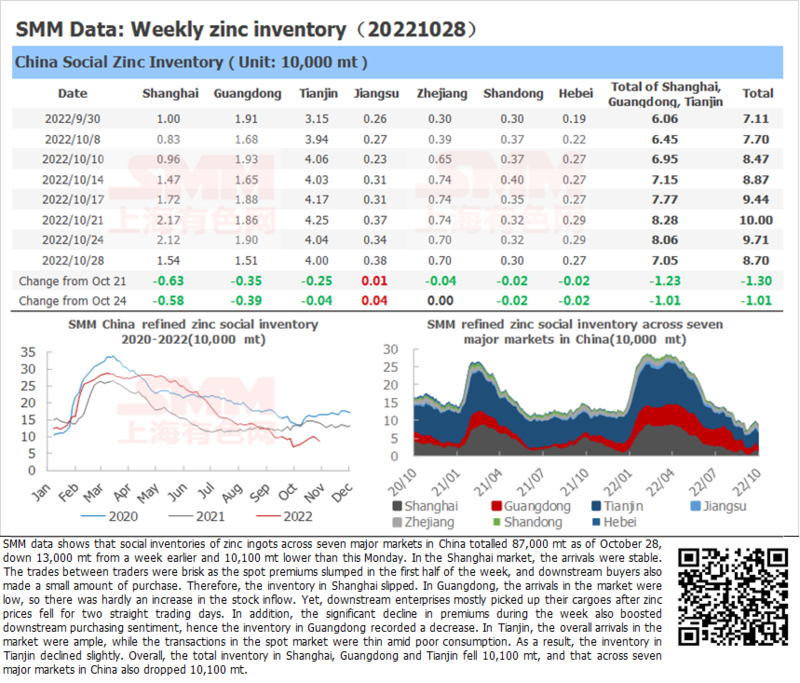

Zinc Ingot Inventory Declines 10,100 mt Compared with Monday

SMM data shows that social inventories of zinc ingots across seven major markets in China totalled 87,000 mt as of October 28, down 13,000 mt from a week earlier and 10,100 mt lower than this Monday. In the Shanghai market, the arrivals were stable. The trades between traders were brisk as the spot premiums slumped in the first half of the week, and downstream buyers also made a small amount of purchase. Therefore, the inventory in Shanghai slipped. In Guangdong, the arrivals in the market were low, so there was hardly an increase in the stock inflow. Yet, downstream enterprises mostly picked up their cargoes after zinc prices fell for two straight trading days. In addition, the significant decline in premiums during the week also boosted downstream purchasing sentiment, hence the inventory in Guangdong recorded a decrease. In Tianjin, the overall arrivals in the market were ample, while the transactions in the spot market were thin amid poor consumption. As a result, the inventory in Tianjin declined slightly. Overall, the total inventory in Shanghai, Guangdong and Tianjin fell 10,100 mt, and that across seven major markets in China also dropped 10,100 mt.

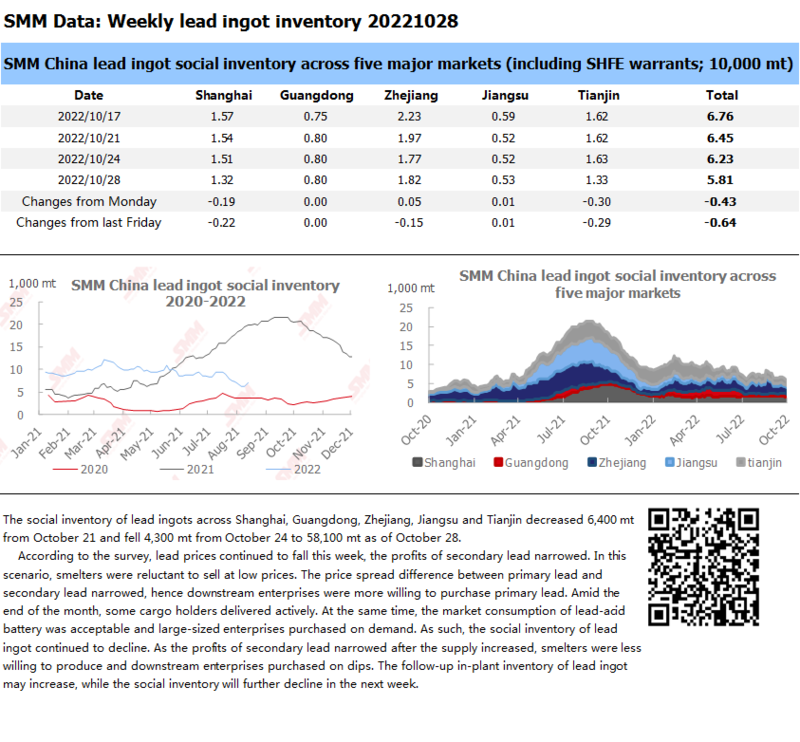

Smelters Reduce Shipments of Lead Ingots due to Poor losses and the Social Inventory Continues to Fal

The social inventory of lead ingots across Shanghai, Guangdong, Zhejiang, Jiangsu and Tianjin decreased 6,400 mt from October 21 and fell 4,300 mt from October 24 to 58,100 mt as of October 28.

