Recently, according to several media reports, Didi's car-building plan codenamed "Da Vinci" may be announced in June this year, which will first build two models for the passenger car market and the online car-hailing market, among them, the model for the passenger car market will be named C1, which will be located at 150000 yuan of compact pure electric cars. The car-hailing model for online ride-hailing is D1 Light, a stripped-down version of D1, which will continue to be manufactured by BYD and will be used by its Huaxiu ride-hailing platform in the future.

This is another major move to adjust the line of business after Didi was laid off by 20% at the beginning of this year. After the news was exposed by the media, Didi, which has always been in a whirlpool of public opinion, has once again become the focus of attention inside and outside the industry. So why did Didi, which had previously announced that it was "determined not to build cars", dabble in building cars at this time? It also starts with its current financial situation.

As the loss widened, Didi was forced to seek other profit points.

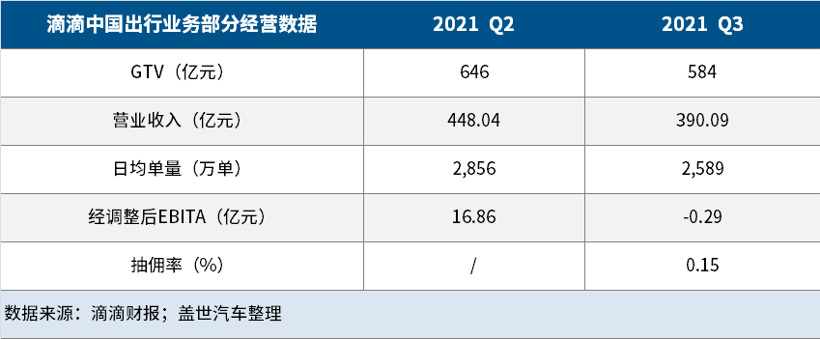

The past year has undoubtedly been a struggling year for Didi, as evidenced by its unaudited results for the second and third quarters of 2021 disclosed at the end of last year. According to the financial report, Didi's net loss widened from 24.271 billion yuan in Q2 in 2021 to 30.375 billion yuan in Q3. In 2021, Didi's total revenue was 42.675 billion yuan, down 11.48% from Q2. Among them, the revenue of China's travel sector was 39 billion yuan, down 19% from the previous month. The income was relative to Q2's 1.7 billion yuan, while Q3 lost 17 million yuan.

According to the division of business, Didi's current scope of business covers Chinese travel business, international business, bike sharing, freight, self-driving, financial services and other businesses. Among them, China's travel business, including ride-hailing, taxi, ride-hailing, ride-sharing and so on, is the largest contribution to revenue in Didi's existing business, and the losses in this part of the business directly lead to the limitation of Didi's profitability.

The main factor behind the limited profitability of Didi's China travel business is that "DiDi" APP was removed from the shelves. In July last year, Didi was forcibly removed from the "DiDi" APP by the State Cyber Information Office on suspicion of illegally collecting and using personal information. After the incident, on the one hand, Didi was unable to get new customers in the domestic ride-hailing market, on the other hand, other ride-hailing platforms, such as T3 Travel and Cao Cao Travel, took advantage of the opportunity to increase concessions and erode Didi's original market share through a "price war". Didi is obviously having a hard time when it is unable to get increments and its original market share is diluted.

Data show that Didi's current average daily orders have fallen from 25 million to 20 million, a decline of nearly 20 per cent. At the same time, its US stock price has fallen from $14 per share to about $4 now, and its market capitalization has shrunk from $67.8 billion at the beginning of the IPO to $19.3 billion today, a decline of more than 2/3.

The share price of Didi US stock on March 18, Photo: screenshot of Oriental Fortune Network

Losses have increased and market capitalization has shrunk sharply, prompting Didi to save itself by laying off staff and slimming down. Not long ago, Didi layoff plan was exposed by the media, the scope of its layoffs related to ride-hailing, two-wheelers, freight and other travel-related businesses, only the international department and self-driving department are not involved. An industry analyst said that Didi did not give up its autopilot division, which requires a lot of money in the face of huge losses, largely because it was optimistic about the future development prospects and profitability of autopilot.

