SHANGHAI, Aug 19 (SMM) - This is a roundup of China's metals weekly inventory as of August 19.

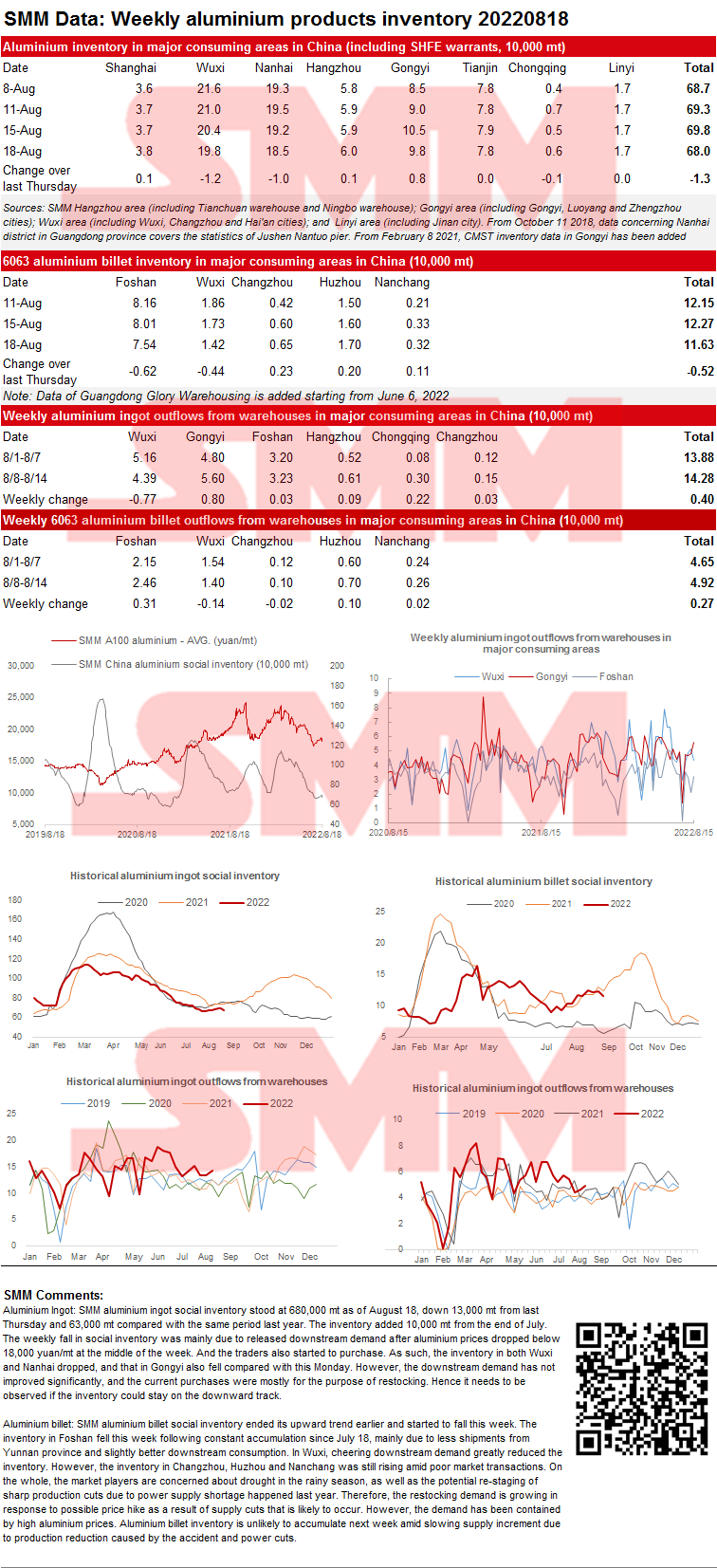

Aluminium Ingot and Billet Inventory both Fell on Week

SMM aluminium ingot social inventory stood at 680,000 mt as of August 18, down 13,000 mt from last Thursday and 63,000 mt compared with the same period last year. The inventory added 10,000 mt from the end of July. The weekly fall in social inventory was mainly due to released downstream demand after aluminium prices dropped below 18,000 yuan/mt at the middle of the week. And the traders also started to purchase. As such, the inventory in both Wuxi and Nanhai dropped, and that in Gongyi also fell compared with this Monday. However, the downstream demand has not improved significantly, and the current purchases were mostly for the purpose of restocking. Hence it needs to be observed if the inventory could stay on the downward track.

