SHANGHAI, Apr 22 (SMM) - This is a roundup of China's metals weekly inventory as of April 22.

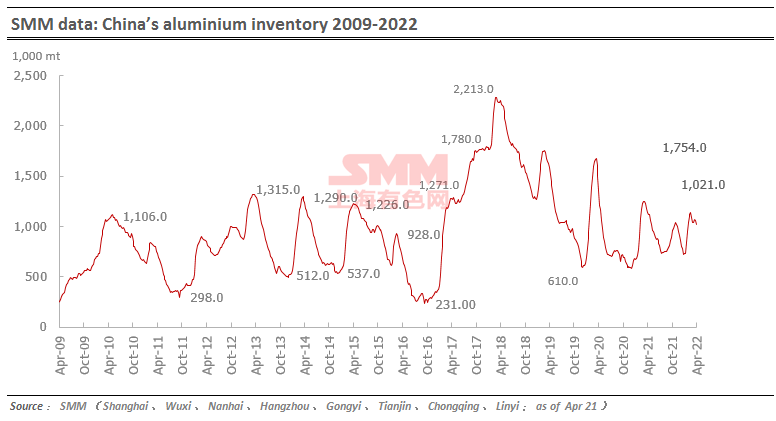

Aluminium Ingot Destocking in China Accelerated

The domestic aluminium ingot social inventory totalled 1.02 million mt as of April 21, down 42,000 mt from last Thursday. Wuxi registered an increase of 2,000 mt as poor transportation curbed the pick-up of cargoes. The inventories in other regions declined amid increased shipments out of warehouses. Gongyi saw normal arrivals and increased sales. Buyers in other areas where cargo pick-up was hindered made purchases from Gongyi, allowing the local inventory to drop by 33,000 mt. The inventory in Nanhai continued to fall and decreased by 6,000 mt due to limited arrivals and strong demand. Aluminum smelters were enthusiastic about resuming their production, but the pandemic continued to disrupt their shipments. Downstream producers became more willingness to stock up after the pandemic situation improved slightly, allowing the inventories of aluminium ingots and billets to continue to fall. The market shall closely watch the impact of pandemic control measures on transportation and sustainability of downstream restocking after their production recovers.

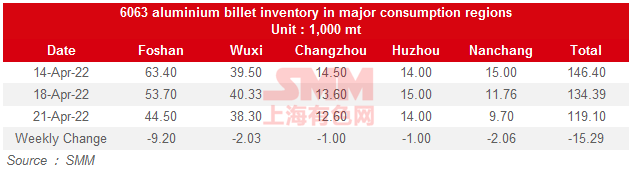

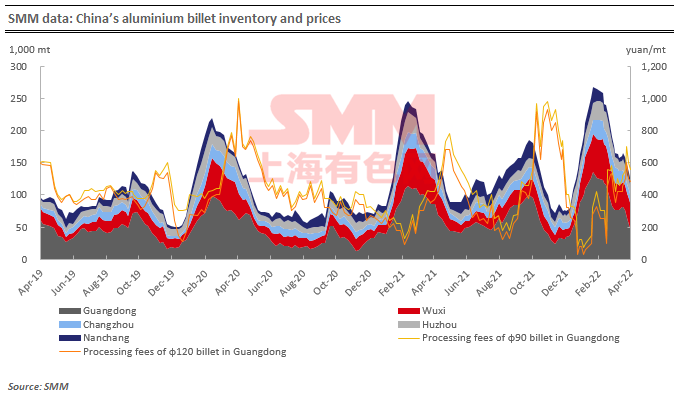

Inventory of Aluminium Billets Declined 15,300 mt as of April 21

The domestic aluminium billet inventory stood at 119,100 mt as of April 21, a drop of 11.37% from a week ago. The inventories declined across each of the five major regions: Nanchang (-2,100 mt or 17.52%); Changzhou (-1,000 mt or 7.35%); Foshan (-9,200 mt or 17.13%); Wuxi (-2,000 mt or 5.02%); Huzhou (-1,000 mt or 6.67%).

Foshan only allowed truck drivers who can provide 48-hour negative nucleic acid test results to enter, but drivers from Guangxi and Yunnan were reluctant to enter Foshan out of concerns that they might be unable to return. In east China, demand was still inhibited and transportation efficiency has not yet fully recovered under the impact of the pandemic. Downstream purchases in Nanchang were driven by rigid demand.

The transportation efficiency in east China is unlikely to improve significantly in the short term, which will keep inventories largely stable. Destocking in south China was driven by the peak season. The overall inventories are expected to continue to decline as downstream buyers will stock up for the upcoming Labour Day holiday. The intensity of destocking will depend on logistics situation and pandemic control measures in different regions.