However, as intelligent electric vehicles become the mainstream in the future, more and more vehicle manufacturers have joined the field of self-driving, and the use of self-developed self-driving systems in future automotive products is regarded by traditional car companies as holding the "soul" in their own hands. this brings many uncertain factors to the commercial application and profitability of the third-party self-driving technology. In this case, to build the car in person, on the one hand, it can land the self-developed self-driving technology well, on the other hand, it can also maximize the profit of the automobile software part.

Analysts pointed out that Didi car-building is caused by external factors, but it is more based on the adjustment of its existing business model. After the development of the main business sharing trip is blocked due to compliance problems, Didi urgently needs to seek other profit models, and cutting into the car-building track will also help to increase the leverage for Didi's smooth transfer to Hong Kong stocks after delisting from the United States.

United Nations witty Jun, Didi wants to build cars in the C-end market.

For car building, Didi has been involved in a lot of projects in recent years, or has accumulated some experience as a result. According to public data, Didi reached a strategic cooperation with ideal Automobile as early as 2018, and the two sides jointly invested 400 million yuan to create Orange Electric Travel, in which Didi holds 51% and ideal Automobile holds 49%. After the partnership, the two sides jointly developed a pure electric MPV, tailored for some of Didi's business, but the project stalled for other reasons. After the "Orange Electric Travel" project was shelved, Didi sought to cooperate with BYD to produce D1 electric vehicles. This car is based on the needs of passengers and drivers on the Didi platform and is aimed at the ride-hailing scene. It is also DiDi's first customized electric car.

Judging from the car-building projects that Didi has previously partnered with the whole car factory, its role is mostly a provider of data and information, and its cut into the field is only limited to the customized models in the online car-hailing scene. Now, Didi is off the market to build cars, cutting into not only the B-end market, but also passenger cars for C-end. According to people familiar with the matter, the C1 project for C-side products will be handled by Luo Wen, a veteran employee of Didi, and will report directly to Cheng Wei, CEO of Didi. At the same time, it is reported that Didi intends to acquire new energy car maker Guoji Zhijun in order to obtain the qualification of building cars as soon as possible. For the news, some netizens sought confirmation from Guoji Automobile on the Shanghai e-interaction, and the answer they got was that "Guoji Zhijun is in contact with a number of enterprises in the industry to seek suitable strategic investors." In addition, domestic media quoted Guoji Zhijun insider sources as saying that Didi is more likely to acquire Guoji Zhijun, perhaps there will be a result by the end of this month, and employees are waiting for follow-up arrangements.

According to public information, Guoji Zhijun was established in 2018 and is controlled by SAIC Group. In 2019, Guoji Zhijun officially obtained the production qualification, and then built a production base with an annual production capacity of 100000 vehicles in the Economic and technological Development Zone of Ganzhou City, Jiangxi Province. In April 2019, AVIC Zhijun unveiled five new pure electric cars at the Shanghai Auto Show, covering cars and SUV, three of which were launched in October 2019. Since the launch of the new product in 2019, three models owned by Guomi Zhijun have sold 4560 vehicles in 2020, falling to 1840 in 2021 and 63 in the first two months of this year, according to statistics from the Federation of passengers. Judging from this sales data, Guoji Zhijun is being rapidly marginalized in the new power of car building. Analysts at the Global Automotive Research Institute pointed out, "for Guoji Zhijun, the direct consequence of the stagnation of products and research and development is that the factory capacity is idle and the business situation has taken a sharp turn for the worse. In this case, being acquired or bringing in stronger investors is the best way out."

However, even if the successful acquisition of car-building qualifications and car-building capacity of the national machine Zhijun, for Didi, the next car is not easy. Some analysts pointed out that Didi has certain experience and technical reserves in the B-end market and self-driving field, but it lacks the ability and experience in vehicle design and manufacturing, while Guomi Zhijun itself belongs to a weak car enterprise. its own ability in design, research and development and core technology is insufficient, the combination of the two is very difficult to launch competitive C-end products within a short period of time.

In addition, as more and more traditional multinational car companies accelerate their transformation to the new energy field, there is not much time window left for China's new energy vehicle market to leave traditional independent brands and new car-building powers. and a new brand to the market must go through a long running-in period to be accepted by users, such an external environment is extremely severe for any new brand that cuts into the car-building track at this time. Furthermore, after the complete withdrawal of state subsidies, domestic new energy vehicles will be completely market-driven. At this time, consumers often choose brands with strong technology and product endorsement, and after Didi has completely cut into the car-building track, the first issue to consider may be how its C-end products can withstand the market test.