According to the survey, lead prices continued to fall this week, the profits of secondary lead narrowed. In this scenario, smelters were reluctant to sell at low prices. The price spread difference between primary lead and secondary lead narrowed, hence downstream enterprises were more willing to purchase primary lead. Amid the end of the month, some cargo holders delivered actively. At the same time, the market consumption of lead-acid battery was acceptable and large-sized enterprises purchased on demand. As such, the social inventory of lead ingot continued to decline. As the profits of secondary lead narrowed after the supply increased, smelters were less willing to produce and downstream enterprises purchased on dips. The follow-up in-plant inventory of lead ingot may increase, while the social inventory will further decline in the next week.

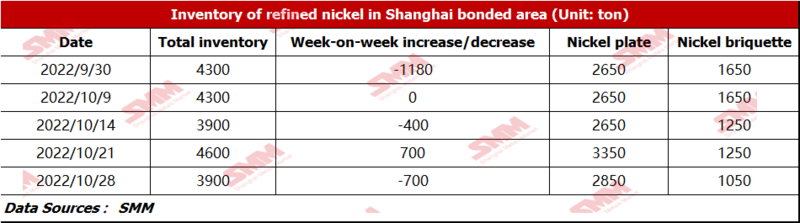

Nickel Inventories in Domestic Bonded Zone Dip 700 mt from October 21

SMM research showed that the bonded zone inventory of nickel dropped by 700 mt to 3,900 mt this week. The inventory of nickel briquette was 1,050 mt, and that of nickel plate stood at 2,850 mt. Although imports of spot pure nickel suffered losses this week, a few nickel briquettes that were locked in the price ratio still cleared customs due to factors such as the rigid demand from nickel sulphate producers. The clearance volume of nickel plates was low as the civil alloy and stainless steel industries entered the off-season.

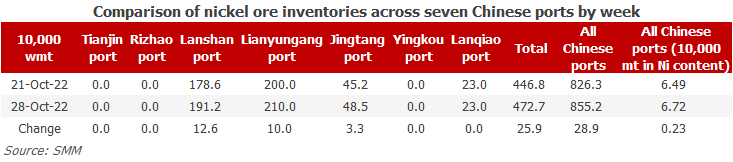

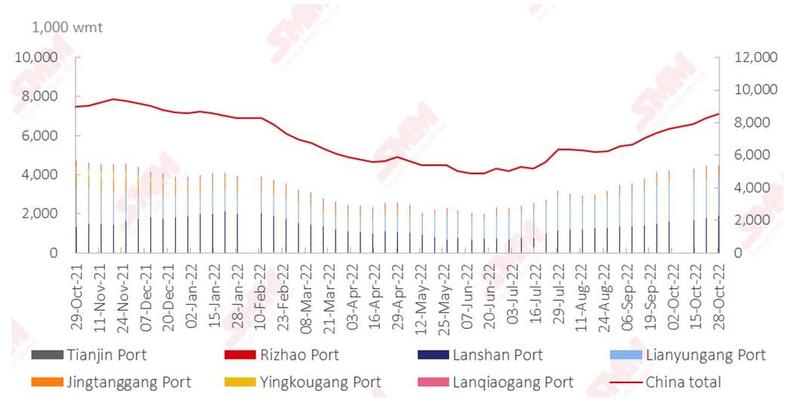

Nickel Ore Inventories at Chinese Ports Up 289,000 wmt WoW

As of October 28, the inventory of nickel ore across Chinese ports increased by 289,000 wmt to 8.55 million wmt compared with last Friday. The total Ni content stood at 67,000 mt. Port inventory of nickel ore across seven major Chinese ports stood at 4.73 million wmt, 259,000 wmt higher than last week. In October, the nickel ore purchased by the NPI plants before the rainy season gradually arrived. The short-term port inventory will continue to rise, but the growth will be limited by the rainy season in the Philippines, and by then, the inventory will decline.