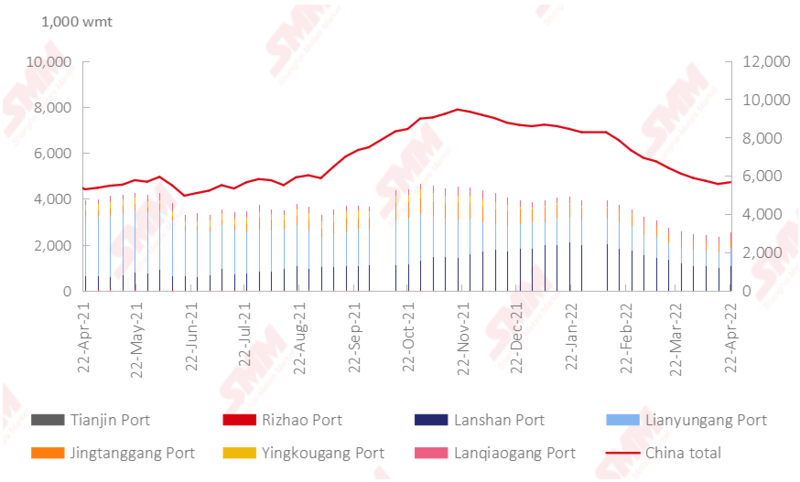

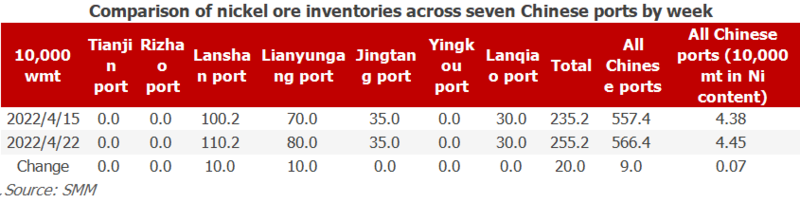

Nickel Ore Inventories at Chinese Ports up 90,000 wmt from Monday

As of April 22, the nickel ore inventory at Chinese ports increased 90,000 wmt from Monday to 5.664 million wmt. Total Ni content stood at 1,000 mt. The total inventory at seven major ports across China stood at 2.552 million wmt, 200,000 wmt higher than the previous week. The decrease in port inventory of nickel ore stops. The tight supply is eased by the increase in shipment from major mining areas in the south of the Philippines. However, due to the weather condition in the Philippines, it still takes some time to recover to the level of the peak season. Besides, weak downstream demand also contributed to the increase in nickel ore inventory. Due to the pandemic outbreak, the consumption of in-plant nickel ore inventory is slowed down by the difficulty in transporting raw materials and the production reduction of smelters, hence the port inventory stops declining. SMM expects that nickel ore inventory will remain at the current level. It will rise sharply when the shipments of nickel ore from the Philippines increase significantly.

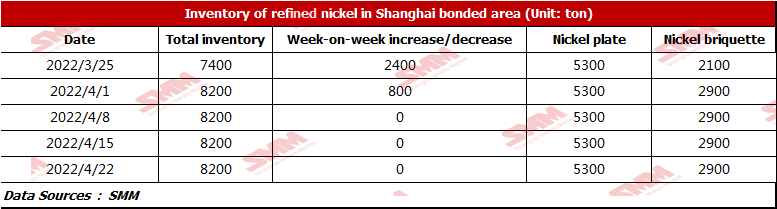

Nickel Inventory in Shanghai Bonded Zone Remained almost Unchanged this Week

This week, LME nickel remained volatile. Although SHFE nickel prices rose, the imports were still at losses. Nickel inventory in Shanghai bonded zone was 8,200 mt this week. The inventory of nickel briquettes and nickel plates was 2,900 mt and 5,300 mt respectively, flat from last week. Due to the COVID-19 outbreak, the operation in Shanghai bonded zone stagnated. At present, LME nickel has not regained its liquidity, but SHFE nickel prices are high due to the shortage of supply in China. If SHFE nickel prices remain high next week, the imports will gain profits.

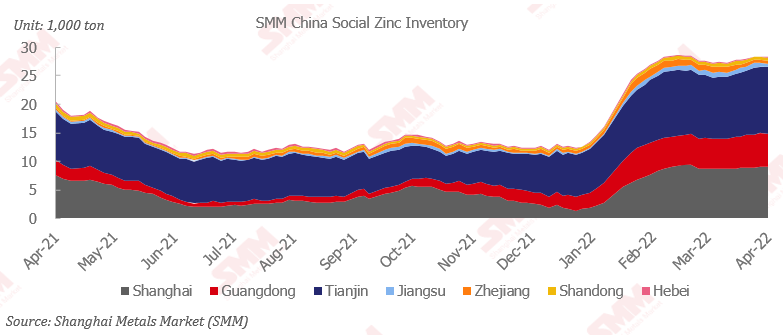

Inventory of Zinc Rose 500 mt from April 15

Total zinc ingots inventories across seven markets stood at 283,600 mt as of Friday April 22, up 500 mt from April 15, down 400 mt from April 18. The slight decrease in domestic inventory was mainly from warehouses in Jiangsu. While Shanghai was still in a lockdown, the market turned to pick up goods in Jiangsu, resulting in the decreases in inventory of Jiangsu. In Shanghai, there were only a small amount of railway arrivals due to the lockdown. In addition, Yuqiang indicated that it has been available for pick-up by appointment, but no shipments have been seen, which lead to a slight increases in inventory. In Tianjin, the arrivals reduced slightly with the market purchasing on rigid demand. The inventory decreased slightly amid weak supply and demand. In Guangdong, the arrivals declined slightly and the inventory picked up because of the moderate consumption. Inventories in Shanghai, Guangdong and Tianjin rose 900 mt, and inventories across seven markets decreased 500 mt.