Aluminium billet: SMM aluminium billet social inventory ended its upward trend earlier and started to fall this week. The inventory in Foshan fell this week following constant accumulation since July 18, mainly due to less shipments from Yunnan province and slightly better downstream consumption. In Wuxi, cheering downstream demand greatly reduced the inventory. However, the inventory in Changzhou, Huzhou and Nanchang was still rising amid poor market transactions. On the whole, the market players are concerned about drought in the rainy season, as well as the potential re-staging of sharp production cuts due to power supply shortage happened last year. Therefore, the restocking demand is growing in response to possible price hike as a result of supply cuts that is likely to occur. However, the demand has been contained by high aluminium prices. Aluminium billet inventory is unlikely to accumulate next week amid slowing supply increment due to production reduction caused by the accident and power cuts.

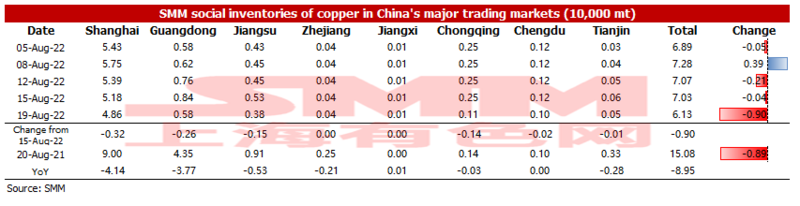

Copper Inventory in Major Chinese Markets Dropped 9,000 mt from Monday

As of Friday August 19, SMM copper inventory across major Chinese markets stood at 61,300 mt, down 9,000 mt from Monday and 9,400 mt from last Friday, hitting an annual low. Compared with Monday's data, the inventories across various regions decreased this week. The total inventory fell 89,500 mt compared with the same period last year when the inventory was recorded at 150,800 mt. Among them, the inventory in Shanghai dropped 41,400 mt, and that in Guangdong dipped 37,700 mt. The reasons for the sharp decline in the inventory this week are as follows. 1. Output of smelters in Jiangsu, Anhui, Zhejiang and Hubei reduced to varying degrees due to the power rationing. 2. Transportation efficiency in Jiangxi declined owing to the pandemic outbreak. 3. The imported copper expected to arrive at ports at the beginning of the week was delayed until the weekend.

In detail, the inventory in Shanghai dipped 3,200 mt to 48,600 mt due to the power rationing and delayed arrival of imported copper, and the inventory in Guangdong fell 2,600 mt to 5,800 mt amid the maintenance of surrounding smelters and the power rationing out of the province.

Looking forward, more output will be cut by the power rationing, but the arrival of imported copper may increase, hence the overall supply will rise compared with this week. In terms of consumption, downstream factories were not affected by the high spot premiums, so the consumption will not drop sharply next week. SMM believes that the weekly inventory next week may rise slightly. It is necessary to pay attention to whether the scope of power rationing will continue to expand.