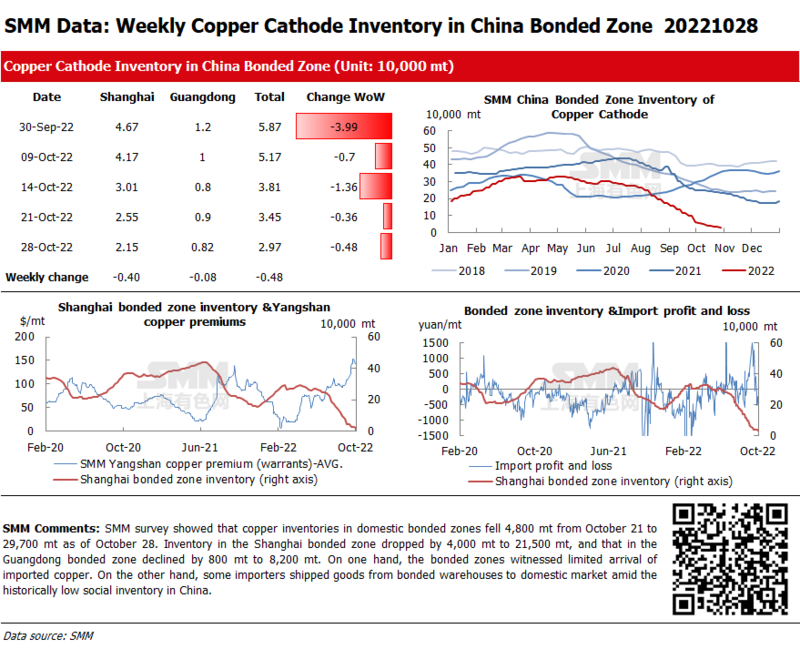

Copper Inventories in Domestic Bonded Zones Dip 4,800 mt from October 21

SMM survey showed that copper inventories in domestic bonded zones fell 4,800 mt from October 21 to 29,700 mt as of October 28. Inventory in the Shanghai bonded zone dropped by 4,000 mt to 21,500 mt, and that in the Guangdong bonded zone declined by 800 mt to 8,200 mt. On one hand, the bonded zones witnessed limited arrival of imported copper. On the other hand, some importers shipped goods from bonded warehouses to the domestic market amid the historically low social inventory in China.

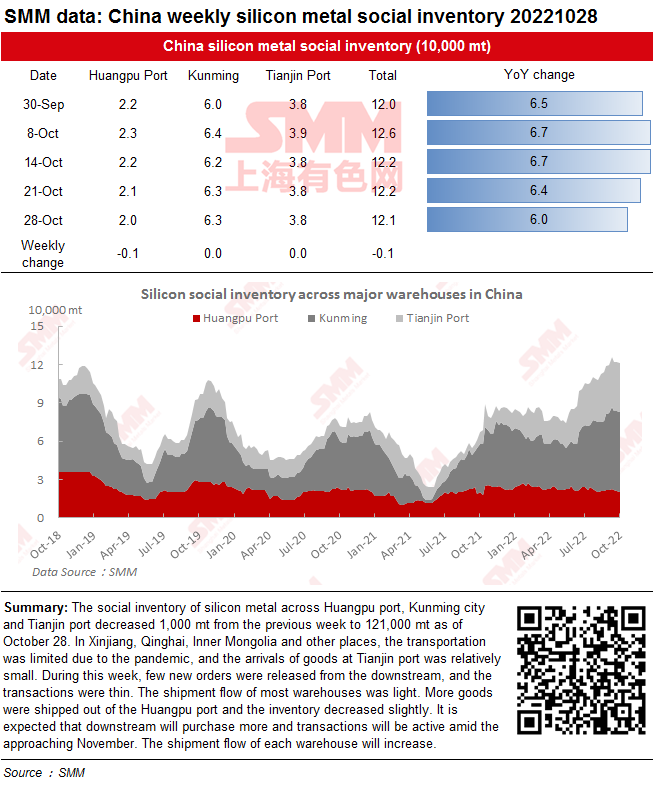

Affected by Pandemic in North China, Arrivals of Silicon in Tianjin Port Decrease

The social inventory of silicon metal across Huangpu port, Kunming city and Tianjin port decreased 1,000 mt from the previous week to 121,000 mt as of October 28. In Xinjiang, Qinghai, Inner Mongolia and other places, the transportation was limited due to the pandemic, and the arrivals of goods at Tianjin port was relatively small.

During this week, few new orders were released from the downstream, and the transactions were thin. The shipment flow of most warehouses was light. More goods were shipped out of the Huangpu port and the inventory decreased slightly. It is expected that downstream will purchase more and transactions will be active amid the approaching November. The shipment flow of each warehouse will increase.