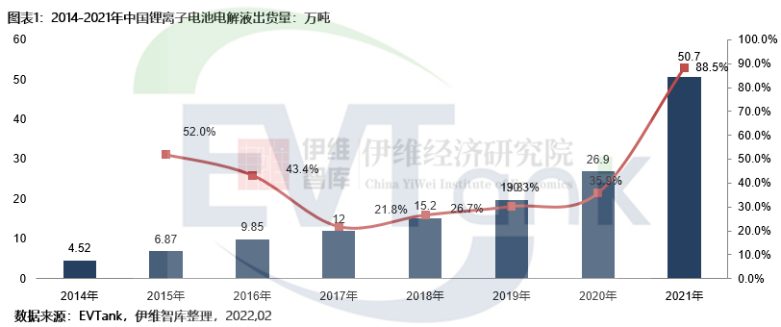

Recently, research institutions EVTank, Ivy Economic Research Institute and China Battery Industry Research Institute jointly issued the "White Paper on the Development of China Lithium Ion Battery electrolyte Industry (2022)". According to the white paper, global lithium-ion battery electrolyte shipments in 2021 were 612000 tons, an increase of 83.2 percent over the same period last year. Chinese enterprises shipped 507000 tons of lithium-ion battery electrolytes, an increase of 88.5 percent over the same period last year, accounting for 82.8 percent of global electrolyte shipments.

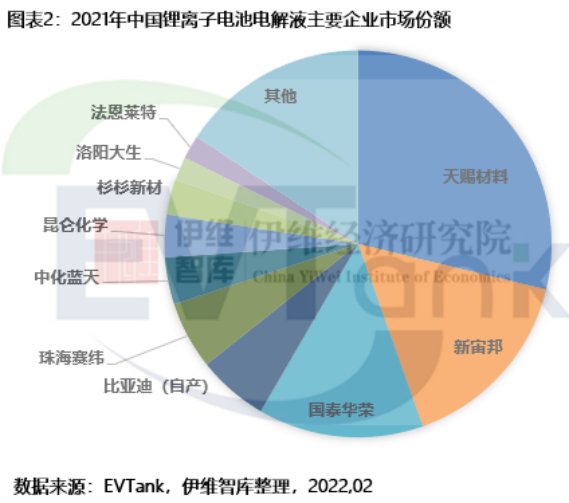

From the perspective of China's major electrolyte enterprises, Tianci ranked first with shipments of more than 100000 tons, New Zebang and Guotai Huarong electrolyte shipments both exceeded 50, 000 tons, and Sinochem Blue Sky ranked among the top 10 electrolyte shipments for the first time. CR10 reached 84.3%.

In the white paper, EVTank ranks the major domestic electrolyte enterprises according to their shipments in 2021. From the perspective of enterprise competition, Divine Materials ranked first for four years in a row, and New Zebang and Guotai Huarong occupied the top three of the industry for a long time. The second echelon enterprises Kunlun Chemical, Zhuhai Saiwei and so on are also in hot pursuit. EVTank predicts that with the gradual extension of a large number of solvent, electrolyte and additive enterprises downstream, the competitive pattern of the electrolyte industry will continue to change. EVTank pointed out in the white paper that in 2021, the tight supply of lithium hexafluorophosphate, solvents and additives led to a substantial rise in prices, making electrolyte enterprises aware of the importance of supply chain security, a large number of electrolyte enterprises are also gradually involved in the upstream field of additives, solvents and lithium salts, the trend of vertical integration and mutual strategic alliance between industrial chain enterprises is becoming increasingly obvious.

Looking to the future, the White Paper on the Development of Lithium-ion Battery electrolyte Industry in China (2022) issued by EVTank predicts that the global demand for lithium-ion battery electrolyte will reach 2.163 million tons by 2025 and 5.485 million tons by 2030, of which more than 85% will be met by Chinese enterprises. The expansion speed of electrolyte enterprises in Japan and South Korea, including Mitubishi Chem, Central Glass, Mitsui Chemical, Tomiyama Pure Chemical, Soulbrain, Enchem, Dongwha and so on, is far from catching up with that of Chinese enterprises.