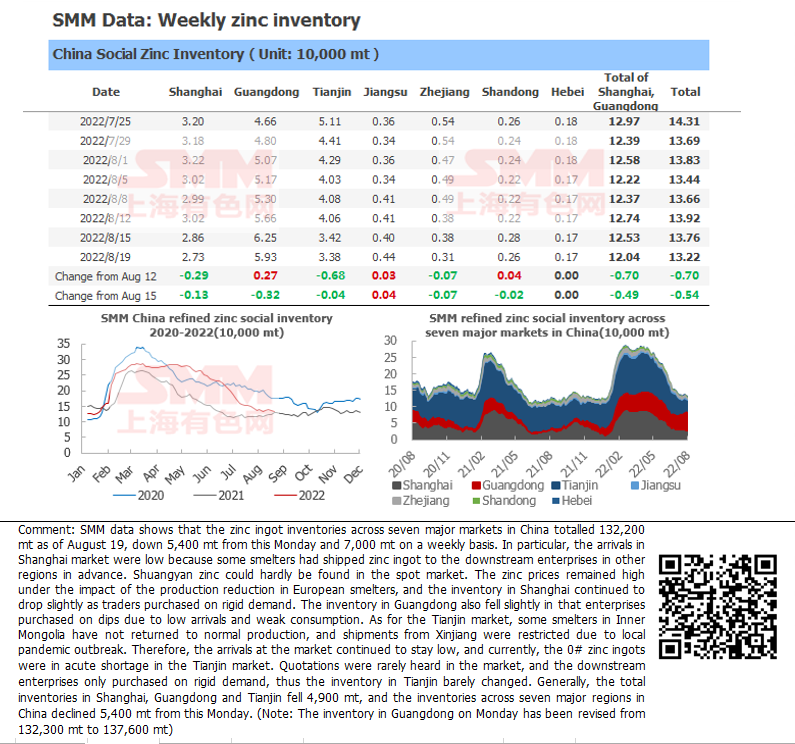

Zinc Ingot Social Inventory in Seven Major Regions Decreased 5,400 mt from Monday

SMM data shows that the zinc ingot inventories across seven major markets in China totalled 132,200 mt as of August 19, down 5,400 mt from this Monday and 7,000 mt on a weekly basis. In particular, the arrivals in Shanghai market were low because some smelters had shipped zinc ingot to the downstream enterprises in other regions in advance. Shuangyan zinc could hardly be found in the spot market. The zinc prices remained high under the impact of the production reduction in European smelters, and the inventory in Shanghai continued to drop slightly as traders purchased on rigid demand. The inventory in Guangdong also fell slightly in that enterprises purchased on dips due to low arrivals and weak consumption. As for the Tianjin market, some smelters in Inner Mongolia have not returned to normal production, and shipments from Xinjiang were restricted due to local pandemic outbreak. Therefore, the arrivals at the market continued to stay low, and currently, the 0# zinc ingots were in acute shortage in the Tianjin market. Quotations were rarely heard in the market, and the downstream enterprises only purchased on rigid demand, thus the inventory in Tianjin barely changed. Generally, the total inventories in Shanghai, Guangdong and Tianjin fell 4,900 mt, and the inventories across seven major regions in China declined 5,400 mt from this Monday. (Note: The inventory in Guangdong on Monday has been revised from 132,300 mt to 137,600 mt)

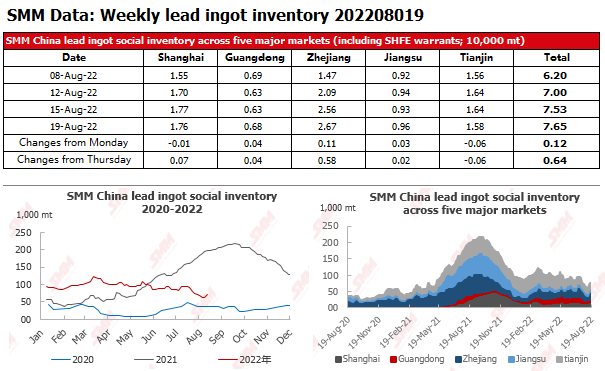

Social Inventory of Lead Ingots Increased amid the Delivery of SHFE 2208 Contract, Further Attention should be Paid to the Impact of Power Rationing and Exports

As of August 19, the social inventory of lead ingots across Shanghai, Guangdong, Zhejiang, Jiangsu and Tianjin was 76,500 mt, down 6,400 mt from last Friday (August 12) and down 1,200 mt from last Monday (August 15).

According to research, due to the high temperature, lead industry was affected by power rationing, including the production of primary lead, secondary lead and lead-acid battery. Therefore, both supply and demand of lead ingots was weak. SHFE 2208 lead contract was delivered this Monday and about 16,000 mt of goods were delivered, hence the social inventory rose sharply. However, as the lead prices fell during the week, downstream enterprises mainly purchased as demand. Therefore, the increase of social inventory slowed down. The power rationing is unlikely to stop next week, hence the supply and demand will be further affected. Meanwhile, market should pay attention to the goods flowing back to the market after the delivery of futures contract, and the expectation of exports. It is expected that the increase of lead ingot social inventory will continue to slow down.

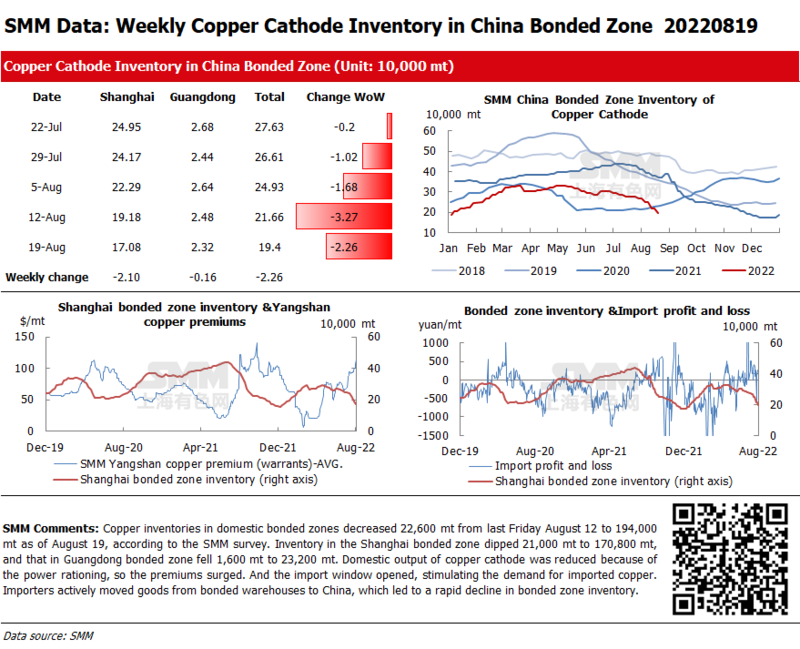

Copper Inventories in Domestic Bonded Zones Dipped 22,600 mt from Last Friday

Copper inventories in domestic bonded zones decreased 22,600 mt from last Friday August 12 to 194,000 mt as of August 19, according to the SMM survey. Inventory in the Shanghai bonded zone dipped 21,000 mt to 170,800 mt, and that in Guangdong bonded zone fell 1,600 mt to 23,200 mt. Domestic output of copper cathode was reduced because of the power rationing, so the premiums surged. And the import window opened, stimulating the demand for imported copper. Importers actively moved goods from bonded warehouses to China, which led to a rapid decline in bonded zone inventory.

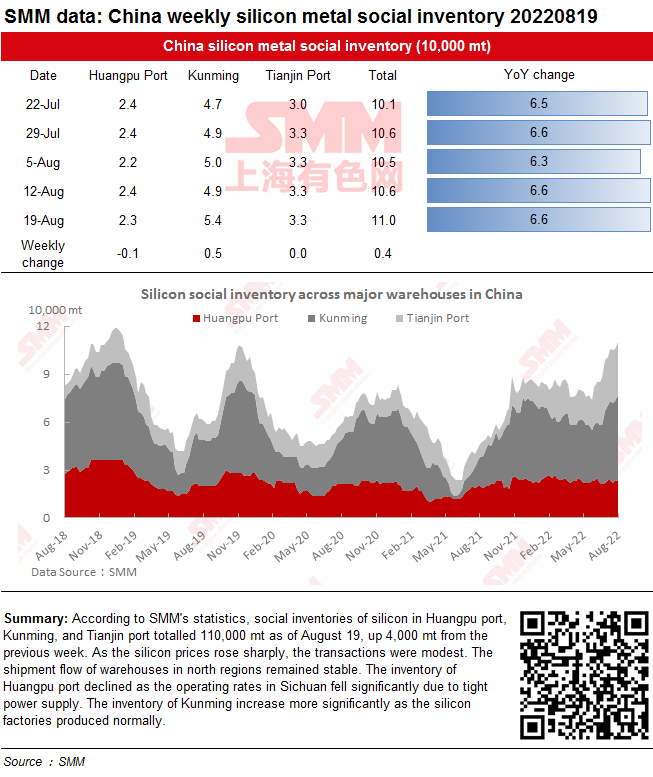

Social Inventories of Silicon Increased on the Week

According to SMM's statistics, social inventories of silicon in Huangpu port, Kunming, and Tianjin port totalled 110,000 mt as of August 19, up 4,000 mt from the previous week. As the silicon prices rose sharply, the transactions were modest. The shipment flow of warehouses in north regions remained stable. The inventory of Huangpu port declined as the operating rates in Sichuan fell significantly due to tight power supply. The inventory of Kunming increase more significantly as the silicon factories in Yunan produced normally.

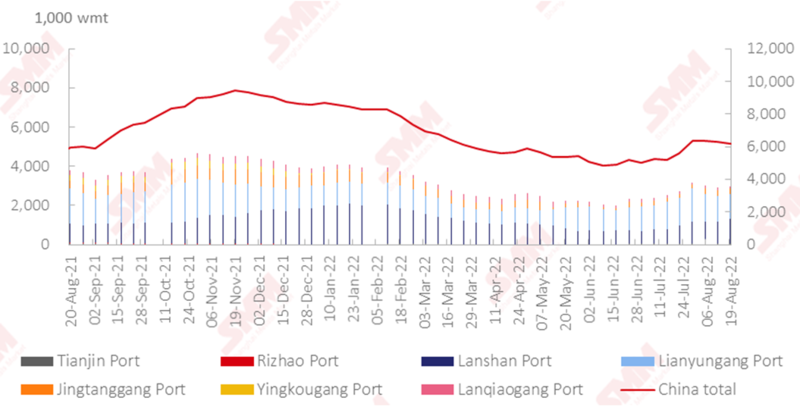

Nickel Ore Inventories at Chinese Ports Fell 80,000 wmt WoW

As of August 19, the nickel ore inventory at Chinese ports dipped 80,000 wmt from a week earlier to 6.21 million wmt. The total Ni content stood at 48,800 mt. Port inventory of nickel ore across seven major Chinese ports stood at 2,968,000 wmt, 60,000 wmt higher than last week. The sluggish stainless steel and NPI markets weakened their demand for nickel ore. On the supply side, the shipment was low amid the poor demand, and the mines generally held a wait-and-see sentiment because of the rainy season. The short-term port inventory of nickel ore will hover around the current level, and the supply may remain tight.

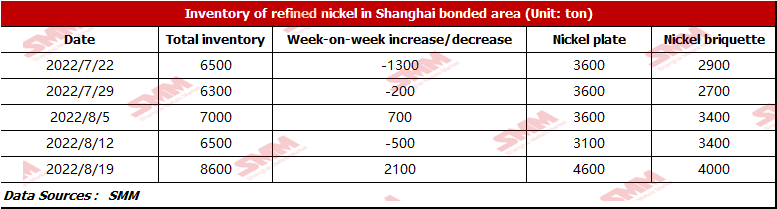

Bonded Zone Inventory of Nickel Rose 2,100 mt from Last Week

According to the SMM research, the bonded zone inventory stood at 8,600 mt this week. The inventory of nickel briquette was 4,000 mt, and that of nickel plate was 4,600 mt, 1,500 mt higher than last week. At present, the downstream still purchases on rigid demand. Besides, some pure nickel arrived at ports this week as some traders have locked in the price ratio. Nickel briquette inventory added 600 mt mainly because of the peak season of new energy industry. In addition, some salt plants purchased the nickel briquette on their rigid demand based on their long-term orders.